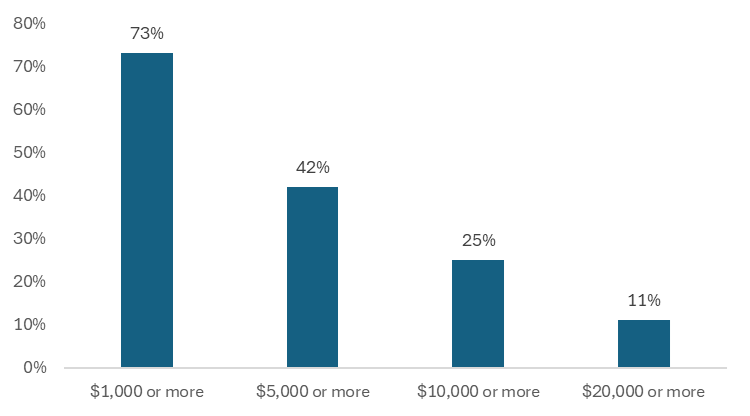

1 in 4 Americans who carry credit card balances currently owe $10,000 or more in credit card debt

Key insights from a survey of 1,447 Americans who have a credit card and do not pay their bills in full*:

1 in 4 Americans who carry credit card balances currently owe $10,000 or more in credit card debt

Key insights from a survey of 1,447 Americans who have a credit card and do not pay their bills in full*:

Among Americans with a credit card who do not pay their bills in full, over two in five (41%) have delayed or canceled major purchases due to financial strain or credit card debt.

About three in five (59%) are cutting back on discretionary spending such as dining out and entertainment because of credit card debt.

More than half (52%) agree that rising costs/inflation has made it harder to keep up with credit card payments.

Nearly half (47%) prefer using credit cards over “Buy Now, Pay Later” options.

Rising balances, rising worries: A snapshot of U.S. credit card debt

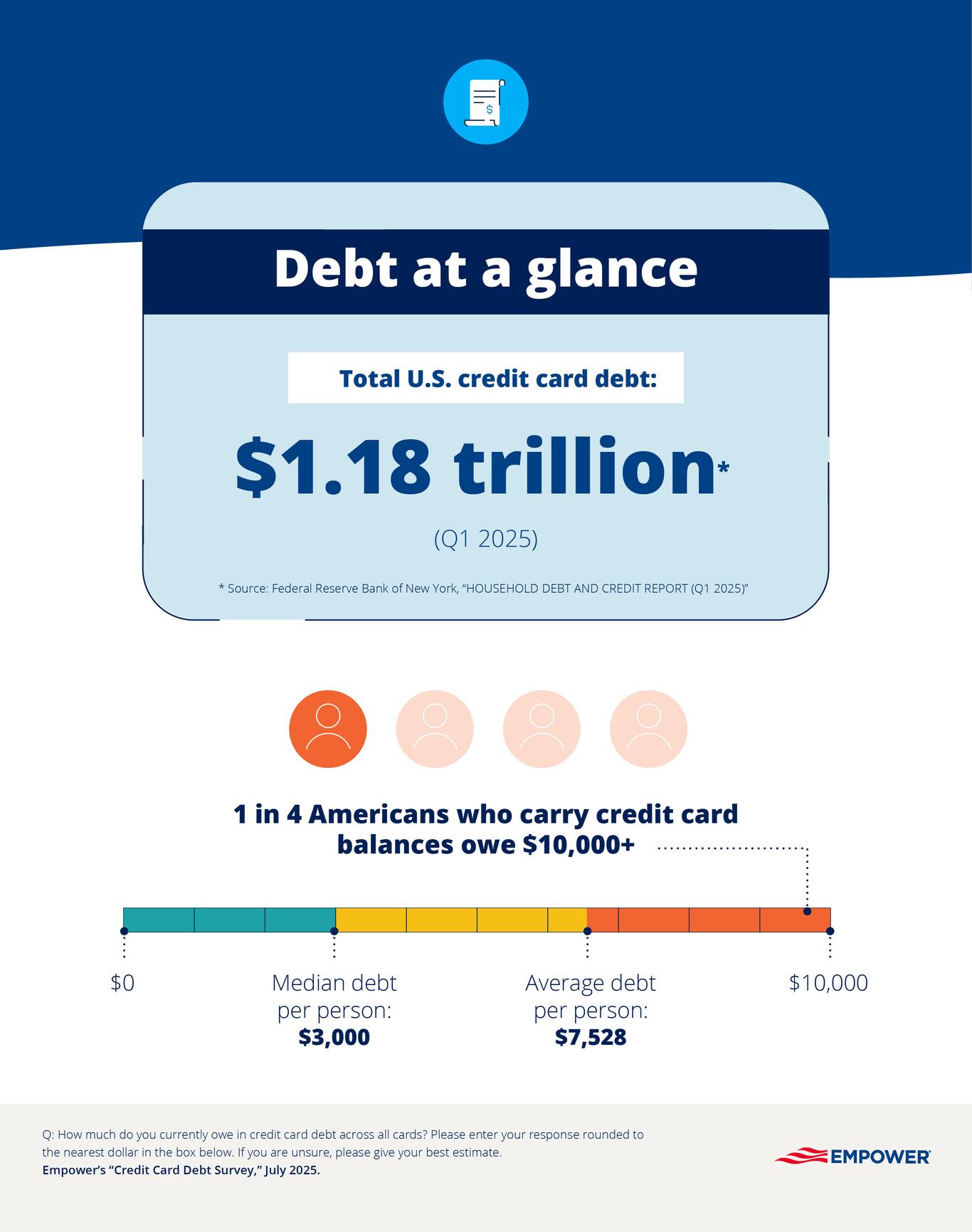

Credit cards are not only increasing Americans’ debt burden (Figure 1). As of Q1 2025, consumers had accumulated $1.18 trillion in credit card debt, with 172 million people carrying a balance on their cards.1

Among American adults who do not pay their credit cards in full:

Nearly two in five (39%) agree their total debt (including credit cards) keeps them up at night.

Over one in four (27%) have paused or reduced their contributions to monthly savings or emergency funds.

Figure 1: A snapshot of credit card debt (among those who do not pay their bills in full)

Source: Empower “Credit Card Debt Survey”, July 2025. Question: How much do you currently owe in credit card debt across all cards? Please enter your response rounded to the nearest dollar in the box below. If you are unsure, please give your best estimate.

Average credit card debt: $7,528. This aligns with data from the Federal Reserve Bank of New York, which shows that the national average credit card debt among cardholders with unpaid balances in Q1 2025 was $7,321, up 5.8% from $6,921 in Q1 2024.2

Median credit card debt: $3,000.

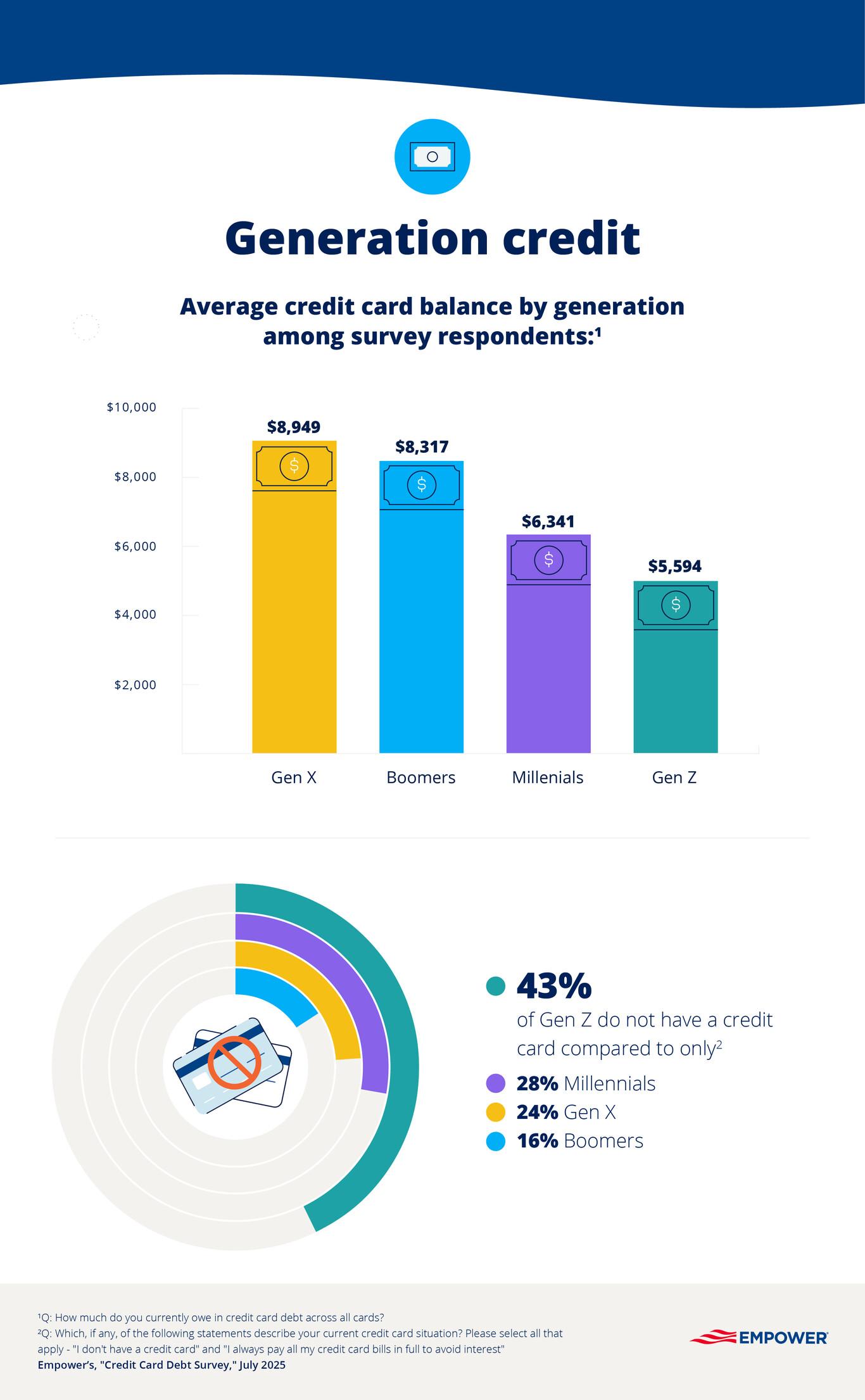

Average credit card balance by generation among survey respondents:

Gen X: $8,949

Boomers: $8,317

Millennials: $6,341

Gen Z: $5,594

Quarterly data from the Federal Reserve Bank of New York’s Consumer Credit Panel/Equifax—which tracks the percentage of people and debt in delinquency—indicate that the share of people 30 days delinquent on their credit card debt has been trending upward since the first half of 2021.3 From Q2 2021 to Q1 2025, delinquency rates increased by 63% and 44%, respectively, in relative terms.4

Americans’ complex relationship with credit cards

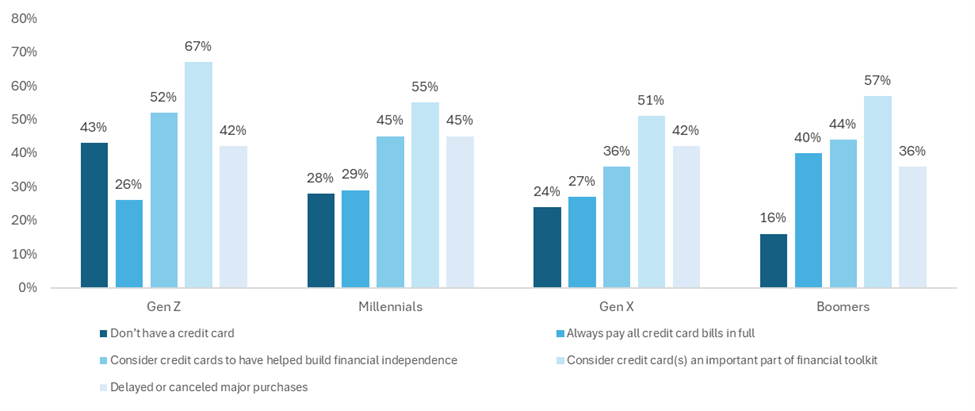

Despite the burden of debt, many Americans who carry credit card balances still value their credit cards:

Nearly three in five (57%) agree that using their credit card offers financial incentives (e.g., cashback, rewards points, access to experiences, etc.).

Similarly, 56% consider their credit card(s) to be an important part of their financial toolkit.

Moreover, 43% say credit cards have helped them build financial independence.

Figure 2: Credit card usage by generation

Questions: Which, if any, of the following statements describe your current credit card situation? Please select all that apply - "I don't have a credit card" and "I always pay all my credit card bills in full to avoid interest"; To what extent, if at all, do you agree or disagree with each of the following statements? Please select one option for each row - "Credit cards have helped me build financial independence" and "I consider my credit card(s) an important part of my financial toolkit"; and Which, if any, of the following actions have you taken in response to financial strain or credit card debt? Please select all that apply - "Delayed or canceled major purchases". Source: Empower “Credit Card Debt Survey”, July 2025.

The cost of credit: How Americans are coping with card debt

Among those who do not pay their credit card debt in full, here’s how they are coping:

Almost one in five (19%) have borrowed money from family or friends.

Nearly one in five (18%) have transferred balances to lower-interest credit cards.

About one in six (15%) have taken on a second job or side gig to manage their credit card debt.

Nearly one in seven (14%) have consolidated debt with loans (i.e., combining multiple debts into a single loan).

*Methodology

Empower’s “Credit Card Debt Survey” is based on online survey responses from 1,447 U.S. adults who have a credit card on which they don’t pay their bills in full. Fielded during two periods: June 18–19, 2025, and July 2–3, 2025. The figures have been weighted and are representative of all U.S. adults.

Get financially happy

Put your money to work for life and play

1 Federal Reserve Bank of New York, “HOUSEHOLD DEBT AND CREDIT REPORT (Q1 2025)”.

2 Ibid.

3 Federal Reserve Bank of St. Louis, "The Broad, Continuing Rise in Delinquent U.S. Credit Card Debt Revisited," May 2025.

4 Ibid.

RO4671168-0725

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. No part of this blog, nor the links contained therein is a solicitation or offer to sell securities. Compensation for freelance contributions not to exceed $1,250. Third-party data is obtained from sources believed to be reliable; however, Empower cannot guarantee the accuracy, timeliness, completeness or fitness of this data for any particular purpose. Third-party links are provided solely as a convenience and do not imply an affiliation, endorsement or approval by Empower of the contents on such third-party websites. This article is based on current events, research, and developments at the time of publication, which may change over time.

Certain sections of this blog may contain forward-looking statements that are based on our reasonable expectations, estimates, projections and assumptions. Past performance is not a guarantee of future return, nor is it indicative of future performance. Investing involves risk. The value of your investment will fluctuate and you may lose money.

Certified Financial Planner Board of Standards Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design), and CFP® (with flame design) in the U.S., which it authorizes use of by individuals who successfully complete CFP Board's initial and ongoing certification requirements.