Going Rate

Going Rate

Gift giving can be a barometer for economic sentiment. Between inflation, evolving etiquette, and what many describe as “gifting fatigue,” consumers are navigating a shift in giving gifts and tips. A new Empower study explores the Going Rate – the price tags, expectations, and generational perspectives on generosity.

Gift giving can be a barometer for economic sentiment. Between inflation, evolving etiquette, and what many describe as “gifting fatigue,” consumers are navigating a shift in giving gifts and tips. A new Empower study explores the Going Rate – the price tags, expectations, and generational perspectives on generosity.

Economists have long looked for signals in unexpected places. During tough times, Leonard Lauder popularized the lipstick index—the idea that small luxuries rise when bigger purchases are out of reach.1 We are introducing a new kind of measure: the Going Rate. How we give, tip, and celebrate offers another lens into the economy alongside traditional data points. Our new Empower study shows that generosity can be a surprisingly powerful economic indicator. It’s one gauge of how households balance tradition and financial wellbeing.

According to our research, Americans say inflation and tariffs are visible in gift prices. Consumer concern is showing up as ‘gift fatigue’ and no-gift policies. Confidence or caution reveals itself in tipping habits and allowances.

“While most gifts are small spending trackers, they can be economic micro-signals," says Rebecca Rickert, head of communications and consumer insights. "They point to how consumer prices, wages, and sentiment translate into real behaviors — from the birthday table to the wedding reception.”

Key findings:

Etiquette confusion: Half of Americans don’t know what the “right” amount is to give, even though 50% feel pressure to spend a certain amount on gifts.

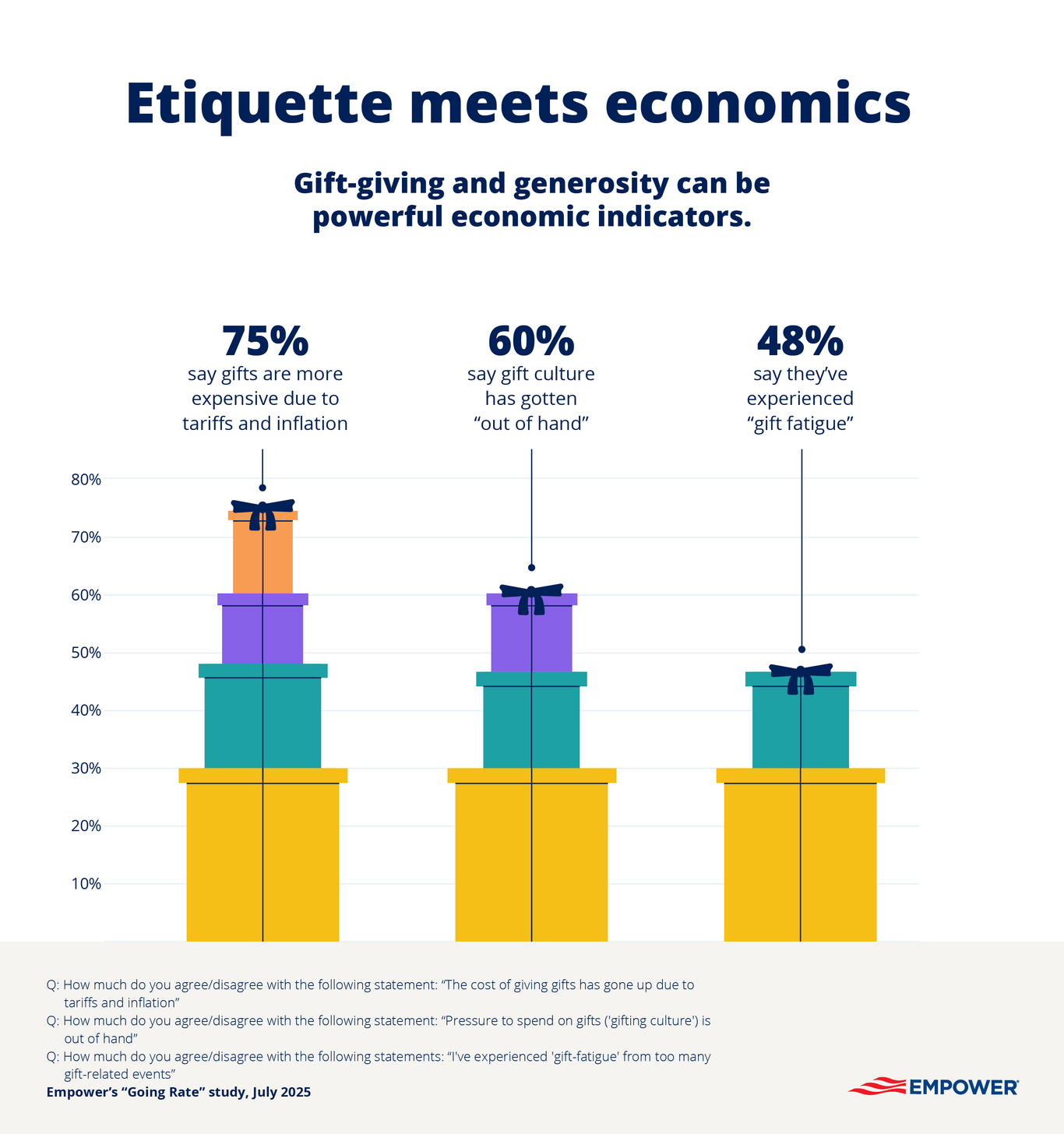

Giftflation: 75% say gifts are more expensive due to tariffs and inflation. Six in 10 say gifting culture has gotten “out of hand” and 48% report experiencing “gift fatigue.”

Going rates for gifts: Americans define the average “going rate” for a birthday gift as $56 for adults, $83 for kids; Wedding gift at $85; Holiday gift at $64; Mother’s Day vs. Father’s Day at $55 vs. $38; Teacher or coach gift at $15

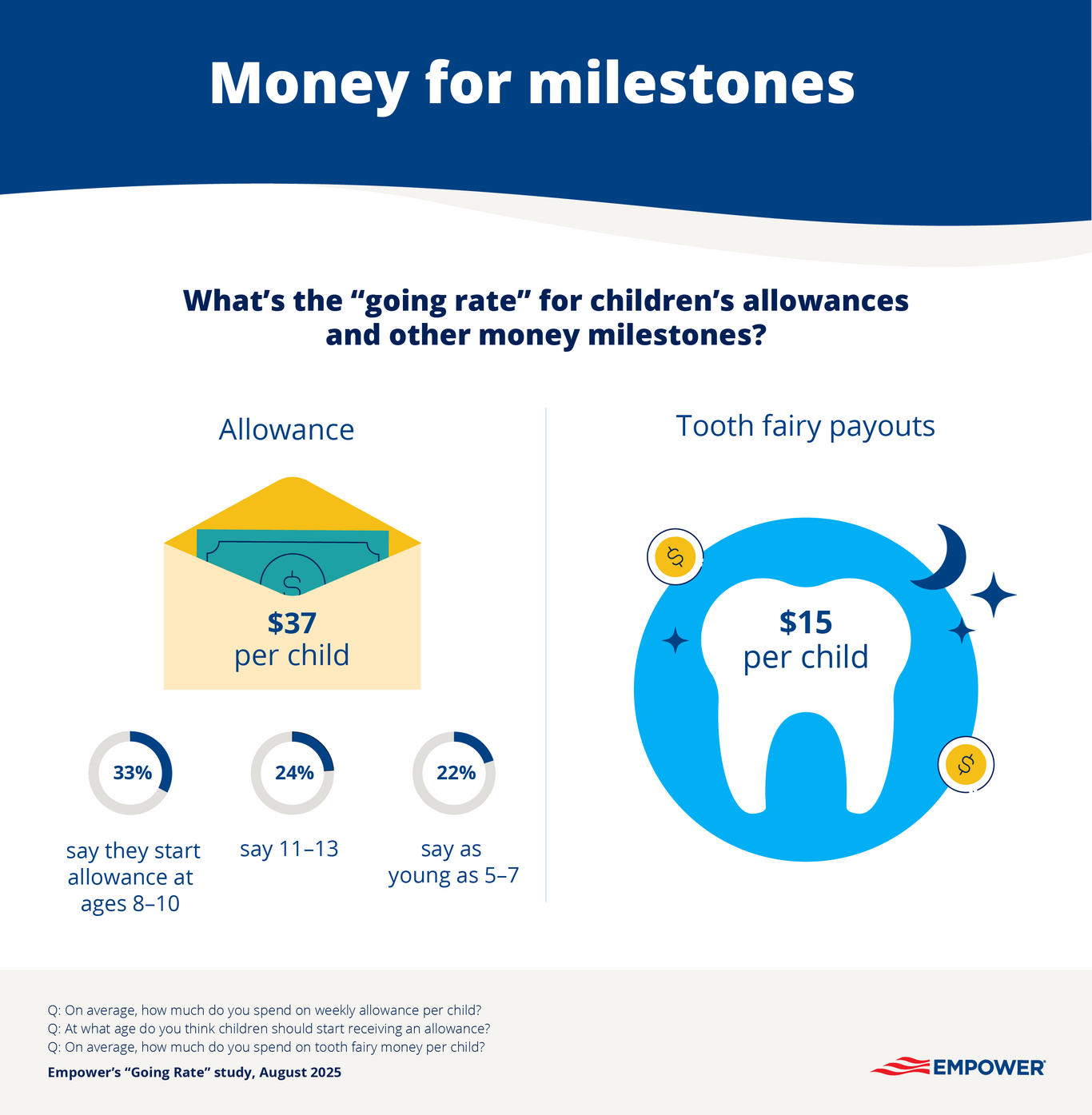

How much?: Weekly allowance: $37 per child and Tooth Fairy payouts: $14.87 per child

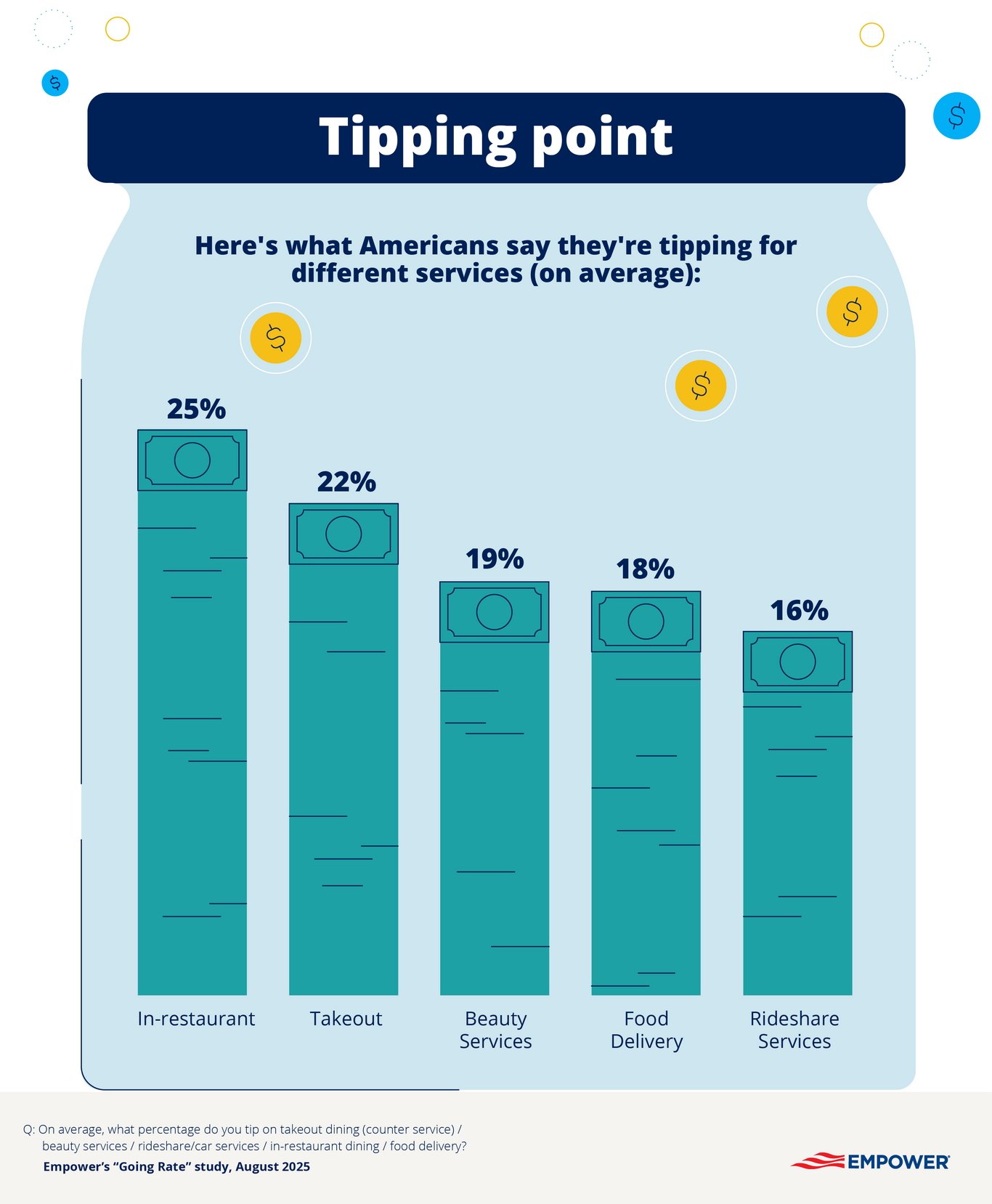

Tipping today: People say they leave a median of 16% for takeout dining; 11% food delivery; 14% beauty services; 10% rideshare services.

Generational generosity: More than half (55%) think their generation spends more than others. Eight in 10 (79%) say cash and gift cards are more acceptable today than in the past (rising to 84% of Boomers).

The guest rule: 49% say you should “pay for the plate” at weddings.

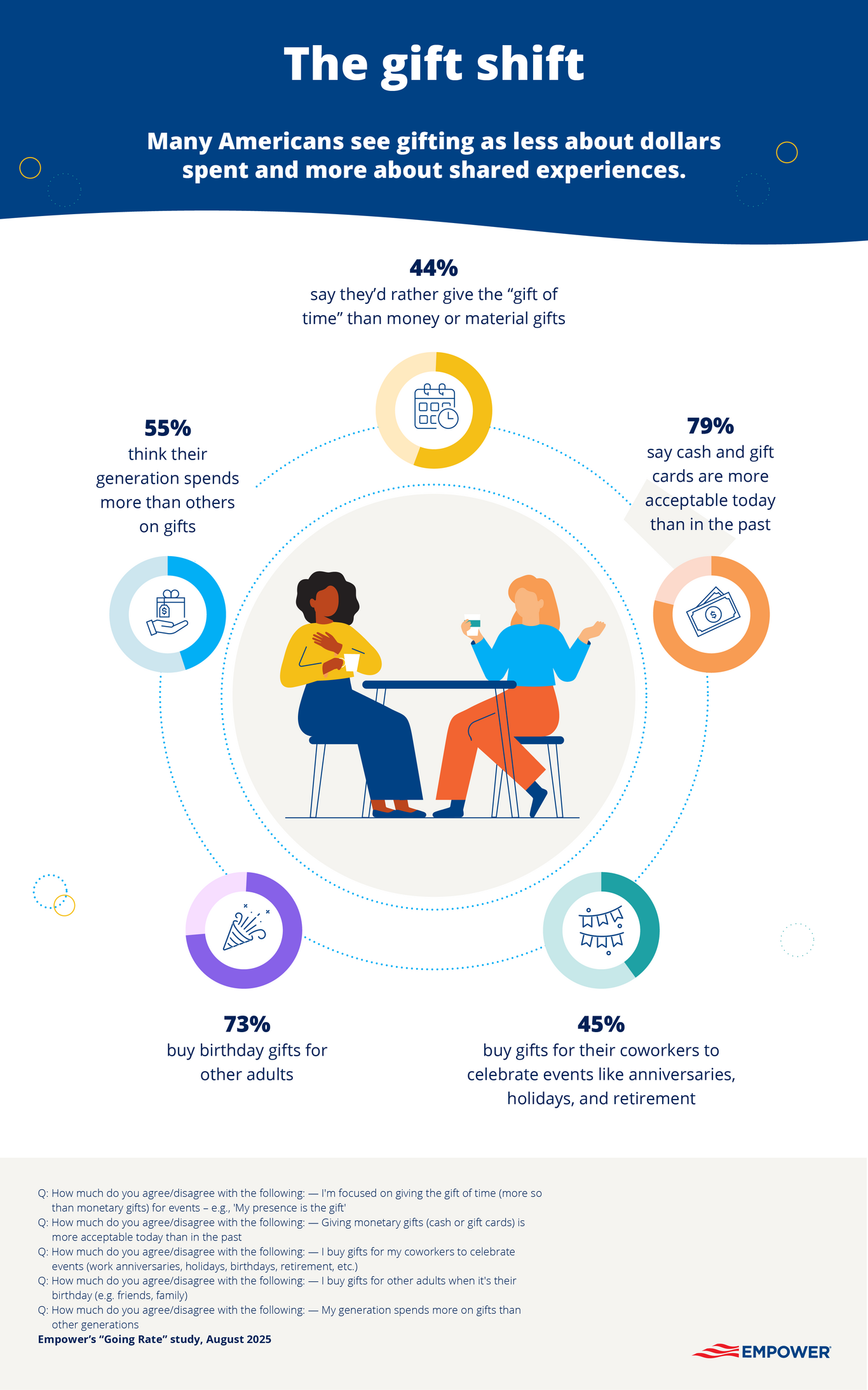

Time is money: 44% say they’d rather give the “gift of time” than money or material items – and say their presence is the real gift.

Present pause: A third (33%) are adopting a “no gifts” policy this year, asking others not to spend money on them at all.

The price tag of thoughtfulness

When it comes to gifting, people have clear benchmarks and codes for different occasions, like the half of people (49%) who say you should “pay for the plate” at weddings (Boomers 39%). For many, it’s a balancing act between etiquette and financial limits: half don’t know what the “right” amount is to give, even though 50% feel pressure to spend a certain amount on gifts. This tension may signal a sense of economic uncertainty, as three in 4 (75%) say gifts are more expensive due to tariffs and inflation.

Six in 10 people (60%) say gifting culture has gotten “out of hand” and nearly half (48%) report “gift fatigue.” In fact, many are taking a pause altogether, with 33% adopting a “no gifts” policy this year, asking others not to spend money on them at all. Still, the vast majority (86%) agree that gifts can be meaningful without being expensive.

Here is how Americans define the average “going rate” for many of life’s special occasions:

Birthday gift: $55.65 for adults, $83.03 for kids

Holiday gift: $64.10 per person

Teacher or coach gifts: $15.00

Wedding gift: $85.18

Valentine’s Day gift: $50.69

Mother’s Day vs. Father’s Day: $55.25 vs. $38.48

Adults say the average “going rate” for children’s allowances and milestones like visits from the Tooth Fairy add up as follows:

Weekly allowance: $36.52 per child

Tooth Fairy payouts: $14.87 per child

Over half of adults (53%) say they’ve gifted money from the Tooth Fairy (58% Millennials). Meanwhile, people are split when kids should start receiving an allowance: A third (33%) say ages 8–10 is the right time, while 24% prefer 11–13, and 22% say as young as 5–7.

Tipping today

Consumers are also navigating an evolving landscape of tipping, where norms vary widely depending on the situation. Tipping culture has moved beyond sit-down dining, with the majority of consumers now tipping for takeout (60%; 69% Millennials vs. 43% Boomers), delivery (69%; 76% Gen Z and Millennials vs. Boomers 57%), and rideshares (60%; 65% Gen Z and Millennials vs. 50% Boomers). Here is what Americans say they’re leaving:

In-restaurant dining: 20% median tip; 24.71% average

Takeout dining: 16% median; 21.79% average

Food delivery: 11% median; 18.09% average

Beauty services: 14% median; 18.55% average

Rideshare services: 10% median; 15.85% average

A shift in what counts as a gift – and who’s giving

Many Americans see gifting as less about dollars spent and more about shared experiences. 44% say they’d rather give the “gift of time” than money or material items – and say their presence is the real gift (55% Millennials; 50% Gen Z; 28% Boomers). Eight in 10 (79%) say cash and gift cards are more acceptable today than in the past (rising to 84% of Boomers). More than half (55%) think their generation spends more than others.

Gift-giving extends into dozens of micro-moments across the year, and is widely commonplace – especially for birthdays, regardless of age. Nearly three in four (73%) buy birthday gifts for other adults (81% Gen Z vs 65% Boomers), and kids (70%) alike. Nearly half (45%) buy gifts for coworkers to celebrate events like work anniversaries, holidays, and retirement (60% Gen Z; 54% Millennials).

The cost of goods

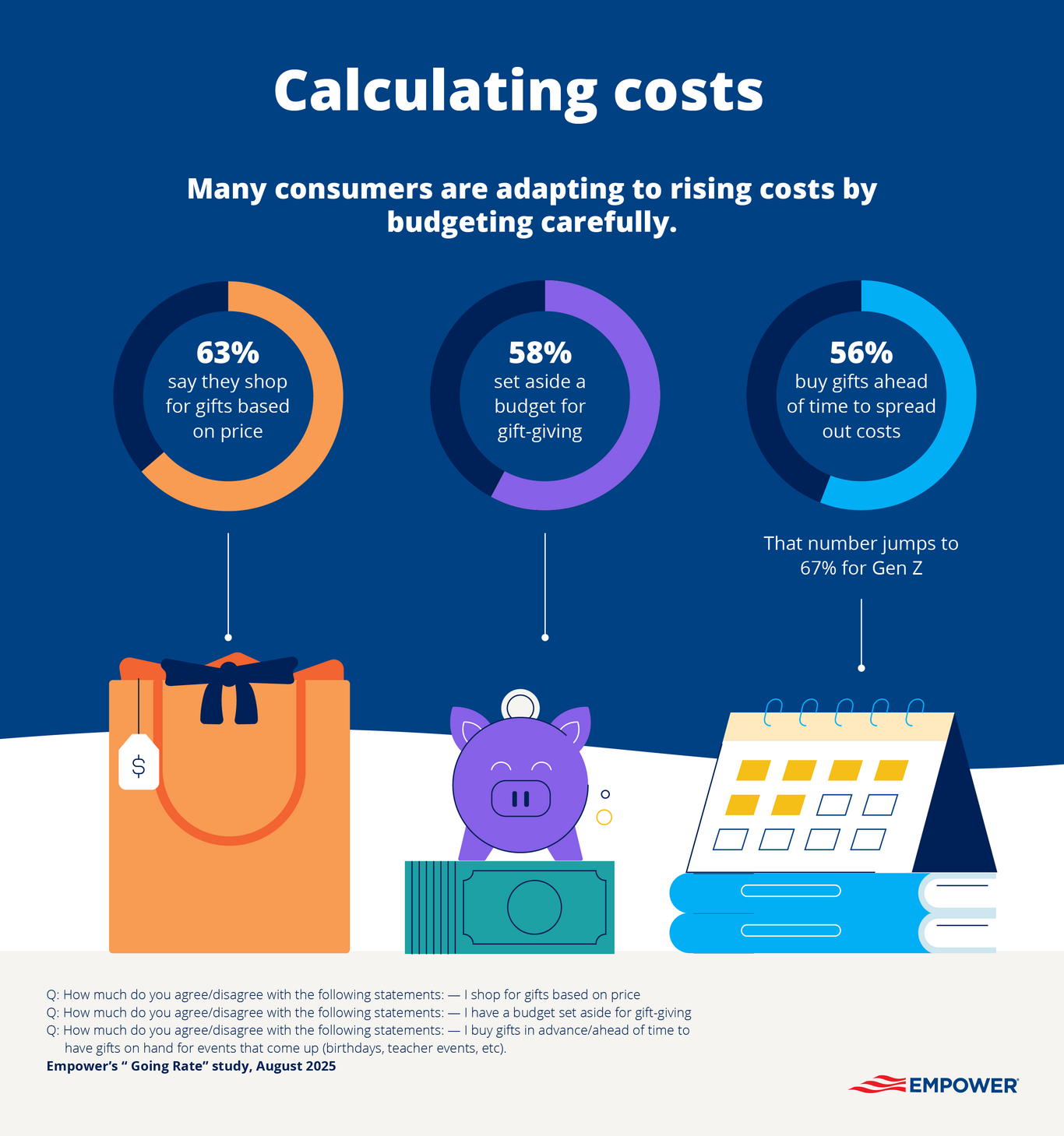

Many consumers are adapting to the effects of rising costs by budgeting carefully. Some 63% say they shop for gifts primarily based on price, and 58% set aside a dedicated budget for gift-giving. People also report planning for occasions: 56% buy gifts ahead of time to spread out the costs, especially Gen Z (67%).

Methodology:

Empower’s “Going Rate” study is based on online survey responses from 2,202 Americans ages 18+ from August 19-21, 2025. The survey is weighted to be nationally representative of U.S. adults.

Get financially happy

Put your money to work for life and play

RO4780013-0825

1 New York Times. "Leonard Lauder Was Beauty’s Original Influencer." June 2025.

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. No part of this blog, nor the links contained therein is a solicitation or offer to sell securities. Compensation for freelance contributions not to exceed $1,250. Third-party data is obtained from sources believed to be reliable; however, Empower cannot guarantee the accuracy, timeliness, completeness or fitness of this data for any particular purpose. Third-party links are provided solely as a convenience and do not imply an affiliation, endorsement or approval by Empower of the contents on such third-party websites. This article is based on current events, research, and developments at the time of publication, which may change over time.

Certain sections of this blog may contain forward-looking statements that are based on our reasonable expectations, estimates, projections and assumptions. Past performance is not a guarantee of future return, nor is it indicative of future performance. Investing involves risk. The value of your investment will fluctuate and you may lose money.

Certified Financial Planner Board of Standards Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design), and CFP® (with flame design) in the U.S., which it authorizes use of by individuals who successfully complete CFP Board's initial and ongoing certification requirements.