U.S. bonds: Enter AI

Overview I Economy I Equity market I Bond market I AI I Housing market I Global debt

U.S. economic and market outlook 2026

U.S. bonds: Enter AI

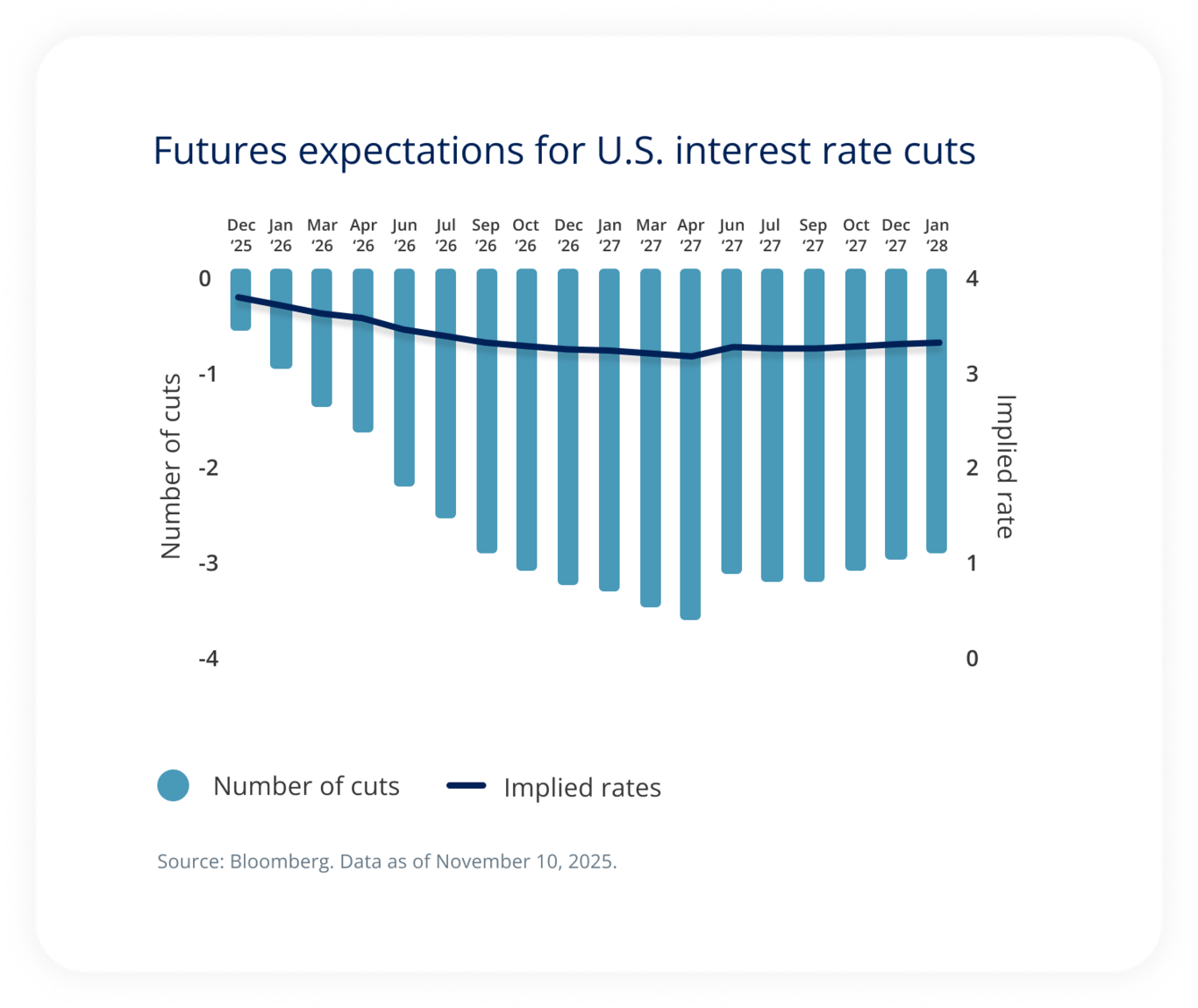

As of early November, the Fed funds futures market priced in slightly more than three cuts by the end of 2026

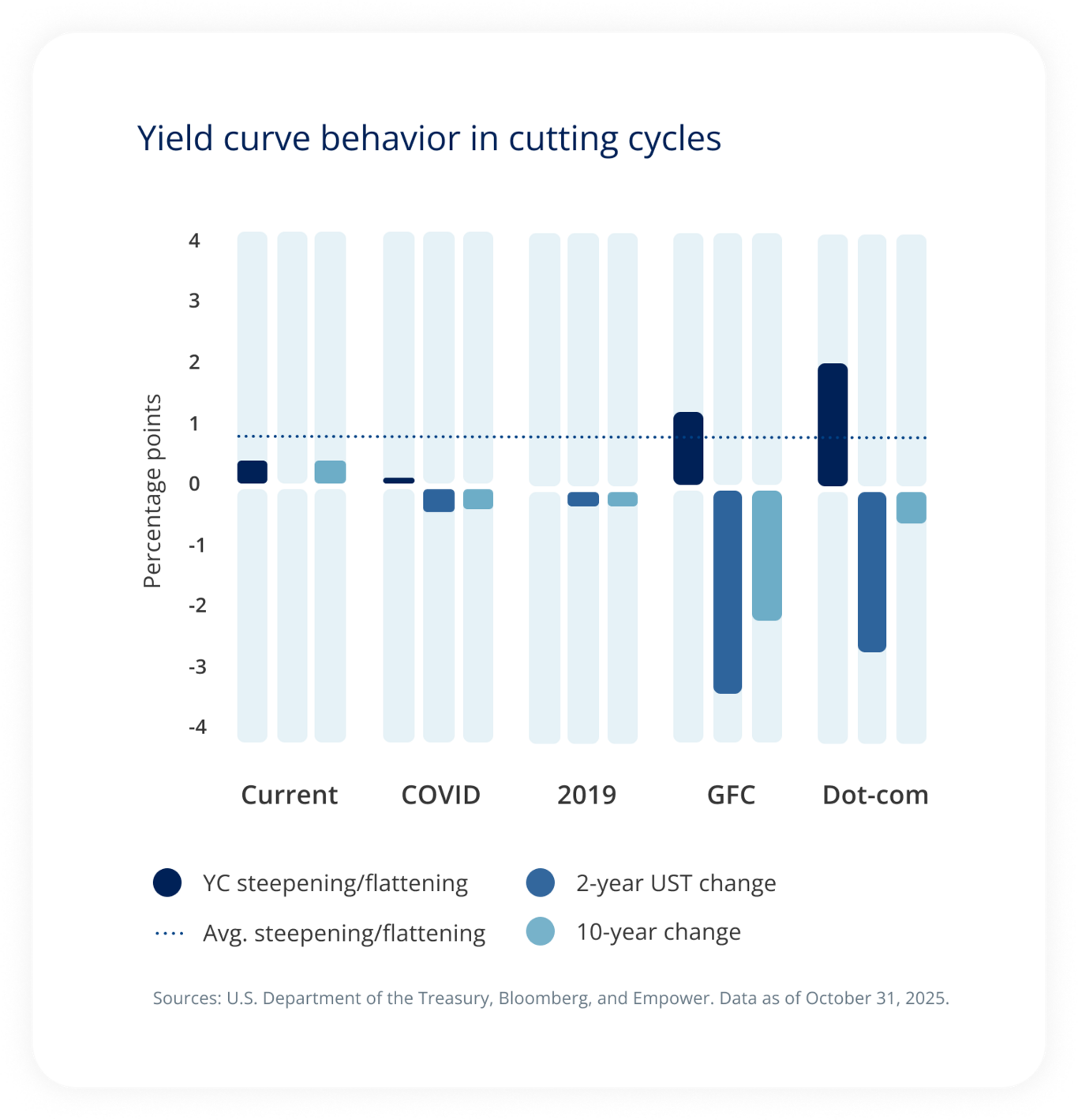

In 2025, the U.S. yield curve steepened and interest rates moved down, particularly on the front end, which is consistent with what we’ve seen historically during rate-cutting cycles. When we isolate real rates — rates adjusted for inflation — bond investors appear to expect the Fed to continue cutting, potentially reflecting lower growth ahead.

Indeed, in early November, the market anticipated that the Fed funds rate would near 3.2% by the fall of 2026.

Possible?

Yes. Particularly if the Fed committee turns more dovish under a new Fed chair.

But will the data justify that kind of move?

That seems less clear. Remember, we’ve essentially seen no movement in inflation over the course of 2025. In fact, core personal consumption expenditures (PCE) — the Fed’s preferred inflation measure — ticked up between January and August (the last PCE data point prior to the government shutdown).

So assuming inflation continues its stickiness in 2026 — a possibility given that the full effect of tariffs has yet to be felt — a big move in rates would need notable labor-market deterioration.

Another possibility but not necessarily our base case, given our expectation for continued economic resilience rooted in the AI supercycle.

So, as we look at it, the market represents the floor in our rate-cutting expectations, with the potential for rates to stay a bit higher over the course of the year.

A bigger question — particularly for the homebuyers out there — is what happens to the longer end of the curve

(Mortgage rates tend to key off 10-year Treasuries.)

We can see room for long rates to move a bit lower, particularly if the Fed does cut rates more than once over the course of 2026. However, as we look at the state of U.S. debt and the sovereign debt concerns here and abroad, we think longer rates are still pinned higher than they otherwise would be during a cutting cycle as investors demand more compensation for lending to a heavily indebted country.

Plus, a widening 2’s-10’s spread fits historical precedent; we typically see the short end come down more than the long end during a cutting cycle.

Our curve view has a number of implications for investors

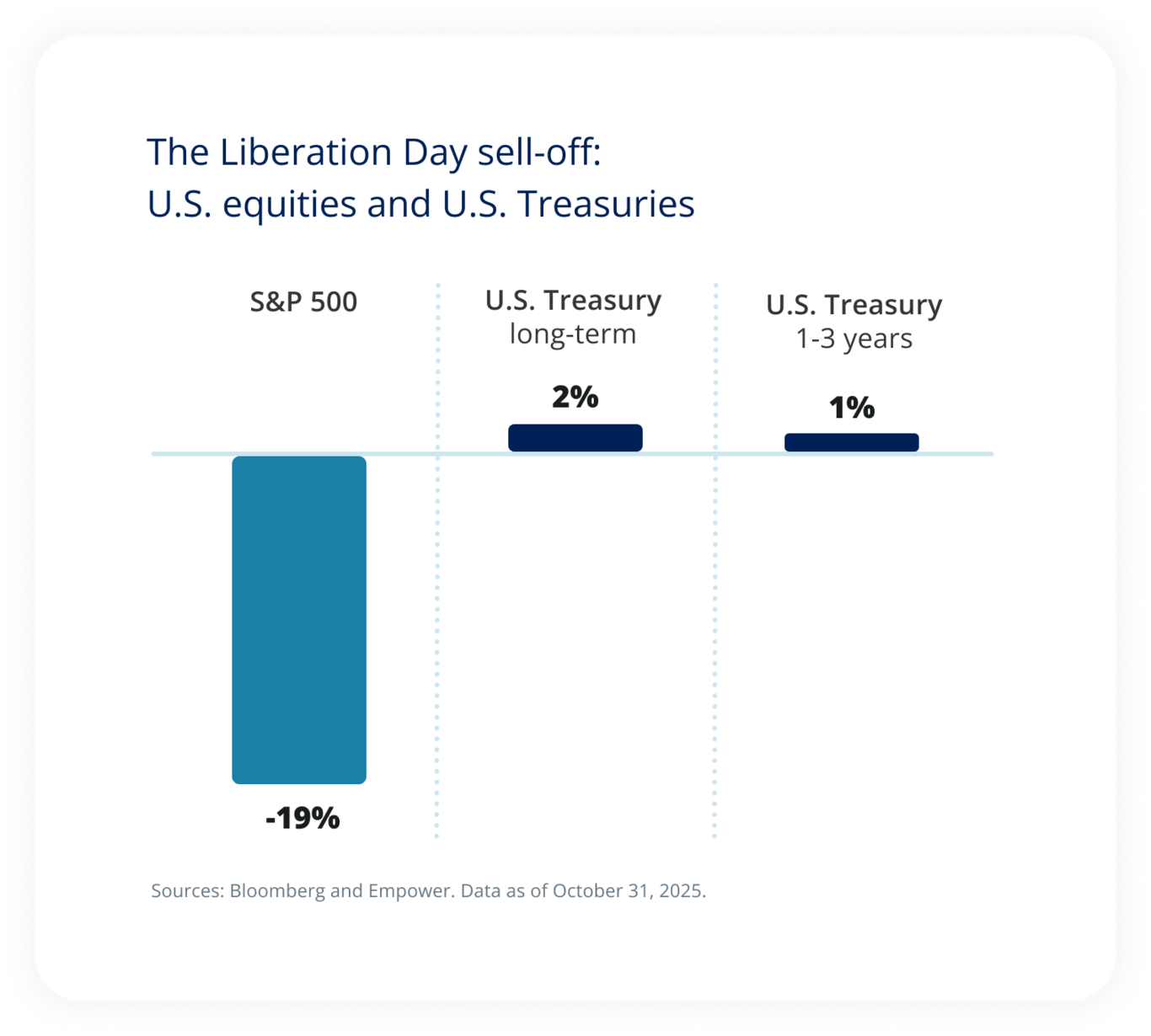

First, we continue to expect good absolute yields — at least relative to recent history — from U.S. government bonds, particularly at the longer end of the curve. However, we don’t necessarily expect steep gains in long-term bonds if and when the equity market sells off. Indeed, that’s what we saw in April, when tariffs caused an equity market sell-off. Bonds didn’t collapse, but they didn’t rally, either.

And just like in equities, we’re leery of valuations in credit markets

Spreads remain tight and vulnerable to negative credit surprises. That’s what we saw with October’s “cockroaches”: instances of fraud and credit distress in lower-quality corporate bonds. This means careful credit selection remains a must.

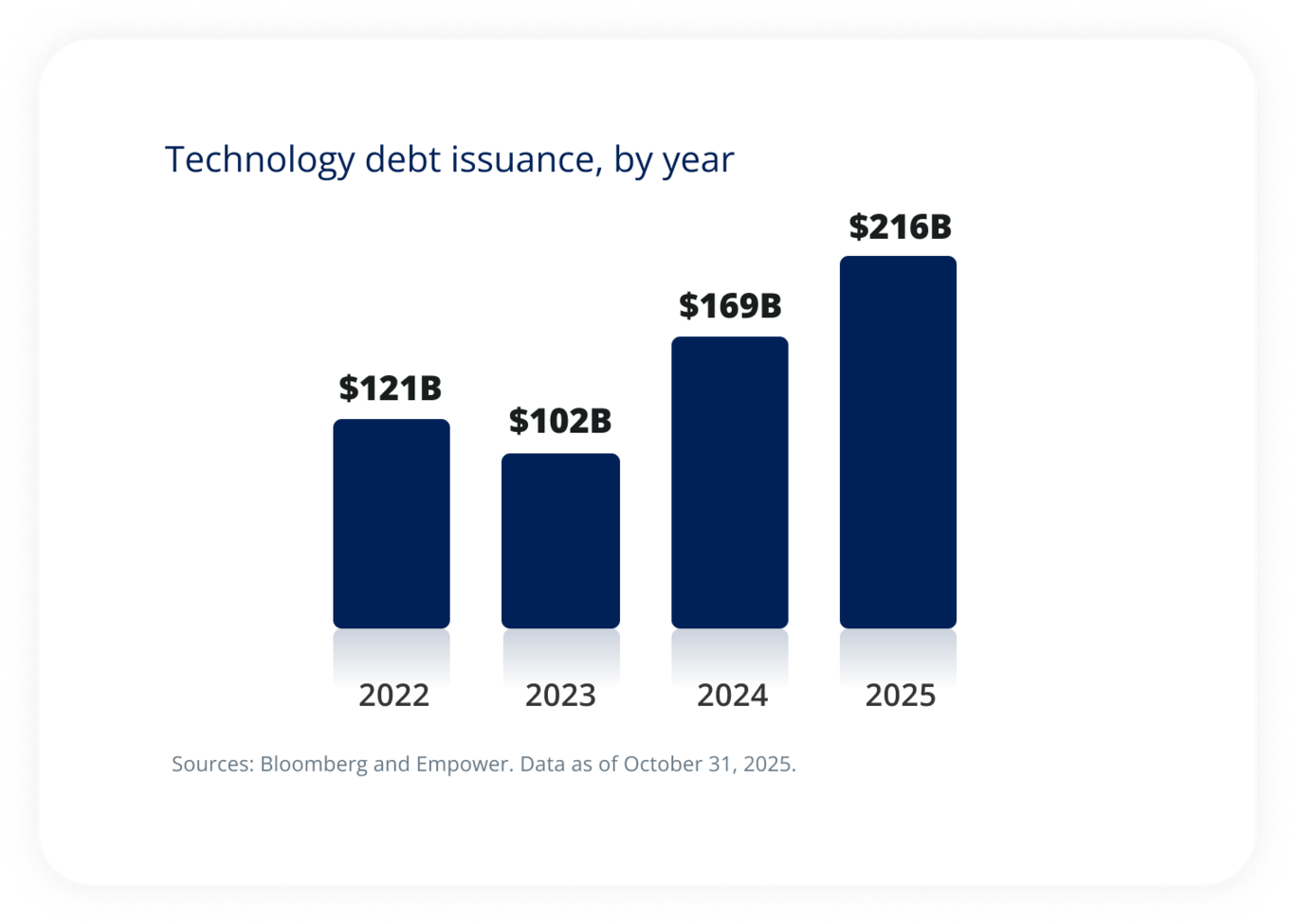

And take note: There’s an AI story to credit as well. Tech debt issuance has picked up in 2025, with even the hyperscalers turning to the bond market to fund their AI progress.

This could prove an opportunity for investors if the debt offers a better spread to the broader corporate market, meaning perhaps there’s less valuation risk on the credit side than the equity side for these names.

That remains to be seen, however: In October, Bloomberg announced Meta received $125 billion in orders for a corporate debt sale; that's the most ever for a public corporate bond offering. With demand like that, it's hard to anticipate higher yields for AI names.

And here’s the real key:

Increasing levels of debt issuance suggest the AI cycle is reaching

a frothier stage.

Will AI steal our jobs in 2026? We expect a labor market impact from AI. But when and by how much? This is where it gets speculative. So far, it’s hard to closely tie AI to layoffs — which, by the way, remain low relative to historical standards. And if we are correct that 2026 is another infrastructure year, rather than a deployment year, it’s possible we won’t see a surge in AI-fueled layoffs near term. However, we do anticipate payrolls remaining stagnant as companies put off hiring, in part due to AI and in part due to the hiring bonanza in the wake of the pandemic, which may have overstaffed corporate America. So we aren’t raising alarm bells just yet, but we’re watching the data closely. |

Explore the outlook

Explore the outlook

Overview I Economy I Equity market I Bond market I AI I Housing market I Global debt

Investing involves risk, including possible loss of principal. The opinions expressed in this communication represent the current, good-faith views of Empower at the time of publication and are provided for limited purposes, are not intended as investment or legal advice, and should not be relied on as such. This content is based on the information available at the time of the recording and may change based on more current conditions. Past performance, where discussed, is not a guarantee of future results. Investing involves risk.

This is neither an endorsement of any index, sector, or investment, nor a solicitation to offer investment advice or sell products or services offered by Empower or its affiliates. It is impossible to invest directly in an index. The information presented was developed internally and/or obtained from sources believed to be reliable; however, Empower does not guarantee the accuracy, adequacy, or completeness of such information. Predictions, opinions, and other information contained in this communication are subject to change and without notice of any kind and may no longer be true after the date indicated. Commentary may contain forward-looking statements based on reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict.

Empower refers to the products and services offered by Empower Annuity Insurance Company of America and its subsidiaries. “EMPOWER” and all associated logos and product names are trademarks of Empower Annuity Insurance Company of America. ©2025 Empower Annuity Insurance Company of America. All rights reserved.

The S&P 500® Index (“Index”) and associated data are a product of S&P Dow Jones Indices LLC, its affiliates and/or their licensors and has been licensed for use by Empower Retirement, LLC. ©2025 S&P Dow Jones Indices LLC, its affiliates and/or their licensors. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC (“SPFS”) and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). Neither S&P Dow Jones Indices LLC, SPFS, Dow Jones, their affiliates nor their licensors (“S&P DJI”) make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and S&P DJI shall have no liability for any errors, omissions, or interruptions of any index or the data included therein.

The research, views, and opinions contained in these materials are intended to be educational; may not be suitable for all investors; and are not tax, legal, accounting, or investment advice.

Empower and its affiliates are not providing impartial investment advice in a fiduciary capacity to the plan with respect to this material. The plan fiduciaries are solely responsible for the selection and monitoring of the planʼs investment options and for determining the reasonableness of all plan fees and expenses.

©2025 Empower Annuity Insurance Company of America. All rights reserved. INV-FBK-WF-5216229-1125 RO# 4958715-1125