Day in the life: What it really costs to live in 6 major U.S. cities

Day in the life: What it really costs to live in 6 major U.S. cities

Day in the life: What it really costs to live in 6 major U.S. cities

What does a typical weekday cost in six major American cities? Beyond rent and utilities, everyday expenses from a morning coffee to childcare and commuting paint a fuller picture of affordability and lifestyle (figure 1). Empower analyzed and compared daily costs in New York City (NYC), Boston, Miami, Chicago, Los Angeles (LA), and Austin (see ‘Methodology’).

Figure 1: What a day costs – Daily expenses for a single individual in six American cities

Source: Empower’s analysis based on data from the U.S. Census Bureau, Care.com, Numbeo, PriceList, restaurant websites, and mobile apps.

- New York City is the most expensive at about $168.32/day, primarily driven by high childcare and commute costs.1

- LA comes second at $156.92/day, with high childcare and commuting costs.2

- Miami is the most affordable among the six cities, at $128.66/day, with comparatively low childcare and commute expenses.3

- Childcare is consistently the largest single cost across all the cities, more than all other costs combined.

- Even in cities with relatively lower costs such as Miami and Austin, daily living adds up quickly, especially for working parents with active routines.

Childcare: The budget breaker

Childcare is the single most significant daily expense for working parents across all six cities analyzed (figure 2). Los Angeles ($105.85/day) and New York City ($98.95/day) top the list, reflecting high demand and limited availability of affordable childcare.4 Even in more “affordable” cities like Miami ($88.70/day) and Austin ($92.05/day)5, daily childcare costs still exceed or rival other major living expenses, underscoring the financial strain on working individuals nationwide.

Figure 2: LA residents spend the most on daily childcare

Source: Empower’s analysis of childcare costs based on data from Care.com.

Commute: Getting around costs a lot

How much it costs to simply get to work varies dramatically (figure 3). Commuting expenses show sharp contrasts across major metro areas, with NYC topping the list at $41.65/day, far exceeding other cities due to high transit and rideshare dependence.6 Miami ($17.50/day) and Austin ($24.50/day) are the most affordable, despite being car-dependent, likely due to lower parking fees and shorter travel distances.7 Boston and Chicago, while transit-heavy, still cost over $30/day, proving that even public transportation isn’t always cheap.8

Figure 3: Daily commute costs vary widely across major U.S. cities

Source: Empower’s analysis based on the data form the U.S. Census Bureau.

Lunch: Takes a sizeable bite

Prices for a standard fast-food meal vary more than expected, with Los Angeles leading at $13.45 per day (figure 4), followed closely by New York City ($13.30) and Chicago ($12.45).9 Austin ($10.40) and Miami ($11.30) offer the most affordable midday meals, but even in these cities, lunch can add up to over $200/month for working professionals.10 The data highlights how food inflation and regional dining trends influence not just lifestyle but also budgeting decisions across U.S. cities.

Figure 4: LA residents shell out the most for weekday lunches

Source: Empower’s analysis based on fast-food meal data from restaurant websites and mobile apps.

Coffee: A little luxury today

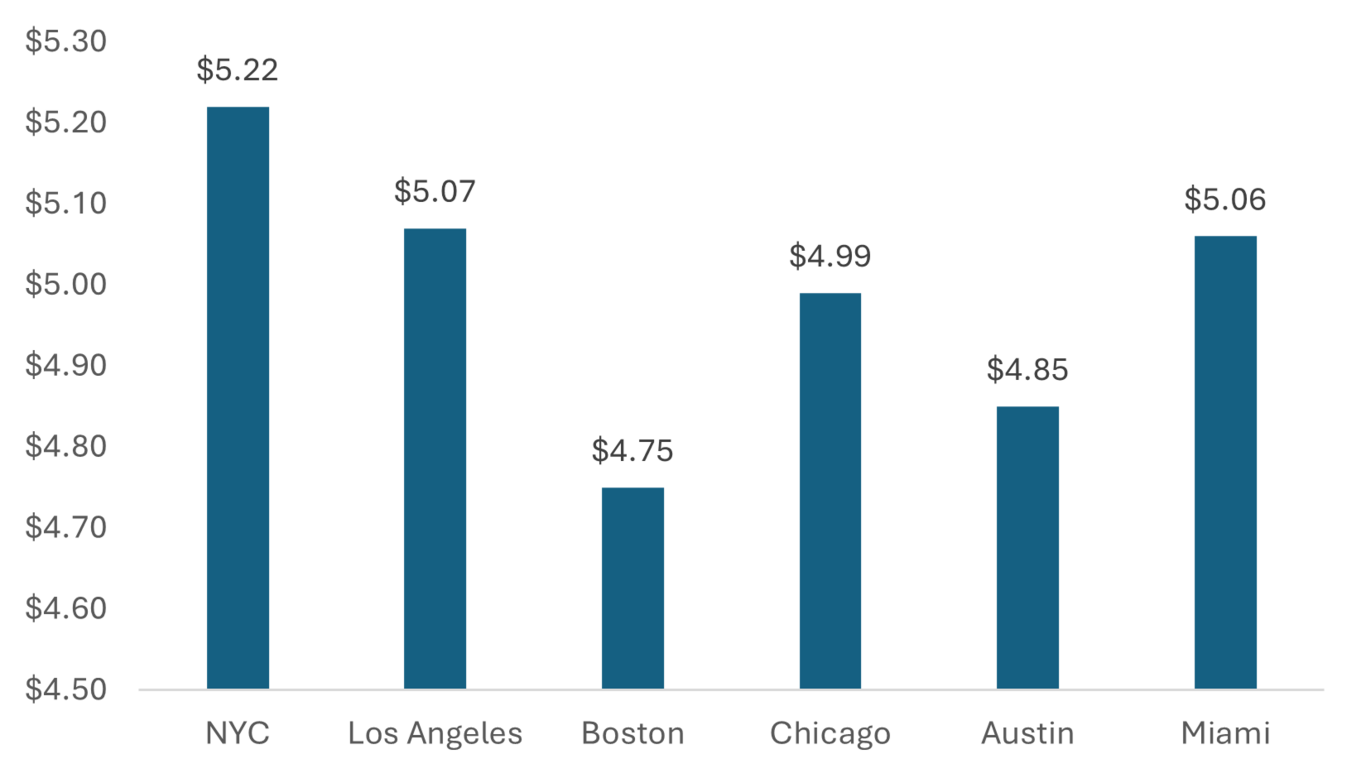

What’s a flat white in the morning really costing you? A single cup of coffee reveals subtle but meaningful differences in daily lifestyle costs across cities (figure 5). NYC at $5.22, followed closely by Los Angeles ($5.07) and Miami ($5.06).11 Surprisingly, Boston offers the most affordable coffee at $4.75, despite its high cost of living in other categories.12 While coffee may seem like a small indulgence, over a 20-workday month, this habit can amount to more than $100–$120. In contrast, according to the Empower Personal DashboardTM, the average monthly spending on coffee in the U.S. was $44.50 in May 2025.

Figure 5: New Yorkers pay the most for their morning coffee

Source: Empower’s analysis based on data from PriceList for a single cup of Starbucks coffee.

Everyday essentials add up

Wi-Fi:

Range from $2.00/day in NYC to $2.30/day in Boston.13

Relatively consistent across cities, contributing a modest but meaningful $40–$46/month.14

Gym access:

NYC is highest at $4.70/day, driven by boutique studios and premium brands.15

Austin and Miami offer the most affordable gym options at $2.10/day, thanks to access to budget gyms.16

While the monthly cost of gym access in the six major cities varied between $48 to $171, according to the Empower Personal DashboardTM, the average monthly spending on gym access in the U.S. was $82.50 in May 2025.

Bottled water:

Costs are relatively uniform, between $1.90/day (Miami) and $2.70/day (Chicago).17

These small, repetitive expenses often go unnoticed but can add up. Together, these three “background” items add $6 to $10 per day depending on city, almost equal to the cost of daily lunch in most places.

Affordability isn’t just about rent

While housing costs and rent often dominate conversations about urban affordability, daily expenses tell a more nuanced story. The real cost of living includes the thousands of dollars Americans spend annually on commuting, childcare, meals, connectivity, and wellness. As Americans consider relocation decisions, understanding the everyday price tag of urban life is more essential than ever.

Methodology

Empower’s analysis estimates the average weekday daily cost of living across six major U.S. cities — New York City (NYC), Boston, Los Angeles (LA), Chicago, Miami, and Austin — by compiling prices for common expenses encountered by working adults. The categories include childcare (center-based care, prorated daily); commute (public transit fares and car-related costs); coffee (daily takeaway beverage); lunch (fast-food meal); Wi-Fi (daily cost); Gym (membership averaged to a daily rate); and bottled water (single-purchase cost per day).

Data was sourced from publicly available information as of June 2025. Where monthly costs applied (e.g., childcare, Wi-Fi), they were converted into daily equivalents assuming 30 days per month, depending on the expense type. This analysis assumes a single working adult with one child in daycare, with costs representing general averages rather than extremes.

Get financially happy

Put your money to work for life and play

1 Empower’s analysis based on data from the U.S. Census Bureau, Care.com, Numbeo, PriceList and restaurant websites and mobile apps

2 Ibid

3 Ibid

4 Care.com, “Childcare cost”

5 Ibid

6 Empower’s analysis based on the data form the U.S. Census Bureau

7 Ibid

8 Ibid

9 Empower’s analysis of fast-food meal data from restaurant websites and mobile apps

10 Ibid

11 Empower’s analysis based on data from PriceList for a single cup of Starbucks coffee

12 Ibid

13 Empower’s analysis based on data from Numbeo

14 Ibid

15 Ibid

16 Ibid

17 Ibid.

RO4603615-0625

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. No part of this blog, nor the links contained therein is a solicitation or offer to sell securities. Compensation for freelance contributions not to exceed $1,250. Third-party data is obtained from sources believed to be reliable; however, Empower cannot guarantee the accuracy, timeliness, completeness or fitness of this data for any particular purpose. Third-party links are provided solely as a convenience and do not imply an affiliation, endorsement or approval by Empower of the contents on such third-party websites. This article is based on current events, research, and developments at the time of publication, which may change over time.

Certain sections of this blog may contain forward-looking statements that are based on our reasonable expectations, estimates, projections and assumptions. Past performance is not a guarantee of future return, nor is it indicative of future performance. Investing involves risk. The value of your investment will fluctuate and you may lose money.

Certified Financial Planner Board of Standards Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design), and CFP® (with flame design) in the U.S., which it authorizes use of by individuals who successfully complete CFP Board's initial and ongoing certification requirements.