Breadcrumb

Individual Retirement Accounts (IRAs)

The right IRA. Right now.

The right IRA. Right now.

We’ll help you choose, fund, and invest — it’s easy to get started.

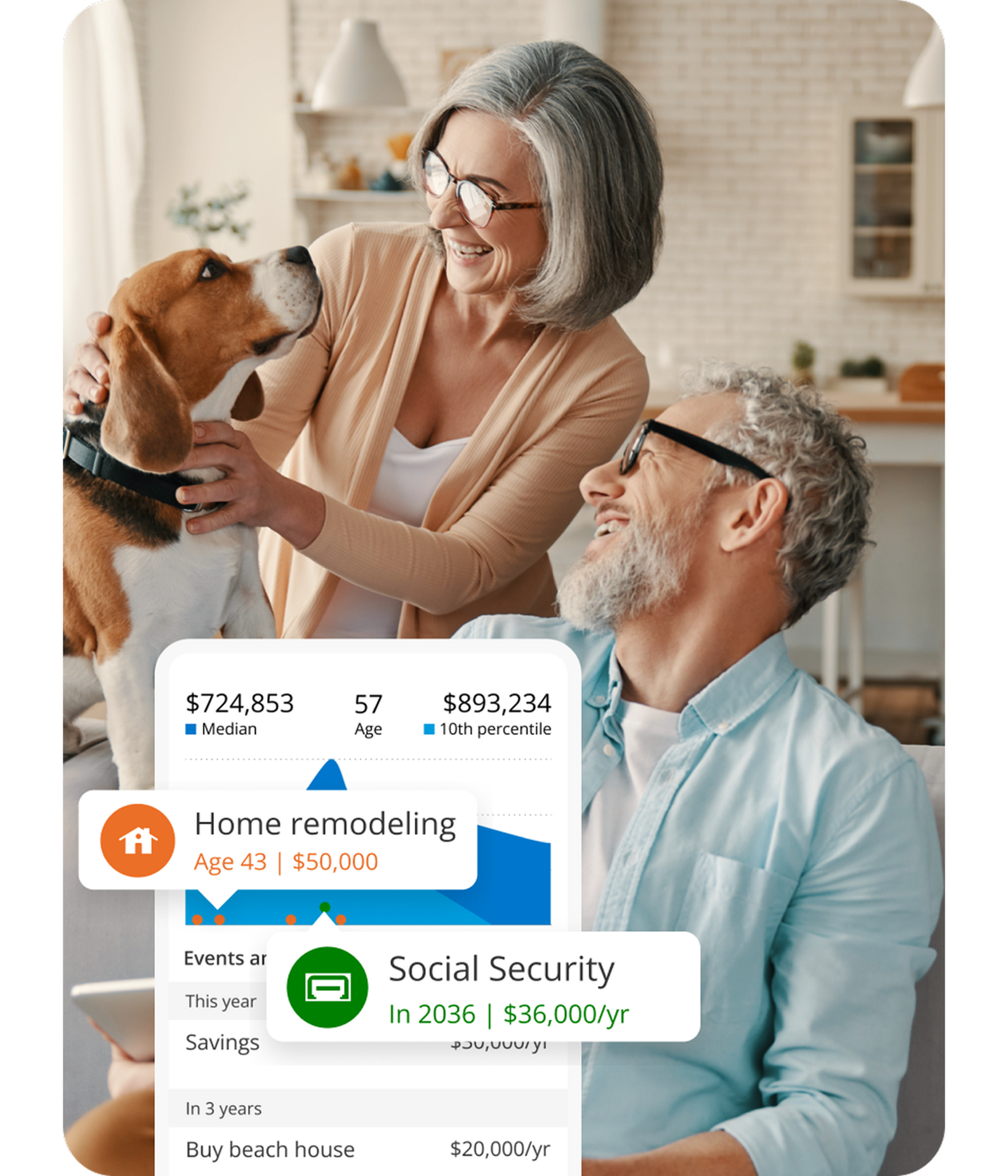

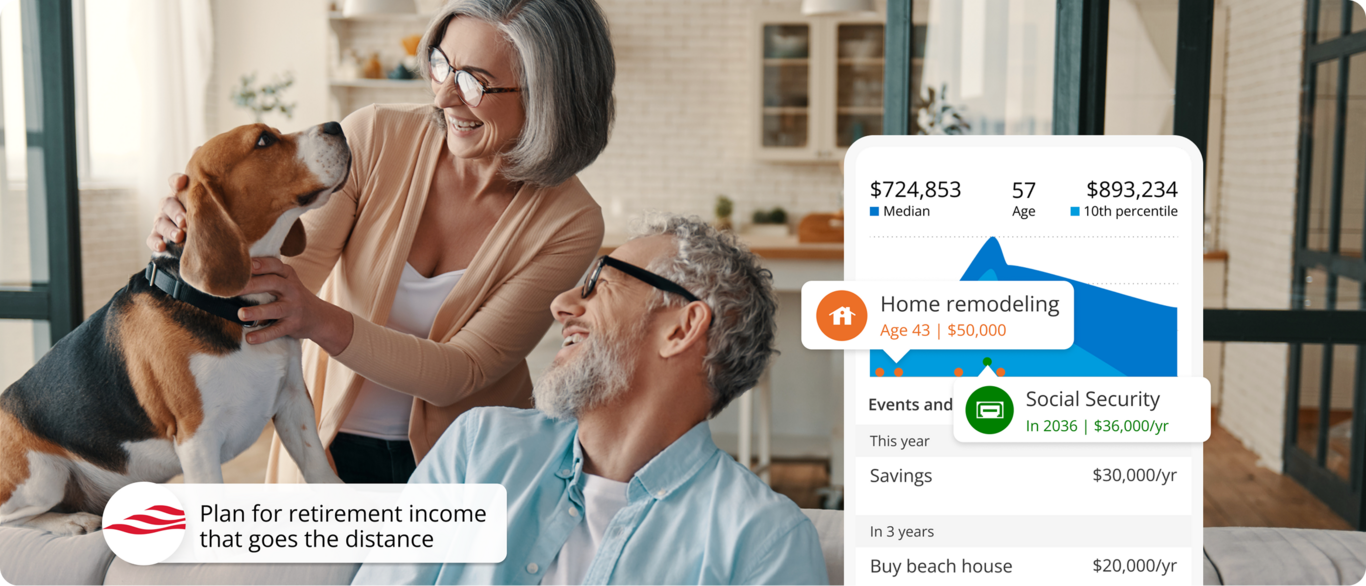

More than just an IRA

With Empower, you get an IRA that fits your investment style, paired with innovative technology and access to an advisor when you need it.

An IRA helps you grow your retirement savings with tax advantages — like deferring taxes now or potentially reducing them later.

Invest your way

Manage your account yourself — or get professional guidance when you need it.

Full-service money management

Personal Strategy®

Comprehensive financial planning and portfolio management.3

- Flexible portfolio investing choices

- Daily monitoring by financial professionals + advanced technology

- Tax optimization, financial coaching, and private equity access4

- Fees start at 0.89% of assets under management, $100K minimum3

Managed portfolio

Premier Managed IRA

Personalized portfolio management and goal-based investment planning.5

- Portfolio of mutual funds selected and invested for you

- Monitored monthly with automated rebalancing as needed

- Fees start at 0.5% of assets under management, no minimum

Guided investing

Premier IRA

Invest on your own, with professional guidance available when you need it.

- Your choice of handpicked mutual funds from top fund managers

- Powerful tools available to help you manage and monitor your own investments

- No advisory fee, no minimum

DIY investing

Brokerage IRA

Trade and manage your own investments from a wide range of choices.6

- Mutual funds, stocks, ETFs, and options available

- 1,000 free online trades every calendar year, no minimum investment

- Designed for experienced traders

Built-in benefits

Designed to support your retirement journey from the start

-

Traditional or Roth

Choose the tax-advantaged IRA that fits your goals.

-

Professional guidance

Get the support you need to help plan your financial future.

-

Start with any amount

No minimum to open an IRA — so you can begin building your future.

-

Easy access to funds

Withdraw contributions anytime — because life doesn’t follow a schedule.

Investing $100K or more?

Get personalized portfolio management and financial planning for life, to help you make smart money moves from today to retirement.3

Traditional or Roth IRA?

Both have tax advantages. Learn about the differences.

Compare your options

Find the account that fits your investing style. Brokerage and investment accounts are intended for knowledgeable investors who acknowledge and understand the risks associated with the investments available through these accounts.

|

Minimum investment |

|

Management fees |

|

Commission-free trading |

|

Access to advisor |

|

Financial planning10 |

|

Retirement planning & spend-down advice |

|

Professional portfolio management |

|

Diversified portfolio |

|

Daily portfolio monitoring |

|

Tax optimization |

Have an old IRA or 401(k)?

Move your money to Empower, and we’ll help make it easy to open and manage your retirement accounts — all in one place. Consider all your options, including taxes, fees, and expenses, before moving money between accounts. Assess all benefits of current accounts before moving money.

More investing options

Broaden your retirement strategy with specialized account options and tailored services.

Small business IRA

A Simplified Employee Pension (SEP) IRA can offer big benefits if you’re a small-business owner or self-employed.

Custodial IRA

If you’re planning for your children’s future, this is a great way to invest money on their behalf.

Private Client

Work with a team that specializes in high-net-worth individuals. Qualify with investments of $1 million or more.

FAQ

FAQ

Ready to start saving for retirement? Discover the steps to how to open an IRA and learn the benefits of tax-deferred growth. Secure your financial future.

An IRA helps you grow retirement savings with tax advantages,

investment choices, and long-term financial security. Learn more about IRAs.

Yes, you can have multiple IRAs, but keep in mind that annual

contribution limits apply across all accounts. More on multiple IRAS.

Roth IRAs can be great investment avenues for long-term

savings, but there are several rules to be aware. Here is a

rundown of contribution limits and other key considerations.

A Roth IRA has the potential to grow tax-free, so your

investments can build over time, and you can withdraw any

earnings tax-free in retirement.

Roth IRAs have unique tax benefits, including tax-free growth

and withdrawals. Read more about Roth IRAs.

A Backdoor Roth IRA lets you convert your nondeductible

traditional IRA contribution to a Roth IRA. Find out how you

might benefit from this strategy.

Two common types of IRAs are Roth IRAs and traditional IRAs, which have similar contribution limits but differ when it comes

to their tax advantages.

Get money news and viewpoints

Get money news and viewpoints

Can you have multiple IRAs?

Can I contribute to a 401(k) and an IRA?

💰 Make it count

Protecting your IRA is part of the plan

We safeguard your account with advanced encryption, fraud protection, and multi-factor authentication.