The Currency

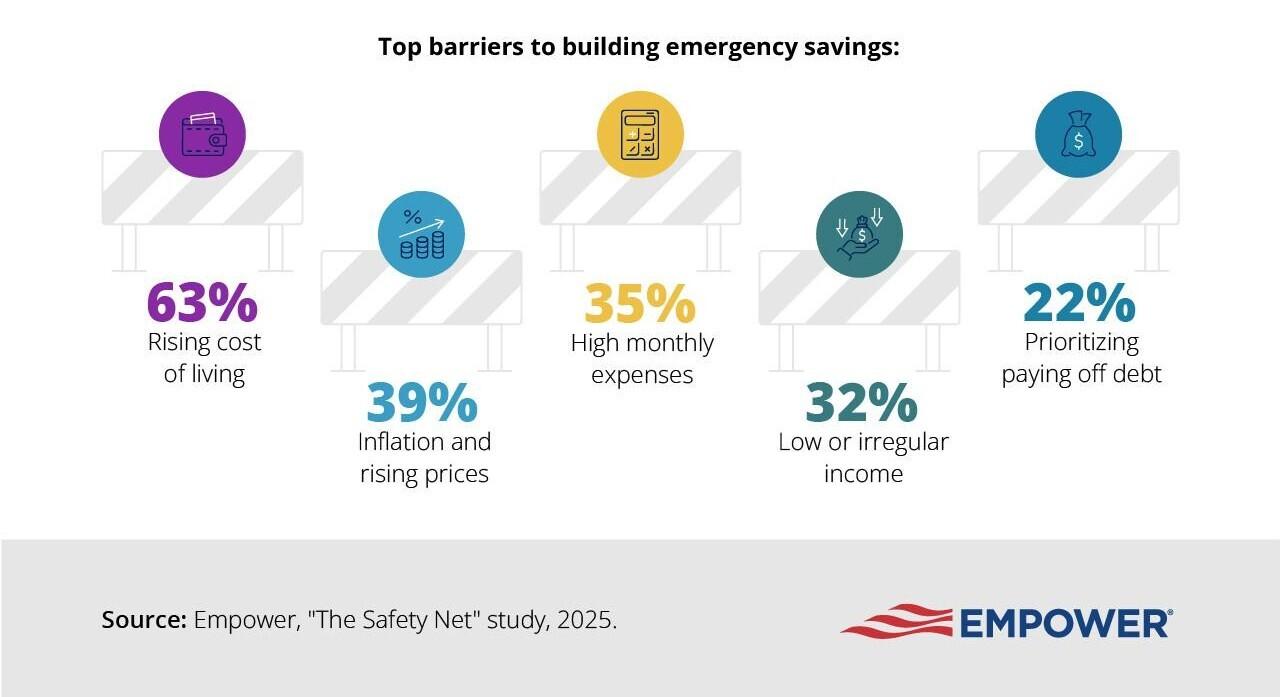

Americans have a median of $500 saved for unexpected expenses. Here’s what people think are getting in the way of saving:

Americans have a median of $500 saved for unexpected expenses. Here’s what people think are getting in the way of saving:

Saying “I do” to separate finances

Life

Theme Slug

category--life

Pathauto Slug

life

More couples are moving away from merging money as a way to reduce stress, preserve independence, and still support shared goals.

🗺️ Go the distance

Money

Theme Slug

category--money

Pathauto Slug

money

Vacationing at "destination dupes" can save travelers nearly $2,300 on average. Here's this week's money news.

How to spend your tax refund

Money

Theme Slug

category--money

Pathauto Slug

money

Here are five ways to use your tax refund as a tool for investing in your future.