Over 7 in 10 mortgage holders don’t want to lose their current mortgage rate

Key insights from a survey of 1,297 Americans with mortgage*:

Over 7 in 10 mortgage holders don’t want to lose their current mortgage rate

Key insights from a survey of 1,297 Americans with mortgage*:

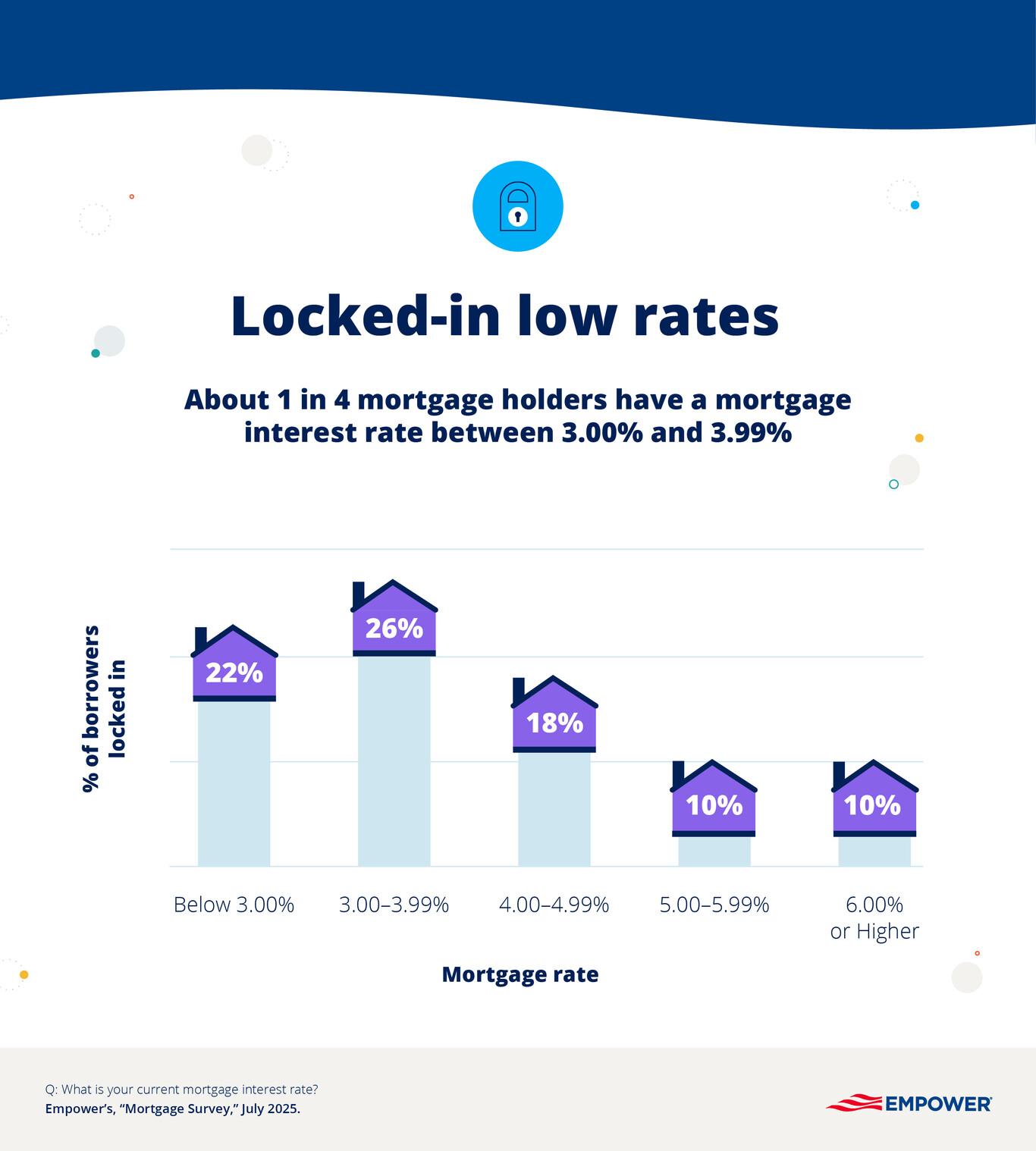

- Over one in four (26%) mortgage holders currently have a mortgage interest rate between 3.00% and 3.99%.

- Nearly three quarters (74%) of mortgage holders agree they don’t want to lose their current mortgage rate.

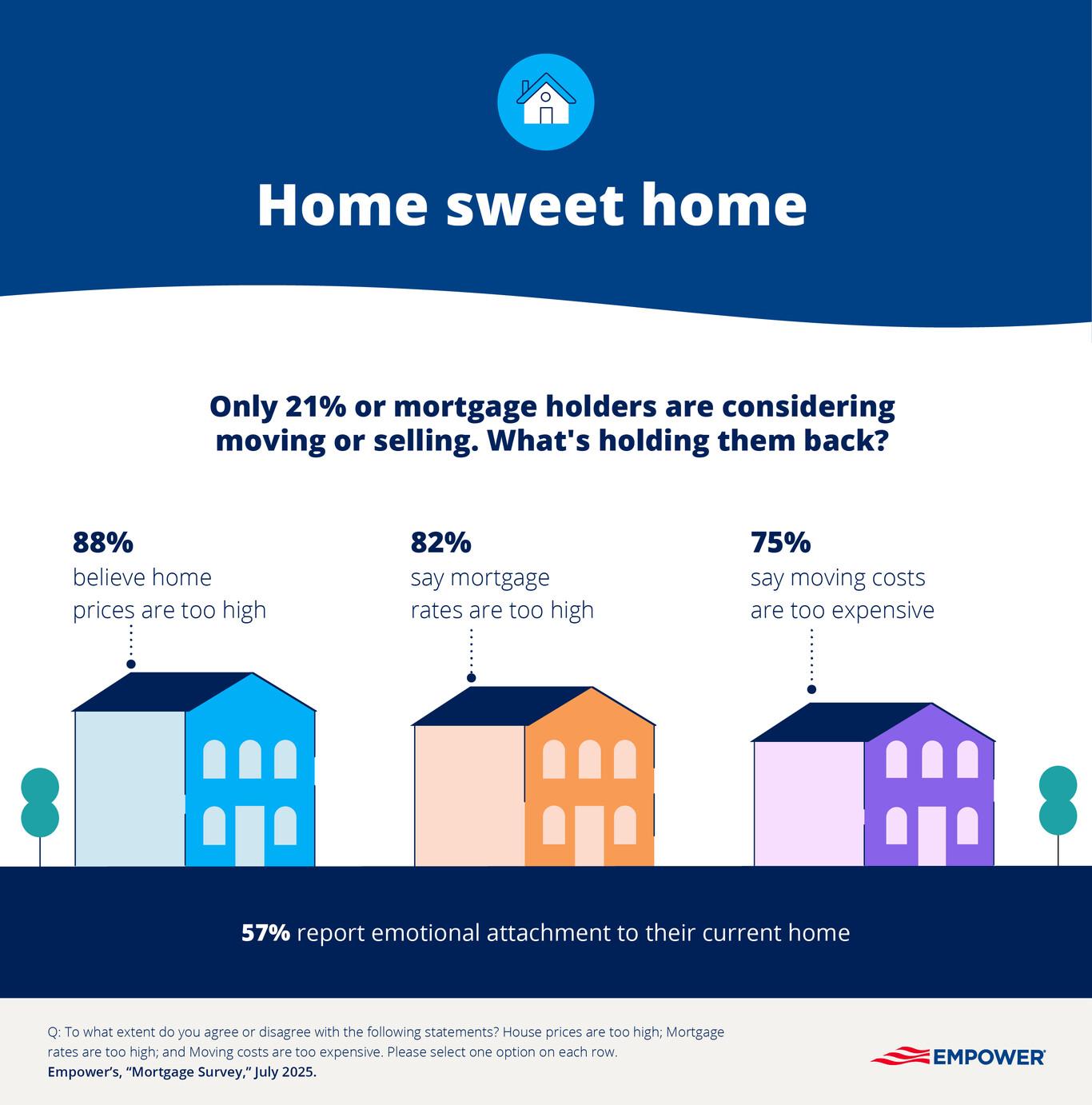

- Almost nine in ten (88%) believe home prices are too high, and 82% believe mortgage rates are too high.

- About three in five mortgage holders (57%) report an emotional attachment to their current home.

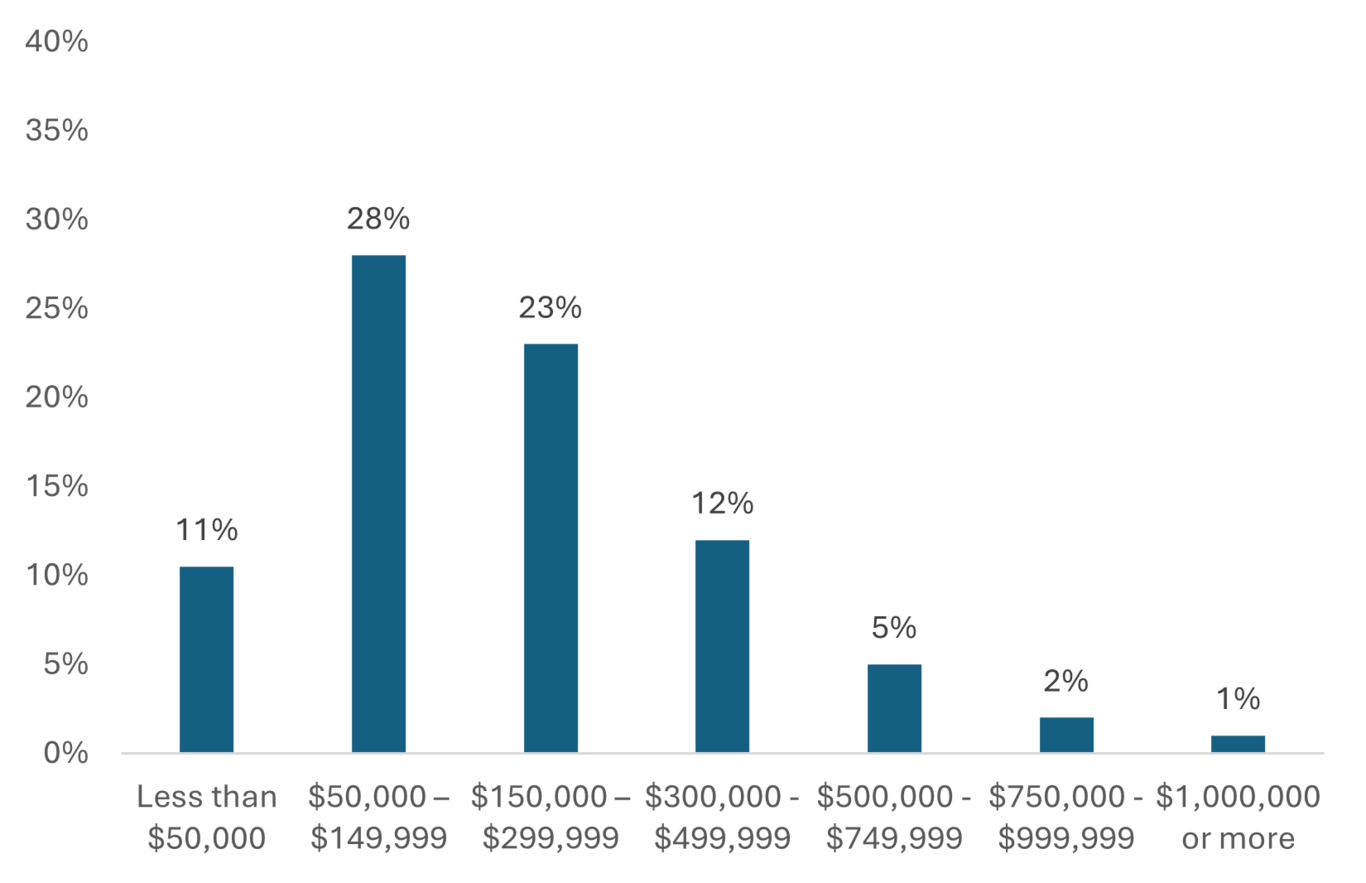

- Nearly three in ten (28%) believe they currently have $50,000 to $149,999 in home equity.

- Despite rising real estate values, almost seven in ten (69%) mortgage holders haven’t tapped into their home equity in the past two years nor considered doing so.

- Only 17% have taken out—or have considered taking out—a Home Equity Line of Credit (HELOC) or completed a cash-out refinance.

Staying put: Mortgage rate gaps create reluctant homeowners

About one in five (22%) U.S. mortgage holders have historically low rates below 3.00% (Figure 1). Currently, the average 30-year fixed mortgage rate remains near 7%.1

With current rates more than double the average mortgage holder’s rate, it’s no surprise that 74% are hesitant to give up their existing terms. Over four in five (82%) agree that mortgage rates are too high.

High costs, low mobility: The new reality for mortgage holders

Almost nine in ten (88%) mortgage holders believe home prices are too high (Figure 2). Home prices remain above pre-pandemic levels, driven primarily by a lack of supply and the so-called “rate lock effect.”2 Moreover, three in four (75%) mortgage holders believe that moving costs are too expensive.

Only about one in five (21%) mortgage-holders are considering moving or selling their home. Americans simply don’t move as much as they used to—the share of people who relocate each year has steadily declined from around 20% in 1985 to less than 10% in 2025.3 Nearly seven in ten (68%) say they don’t want to pay a broker fee if they sell their home. Another important factor: more than half (57%) report being emotionally attached to their current home.

Home equity

American homeowners with mortgages—who account for roughly 62% of all properties—saw their home equity increase by $425 billion since the third quarter of 2023, a 2.5% year-over-year gain.4 This brought total net homeowner equity to over $17.5 trillion in the third quarter of 2024.5 Some 62% of those with a mortgage believe they have less than $300,000 in their home, and 8% estimate their home equity is over $500,000.

Figure 3: About three in five mortgage holders estimate they have less than $300k in home equity

Question: How much home equity do you believe you currently have? Source: Empower “Mortgage Survey”, July 2025.

Home equity as a safety net

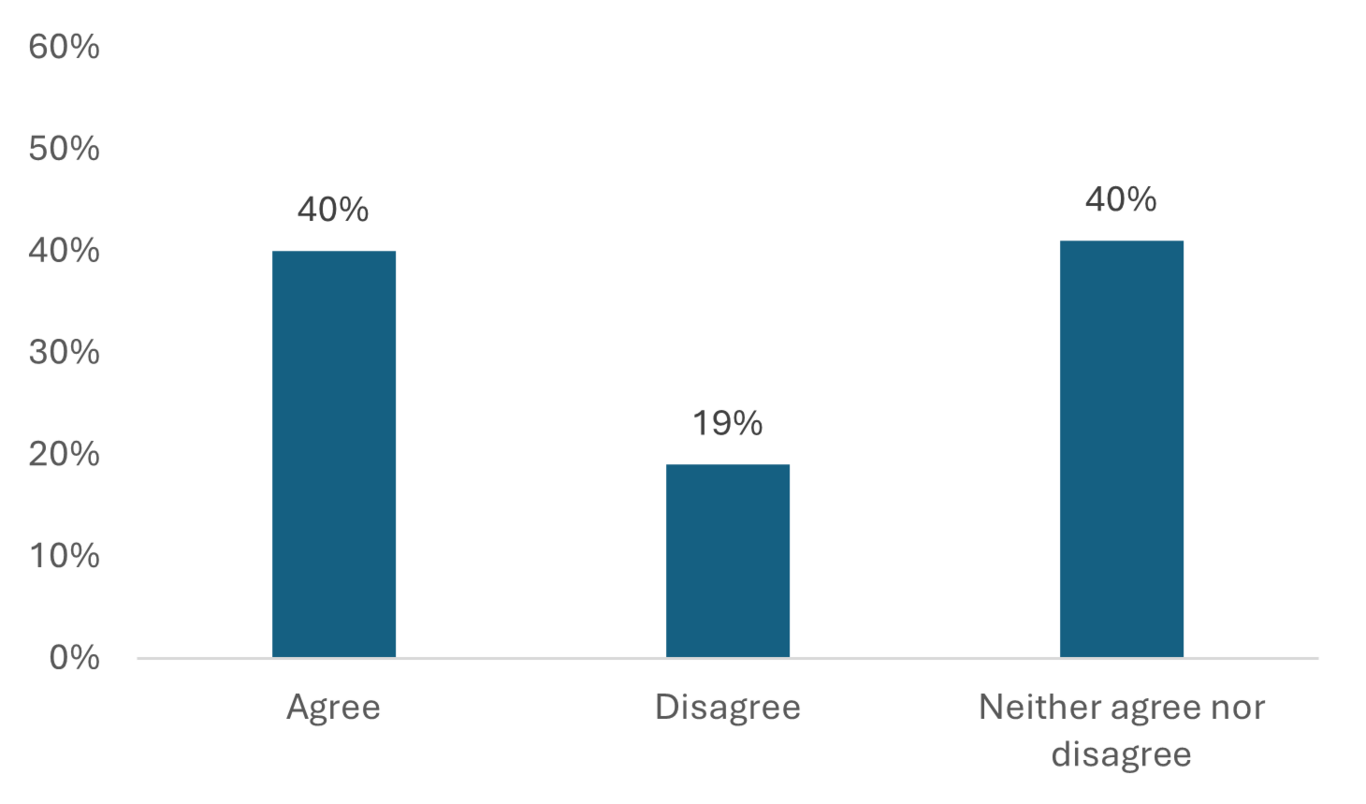

Some 40% of Americans with mortgages are confident that their home equity will support their long-term financial goals (Figure 4).

Figure 4: Two in five (40%) mortgage holders are confident that their home equity will help support their long-term financial goals

Question: To what extent do you agree or disagree with the following statement? – I am confident that my home equity will support my long-term financial goals (e.g., retirement, saving for travel, etc.). Source: Empower “Mortgage Survey”, July 2025.

*Methodology

Empower’s “Mortgage Survey” is based on online survey responses from 1,297 adults with a mortgage. The survey was fielded between June 9, 2025, and July 8, 2025. The figures have been weighted and are representative of all U.S. adults.

Get financially happy

Put your money to work for life and play

1 CNBC, "30-Year Fixed Mortgage Rate," accessed July 21, 2025.

2 Yahoo Finance, “Why are home prices so high?,” June 2025.

3 Forbes, “Not Enough People are Moving to Where the Jobs are,” September 2023.

4 Yahoo Finance, “CoreLogic: US Homeowners See Equity Gains Drop by More Than 5 Percent in Q3,” December 2024.

5 Ibid.

RO4671146-0725

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. No part of this blog, nor the links contained therein is a solicitation or offer to sell securities. Compensation for freelance contributions not to exceed $1,250. Third-party data is obtained from sources believed to be reliable; however, Empower cannot guarantee the accuracy, timeliness, completeness or fitness of this data for any particular purpose. Third-party links are provided solely as a convenience and do not imply an affiliation, endorsement or approval by Empower of the contents on such third-party websites. This article is based on current events, research, and developments at the time of publication, which may change over time.

Certain sections of this blog may contain forward-looking statements that are based on our reasonable expectations, estimates, projections and assumptions. Past performance is not a guarantee of future return, nor is it indicative of future performance. Investing involves risk. The value of your investment will fluctuate and you may lose money.

Certified Financial Planner Board of Standards Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design), and CFP® (with flame design) in the U.S., which it authorizes use of by individuals who successfully complete CFP Board's initial and ongoing certification requirements.