U.S. stocks: One big bet

Overview I Economy I Equity market I Bond market I AI I Housing market I Global debt

U.S. economic and market outlook 2026

U.S. stocks: One big bet

Of the 11 global GICS sectors, the U.S. economy represents more than 50% of the market cap in 10 of them

At least according to MSCI global sector indexes. But don’t let that convince you it’s a diversified market. After another year of outperformance by the tech sector, tech companies account for nearly 36% of the S&P 500® Index as of October 31.

Within the tech sector itself, the top three names — Nvidia, Apple, and Microsoft — account for just under 60% of the sector’s weight in the index. The S&P 500 Index is also top heavy: The top 10 names account for roughly 40% of the index’s market cap.

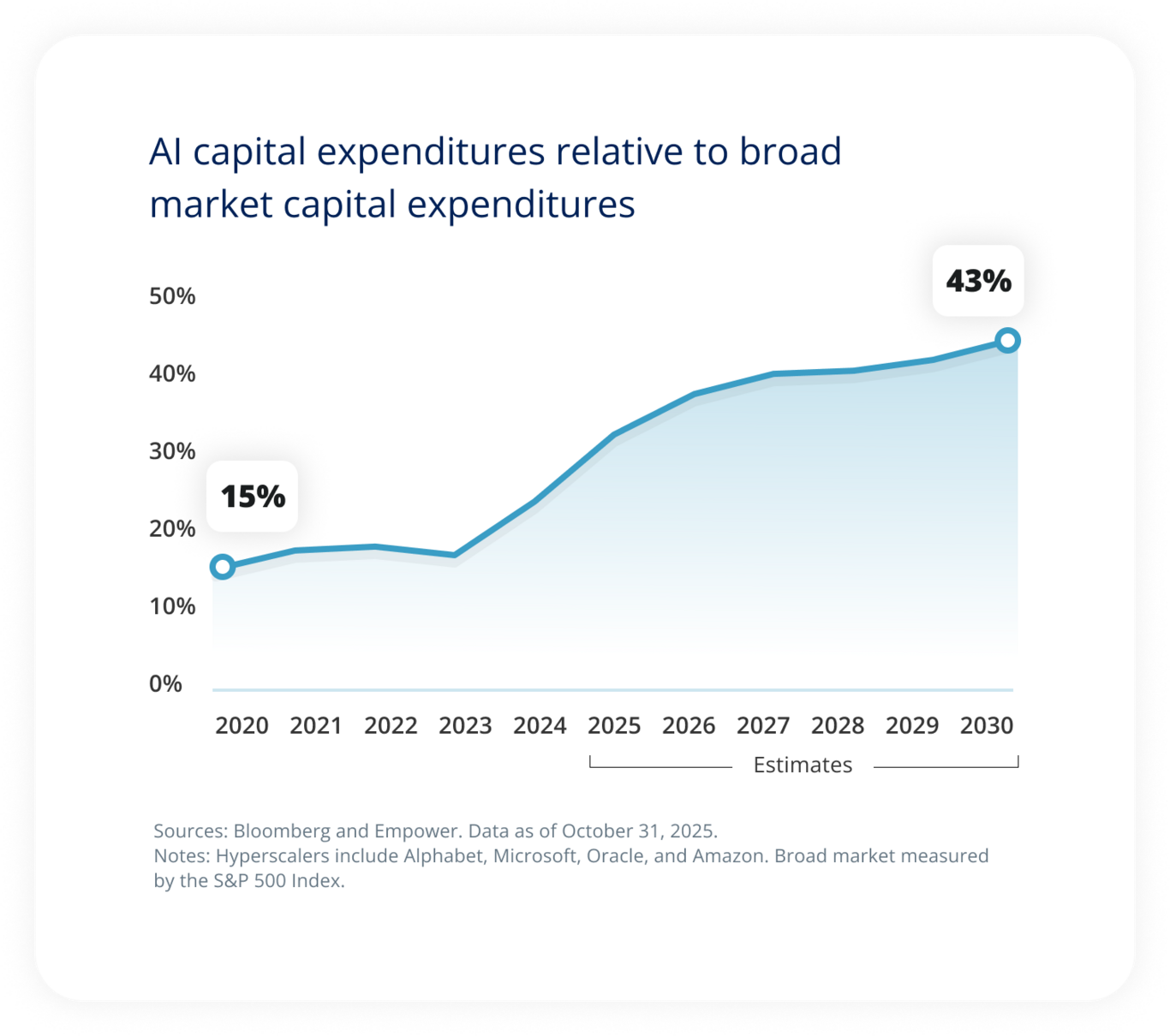

But the concentration is even more pronounced than those numbers suggest. As the mega-cap tech names increasingly hitch their wagons to AI — and finance each other’s AI investments — the broader U.S. market is ever more dependent, for better or worse, on AI’s trajectory.

This dependency was nothing but good news in 2025

When the market was under assault from tariff uncertainty, tech earnings saved the day. Investors liked the continued commitment to AI in the form of ever-increasing capex but also took comfort in growing cloud revenue, which hyperscalers such as Oracle, Microsoft, Amazon, and Alphabet tied to increasing AI workflows from around corporate America.

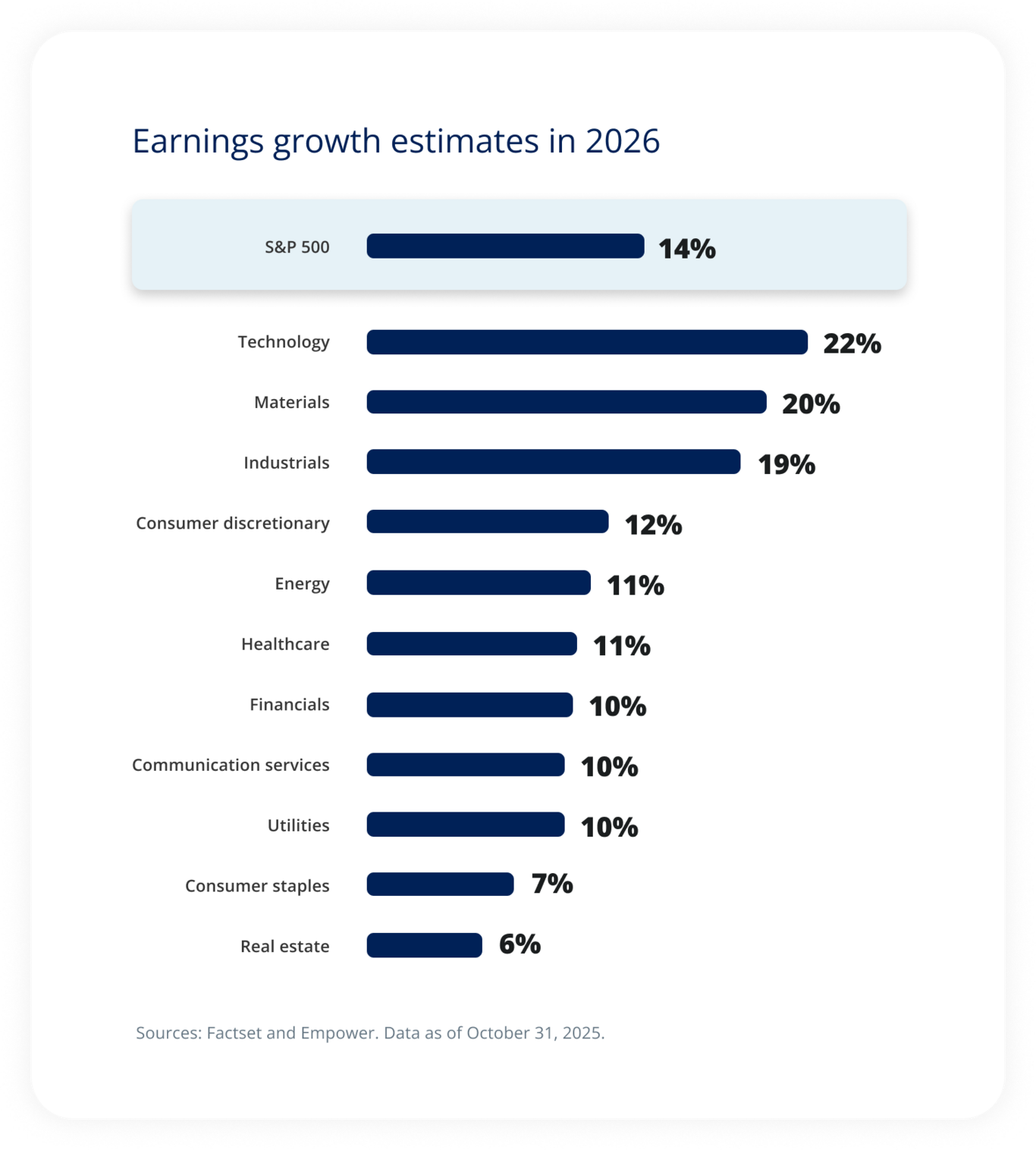

This looks set to continue in 2026. Analysts estimate 14% earnings growth in 2026, buoyed once again by technology companies (and the AI companies in communication services and consumer discretionary).

Should OpenAI go public in 2026 as many expect, it could be a watershed moment for the industry (and the broader market)

What could upend this?

Weaker results in areas like staples or discretionary could result from a deteriorating consumer, though our view is that the high-income subset still sits on solid ground, offering resilience to overall consumer spending.

We also expect tariffs to drag on earnings over the course of 2026, though not potentially enough to derail earnings at a broad scale.

But the largest concern is disruption in the AI narrative

At this early stage, this is less likely to relate to demand issues and more likely to result from a stall in infrastructure building, the likes of which could include bottlenecks in energy supply, snowballing capex requirements from the short lives of servers and semiconductors, threats from Chinese competitors that call into question the wild levels of U.S. spending (another “DeepSeek moment”), or even financing concerns as the AI universe turns to debt and becomes increasingly tangled in circular financing.

Even if we don’t see disruption in the AI narrative, the current AI leaders could find their business models under competitive threat as the growth opportunities attract more competitors. Given the heft of the top AI names in the index, this disruption could cause volatility for the market on the whole.

Are these potential problems a given? No. But it’s hard to imagine perfect execution in a technology as new and unknown as AI. Preparing for uneven deployment that creates moments of doubt seems a prudent strategy.

There’s also the valuation concern

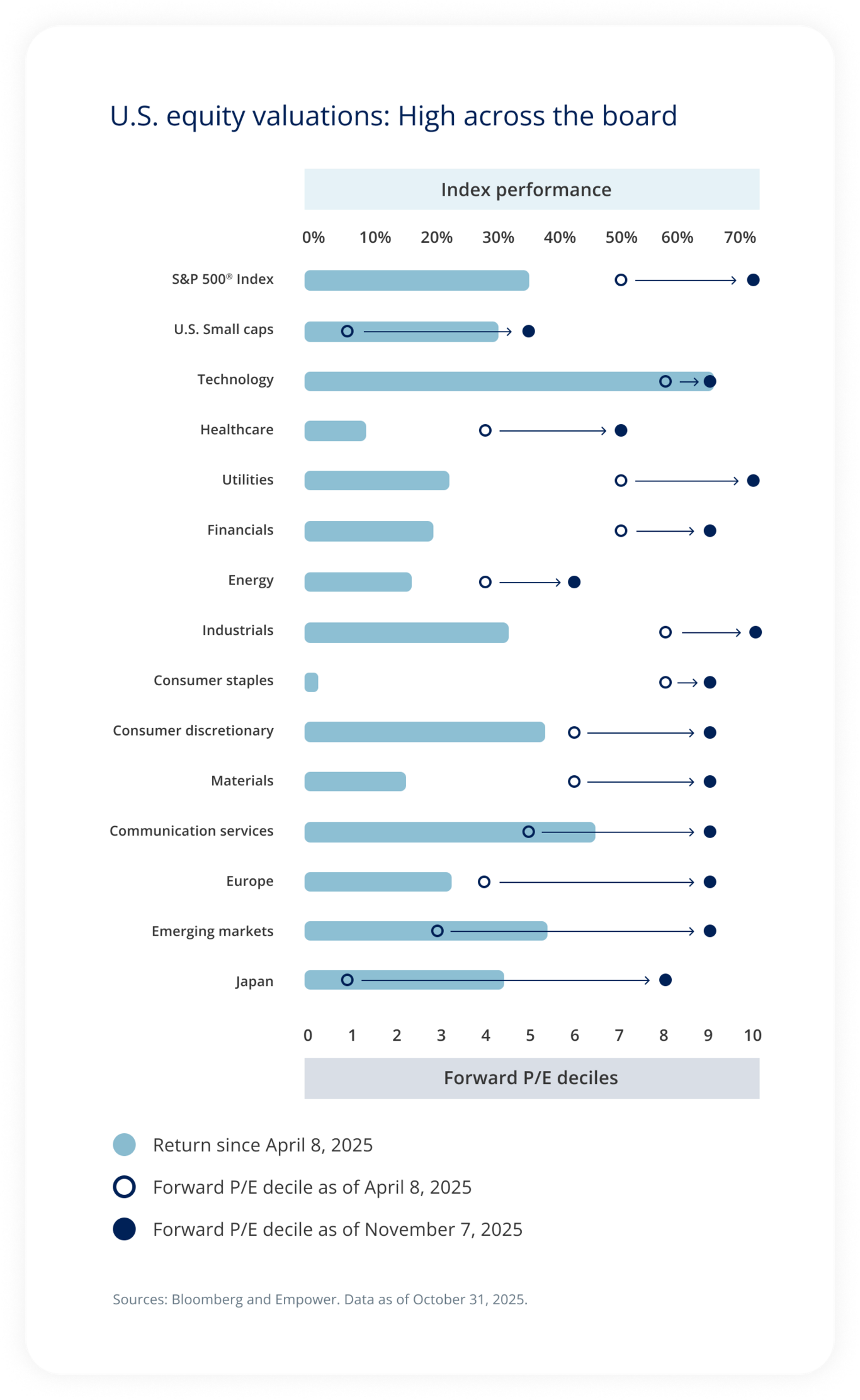

There just isn’t much room in the U.S. equity market’s valuations for anything but unrelenting growth. That’s true not just for technology, but also for the broader U.S. market, much of which investors have bid higher as economic concerns have waned.

By our measure, most sectors of the U.S. now trade in the 9th or 10th decile relative to their own histories.

Our research shows that these more extreme valuations loosely associate with weaker prospective three-year returns. This doesn’t guarantee a sell-off — the market can grind higher even at elevated valuations — but it does suggest investors should potentially lower expectations from here.

Exceptions to the overvaluation trend are growing rarer. In mid-2025, we pointed to healthcare, but its fall rally takes away a bit of its appeal, though it remains better priced compared with other sectors.

At this point, we think small caps remain the only broad market opportunity in the U.S. that looks cheap relative to its own history. However, beware the economic sensitivity: Should the economy prove weaker than anticipated or rate cuts disappoint, small caps may face greater challenges.

International opportunities A year ago, we were enthused about stocks outside the U.S. The valuation discrepancy was significant, with expectations for U.S. stocks at extremes in the wake of the Trump presidential win. The U.S. dollar also looked stretched. Today, many non-U.S. stocks have had a strong run and erased some of their valuation appeal. The U.S. dollar remains overvalued, but other developed currencies have shown their own debt vulnerabilities. Strategically, we’d still argue U.S. investors have room to increase their non-U.S. exposure, since many individual investors tend to have limited global exposure, but the tactical opportunity is less obvious today. |

Explore the outlook

Explore the outlook

Overview I Economy I Equity market I Bond market I AI I Housing market I Global debt

Investing involves risk, including possible loss of principal. The opinions expressed in this communication represent the current, good-faith views of Empower at the time of publication and are provided for limited purposes, are not intended as investment or legal advice, and should not be relied on as such. This content is based on the information available at the time of the recording and may change based on more current conditions. Past performance, where discussed, is not a guarantee of future results. Investing involves risk.

This is neither an endorsement of any index, sector, or investment, nor a solicitation to offer investment advice or sell products or services offered by Empower or its affiliates. It is impossible to invest directly in an index. The information presented was developed internally and/or obtained from sources believed to be reliable; however, Empower does not guarantee the accuracy, adequacy, or completeness of such information. Predictions, opinions, and other information contained in this communication are subject to change and without notice of any kind and may no longer be true after the date indicated. Commentary may contain forward-looking statements based on reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict.

Empower refers to the products and services offered by Empower Annuity Insurance Company of America and its subsidiaries. “EMPOWER” and all associated logos and product names are trademarks of Empower Annuity Insurance Company of America. ©2025 Empower Annuity Insurance Company of America. All rights reserved.

The S&P 500® Index (“Index”) and associated data are a product of S&P Dow Jones Indices LLC, its affiliates and/or their licensors and has been licensed for use by Empower Retirement, LLC. ©2025 S&P Dow Jones Indices LLC, its affiliates and/or their licensors. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC (“SPFS”) and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). Neither S&P Dow Jones Indices LLC, SPFS, Dow Jones, their affiliates nor their licensors (“S&P DJI”) make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and S&P DJI shall have no liability for any errors, omissions, or interruptions of any index or the data included therein.

The research, views, and opinions contained in these materials are intended to be educational; may not be suitable for all investors; and are not tax, legal, accounting, or investment advice.

Empower and its affiliates are not providing impartial investment advice in a fiduciary capacity to the plan with respect to this material. The plan fiduciaries are solely responsible for the selection and monitoring of the planʼs investment options and for determining the reasonableness of all plan fees and expenses.

©2025 Empower Annuity Insurance Company of America. All rights reserved. INV-FBK-WF-5216550-1125 RO# 4958715-1125