The Currency

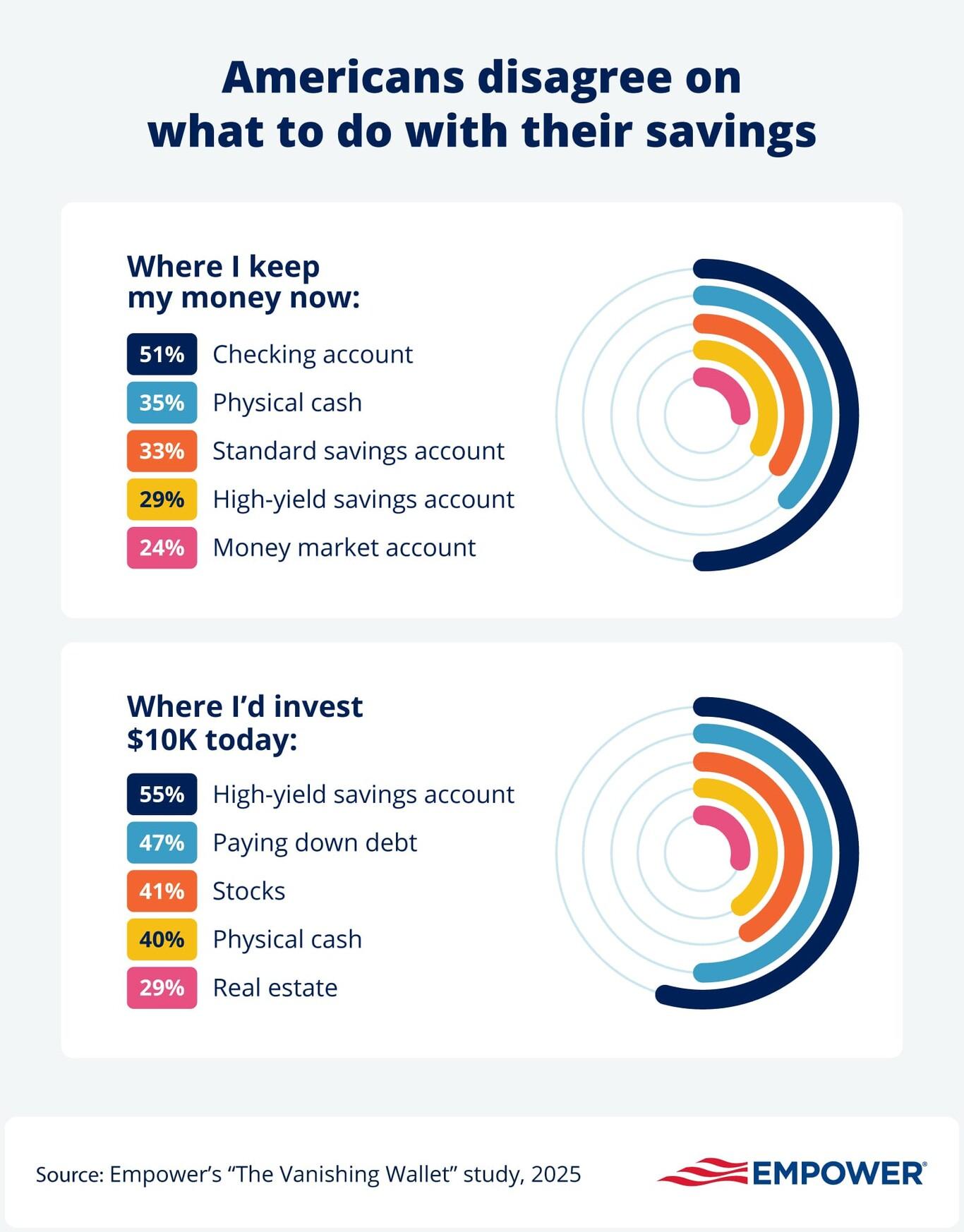

The average American holds between $51 and $100 cash in their “wallet,” according to Empower research. Here’s how people approach where to keep their liquid savings:

The average American holds between $51 and $100 cash in their “wallet,” according to Empower research. Here’s how people approach where to keep their liquid savings:

Valentine’s Day spending set to reach record $29.1B

Play

Theme Slug

category--play

Pathauto Slug

play

Valentine’s Day spending is growing at roughly twice the pace of overall U.S. retail sales, and is set to reach $29.1B in 2026.

Federal income tax: Rules & ways to reduce your tax burden

Money

Theme Slug

category--money

Pathauto Slug

money

The federal income tax is a tax the federal government imposes on the money each individual earns, whether it’s through a full-time job, a business they own, or their investments.

Roth 401(k) catch up: New rule for age 50 and up

Money

Theme Slug

category--money

Pathauto Slug

money

Catch-up contribution rules have been revised for older 401(k) participants, and revisiting accounts may help people save for retirement more strategically.