We are Empower

We are Empower

We’re an award-winning, customer-obsessed financial services company helping 19.5M people1 find financial freedom throughout life’s milestones with an experience unlike any other.

If you’re looking for numbers,

here are some impressive ones

Empowering more than 19.5M people

to make smart financial decisions — today through retirement.1

Ranked as a top work place

for the past three years.5

Invest well. Live a little.™

Whatever your financial happiness looks like, let’s get you there.

Our people set us apart

- A diverse range of forward-thinking, financially-focused minds

- Tailored, actionable guidance to help reach your goals

- Real people to help you on your financial journey

Our tools and technology keep us moving forward

- Steadfast commitment to innovation

- Exclusive and personalized Empower Personal Dashboard™

- Tools that put your money to work for you

Our values are

reflected in our culture

We live our values every day — in how we think, lead, and work together.

-

To transform financial lives through advice, people, and technology

-

To empower financial freedom

for all

“Our commitment to our customers and clients is unmatched. At our core, we serve every one of them with purpose and a singular goal in mind: securing financial freedom.”

Edmund F. Murphy III

President and CEO, Empower

Our history

Our roots stretch back over 110 years. And in 2014, our parent company, Great-West Lifeco, created Empower. We’ve grown exponentially in a short time, and one thing for sure — we're not your parents' financial company.

Who we serve

-

Personal investors

We’ll help you understand your full financial picture, answer your money questions, and give tailored guidance.

-

Workplace investors

Enrolling in your workplace retirement plan lets us help you invest smartly, stay on track with tailored guidance, and see all your finances in one place.

-

Plan sponsors

Nearly 61,000 organizations have chosen us to help empower their people to find financial success on the way to retirement and beyond.

-

Financial professionals

We work with advisors to provide them with support, content, and resources to expand their retirement plan opportunities across all market sizes.

Growing to meet your needs

Over the past decade, we’ve achieved unprecedented growth.6

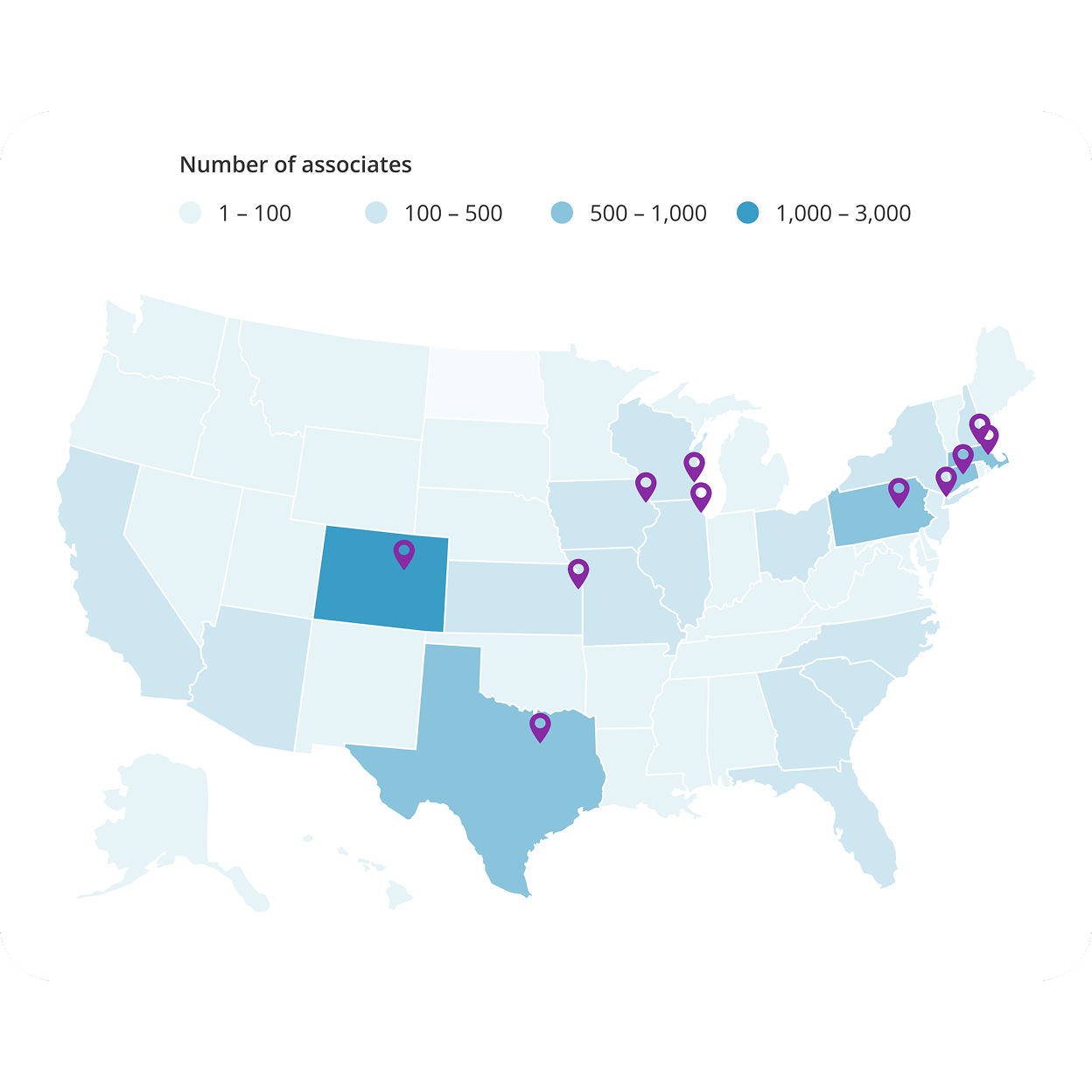

13,000+ associates

across the country and around the world.7

U.S. office locations

Greenwood Village, CO, Headquarters

Hartford, CT; Dubuque, IA; Chicago, IL; Overland Park, KS; Boston, MA; Salem, NH; New York, NY; Moosic, PA; Dallas, TX; Milwaukee, WI

Global office locations

Bangalore, India

Manila, Philippines

Multilayered security and data privacy

Industry-standard encryption, multifactor authentication, and fraud protection help keep your assets and information safe.