Back-to-school shopping expected to reach almost $900 per household in 2025

It’s that time again — store shelves are packed with crayons and tablets for back-to-school shoppers.

Back-to-school shopping expected to reach almost $900 per household in 2025

It’s that time again — store shelves are packed with crayons and tablets for back-to-school shoppers.

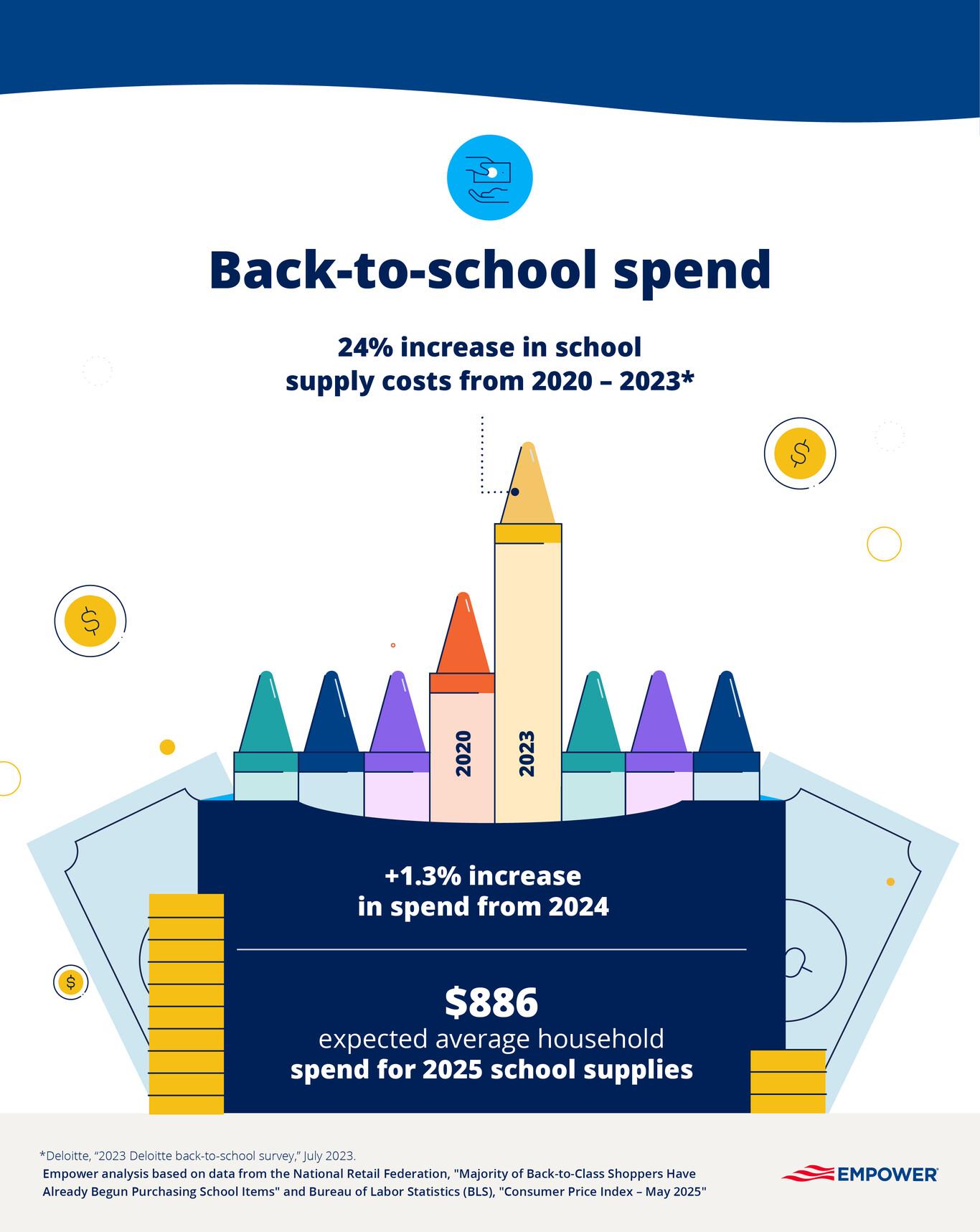

This year, American families are preparing for one of their largest annual expenses: school supplies. Surprisingly, this seasonal cost now rivals—and in some cases exceeds—essential household expenses such as monthly grocery bills or utility costs.1 What was once considered a relatively minor budget line item has ballooned dramatically, with school supply increasing by 24% between 2020 and 2023—largely driven by rising raw material costs and supply chain disruptions.2

In 2025, families are also navigating the lingering effects of inflation and the renewed impact of tariffs on imported goods—especially electronics and apparel (see below). Prices for school-related items remain high, making this back-to-school season another costly one for households across the country.

Not just a shopping season, but a mirror of the American economy

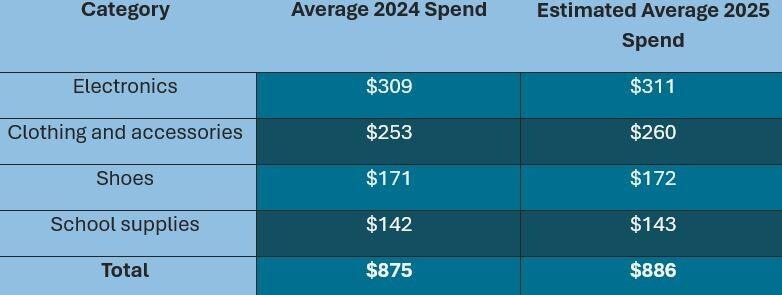

For most families, it represents a significant financial commitment. Total spending in 2024 was estimated at $38.8 billion, up 48% from 2019 levels, with families spending an average of $875.3

What's driving these numbers?

- Electronics remain a major cost as digital learning has become deeply embedded in education. Even a basic tablet or student Chromebook often exceeds $300.4 The Consumer Price Index (CPI) for computers, peripherals, and smart home assistants has been rising since the start of 2025, with a 4.13% increase between January and June 2025.5

- Apparel and footwear prices are on the rise, partly due to lingering inflation and newly imposed import tariffs.6 The CPI for apparel has seen a modest but consistent uptick, especially for children's clothing and footwear.7 Much of this can be attributed to rising input costs (such as labor and cotton), as well as tariff-related pressures.8

So, what does the price tag look like in 2025?

Empower estimates that the average back-to-school spending per household in 2025 will be $886—an increase of 1.3% year-over-year—assuming current inflation trends and partial tariff pass-through (figure 1).9

Figure 1: Back-to-school costs set to rise in 2025, pushing household spend closer to $900

Source: Empower analysis based on data from the National Retail Federation (NRF), "Majority of Back-to-Class Shoppers Have Already Begun Purchasing School Items" and Bureau of Labor Statistics, "Consumer Price Index - May 2025”.

Shoppers get savvy

As a result of rising costs, Americans are increasingly turning to online shopping for back-to-school purchases.10 The days of last-minute August hauls are fading, with the majority likely to complete their shopping by the end of July—prompted by early discounting events like Amazon Prime Day.11

According to a recent annual survey by the National Retail Foundation (NRF), Americans are increasingly adopting budget-conscious shopping habits—starting earlier, seeking out sales and coupons, comparing prices both online and in print, and opting for store-brand or generic products to stretch their back-to-school budgets.12

2025: Beyond the basics

American families are likely to prioritize essentials this season—though not always in expected ways.

- Many will likely make some trade-offs. For example, cutting back on dining out just to get the right pair of sneakers or tech tool that boosts their child’s confidence or performance.13

- Back-to-school shoppers are likely to use platforms like Instagram and TikTok to discover products or score discounts.14

Generative AI technology, such as ChatGPT, is emerging as a tool to streamline the shopping experience—from price comparisons to real-time reviews. This technology will likely help shoppers make smarter and faster purchasing decisions.15

Get financially happy

Put your money to work for life and play

1 Empower analysis based on data from the National Retail Federation, "Majority of Back-to-Class Shoppers Have Already Begun Purchasing School Items".

2 Deloitte, “2023 Deloitte back-to-school survey," July 2023.

3 National Retail Federation (NRF), "Back to basics: 3 ways the economy is impacting back-to-school this year," July 2025.

4 Empower analysis based on data from Amazon.com and Best Buy.

5 U.S. Bureau of Labor Statistics, "Consumer Price Index for All Urban Consumers," July 2025.

6 Business Insider, "Nike plans 'surgical' price increases as it expects $1 billion hit from tariffs," June 2025.

7 Federal Reserve Bank of St. Louis, “Consumer Price Index for All Urban Consumers: Apparel,” June 2025.

8 The Associated Press, "Tariffs will make sneakers, jeans and almost everything Americans wear cost more, trade groups warn," April 2025.

9 Empower analysis based on data from the NRF, "Majority of Back-to-Class Shoppers Have Already Begun Purchasing School Items" and Bureau of Labor Statistics (BLS), "Consumer Price Index – May 2025".

10 NRF, “Holiday and Seasonal Trends, Back-to-School”.

11 NerdWallet, “What to Buy (and Skip) on Prime Day, July 8-11,” June 2025.

12 NRF, “Back-to-School Season Begins Early for Majority of Shoppers,” July 2025.

13 Intuit, "Half of parents will sacrifice necessities to pay for back-to-school expenses, study finds," August 2024.

14 Mintel, "Kids, coupons, and social media among top influences for US parents shopping back-to-school," August 2022.

15 Reuters, "OpenAI rolls out new shopping features with ChatGPT search update," April 2025.

RO4693376-0725

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. No part of this blog, nor the links contained therein is a solicitation or offer to sell securities. Compensation for freelance contributions not to exceed $1,250. Third-party data is obtained from sources believed to be reliable; however, Empower cannot guarantee the accuracy, timeliness, completeness or fitness of this data for any particular purpose. Third-party links are provided solely as a convenience and do not imply an affiliation, endorsement or approval by Empower of the contents on such third-party websites. This article is based on current events, research, and developments at the time of publication, which may change over time.

Certain sections of this blog may contain forward-looking statements that are based on our reasonable expectations, estimates, projections and assumptions. Past performance is not a guarantee of future return, nor is it indicative of future performance. Investing involves risk. The value of your investment will fluctuate and you may lose money.

Certified Financial Planner Board of Standards Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design), and CFP® (with flame design) in the U.S., which it authorizes use of by individuals who successfully complete CFP Board's initial and ongoing certification requirements.