Taking stock: A look at how Americans are investing

Tis the season…to buy stocks? New Empower research reveals that 43% of those surveyed would prefer receiving stocks or cryptocurrency instead of traditional gifts this year. Gen X investors are the most enthusiastic, with 48% saying they’ll take stocks as a stocking stuffer. Digital investments may be the gifts that keep on giving: According to investors, these presents are a good investment (37%) and useful for teaching your children about money (35%).

With their sights set on 2024, Americans are taking stock to set themselves up for a brighter financial future. To learn more about how people are investing, Empower surveyed 1,003 stock owners, 79% of whom are retail investors.

Key takeaways

- 43% of those surveyed would prefer receiving stocks or cryptocurrency instead of traditional gifts this year.

- 48% of Gen X investors are interested in receiving stocks or crypto as a holiday present.

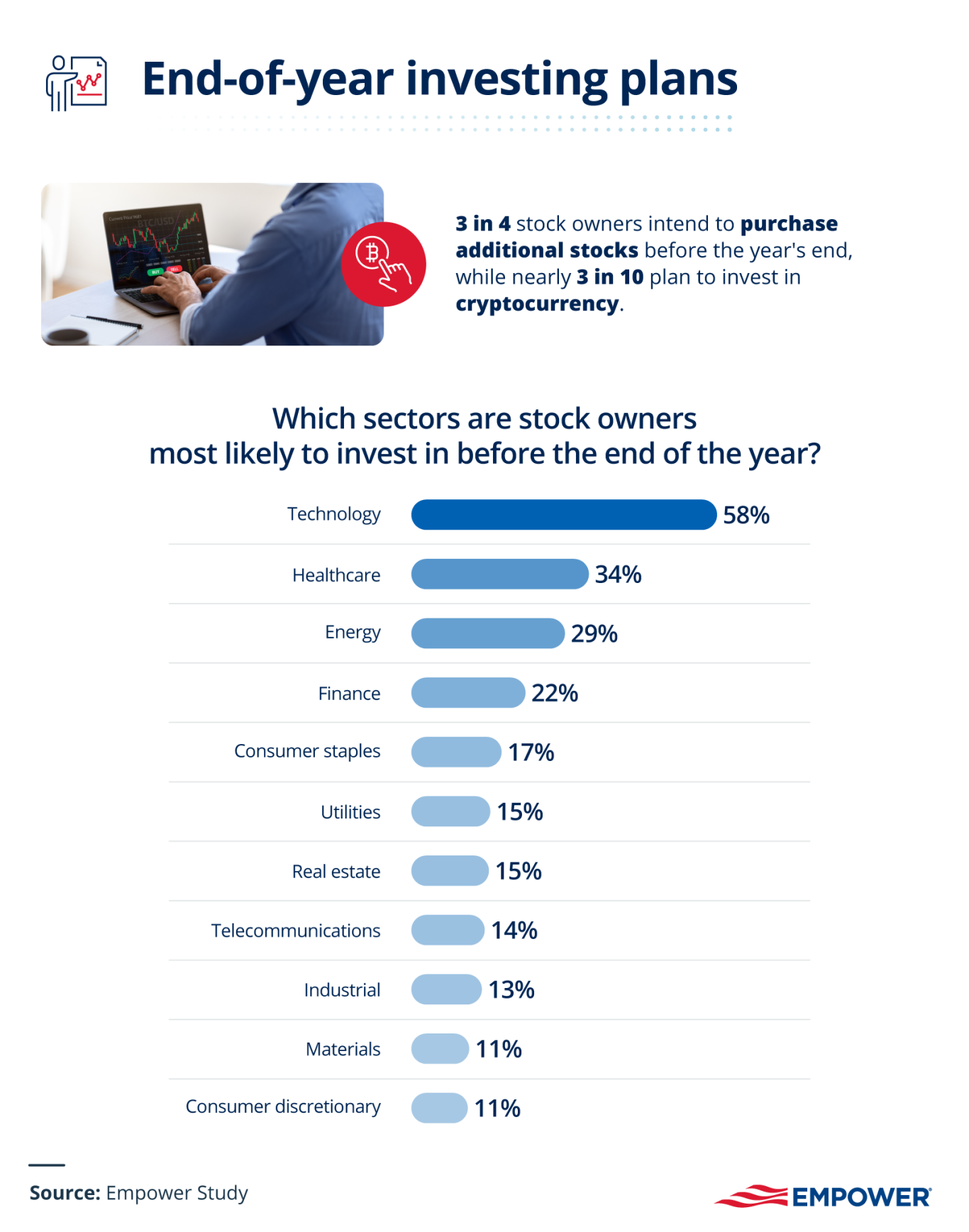

- 3 in 4 stock owners intend to purchase additional stocks before the year’s end, while nearly 3 in 10 plan to invest in cryptocurrency.

- Among investors purchasing more stock by the year’s end, 58% will focus on tech, 34% on healthcare, and 29% on energy. However, 1 in 7 investors say they don’t diversify by sector — rather, they focus on company value when choosing where to invest.

- Nearly 2 in 5 stock owners use social media to monitor the stock market.

- Over 1 in 5 retail investors said social media influenced them to invest in meme stocks this past year, leading them to make an average annual investment of $222.

Gifts that give

For those looking for a less traditional approach to holiday spending, gift-giving can be a way to pass along investing strategies, promising not just immediate joy but the potential for future financial growth.

Many stock owners favored receiving a stake in the financial markets over conventional presents: Nearly half of respondents (43%) said they’d choose stocks or cryptocurrency over traditional gifts this year, highlighting the value of presents that have the potential to appreciate over time. Additionally, men showed a 15% higher preference than women, and Gen X investors were the most interested generation (48%).

Millennials were 30% more likely than Gen Z to want these investment gifts, though stock owners say they’re more practical (20%) than other presents.

As the year winds down, the appetite for investing shows no signs of waning, with three-quarters of stock owners planning to expand their portfolios. But their investments won’t be limited to stocks; nearly 30% said they’re setting their sights on cryptocurrencies.

This approach complements their strategic focus on technology, healthcare, and energy as the top sectors they’ve planned to invest in. Meanwhile, 1 in 7 said they don’t diversify by sector — instead, they focus on company value when choosing where to invest.

Readying for retirement

Beyond day-to-day investing, generations are taking different retirement planning approaches, with preferences reflecting each generation’s thoughts around financial security.

Among those surveyed, stocks were tied with employer retirement plans as the top investment strategies for retirement planning.

Baby boomers, in particular, anchored their retirement expectations on the growth potential of stocks (60%). Other baby boomer investors relied on employer-provided retirement plans (40%), while one-third saw owning real estate as a key component of their retirement strategy. If given the choice, 1 in 5 baby boomers would opt for holding $10,000 in cash, while 44% of Gen Zers would invest $10,000 in stocks.

Taking stock with social media

While traditional

The allure of meme stocks has not gone unnoticed, with social media’s influence leading 21% of retail investors to ride the wave of these viral investments. The average annual investment in such stocks was $222.

On average, retail investors spent 12 minutes daily (73 hours annually) evaluating stocks they’ve yet to invest in. Gen Z retail investors, in particular, dedicated significant time to researching new investment opportunities, averaging 14 minutes per day (85 hours a year). Their stock market engagement is also much more mobile compared with other generations; Gen Zers were 70% more likely than baby boomers to monitor their investments through stock market-specific apps.

Closing the books

The end of the year is a great time to take stock of your financial plan and investments. Learn about how Empower can help you reach your goals.

Methodology

Empower survey of 1,003 stock owners in America. Among respondents, 79% identified as retail investors. All data referenced in this article is from the survey.

About Empower

Empower is a financial services company on a mission to empower financial freedom for all. We offer investment, wealth management, and retirement solutions for individuals and all sizes of organizations. Connect with us on Empower.com.

Fair use statement

Interested in the shifting trends of American investment habits? Feel free to share these findings non-commercially, but please link back to this page to provide full access to our data and insights.

RO3240392-1123

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. No part of this blog, nor the links contained therein is a solicitation or offer to sell securities. Compensation for freelance contributions not to exceed $1,250. Third-party data is obtained from sources believed to be reliable; however, Empower cannot guarantee the accuracy, timeliness, completeness or fitness of this data for any particular purpose. Third-party links are provided solely as a convenience and do not imply an affiliation, endorsement or approval by Empower of the contents on such third-party websites. This article is based on current events, research, and developments at the time of publication, which may change over time.

Certain sections of this blog may contain forward-looking statements that are based on our reasonable expectations, estimates, projections and assumptions. Past performance is not a guarantee of future return, nor is it indicative of future performance. Investing involves risk. The value of your investment will fluctuate and you may lose money.

Certified Financial Planner Board of Standards Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design), and CFP® (with flame design) in the U.S., which it authorizes use of by individuals who successfully complete CFP Board's initial and ongoing certification requirements.