Breadcrumb

- Individuals

- Products & Services

- Investment accounts

Investment accounts

Start investing with confidence.

Start investing with confidence.

Choose your investing style. Stay on track. Get guidance when you need it.

Invest for what’s next

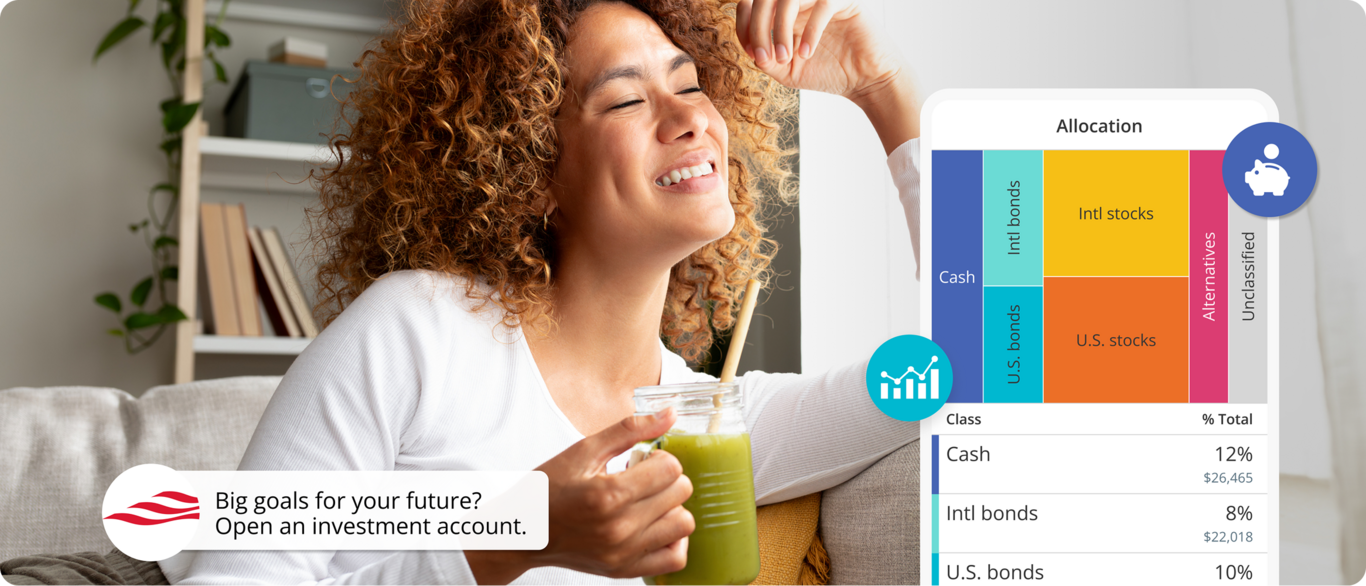

Choose from four options to support your goals — whether you're saving for a home, education, or the unexpected.

Invest your way

Manage your account yourself — or get professional guidance when you need it.

Full-service money management

Personal Strategy®

Comprehensive financial planning and portfolio management1

• Flexible portfolio investing choices

• Daily monitoring by financial professionals plus advanced technology

• Tax optimization, financial coaching, and private equity access2

• Fees starting at 0.89% of assets under management, $100K minimum1

Managed portfolio

Empower Premier Managed Account

Personalized portfolio management and goal-based investment planning3

• Portfolio of mutual funds selected and invested for you

• Monitored monthly with automated rebalancing as needed

• Fees starting at 0.5% of assets under management, no minimum

DIY investing

Empower Brokerage

Trade and manage your own investments from a wide range of choices.4

• Mutual funds, stocks, ETFs, and options available

• 1,000 free online trades every calendar year, no minimum investment

• Designed for experienced investors

Investing $100K or more?

Get personalized portfolio management, dedicated guidance from professionals, and tools to help you invest well and live a little.1

Compare your options

Find the account that fits your investing style. Brokerage and investment accounts are intended for knowledgeable investors who acknowledge and understand the risks associated with the investments available through these accounts.

|

Minimum investment |

|

Management fees |

|

Financial planning |

|

Commission-free trading |

|

Access to advisor |

|

Retirement planning and spend-down advice |

|

Professional portfolio management |

|

Diversified portfolio |

|

Daily portfolio monitoring |

|

Tax optimization |

Plan for a child’s future

The Empower Custodial Account offers a great way to invest money on behalf of a child. Gift up to $19,000 per year ($38,000 for couples filing jointly) per child without incurring the gift tax. To open an account, call us at 877-788-6261.

More investing options

Broaden your financial strategy with powerful tools and specialized account options.

Investment monitoring

Track your investment portfolio and other financial accounts with Empower's powerful financial tools.

Personal Strategy

Get portfolio management and financial planning for life. Qualify with investments of $100,000 or more.1

Private Client

Work with a team that specializes in high net worth individuals. Qualify with investments of $1 million or more.1

FAQ

FAQ

Investment accounts are non-retirement accounts with no contribution limits or withdrawal restrictions, offering more flexibility. Retirement accounts, like IRAs and 401(k)s, have tax advantages but come with rules around contributions and withdrawals.

With a brokerage account, you can buy and sell mutual funds, ETFs, and individual stocks and bonds. Learn more about what a brokerage account is and how to begin investing with our guide.

Learn more about what mutual funds are, the various types of funds available, and the advantages and disadvantages of this type of investment.

ETFs are an increasingly popular investment tool. Learn how ETFs work, the different types of ETFs, how to get started with ETF investing, and other important considerations.

While cash held in the account may be FDIC-insured up to applicable limits, investments themselves (like stocks and mutual funds) are not insured and can fluctuate in value.

Yes. Because this is a taxable account, capital gains, dividends, and interest income may be subject to taxation. Empower does not offer tax advice but provides tax documents at year-end.

Get money news and viewpoints

Get money news and viewpoints

5 key strategies to reach your money goals

Financial planning for your life

Q3 2025 Outlook

Protecting your investments is part of the plan

We safeguard your account with advanced encryption, fraud protection, and multifactor authentication.