401(k) matching example: Potential growth over time

401(k) matching example: Potential growth over time

Contributing enough to a 401(k) to unlock an employer match can be a key strategy for retirement savings

401(k) matching example: Potential growth over time

Contributing enough to a 401(k) to unlock an employer match can be a key strategy for retirement savings

Key takeaways

- Employees can defer up to $24,500 toward their 401(k) in 2026, and older workers can qualify for catch-up contributions

- More than half of retirement plans offer a 5% employer match cap, according to Empower data

- 401(k) matching can be made in partial or full; it’s best to check with your workplace to get the details

Workplace retirement plans can boost retirement contributions thanks to employer matching programs. Workers should understand the impact of these deposits.

In an effort to help strengthen the financial health and wellness of their employees, many companies offer financial benefits for their workforce. These can include bonuses, paid time off, a retirement account, and a 401(k) match.

Employer matching involves a company contributing its own funds to a worker’s retirement account, and the amount can depend on how much the employee contributes. Check out this example of 401(k) matching and why it’s important to try and meet your company match.

Why is it important to meet your company 401(k) match?

For 2026, people can put aside $24,500 toward their 401(k), and those 50 and older can contribute an additional $8,000. Companies that offer an employer match often structure the payout as a percentage of what the worker defers. Over half of retirement plans offer a 5% match cap, according to data from the 2025 Empowering America’s Financial Journey annual report.

If you’re able, meeting your company match is generally a good idea. There’s a reason a 401(k) match is often referred to as “free money.” You don’t have to do anything to earn it other than contribute to your retirement plan; if you contribute to your 401(k), your employer also contributes funds. Knowing how your match works is a key piece of understanding your 401(k) plan.

If your retirement plan offers matching, many companies will typically match 50% or 100% of your contributions up to a certain percentage of your salary. Employer matches are typically made each payroll period, but some employers may make them annually instead. Money that an employer puts in does not count toward the annual IRS deferral limit.

Example of a partial match: 50% of what you contribute up to 6% of your salary. In this scenario, if you earn $100,000 per year and you contribute 6% of your salary, or $6,000, your employer will match and contribute half of that, or $3,000.

Example of a full match: 100% of what you contribute up to 6% of your salary. In this scenario, if you earn $100,000 per year and contribute 6% of your salary ($6,000), your employer will match and contribute the same amount, or $6,000 in this case.

Read more: How does 401(k) matching work?

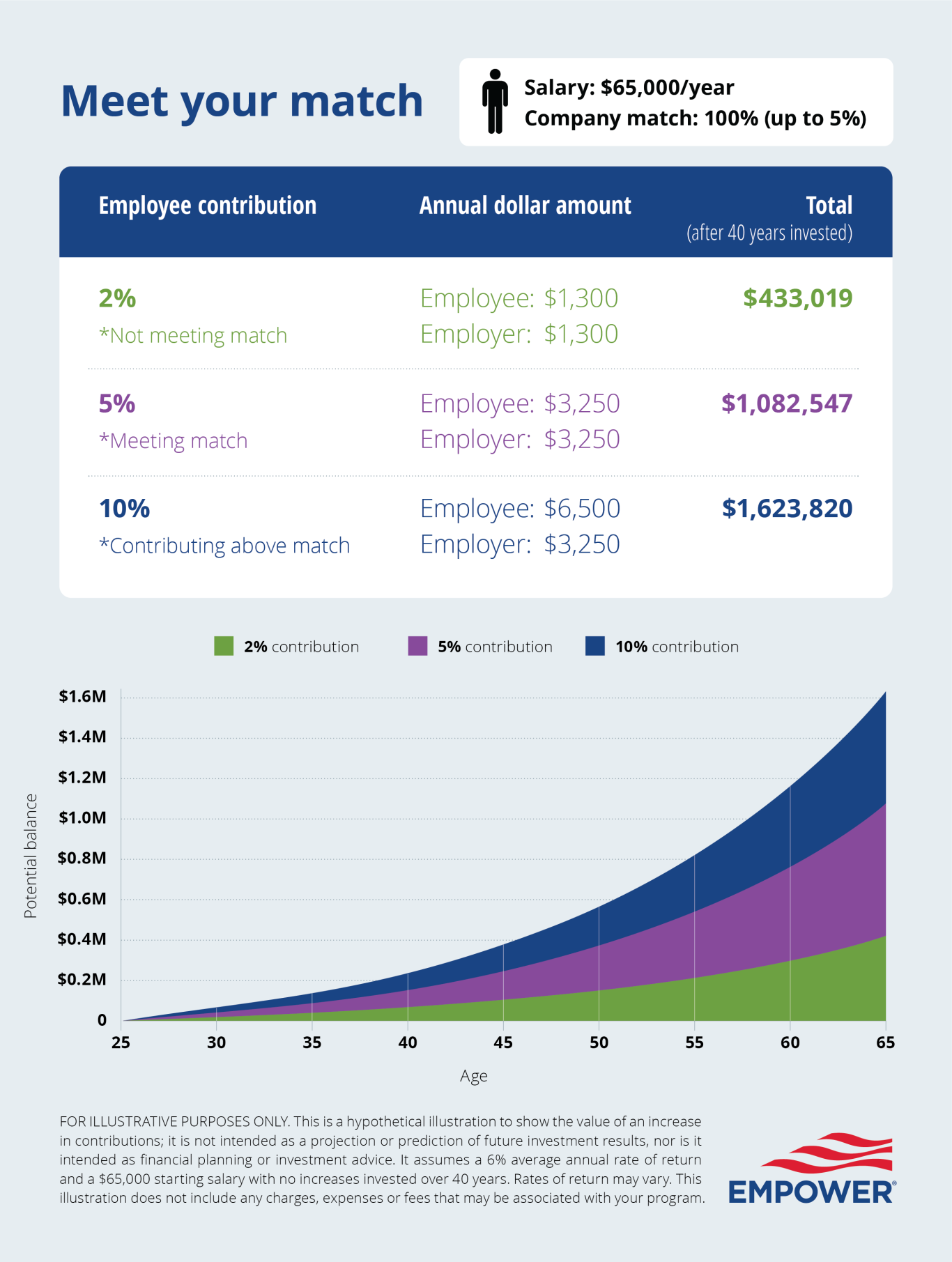

401(k) contribution and matching examples

The above examples illustrate the potential benefits of meeting (or even going beyond) your company match. But you don’t have to stop there. Remember, the IRS sets annual contribution limits for 401(k)s and other retirement accounts, meaning you can generally contribute more than the employer match.

If you were to “max out” your 401(k) in 2026, that would mean you would contribute the IRS contribution limit of $24,500. And thanks to catch-up contributions, employees age 50 or older can contribute an additional $8,000 to their 401(k). Workers age 60 to 63 are also able to set aside $11,250 in catch-up contributions. This contribution limit is separate from any potential company contributions (like a 401(k) match).

Read more: New catch-up contribution: Retirement limit boosted for 401(k) savers in their early 60s

But what if your employer doesn’t offer a match? You can still aim to contribute as much as you can to your 401(k) — and potentially even max it out. Here’s why you might want to consider it:

Why max out your 401(k) if you don’t have an employer match?

Even if your employer doesn’t offer a 401(k) match, retirement contributions can be a powerful way to grow your nest egg.

Using Empower’s free 401(k) calculator, this scenario maps out what could happen for a 30-year-old worker starting with a $0 balance and then maxing out their 401(k) contributions at the 2026 contribution limit ($24,500), with a target of retiring at age 65. By the time that target age arrives, they’ll have saved $4,559,503.

Every person must decide how much they can realistically contribute to a retirement plan given their unique financial situation. Even if you’re not able to max out your 401(k), then a good goal may be to contribute the minimum amount required to take full advantage of your company match.

Even saving 1% more toward retirement can help in harnessing the power of compounding.

Next steps for you

Analyze your retirement readiness. Empower’s Retirement Planner allows you to see how likely your current portfolio and retirement plan are to be successful. You can test out different scenarios to see how different expenses, timelines, or potential company matches may impact your retirement plan.

IMPORTANT: The projections or other information generated on the website by the investment analysis tool regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. The results may vary with each use and over time.

RO5042025-1225

FOR ILLUSTRATIVE PURPOSES ONLY. This is a hypothetical illustration to show the value of an increase in contributions; it is not intended as a projection or prediction of future investment results, nor is it intended as financial planning or investment advice. It assumes a 6% average annual rate of return, $115,000 starting salary with no increases invested over 40 years. Rates of return may vary. This illustration does not include any charges, expenses or fees that may be associated with your program.

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. No part of this blog, nor the links contained therein is a solicitation or offer to sell securities. Compensation for freelance contributions not to exceed $1,250. Third party data is obtained from sources believed to be reliable; however, Empower cannot guarantee the accuracy, timeliness, completeness or fitness of this data for any particular purpose. Third party links are provided solely as a convenience and do not imply an affiliation, endorsement or approval by Empower of the contents on such third party websites. Certain sections of this blog may contain forward-looking statements that are based on our reasonable expectations, estimates, projections and assumptions. Past performance is not a guarantee of future return, nor is it indicative of future performance. Investing involves risk. The value of your investment will fluctuate and you may lose money. Advisory services are provided for a fee by either Personal Capital Advisors Corporation ("PCAC") or Empower Advisory Group, LLC (“EAG”) depending on your specific investment advisory services agreement. Both PCAC and EAG are registered investment advisers with the Securities and Exchange Commission (“SEC”) and subsidiaries of Empower Annuity Insurance Company of America. Registration does not imply a certain level of skill or training. © 2023 Empower Annuity Insurance Company of America. All rights reserved. “EMPOWER” and all associated logos, and product names are trademarks of Empower Annuity Insurance Company of America.