Breadcrumb

- Individuals

- Products & Services

- Wealth Management

- Personal Strategy

Personal Strategy®

Portfolio management & financial planning for life

Portfolio management & financial planning for life

Get guidance to help you make smart financial decisions from today to retirement.

Empower lives up to its name: Our wealth management consultant empowers us to make the right decisions that move us towards our goals. They always have our best interest in mind, and have simplified retirement planning and achieving our financial goals.

Matthew H.

Unpaid Empower Advisory Group, LLC (EAG) client testimonial*

Your financial strategy & nobody else’s

Proactive planning, dedicated guidance, and tools to help you invest well and live a little.

-

Responsive advisors

Accessible and attentive — your team is here when you need them.

-

Ongoing financial planning

Guidance from financial planning specialists helps refine your strategy.

-

Unbiased advice

Your success is our priority. We work for you.

-

Innovative technology

Clearly see how today’s decisions could impact your financial future.

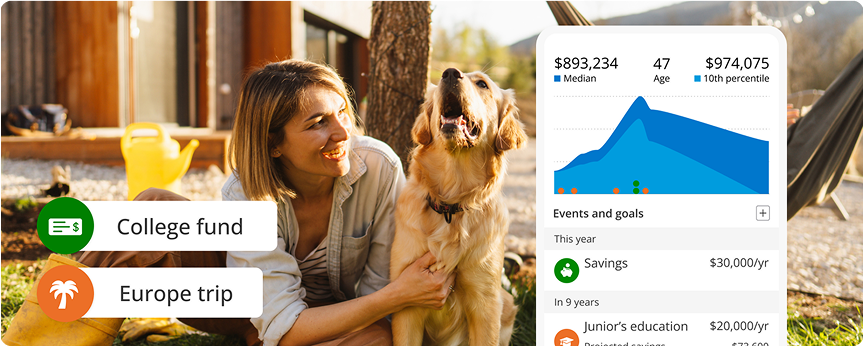

Tell us where you want to go

If you have $100,000 or more in investable assets, it may be time to consider wealth management. That’s where we come in.

Personalized portfolio design

Experience a tailored investing strategy that adjusts with your changing needs.

Unique diversification method

Designed to help manage risk and support growth, our Smart Weighting™ approach helps keep your portfolio balanced.

Daily portfolio monitoring

Financial professionals + advanced technology monitor your account for rebalancing opportunities.

Flexible investing choices

Customize your portfolio with options that reflect what’s important to you.

Tax guidance and filing, together at last

Finally, a total tax solution, directly from your Empower Personal DashboardTM.

-

Personalized tax report when you invest $250K

Get a clear picture of your tax situation for smarter tax planning.

-

Professional tax filing support at your fingertips

Get matched with a Tax Pro1 from your Empower Personal Dashboard.

Smarter strategies for reducing taxes

Smart tax tools built for every stage to help you keep more of what you earn, no matter where you start.

Maximizing tax efficiency

Your advisor will help you to construct a tax-efficient portfolio that works for you.

Intelligent asset location

We optimize where your assets do their best work: from taxable to tax-deferred or tax-free accounts.

Tax-loss harvesting with precision

We strategically sell investments to help you keep more of what you earn.

Track everything in your dashboard

Keep tabs on your portfolio, trades, performance, income, balances, and projections, all in one place.

Coaching to help you stay on course

Learn how to navigate emotional or complex decisions, which may help improve long-term financial outcomes.2

Transparent advisory fee

We charge an annual advisory fee as a percentage of your total assets under management (AUM), using a tiered fee structure. No hidden fees, no trailing fees, and no trade commissions. Your “all-in” cost is a combination of our advisory fee and any ETF expense ratios.3

| Assets | Annual advisory fee |

|---|---|

| INVESTMENT SERVICES CLIENTS | |

| $100,000-$249,999 | 0.89% |

| WEALTH MANAGEMENT CLIENTS | |

| $250,000-$999,999 | 0.89% |

| PRIVATE CLIENTS | |

| First $3M | 0.79% |

| Next $2M ($3,000,001 - $5M) | 0.69% |

| Next $5M ($5,000,001 - $10M) | 0.59% |

| Amount over $10M | 0.49% |

| Family tiered billing4 | 0.79% |

Compare our wealth management services

|

Financial advisor |

|

Tax optimization |

|

Disciplined rebalancing |

|

Dynamic portfolio allocation |

|

Education & college planning |

|

Tax planning |

|

Private banking services |

|

Private equity access5 |

|

Estate planning |

Value you can see

Enhance your annual return and capture savings with tax-smart strategies, coaching, and financial planning included.

Let's talk

Meet with an advisor for an in-depth financial review. From the first conversation, our focus is on you and your goals.

Getting good at money starts when you see the full picture

Connect your accounts to see your investments, cash, credit, and more in one place. We offer leading security measures like encryption, multifactor authentication, and fraud protection to keep your data safe.