The AI revolution rolls on

Overview I Economy I Equity market I Bond market I AI I Housing market I Global debt

U.S. economic and market outlook 2026

The AI revolution rolls on

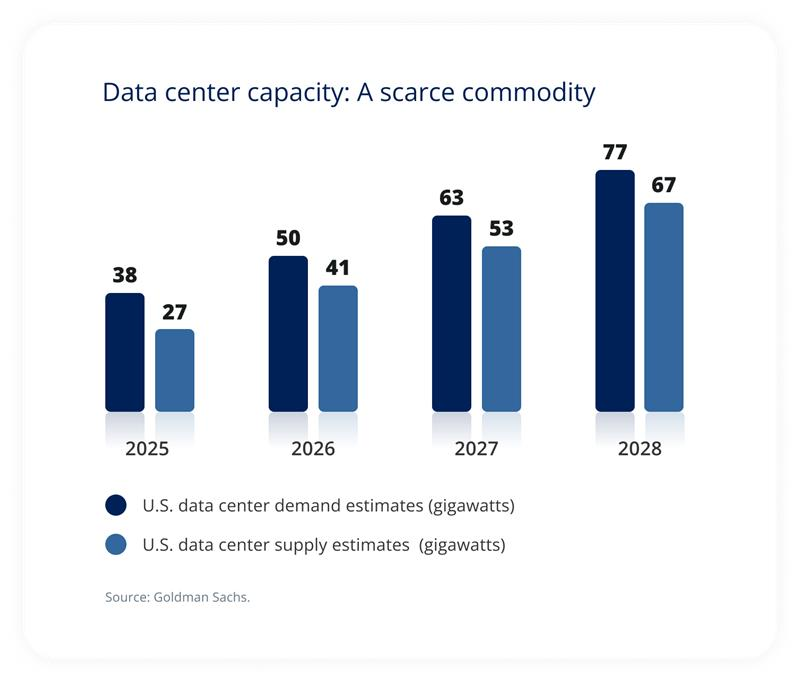

Demand for data centers is rising sharply, driven by the rapid growth of AI and cloud computing

However, existing infrastructure cannot keep pace. Goldman Sachs estimates that U.S. data centers already face a capacity shortfall of more than 11 gigawatts (GW), with the cumulative gap expected to exceed 40 GW by 2028.

The expansion of AI-focused facilities is accelerating at an unprecedented rate

Global commercial real estate services and investment management company Jones Lang LaSalle projects that North American data center capacity will increase eightfold, from 5.6 GW in 2024 to 44 GW by 2030, and Deloitte forecasts that U.S. AI data center power demand could soar from 4 GW in 2024 to 123 GW by 2035. Together, these projections highlight the massive scaling of infrastructure needed to support the next wave of AI adoption.

At the same time, the industry’s energy footprint is expanding rapidly

Bain Capital forecasts that data centers’ share of global electricity consumption will more than double to 9% by 2030, and McKinsey expects AI-related infrastructure to represent 71% of total North American data center capacity by that year.

Despite advances in chip efficiency, the increasing complexity of AI workloads continues to drive sharp growth in overall power consumption.

“AI has the potential to be more transformative than electricity or fire.”

— Sundar Pichai, CEO of Google and Alphabet

A gigawatt is a unit of power equal to 1 billion watts, or 1,000 megawatts It equals approximately 1.3 million horsepower. AI capacity is measured in gigawatts as a standard unit of measurement regardless of specific hardware or vendors involved. It orients measurement to power, which is the primary constraint for data centers. Contextualizing AI energy demands • Analysts estimate North American AI data center capacity will increase eight times. • OpenAI’s Stargate Project aims for 10 GW of AI data center capacity. • Meta’s Hyperion project is expected to scale up to 5 GW. • The expected cumulative shortfall of U.S. data center capacity by 2028 is more

than 40 GW. |

AI infrastructure spending

AI infrastructure spending is entering a hyper-growth phase, propelled by surging compute demand. Analysts project that the AI infrastructure market could reach between $3 trillion and $5 trillion by the end of the decade, with the majority of investments directed toward building capacity to support AI workloads.

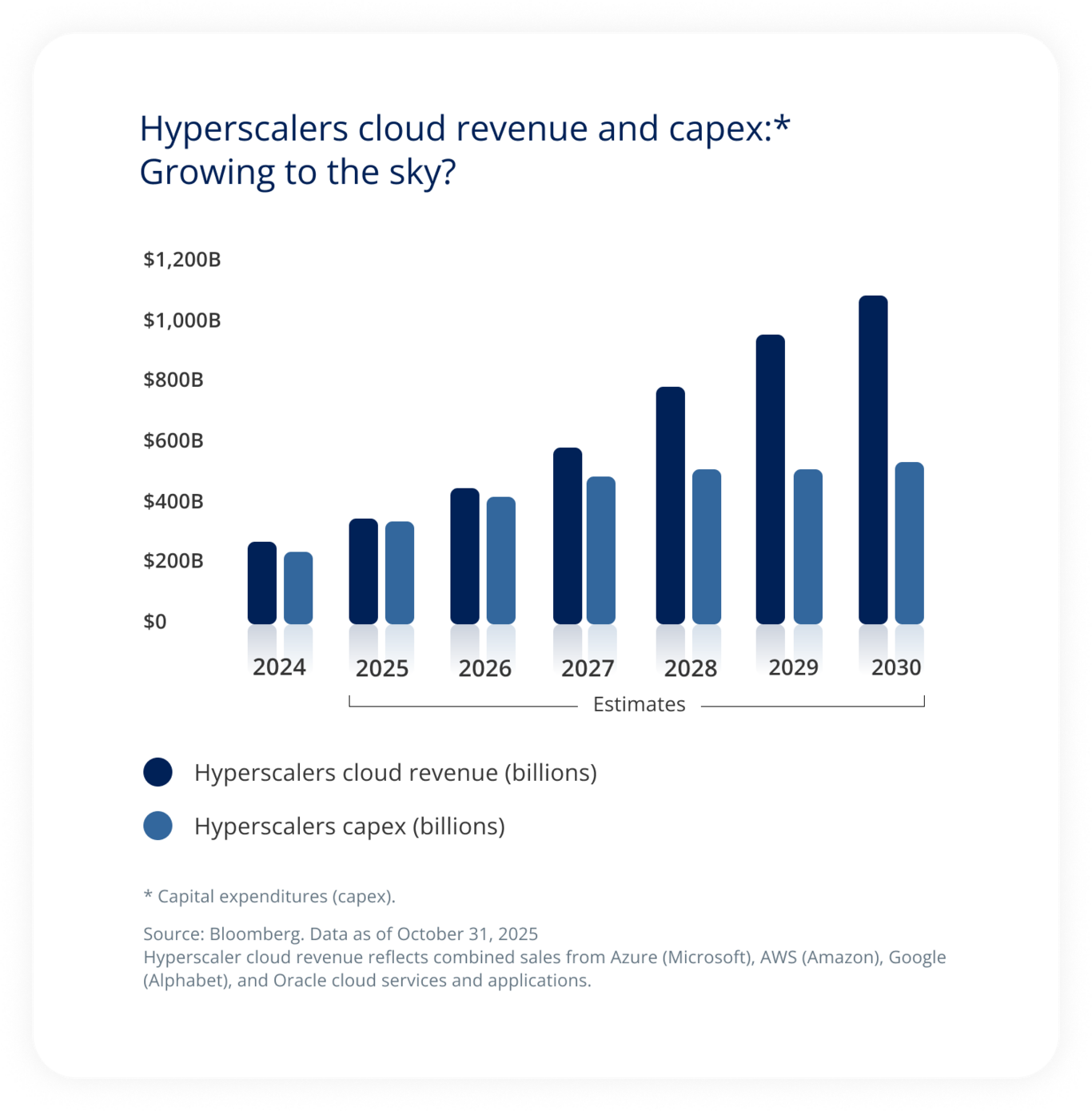

Meeting this unprecedented level of demand will require immense and sustained capital investment

Bain’s research shows that maintaining sustainable investment levels in the cloud sector would require around $500 billion in annual capital spending to generate roughly $2 trillion in revenue, highlighting the enormous scale of capital intensity in AI and cloud infrastructure. Even with full-scale cloud adoption and efficiency gains from AI-driven optimization, the sector could still face an annual investment shortfall of around $800 billion, underscoring the magnitude of the challenge ahead.

With this in mind, as we track AI throughout 2026, we will emphasize capacity building rather than broad AI deployment

Of course we’ll want to continue to see demand take shape, but the key question going into the next 12 months is whether the AI suppliers can build the required capacity to meet demand projections in future years. Without the build, demand cannot emerge.

We see two key capex risk factors to monitor

First, will the short reinvestment cycle for certain AI investments — servers and semiconductors have a life of approximately three to five years — create a capex hole that demand is just unable to fill?

Second, another “DeepSeek moment” still looms: What if models increase in efficiency enough to call into question the wild levels of capex spending we've already seen?

“AI is likely to be either the best or worst thing to happen to humanity.”

— Elon Musk, CEO of SpaceX and Tesla

Recent supply/demand developments in the AI space • While $2 trillion in revenue is needed to support AI infrastructure, sell-side estimates anticipate $1 trillion in hyperscaler cloud revenue by 2030. • According to a U.S. Census Bureau survey, the AI adoption rate among companies with 250 or more employees reached 12.5% in September 2025, up from 3.1% in September 2023. • Uber plans to integrate advanced AI architecture and simulation tools from Nvidia to support the rollout of its next-generation robotaxi fleet. |

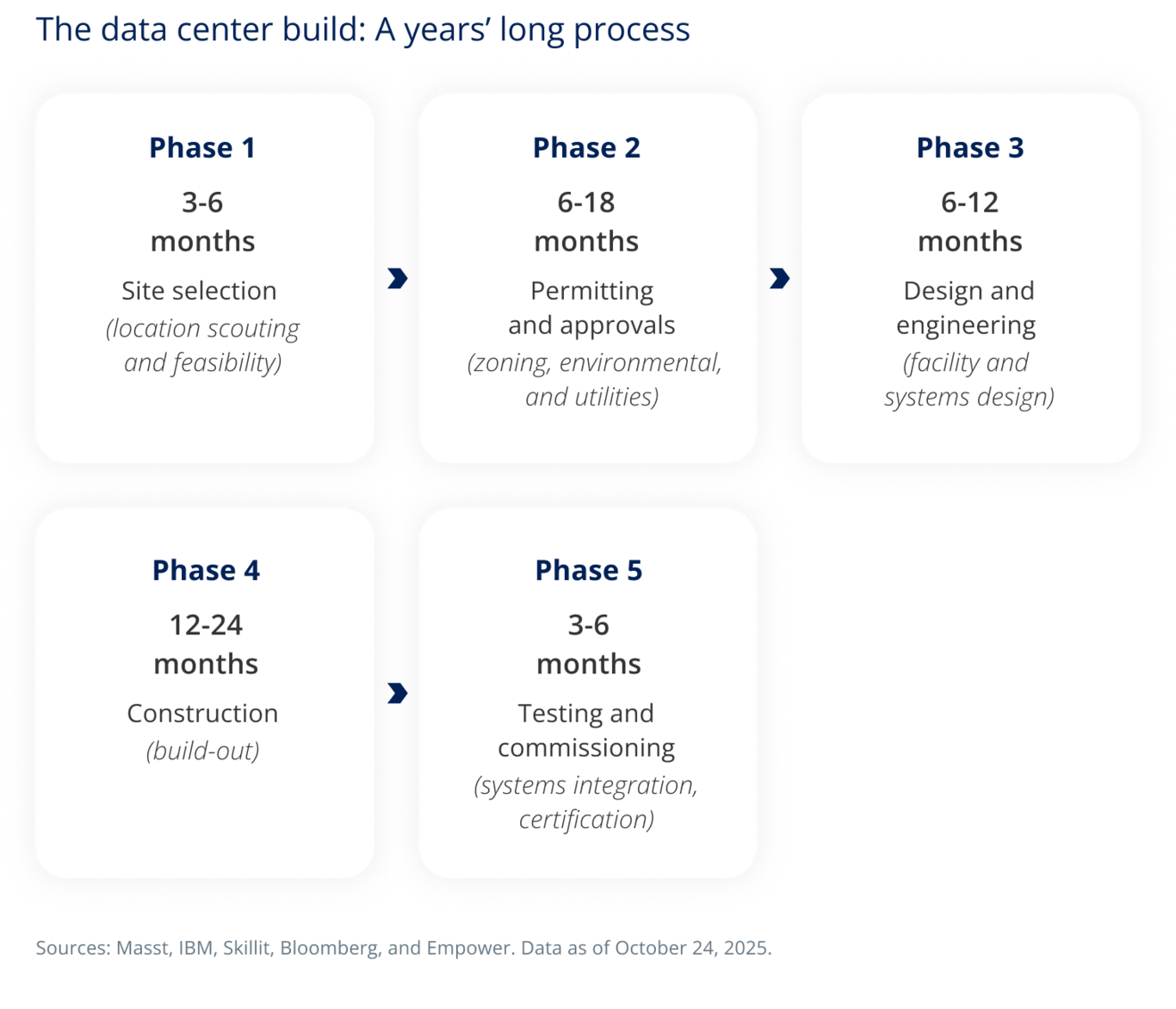

Data center building

Building a data center is a complex and time-intensive process, typically requiring 18 to 30 months from initial concept to commissioning. The timeline varies based on project scale, site conditions, equipment availability, and how early developers procure key components.

However, global expansion efforts are increasingly constrained by grid connection delays as utilities in high-demand regions struggle to manage capacity backlogs. In many cases, developers face long wait times or even temporary moratoriums on new projects while grid operators work to expand transmission capacity.

According to the International Energy Agency (IEA), grid connection queues now range from one to three years across the U.S., extending up to seven years in certain states such as Virginia. Similar challenges are seen globally, with five-to-seven-year waits in the U.K., up to seven years in Germany, and more than five years in Japan’s Kanto region.

Rising operational costs also reflect the strain on power networks

Between 2019 and 2022, congestion-management expenses tripled in Germany, the U.S., and Great Britain and increased sixfold in the Netherlands, underscoring the mounting pressure on energy infrastructure worldwide.

The existing power constraints could slow the pace of capacity expansion, potentially resulting in an even larger backlog by 2026 or 2027.

We're talking massive power Connecting data centers to the grid can take one to three years in the U.S. The administration aims to cut that to just 60 days. Estimates suggest a 10-gigawatt data center cluster would consume as much electricity as Chicago, making it comparable to powering a major U.S. metropolis. |

The AI economy

In the first half of 2025, personal consumption expenditures contributed 2.11 percentage points to U.S. real GDP growth of 3.18%, lower than 3.81% in 1H 2024 and 4.04% in 1H 2023.

Technology-related spending (information-processing equipment, software, and R&D excluding software) contributed 2.28 percentage points in 1H 2025, surpassing consumer spending for the first time in recent years.

In comparison, technology-related spending contributed only 0.56 percentage points to 4.43% GDP growth in 1H 2024 and 0.38 percentage points to 5.47% in 1H 2023, showing a sharp increase in tech-related investment.

“The future of AI is in our hands.”

— Tim Cook, CEO of Apple

AI and the economy by the numbers Technology-related spending contributed more to U.S. GDP growth in the first half of the year than consumer-related spending, marking the first time since 2020. In 2026, S&P 500® Index companies are expected to allocate 33% of their cash spending to capital expenditures, up from the 2020-2025 average of 28%. |

Explore the outlook

Explore the outlook

Overview I Economy I Equity market I Bond market I AI I Housing market I Global debt

Sources:

The Wall Street Journal, "When Will the Surge in AI Spending Pay Off," September 2025.

Bain & Company, "Can the US Energy Grid Keep Up with AI Data Centers?", October 2025.

McKinsey & Company, "Scaling bigger, faster, cheaper data centers with smarter designs," August 2025.

Deloitte Research Center for Energy & Industrials, "Can US infrastructure keep up with the AI economy?", June 2025.

International Energy Agency, "Energy and AI," 2025.

OpenAi, “Five new Stargate sites,” 2025.

The Guardian, "Zuckerberg says Meta will build data center the size of Manhattan in latest AI push," July 2025.

Goldman Sachs, “Powering the AI Era,” 2025.

Nvidia, Q2 2026 earnings call, August 2025.

McKinsey, “The cost of compute: A $7 trillion race to scale data centers,” April 2025.

Bank of America Global Research, August 2025.

Bloomberg, October 2025.

Bloomberg, "AI Boom or Bubble? Here are Some Charts that Warrant Caution," October 2025.

U.S. Census Bureau, “Business Trends and Outlook Survey,” October 2025.

Mastt, "Data Center Construction: Costs, Timeline, and Delivery Steps," May 2025.

Bloomberg, “US Moves Speed Up AI Power Hookup Process,” October 2025.

The research, views, and opinions contained in these materials are intended to be educational; may not be suitable for all investors; and are not tax, legal, accounting, or investment advice.

Investing involves risk, including possible loss of principal. The opinions expressed in this communication represent the current, good-faith views of Empower at the time of publication and are provided for limited purposes, are not intended as investment or legal advice, and should not be relied on as such. This content is based on the information available at the time of the recording and may change based on more current conditions. Past performance, where discussed, is not a guarantee of future results. Investing involves risk.

This is neither an endorsement of any index, sector, or investment, nor a solicitation to offer investment advice or sell products or services offered by Empower or its affiliates. It is impossible to invest directly in an index. The information presented was developed internally and/or obtained from sources believed to be reliable; however, Empower does not guarantee the accuracy, adequacy, or completeness of such information. Predictions, opinions, and other information contained in this communication are subject to change and without notice of any kind and may no longer be true after the date indicated. Commentary may contain forward-looking statements based on reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict.

Empower refers to the products and services offered by Empower Annuity Insurance Company of America and its subsidiaries. “EMPOWER” and all associated logos and product names are trademarks of Empower Annuity Insurance Company of America. ©2025 Empower Annuity Insurance Company of America. All rights reserved.

The S&P 500® Index (“Index”) and associated data are a product of S&P Dow Jones Indices LLC, its affiliates and/or their licensors and has been licensed for use by Empower Retirement, LLC. ©2025 S&P Dow Jones Indices LLC, its affiliates and/or their licensors. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC (“SPFS”) and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). Neither S&P Dow Jones Indices LLC, SPFS, Dow Jones, their affiliates nor their licensors (“S&P DJI”) make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and S&P DJI shall have no liability for any errors, omissions, or interruptions of any index or the data included therein.

“EMPOWER” and all associated logos and product names are trademarks of Empower Annuity Insurance Company of America.

©2025 Empower Annuity Insurance Company of America. All rights reserved. INV-FBK-WF-5216750-1125 RO# 4958715-1125