The vanishing wallet

The vanishing wallet

Key takeaways

- Nearly 4 in 10 Americans say each generation relies less on cash than the one before it (37%).

- Two in 5 say they feel safer keeping cash on hand in case of emergencies or tech outages (40%).

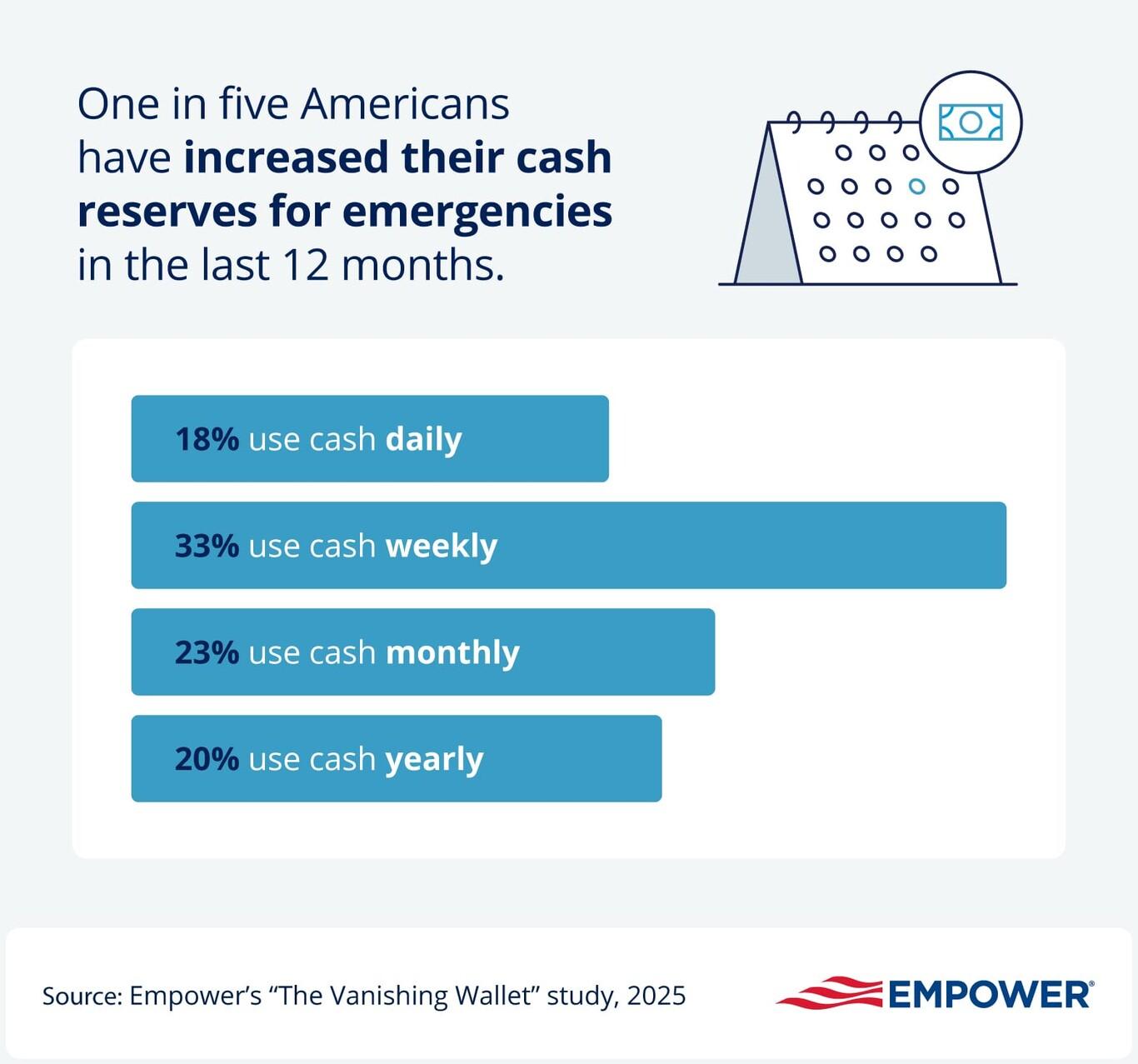

- 1 in 5 have increased the amount of cash they keep at home in the past year due to economic concerns.

- 55% would put $10,000 into a high-yield savings account—but 40% would keep it as cash for safety.

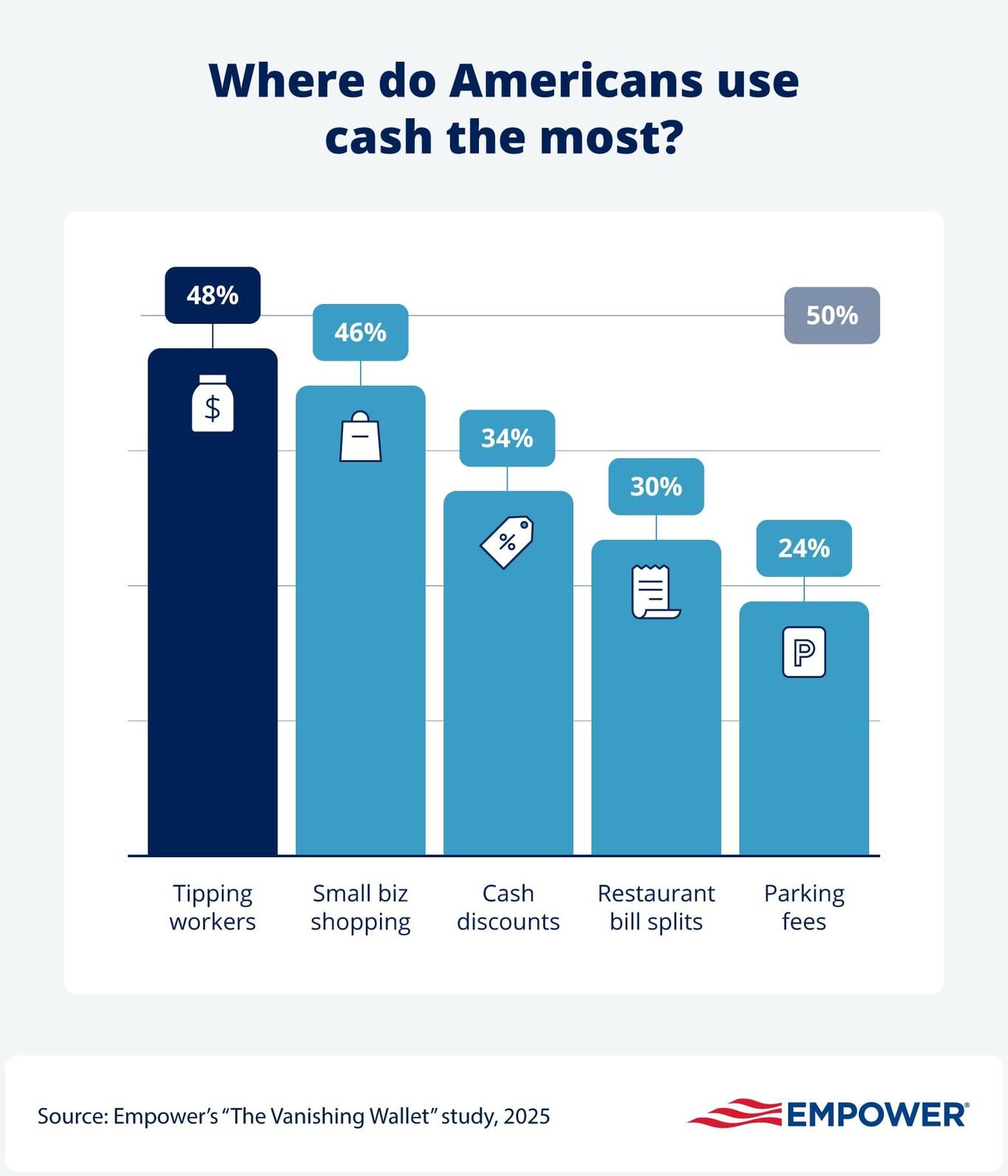

- The number one reason for using cash is tipping (48%) or making purchases at small businesses (46%).

- The average person holds between $51 and $100 in their “wallet.” Gen X is the only generation that carries more cash, averaging between $101 and $200.

Cash in a digital age

While a third (35%) say they are mostly cashless, for close to 1 in 5 Americans (19%), dollar bills remain a trusted form of payment—something they actively use and keep in significant amounts. Overall, 40% of people feel safer keeping some cash on hand in case of emergencies or tech outages.

Nearly a quarter say they use cash for privacy (21%) in an AI-driven, digital world. The same amount also turn to cash when they want to limit their spending for the day (24%). A third say they’re more likely to make impulse purchases with digital payments (33%), and spend more without the natural guardrail of cash (27%).

With the shift towards digital payments (e.g. debit cards, credit cards, mobile wallets, etc.), 27% say they are more likely to pay bills and save automatically. More than a quarter have better awareness of their spending patterns (27%) and spend less because they can track everything digitally (22%). Close to 1 in 5 admit that if cash disappeared, they'd spend less (17%).

Currency in action

While Americans’ savings goals are lofty, most regular cash carriers keep it light. The average person holds between $51 and $100 in their “wallet,” consistent with the $66 cash average from last year’s study. Gen X is the only generation that carries more cash, averaging between $101 and $200.

Half use their physical money for tips (48%), while a third use it to get a discount for paying in cash (34%).

Other scenarios where Americans are most likely to use cash:

- When paying small businesses that don’t accept cards (46%)

- When splitting costs with friends at a restaurant (30%)

- Paying for parking meters or tolls (24%)

- For emergency expenses (22%)

- Retailers or grocery stores (21%)

- When traveling abroad (18%)

- Paying for gas (16%)

- Paying for a kid’s allowance (16%)

Generational shifts: Piggy banks to digital wallets

For many people, cash is tied to their earliest memories about money: 41% say their first financial experiences involved physical cash, not digital payments. Nearly a third understood the value of cash at an early age (32%) and learned to save by setting aside dollar bills before they ever used a bank account (28%).

Yet, today, money etiquette is changing: 35% say younger generations are skipping physical cash entirely and going straight to digital money. Overall, 37% say each generation relies less on cash than the one before it. Close to a quarter predict their own children will grow up with little or no cash experience (22%).

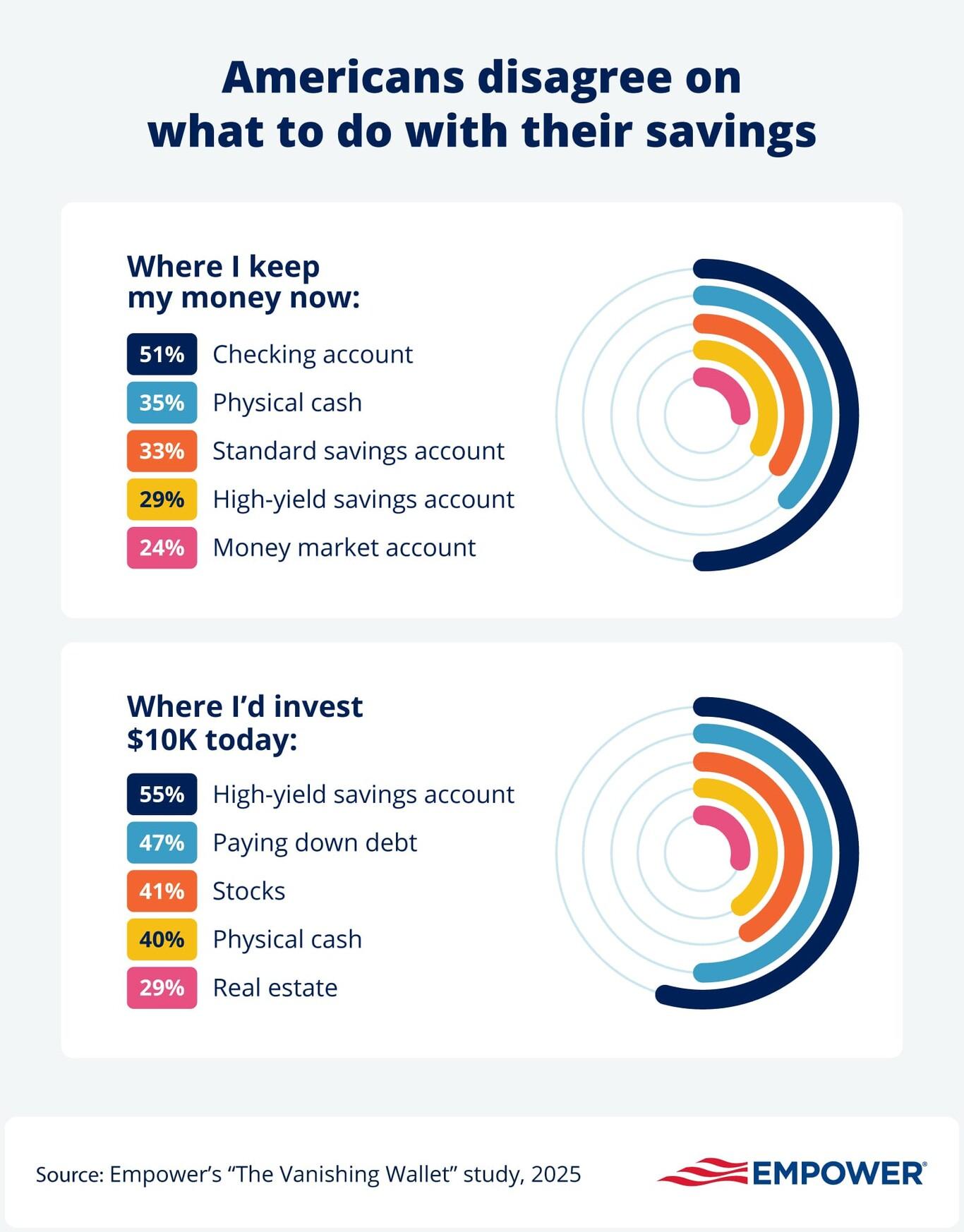

Money moves

When it comes to where Americans keep their liquid savings, more than half (51%) say a checking account. Over a third keep money in a standard savings account (33%), and the same share holds physical cash at home (35%), as many still want instant, tangible access to their funds.

Nearly 3 in 10 have moved money into high-yield savings accounts (29%), while a quarter rely on money market accounts (24%). For some, the strategy is a balance—20% split evenly between accounts and physical cash—while others lean on more traditional products like certificates of deposit (18%).

When asked how they’d allocate $10,000 today, most Americans balance digital returns with physical reassurance:

- 55% would deposit it in a high-yield savings account

- 47% would pay down debt

- 41% would invest in stocks for long-term growth

- 40% would keep it as cash for easy access

- 29% would use it for real estate or a property purchase

- 27% would buy bonds or Treasury bills

- 22% would spend the money on education or skills development to boost earning potential

- 22% would buy precious metals like gold or silver

Even in a digital-first world, nearly half the population sees value in liquidity, flexibility, and the physical assurance of cash.

Additional study findings:

- Going up: 21% have moved money into high-yield savings accounts in the last 12 months due to higher interest rates.

- Market moves: 25% trust physical cash more than digital transactions during uncertain economic times.

- Banking on it: More than a third (36%) say they opened their first savings account before they turned 18.

- Age of cash: One in 5 plan to rely less on physical cash as they get older. 17% think about wanting to have cash on hand in retirement.

Methodology:

Empower's “The Vanishing Wallet” study is based on online survey responses from 1,039 Americans ages 18+ from August 18–19, 2025.

Get financially happy

Put your money to work for life and play

RO4817468-0925

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. No part of this blog, nor the links contained therein is a solicitation or offer to sell securities. Compensation for freelance contributions not to exceed $1,250. Third-party data is obtained from sources believed to be reliable; however, Empower cannot guarantee the accuracy, timeliness, completeness or fitness of this data for any particular purpose. Third-party links are provided solely as a convenience and do not imply an affiliation, endorsement or approval by Empower of the contents on such third-party websites. This article is based on current events, research, and developments at the time of publication, which may change over time.

Certain sections of this blog may contain forward-looking statements that are based on our reasonable expectations, estimates, projections and assumptions. Past performance is not a guarantee of future return, nor is it indicative of future performance. Investing involves risk. The value of your investment will fluctuate and you may lose money.

Certified Financial Planner Board of Standards Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design), and CFP® (with flame design) in the U.S., which it authorizes use of by individuals who successfully complete CFP Board's initial and ongoing certification requirements.