The majority of Americans say there’s no set age to reach big money milestones — but 45% wish they'd saved sooner

The majority of Americans say there’s no set age to reach big money milestones — but 45% wish they'd saved sooner

From buying a first home to changing careers or retiring early, big life moments are often turning points. Yet while 83% of Americans say there’s no set age to achieve life milestones, nearly 1 in 2 (45%) admit they didn’t prepare financially as early as they should have.

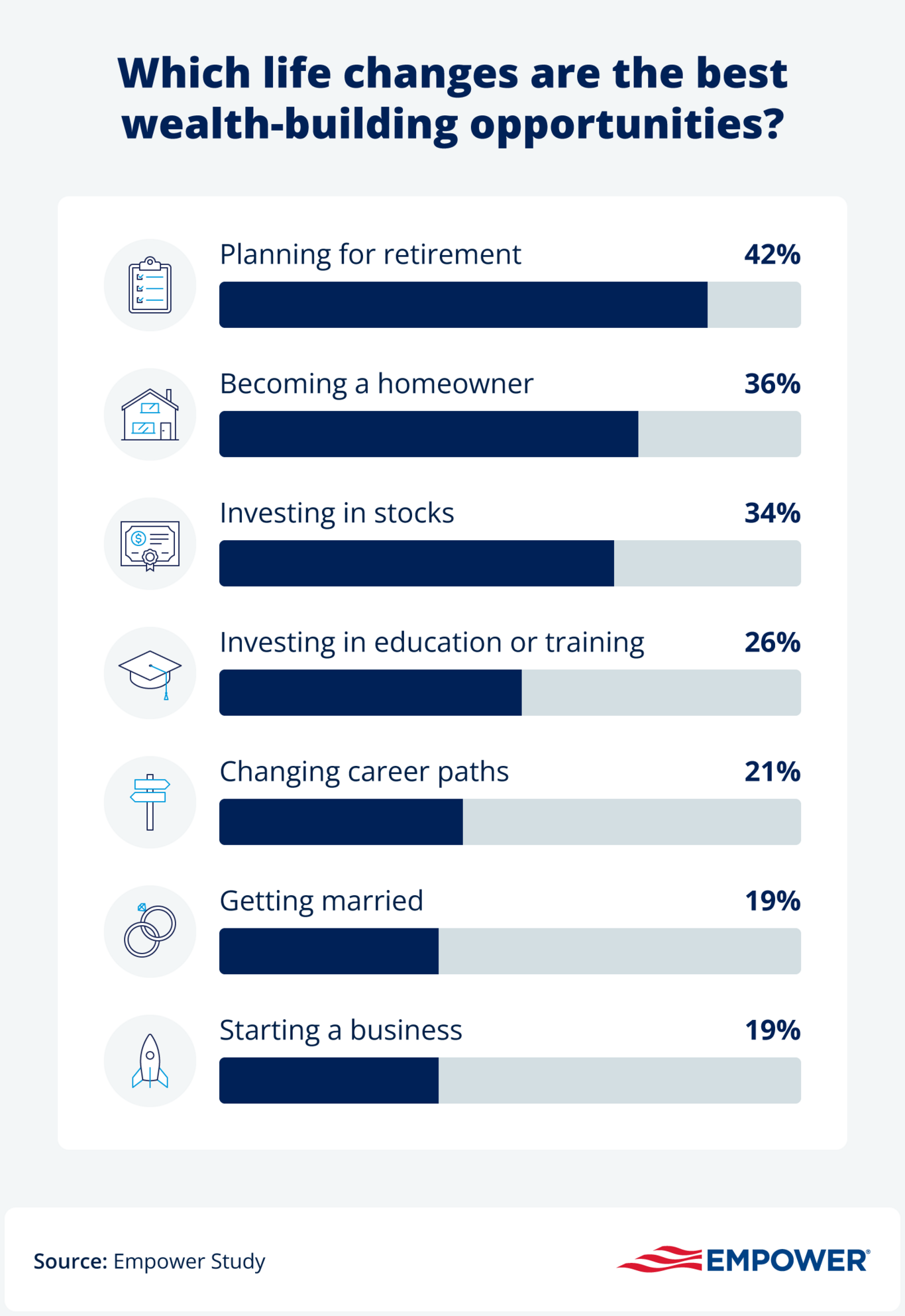

New Empower research uncovers how Americans are navigating the money side of major milestones: 34% wish they’d delayed key life moments to be more financially secure, and 42% see retirement planning as their top wealth-building opportunity.

Key takeaways

- A third (30%) of Americans say hitting a life milestone changed how they define success – it's not just about money.

- 34% wish they reached their last major milestone later – with better financial stability.

- Close to half (45%) wish they had started saving earlier.

- Americans (42%) see retirement planning as the most significant wealth-building opportunity.

- Buying a home is the most financially impactful life change (29%), though nearly the same amount underestimated how much becoming a homeowner would cost.

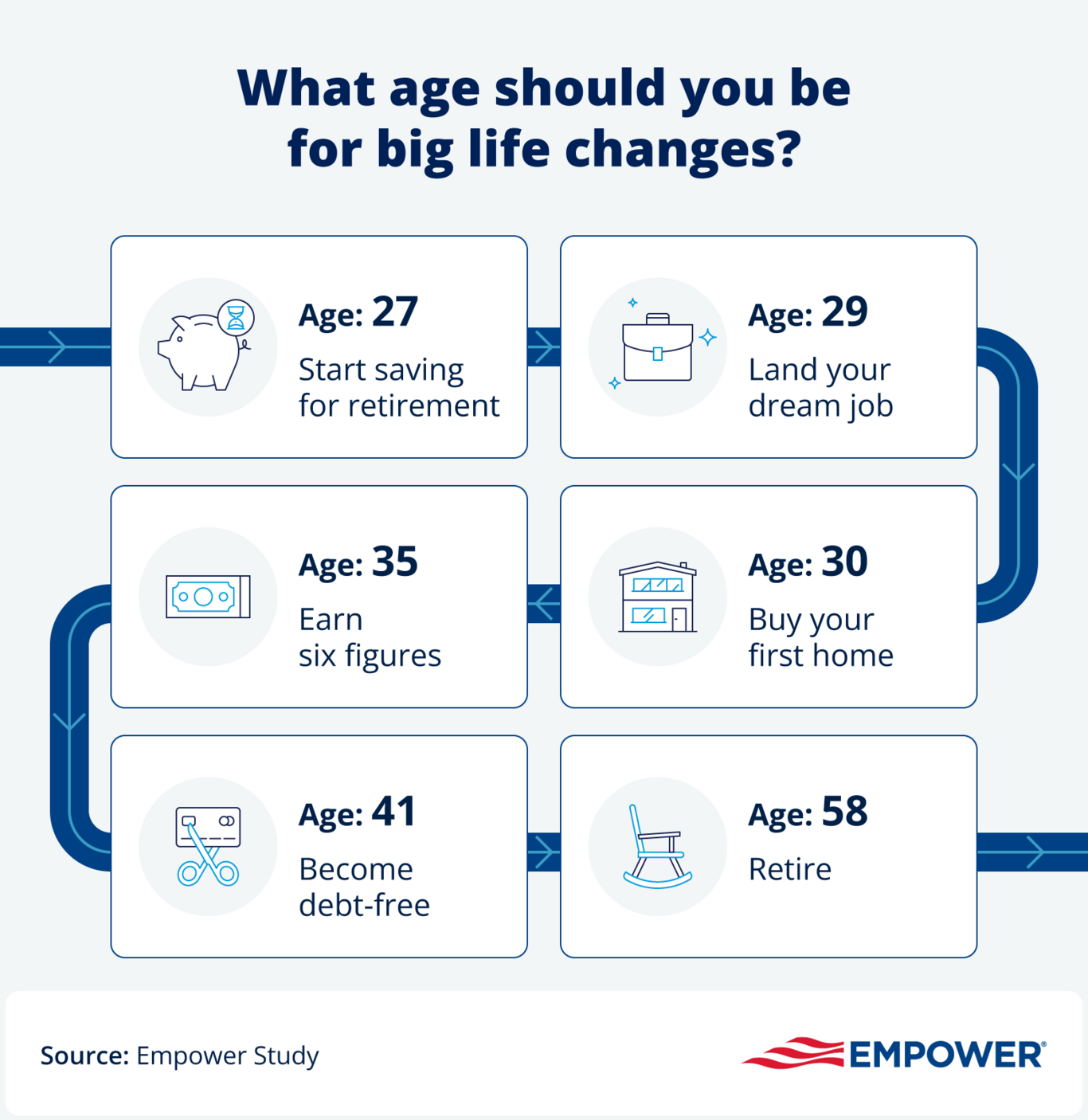

- On average, Americans think you should start saving for retirement at 27, land your dream job at 29, buy your first home at 30, and earn six figures by 35. They also say they should become debt free at 41 and retire at 58.

- A quarter (25%) admit they underestimate the costs of major life events.

- About 1 in 3 (32%) say they realized the importance of having a financial plan or working with a financial planner after reaching a life milestone.

There’s no one-size-fits-all timeline

Just 17% think people should achieve milestones by a specific age.

For the rest, timelines are flexible, and many (44%) are glad they achieved their major life changes when they did — not earlier (23%) or later (34%). However, nearly a quarter (22%) say they've felt behind on hitting money milestones, often turning to family members to avoid falling further behind.

On average, Americans think you should start saving for retirement at 27, land your dream job at 29, buy your first home at 30, and earn six figures by 35. They also say they should become debt free at 41 and retire at 58 — six years before the national average retirement age of 64.

Despite these ideal targets, 34% say they’d trade timing for better financial footing.

Source: Empower, "Big Life Changes" study, 2025.

No. 1 regret: Not saving sooner

Around half of Americans (45%) say they wish they'd saved earlier and more consistently to prepare financially for big life changes like buying a house, starting a business, or graduating college.

Another 41% wish they'd built a larger emergency fund before making a life change — while 80% say they should have set aside more money specifically to navigate financial emergencies. Additionally, a quarter of people (25%) say they underestimate the costs of major life events.

The silver lining: Many Americans believe good saving habits are the most effective way to prepare for life events. About half (44%) say it's important to save earlier than you think you need to when preparing for major changes, and over 1 in 5 (21%) say big life changes made them start saving more aggressively.

Stress less or get serious?

Nearly a quarter of people (24%) say they want to stress less about money and enjoy themselves after making a major life change, and this number is even higher for those who retired (49%), switched careers (30%), or paid off major debts (29%).

On the other hand, 22% say they became more financially disciplined and cautious after their life change. Another 17% say they're more focused on financial planning, while 14% are still trying to recover and become financially stable again.

Source: Empower, "Big Life Changes" study, 2025.

Just 9% say they became more ambitious about building wealth after their last major life event – unless they started a business (22%).

Buying a home = a financial game changer

Americans say the most financially impactful life change is buying a home (29%).

To prepare for purchasing a home, 51% of people created or updated a budget, while 38% paid off existing debts like credit card balances and student loans. A third (32%) researched the costs of homeownership before buying and a quarter met with a financial planner (21%). Overall, 23% say they had a financial plan leading up to buying a home.

Nearly half of homeowners (47%) wish they'd built a larger emergency fund before buying a house, and over a quarter (28%) say they underestimated how much becoming a homeowner would cost.

Americans see big life changes as wealth-building opportunities

While major life changes can lead to financial setbacks, many Americans see them as opportunities to build wealth and invest in the future. People view retirement planning (42%), buying a house (36%), and investing in the stock market (34%) as the three most significant wealth-building opportunities.

Source: Empower, "Big Life Changes" study, 2025.

Others say the top life events for growing wealth are investing in education or training (26%), switching career paths (21%), uniting finances through marriage (19%), or launching a business venture (19%). Overall, 1 in 5 Americans could see themselves building real wealth after making a big life change.

But while money is important, 30% say they started measuring success differently (not just by wealth) after achieving a major life milestone, and another 17% say they stopped identifying as "financially behind."

Other key findings

More key findings from the study:

- Changing conditions: Over a quarter of Americans (27%) believe their generation has a disadvantage compared to other generations due to the state of the economy. This number is highest for Gen Z (38%) and Millennials (36%) compared to Gen X (21%) and Baby Boomers (12%).

- Helping hands: 1 in 5 Americans say they only reached major life milestones because they had financial support from others. This number is twice as high for Millennials and Gen Zers (24%) than for Baby Boomers (12%).

- Planning ahead: Close to a third (32%) say they realized the importance of having a financial plan or working with a financial planner after reaching a life milestone.

- Winging it: 37% of people who started a business figured it out as they went, focusing on the moment instead of the money.

Methodology

Empower's "Big Life Changes" study is based on online survey responses from 1,001 American ages 18+ on June 2, 2025.

Get financially happy

Put your money to work for life and play

RO4717471-0825

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. No part of this blog, nor the links contained therein is a solicitation or offer to sell securities. Compensation for freelance contributions not to exceed $1,250. Third-party data is obtained from sources believed to be reliable; however, Empower cannot guarantee the accuracy, timeliness, completeness or fitness of this data for any particular purpose. Third-party links are provided solely as a convenience and do not imply an affiliation, endorsement or approval by Empower of the contents on such third-party websites. This article is based on current events, research, and developments at the time of publication, which may change over time.

Certain sections of this blog may contain forward-looking statements that are based on our reasonable expectations, estimates, projections and assumptions. Past performance is not a guarantee of future return, nor is it indicative of future performance. Investing involves risk. The value of your investment will fluctuate and you may lose money.

Certified Financial Planner Board of Standards Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design), and CFP® (with flame design) in the U.S., which it authorizes use of by individuals who successfully complete CFP Board's initial and ongoing certification requirements.