BNPL: The Promise of “Pay Later”

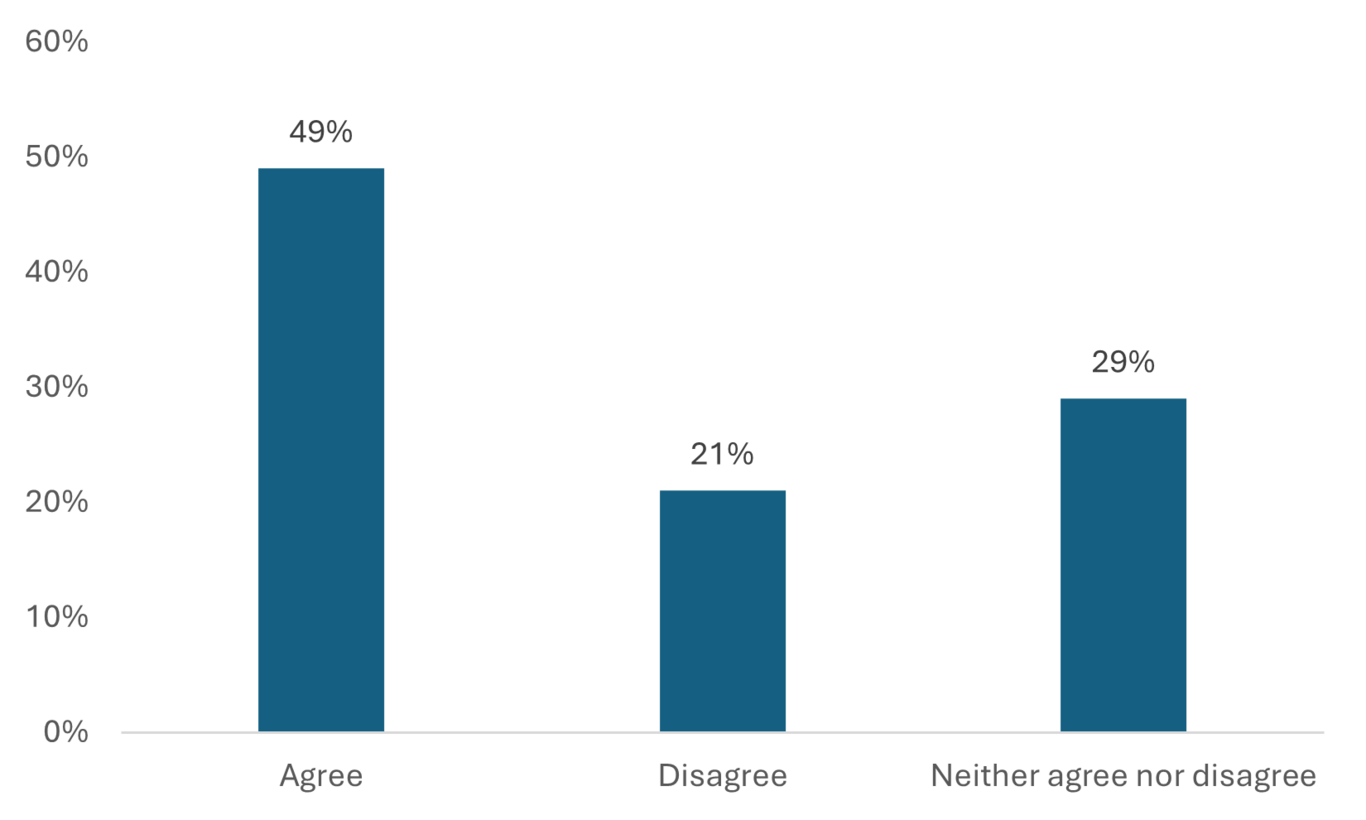

Nearly half of Americans (49%) say BNPL makes it easier to manage large or unexpected expenses.

BNPL: The Promise of “Pay Later”

Nearly half of Americans (49%) say BNPL makes it easier to manage large or unexpected expenses.

What began as an alternative payment option, Buy Now Pay Later (BNPL) services are increasingly a factor in purchasing decisions and financing: Nearly half of Americans (49%) say BNPL makes it easier to manage large or unexpected expenses, according to new Empower research (see ‘Methodology’).

Key findings:

- Nearly half of Americans (49%) say BNPL makes it easier to manage large or unexpected expenses.

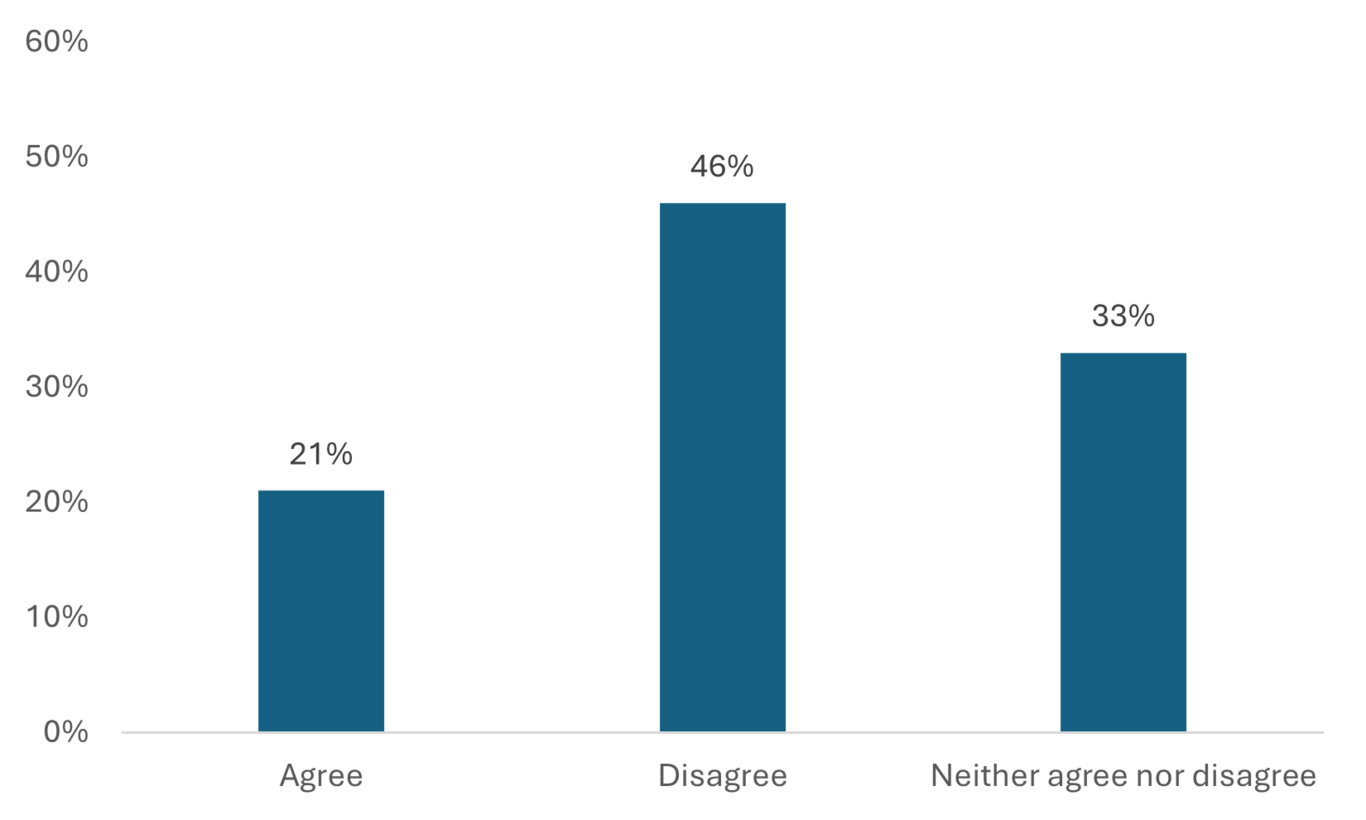

- Over one in four (26%) say they’re more likely to buy when BNPL is an option offered.

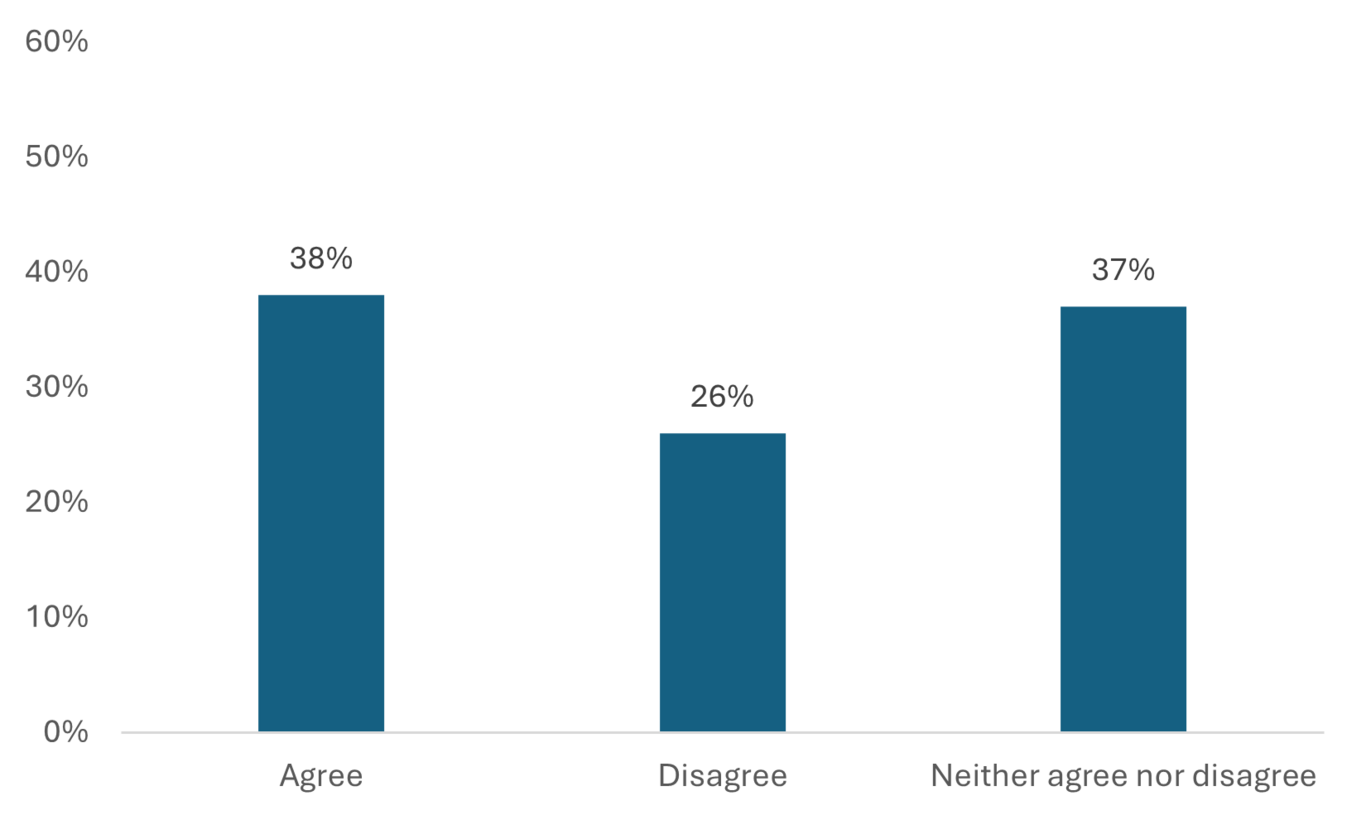

- About two in five (38%) say BNPL makes shopping feel less financially ‘real’ than using a debit or credit card.

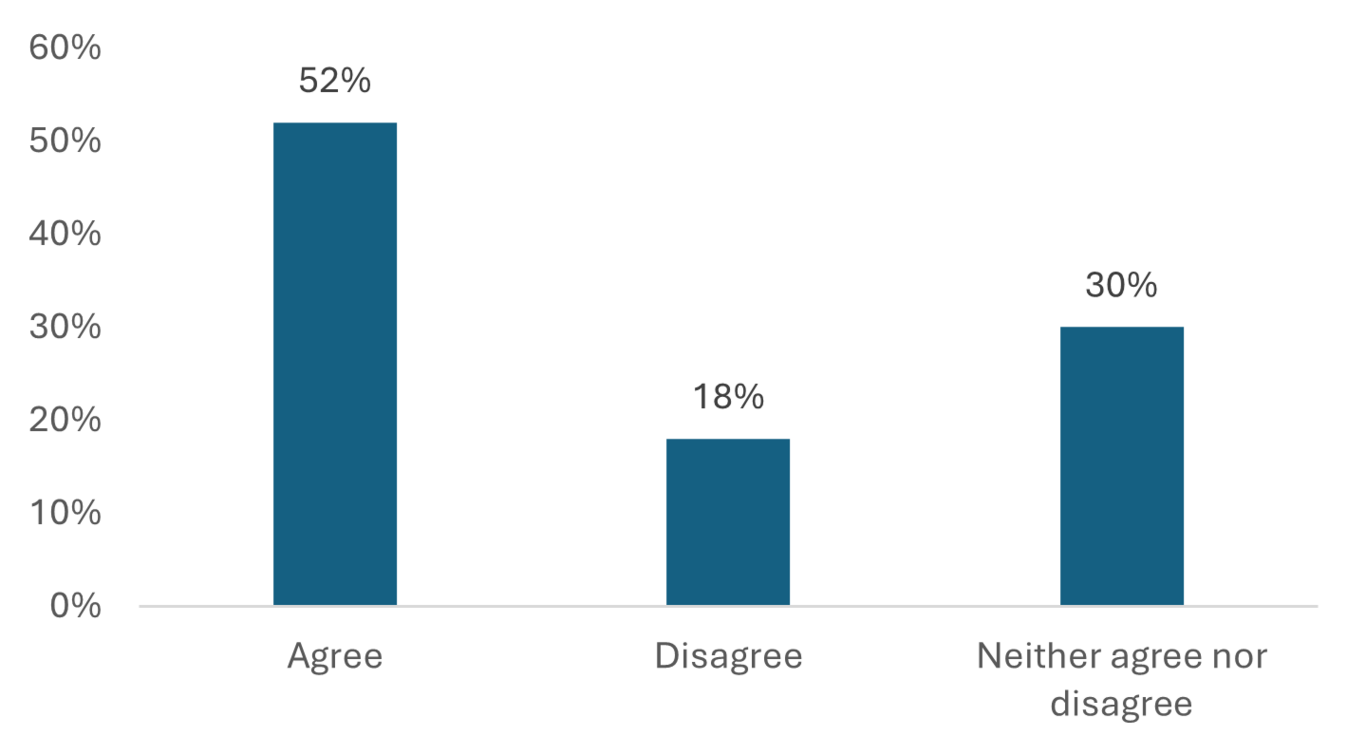

- More than half of Americans (52%) agree BNPL adds to overall financial stress.

Only about one in five (19%) trust BNPL providers to act in their best financial interest.

Why shoppers are using BNPL

Half of Millennials (53%) say BNPL makes it easier to manage large or unexpected expenses (Figure 1). Also, twenty-six percent of Americans say they’re more likely to make a purchase when BNPL is available.

Figure 1: Almost half of Americans (49%) say BNPL makes it easier manage large or unexpected expenses

Source: Empower “Buy Now Pay Later Survey”, August 2025. Question: Please indicate how much you agree or disagree with the following statement related to your purchasing behavior when BNPL options are available: BNPL makes it easier to manage large or unexpected purchases. Note: Totals may not equal 100% due to rounding.

Over one in five (21%) go a step further, agreeing they tend to spend more when BNPL is available at checkout (Figure 2). For many, it's a way to turn big purchases into bite-sized payments, and electronics, furniture, and home appliances are among the most common items bought using BNPL.

Figure 2: Over one in five Americans said they spend more when BNPL is available

Source: Empower “Buy Now Pay Later Survey”, August 2025. Question: Please indicate how much you agree or disagree with the following statement related to your purchasing behavior when BNPL options are available: I tend to spend more when BNPL is available at checkout. Note: Totals may not equal 100% due to rounding.

Spending feels different—and that’s the point

A significant share of Americans—38%—say BNPL makes shopping feel less financially “real” than using a debit or credit card (Figure 3). In fact, more than a third (36%) would use BNPL to cover purchases they couldn’t otherwise be able to afford.

Figure 3: Nearly two in five say BNPL makes shopping feel less financially "real" than using a debit or credit card

Source: Empower “Buy Now Pay Later Survey”, August 2025. Question: Please indicate how much you agree or disagree with the following statement related to your purchasing behavior when BNPL options are available: BNPL makes shopping feel less financially "real" than using a debit or credit card. Note: Totals may not equal 100% due to rounding.

This “softened” sense of spending can also lead to stress: over half (52%) agree BNPL adds to overall financial stress (Figure 4), and 44% would feel anxious about making payments on time. And yet, a sizeable share of Americans are managing the responsibility well—close to a third say they always pay on time (32%). Millennials (36%) are especially likely to stay on top of their payment plans.

Figure 4: Over half (52%) of Americans agree BNPL adds to overall financial stress

Source: Empower “Buy Now Pay Later Survey”, August 2025. Question: Please indicate how much you agree or disagree with the following statement related to your purchasing behavior when BNPL options are available: BNPL adds to overall financial stress. Note: Totals may not equal 100% due to rounding.

Generational usage

More than two-thirds (68%) believe younger users are more vulnerable to falling into BNPL debt than older generations—and 65% of Gen Z agree with that belief. Almost one in 5 Americans (19%) say they trust BNPL providers to act in their best financial interest. Overall, 76% believe there should be more transparency around fees and risks when using BNPL services.

Methodology

Empower’s “Buy Now Pay Later Survey” is based on online survey responses from 2,449 Americans ages 18+ from August 4-6, 2025. The survey has been weighted to be nationally representative of all U.S. adults.

Get financially happy

Put your money to work for life and play

RO4759660-0825

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. No part of this blog, nor the links contained therein is a solicitation or offer to sell securities. Compensation for freelance contributions not to exceed $1,250. Third-party data is obtained from sources believed to be reliable; however, Empower cannot guarantee the accuracy, timeliness, completeness or fitness of this data for any particular purpose. Third-party links are provided solely as a convenience and do not imply an affiliation, endorsement or approval by Empower of the contents on such third-party websites. This article is based on current events, research, and developments at the time of publication, which may change over time.

Certain sections of this blog may contain forward-looking statements that are based on our reasonable expectations, estimates, projections and assumptions. Past performance is not a guarantee of future return, nor is it indicative of future performance. Investing involves risk. The value of your investment will fluctuate and you may lose money.

Certified Financial Planner Board of Standards Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design), and CFP® (with flame design) in the U.S., which it authorizes use of by individuals who successfully complete CFP Board's initial and ongoing certification requirements.