The December Mindset

The December Mindset

From year-end stress to new-year optimism, close to a quarter of Americans say the financial choices they make in December set the tone for the new year (21%).

From year-end stress to new-year optimism, close to a quarter of Americans say the financial choices they make in December set the tone for the new year (21%).

As the year winds down, Americans are taking stock of their finances: 54% say the cost of living rose in 2025, though close to a third feel more optimistic now than they did in January (28%). In December, specifically, 31% report feeling more financial stress than in other months, as a quarter find it difficult to balance holiday expenses with their financial goals (25%).

Close to a quarter (21%) use December as a financial “checkpoint,” and 21% believe the choices they make this month set the tone for the year ahead. One in 5 say meeting with a financial professional before year-end is important.

Key findings:

- 54% of Americans say the cost of living rose in 2025, though 28% feel more optimistic now than they did in January.

- 31% report feeling more financial stress in December than in other months, as a quarter find it difficult to balance holiday expenses with their financial goals (25%).

- Close to 2 in 5 of Americans prioritized their financial future by building emergency savings (37%) and contributing to their retirement savings (36%) this year.

- At year’s end, 37% are exploring new job opportunities, updating their résumé or LinkedIn profile (31%) and preparing to ask for a raise or promotion (28%) at work.

- Around a third of Americans set financial goals or resolutions for 2026 and create a financial plan (30%) at year’s end. One in 5 speak with a financial professional to discuss goals, check in on progress, or review their portfolio (20%).

What people did with their money in 2025

Even as inflation pressures linger, close to 2 in 5 Americans prioritized their financial future by building emergency savings (37%) and contributing to their retirement savings (36%). A third invested in the stock market (34%), paid down debt (32%), and followed a budget (31%) in 2025.

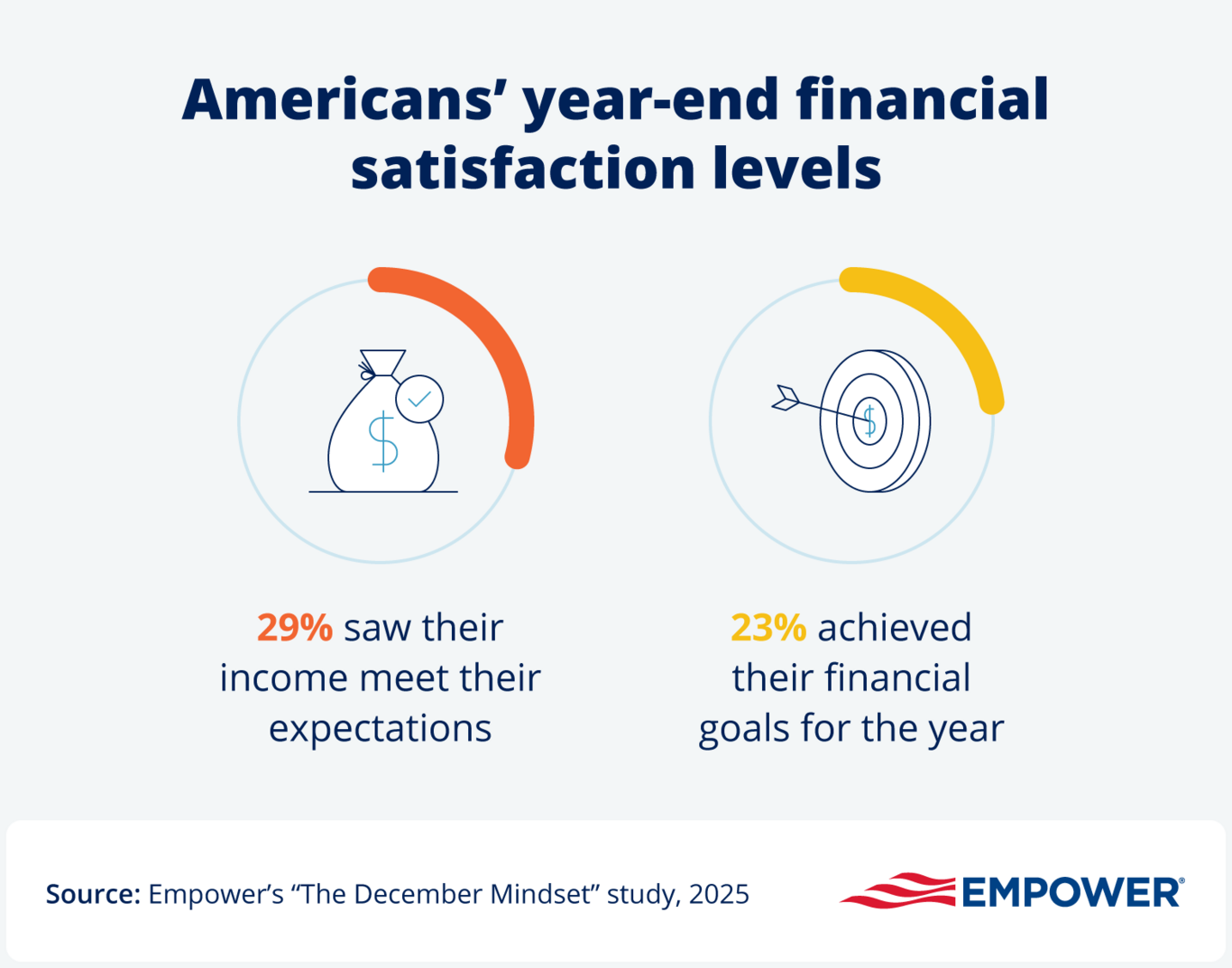

When it comes to reaching financial goals, 29% say their income met expectations and a quarter reached the financial goals they set for the year (23%).

Americans also take practical financial steps: More than a third (35%) check their credit score or credit report, or gather receipts for deductions such as charitable gifts, medical expenses, or business expenses (31%). Some 27% review and pay down credit card balances, and 22% review or rebalance their investments.

December reflections on money

In December, many people report shifts in their financial attitudes — becoming more aware of their situation, setting goals, and feeling both stress and motivation. More than a third (35%) say the season makes them more aware of their financial situation, while 30% focus more on gratitude than money.

At the same time, 29% of people find hidden holiday costs more stressful than buying gifts, and 22% feel added pressure to appear more financially successful.

December also sparks financial planning behaviors: A quarter feel more financially organized after taking the time to review their accounts (23%), and 22% take stock of whether they hit their money goals. Some 24% hope to have $5,000 saved up by the month’s end.

Looking ahead, more than 1 in 5 say the holiday season motivates them to plan for the future (21%), and 21% believe their December money habits set the tone for the year ahead.

Workplace checklist

During the month of December, close to 2 in 5 Americans (37%) plan to set professional goals at work and 32% are increasing their retirement contributions. Another 37% will use remaining PTO or schedule next year’s vacations. More than a third intend to review workplace benefits (36%) and are adjusting their health insurance or flexible spending elections (35%).

At the same time, workers are also thinking about bigger career and financial moves: 37% are exploring new job opportunities, while a third are updating their résumé or LinkedIn profile (31%). More than a quarter are preparing to ask for a raise or promotion (28%), and 22% are looking to negotiate a year-end bonus.

Windfall wins

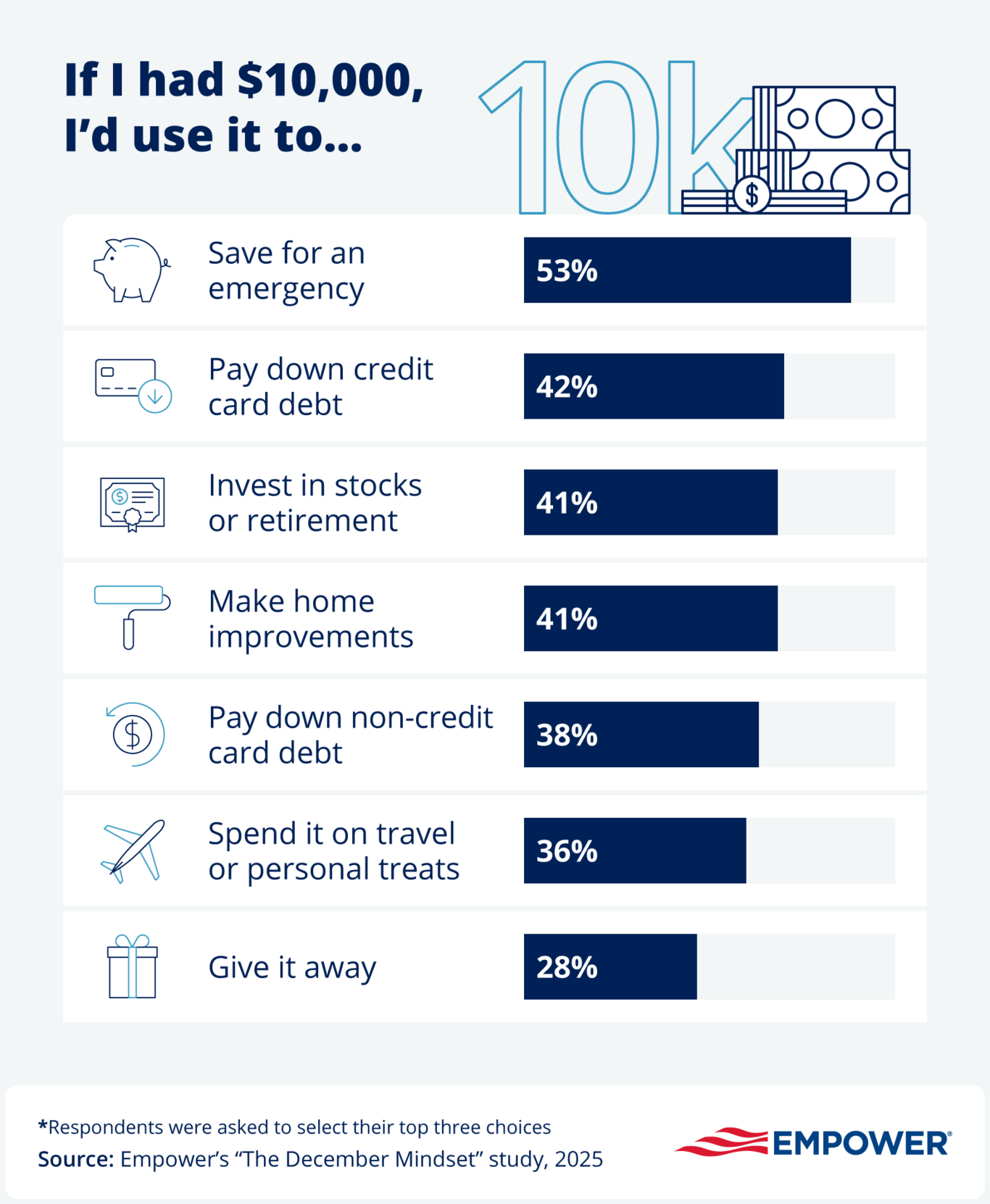

When asked how they would use an unexpected $10,000, half of Americans say they would build an emergency fund (53%). More than 2 in 5 would use it to pay down credit card debt (42%) or invest the money for long-term growth (41%).

Some 41% would use the money to make home improvements or upgrades, while 38% would pay down student loans, mortgage or other major debt. A third would spend it on holiday expenses (36%) or give it away to family, friends or charity (28%).

End-of-year tax strategies

A quarter of Americans (25%) feel confident in the way they prepare for tax season, though close to a third would take more advantage of tax strategies if they understood them better (30%).

At the end of the year, a quarter (23%) review their withholdings or overall tax strategy for the coming year and make charitable donations for tax benefits (22%). More than 1 in 5 review or rebalance their investments (21%). Around 20% max out retirement contributions, while 19% adjust W-4 withholdings to avoid a surprise bill in April.

Others focus on year-end planning by accelerating deductible expenses such as mortgage or property tax payments (18%), harvesting investment gains or losses (17%), deferring income into January (17%), or making last-minute contributions to 529 college savings plans (17%).

Focus on the future

Around a third of Americans set financial goals or resolutions for 2026 and create a financial plan (30%) at year’s end. One in 5 speak with a financial professional to discuss goals, check in on progress, or review their portfolio (20%).

Methodology

Empower’s “The December Mindset” study is based on online survey responses from 1,032 Americans ages 18+ from fielded by a third-party provider during September 8-9, 2025.

Get financially happy

Put your money to work for life and play

RO4855971-1025

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. No part of this blog, nor the links contained therein is a solicitation or offer to sell securities. Compensation for freelance contributions not to exceed $1,250. Third-party data is obtained from sources believed to be reliable; however, Empower cannot guarantee the accuracy, timeliness, completeness or fitness of this data for any particular purpose. Third-party links are provided solely as a convenience and do not imply an affiliation, endorsement or approval by Empower of the contents on such third-party websites. This article is based on current events, research, and developments at the time of publication, which may change over time.

Certain sections of this blog may contain forward-looking statements that are based on our reasonable expectations, estimates, projections and assumptions. Past performance is not a guarantee of future return, nor is it indicative of future performance. Investing involves risk. The value of your investment will fluctuate and you may lose money.

Certified Financial Planner Board of Standards Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design), and CFP® (with flame design) in the U.S., which it authorizes use of by individuals who successfully complete CFP Board's initial and ongoing certification requirements.