U.S. economic and market outlook

Overview I Economy I Equity market I Bond market I AI I Housing market I Global debt

U.S. economic and market outlook

Our 2026 Outlook — It's an AI World — explores the impact of the AI supercycle on the U.S. economy and markets

Our research tells us we are still early days, with 2026 marked by capacity expansion rather than full-scale adoption. It's exciting stuff, full of promise and opportunity ... and risk. Increasingly it feels as though the economy, the stock market, and, perhaps at some point in the future, the bond market depend on a single theme.

Of course, as much as AI is overtaking the country, other variables still matter, though maybe less than they otherwise would.

In this Outlook, we also took a close look at the U.S. housing market and the global debt deluge, both of which we think could impact markets.

The key question we continued to return to throughout our research:

What do these views mean for individual investors,

both for their expectations and their portfolio positioning?

In that spirit, you'll find investment implications sprinkled throughout. But let me call out the most important principles I think investors should cling to this year, and every year, as they harness markets to achieve their financial goals.

Investing

It's tempting to use closely held political views or convincing market narratives to time the market. It rarely works out in your favor. And I know of no example in which it works consistently over time. However, I know of countless examples of long-term investing leading to wealth creation.

Diversifying

With AI enveloping the economy and the markets, this is harder than ever. That’s why we highlight areas of the market that investors have overlooked in order to offer a different type of exposure investors can consider. And don’t forget: It's a global world, across stocks and bonds. Finding ways to broaden as appropriate for your particular financial goal may help generate more consistent results.

Planning

It’s hard not to zoom in on what's topping markets: Gold! Crypto! AI! But not every asset class makes sense for every portfolio. Know what you own, and know what you want to achieve. Everything else is secondary.

Wishing you and yours all the best as we close out 2025 and turn our gaze forward to 2026.

Key findings We anticipate an anemic labor market in 2026 Along with lingering inflation and continued challenges in home affordability. However, these problems are less impactful than they otherwise would be: The AI supercycle mutes the normal effects of the business cycle. We expect capital expenditures to grow in importance Because AI remains capacity constrained, we expect capital expenditures will continue to grow in importance to the U.S. economy over the course of 2026. There are risks to this U.S. stock market valuations are high, leaving no room for infrastructure bottlenecks, shifting competitive dynamics, or uneven deployment. We’re seeing increasing debt issuance And we’re seeing increasing debt issuance to fund the AI build. Debt introduces new risks to markets and the economy, particularly if it grows in size. Government debt remains a problem for the U.S. and other developed countries We think this will remain a factor in the level and behavior of yield curves and currency movements. It may also remain a justification — or an excuse — for investors to jump on gold and crypto momentum. |

What we’re watching

What we’re watching

Capital expenditures

Capital expenditures in the AI race are an increasingly important part of the economy.

Impact: Economy and stocks

Cloud revenue

Cloud revenue is an indication of AI adoption in the broader economy.

Impact: Economy and stocks

Tech debt issuance

This is a growing source of funding in the AI race.

Impact: Economy, stocks, and bonds

Housing

Housing is closely tied to wealth creation and higher-income consumer spending.

Impact: Economy

Stock market valuations

High valuations create vulnerability for stocks and the economy.

Impact: Economy and stocks

The wealth effect

Consumer spending from the high-income consumer depends partly on home values and somewhat on investment portfolios.

Impact: Economy

Inflation

Sticky inflation could slow the Fed's ability to lower rates.

Impact: Economy and bonds

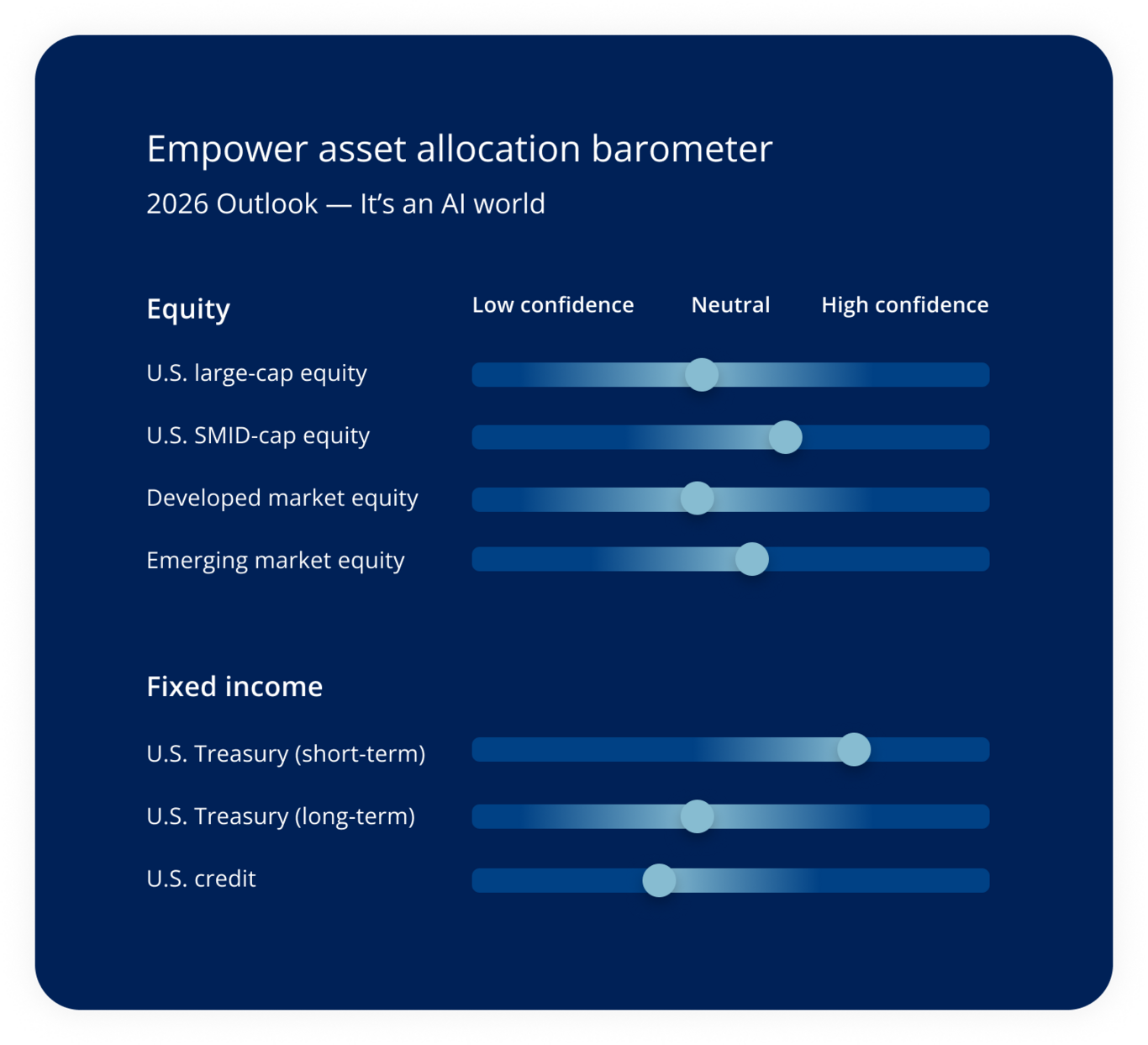

Asset allocation barometer

Equity

• We are somewhat constructive on U.S. large-caps, but we are wary of still-tight valuations and the extent to which the AI capex cycle dominates the narrative — and not just for the hyperscalers, but suddenly for the entire U.S. market.

• US small- and mid-caps are the last valuation opportunity left standing, but we’re wary of their sensitivity to the economic cycle and rates. It may also be harder for many SMID sectors to hitch their fortunes to the AI bandwagon.

• We think non-U.S.-developed equities are no longer as cheap as they were a year ago. They may still benefit from dollar weakness, but several European countries have demonstrated their own debt sensitivities.

• A U.S. dollar tailwind may still help certain emerging markets. However, China rallied strongly in 2025, taking out some of the obvious opportunity. We believe it will be a "show-me" market in 2026, with China AI in a starring role.

Fixed income

• We think the Fed will continue cutting in 2026, but we are wary that market expectations might be too aggressive on that front without a big(ger) reset in U.S. labor markets.

• Yields remain compelling and total returns may benefit from Fed cuts, but term premiums tend to widen during Fed-cutting cycles. Generous fiscal policy remains a concern both here and abroad.

• Like large-cap equity valuations, spreads remain very tight, even relative to very strong fundamentals. We view sub-prime problems issues as isolated for now, and we’re also watching to see if AI hyperscaler debt issuance influences market technicals.

Explore the outlook

Explore the outlook

Overview I Economy I Equity market I Bond market I AI I Housing market I Global debt

Investing involves risk, including possible loss of principal. The opinions expressed in this communication represent the current, good-faith views of Empower at the time of publication and are provided for limited purposes, are not intended as investment or legal advice, and should not be relied on as such. This content is based on the information available at the time of the recording and may change based on more current conditions. Past performance, where discussed, is not a guarantee of future results. Investing involves risk.

This is neither an endorsement of any index, sector, or investment, nor a solicitation to offer investment advice or sell products or services offered by Empower or its affiliates. It is impossible to invest directly in an index. The information presented was developed internally and/or obtained from sources believed to be reliable; however, Empower does not guarantee the accuracy, adequacy, or completeness of such information. Predictions, opinions, and other information contained in this communication are subject to change and without notice of any kind and may no longer be true after the date indicated. Commentary may contain forward-looking statements based on reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict.

Empower refers to the products and services offered by Empower Annuity Insurance Company of America and its subsidiaries. “EMPOWER” and all associated logos and product names are trademarks of Empower Annuity Insurance Company of America. ©2025 Empower Annuity Insurance Company of America. All rights reserved.

The S&P 500® Index (“Index”) and associated data are a product of S&P Dow Jones Indices LLC, its affiliates and/or their licensors and has been licensed for use by Empower Retirement, LLC. ©2025 S&P Dow Jones Indices LLC, its affiliates and/or their licensors. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC (“SPFS”) and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). Neither S&P Dow Jones Indices LLC, SPFS, Dow Jones, their affiliates nor their licensors (“S&P DJI”) make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and S&P DJI shall have no liability for any errors, omissions, or interruptions of any index or the data included therein.

The research, views, and opinions contained in these materials are intended to be educational; may not be suitable for all investors; and are not tax, legal, accounting, or investment advice.

Empower and its affiliates are not providing impartial investment advice in a fiduciary capacity to the plan with respect to this material. The plan fiduciaries are solely responsible for the selection and monitoring of the planʼs investment options and for determining the reasonableness of all plan fees and expenses.

©2025 Empower Annuity Insurance Company of America. All rights reserved. INV-FBK-WF-5206738-1125 RO# 4958715-1125