The Currency

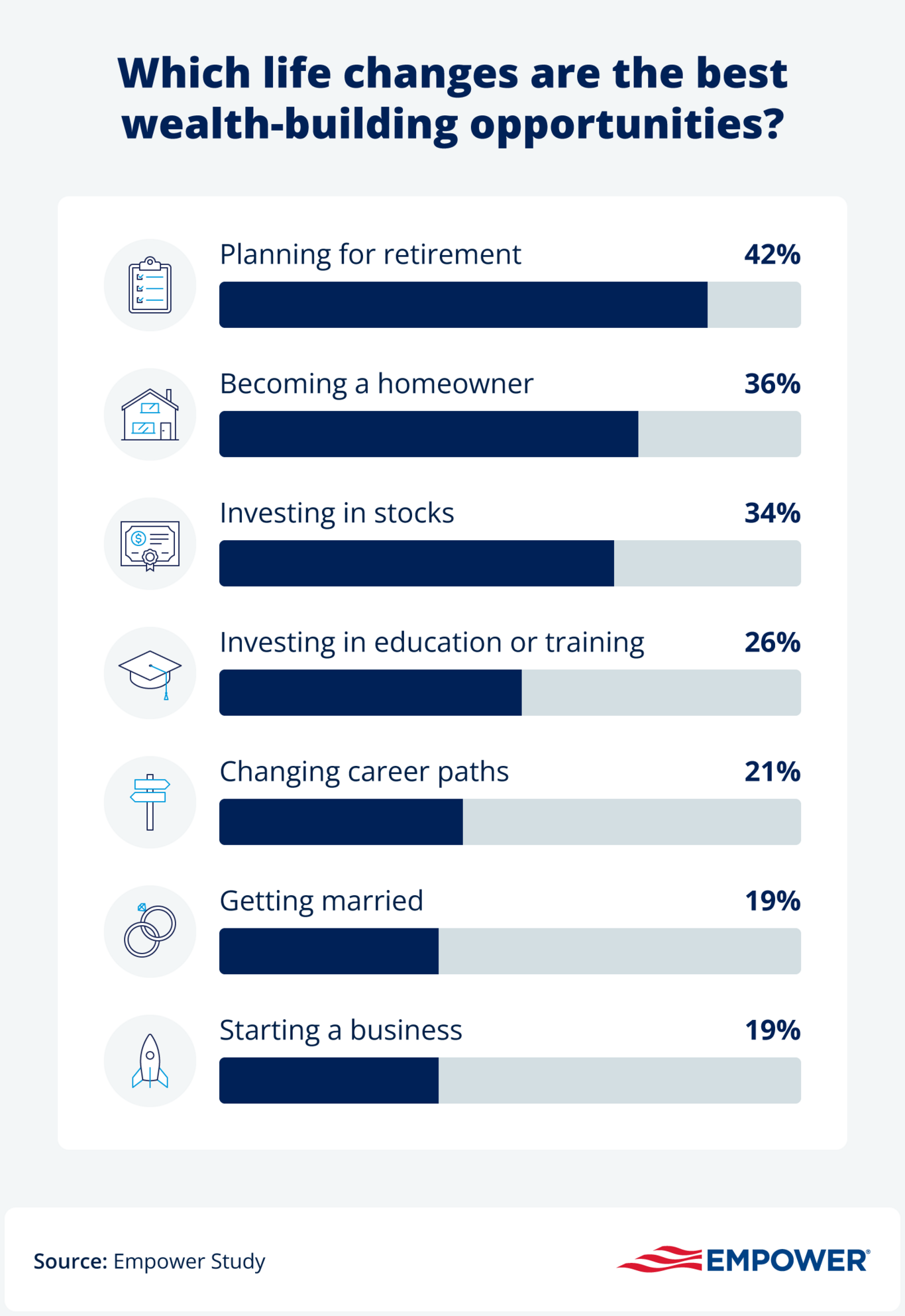

More than 4 in 5 Americans (83%) say there’s no set age to achieve life milestones, based on an Empower study. On the road to financial happiness, these are the moves people think are best for their money:

More than 4 in 5 Americans (83%) say there’s no set age to achieve life milestones, based on an Empower study. On the road to financial happiness, these are the moves people think are best for their money:

Trump account for kids: Eligibility, government contribution, and limits

Money

Theme Slug

category--money

Pathauto Slug

money

Find out how Trump Accounts for kids work, plus learn more about contribution limits, withdrawal rules, and tax implications.

Pet services costs climb 1.3x faster than child care

Money

Theme Slug

category--money

Pathauto Slug

money

Pet care costs are rising faster than child care, climbing 34.6% since 2020 compared with a 25.8% increase for kids’ day care.

🏹 Yours, mine, and ours

Money

Theme Slug

category--money

Pathauto Slug

money

Approaches to managing finances together are changing, as 23% of couples say “I do” to separate finances. Here's this week's money news.