Breadcrumb

- Plan Sponsors

- Experience

- Participant engagement

- Advice & guidance

Participant Engagement

The advice advantage.

Day one through retirement.

The advice advantage. Day one through retirement.

Support that helps strengthen your plan and your participants’ financial future.

Flexible education and advice for the entire journey

Support that grows with participants’ needs — from simple guidance to managed portfolios to complete financial planning.

Guidance, education, and advice

- Complementary tools and education

- Financial wellness coaching

- Retirement Readiness Reviews4

- Best-interest advice program through an Empower representative5

Professionally managed solutions

- Active account management, withdrawal strategies with access to Empower representatives

- Online Advice recommendations for participants to implement on their own

- Customized investment portfolios built around personal goals and risk tolerances

- Retirement income solutions and drawdown strategies

Comprehensive financial planning

- Assessing needs, lifestyle goals, and legacy intentions

- Complete household financial planning6

- Advanced planning including estate, tax, equity compensation, insurance, risk management, and more

Fiduciary advice, tailored to personal goals

Learn how we deliver advice that can help lead to better outcomes.

A closer look at managed accounts

Customized portfolio offerings with more dynamic account management.

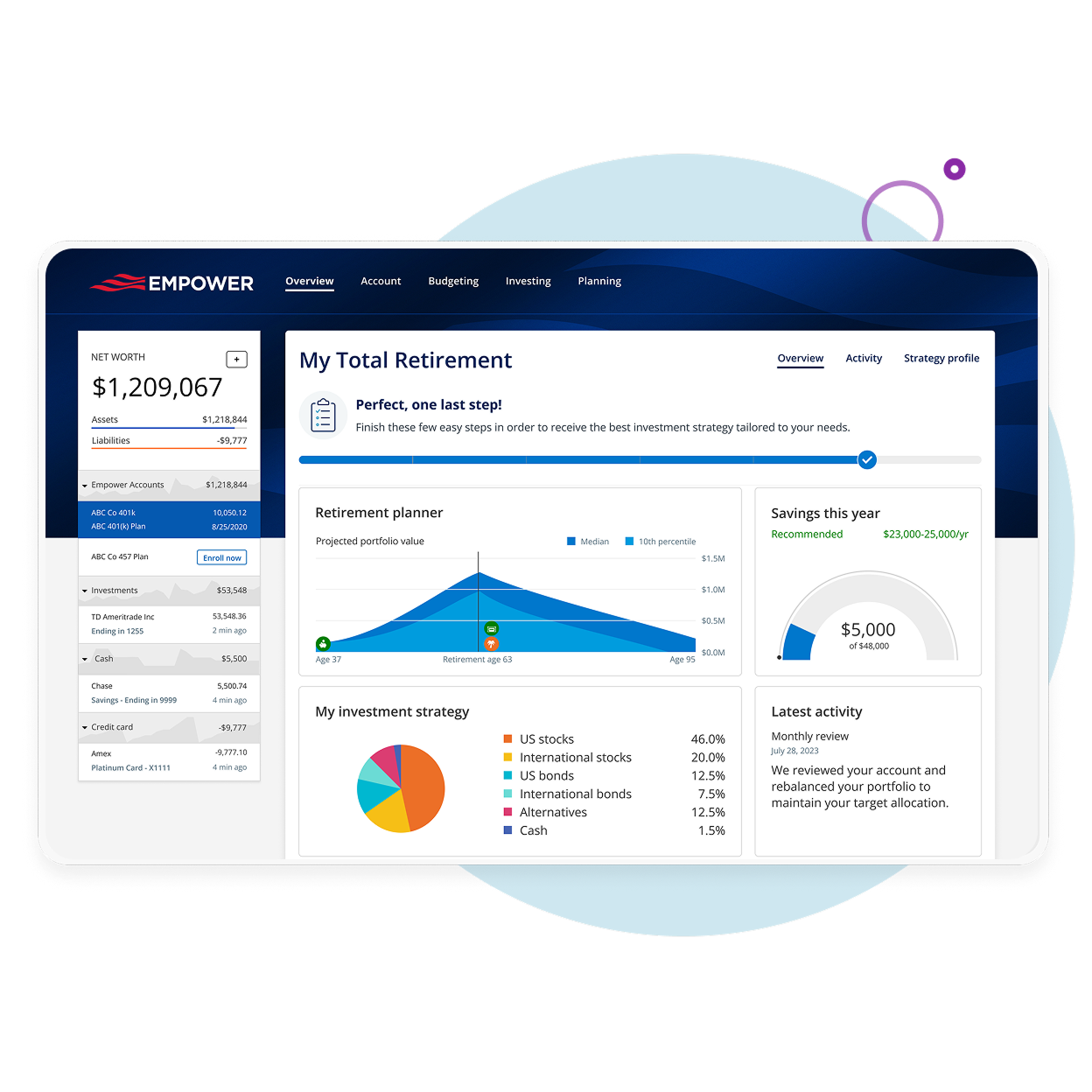

My Total Retirement™

Along with Morningstar Investment Management LLC, we create portfolios tailored to each participant’s goals and situation.

Professional Management Program

Together with Edelman Financial Engines L.L.C., we offer portfolios managed with professional oversight personalized to participant goals.

Advisor Managed Accounts

Through our relationship with select firms, we work together to deliver customized portfolios for participants.

An online experience driving real-world results

Participants get personalized guidance, education, tools, and managed account support — all within one digital experience tailored to their goals.

He has given me confidence in retiring. He went over everything, and I am so happy I have him in my corner.

Miranda*

Starting strong, finishing secure

From using a dual qualified default investment alternative (QDIA) to offering retirement income solutions, we've got options from start to finish.

Empower Dynamic Retirement Manager™ (DRM)

Qualified default investment alternative (QDIA)

Evolve your QDIA with our dual solution, designed as a "safe harbor" for plan fiduciaries. DRM automatically places younger individuals with straightforward financial needs into target date funds. As participants reach a specific age (typically 45-50), they are moved to a managed account.

Empower Retirement Income Solution

Providing peace of mind in retirement — make it last, live with confidence

We offer a unique multi-provider solution that’s easy to implement and manage. It offers in-plan or out-of-plan solutions.

Meeting people when it works for them

Our representatives meet participants where they are — when it’s most convenient and with their spouse or partner if they choose.

Connect with us by phone, online, or in person — where available.

Leading the conversation on the value of advice

Elements of fiduciary oversight

Working together to understand advisory services and fiduciary responsibilities