Money on the Mind

Money on the Mind

Money is on our minds—and these days, it’s taking up more space than ever. Empower’s latest research reveals Americans are spending nearly 4 hours a day thinking about money. For younger generations, it's even more. This report explores the behavioral shifts, and the surprising motivation behind our collective financial mindset.

Money is on our minds—and these days, it’s taking up more space than ever. Empower’s latest research reveals Americans are spending nearly 4 hours a day thinking about money. For younger generations, it's even more. This report explores the behavioral shifts, and the surprising motivation behind our collective financial mindset.

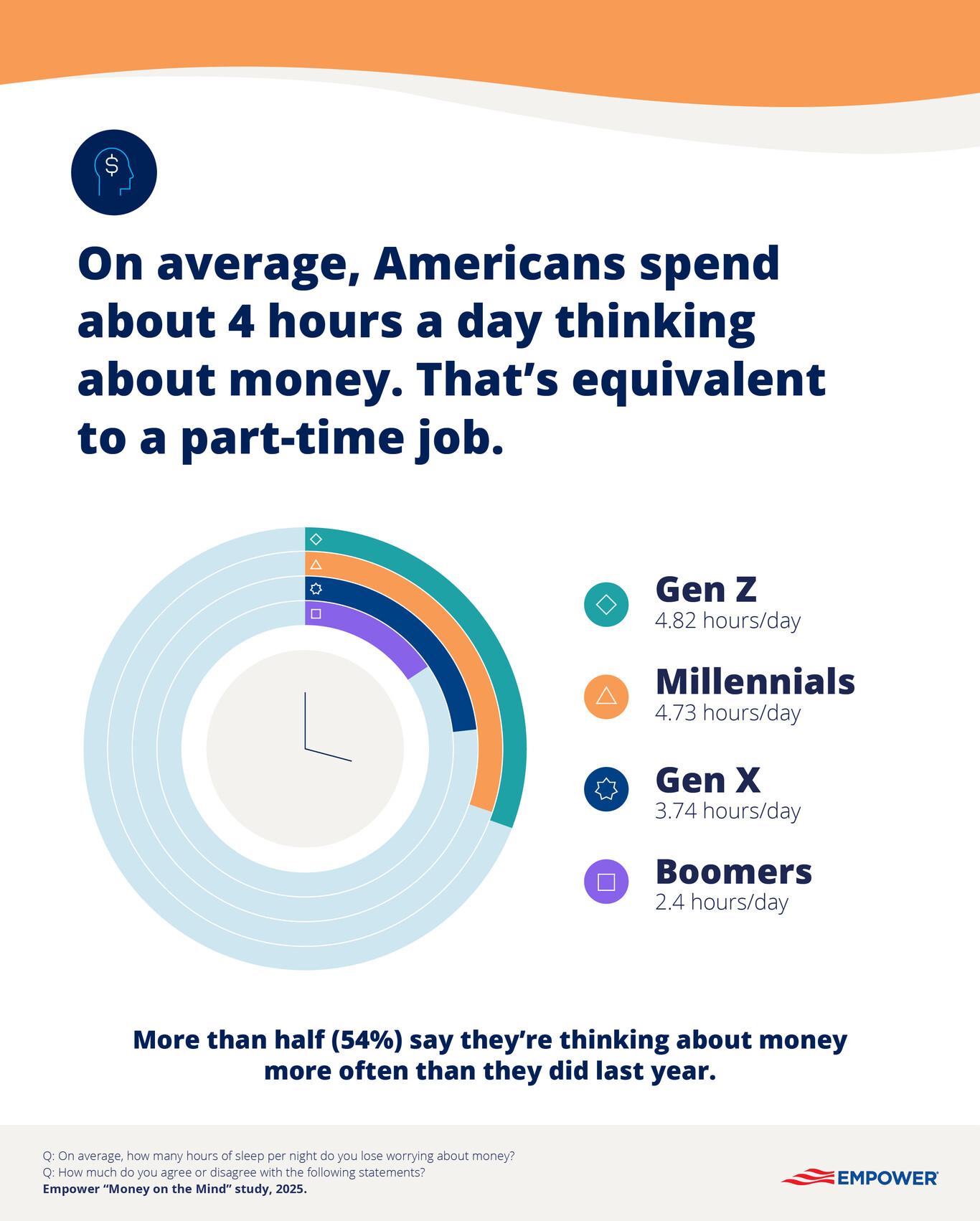

4 hours a day—and counting

Americans spend nearly 4 hours a day thinking about money. It’s the equivalent of a part-time job, and more time than most people spend preparing meals or exercising combined.1 Nearly half of Americans (45%) say thinking about money motivates them to take action to reach their long-term goals.

Time spent thinking about money by generation

- Gen Z: 4.82 hours/day

- Millennials: 4.73 hours/day

- Gen X: 3.74 hours/day

- Boomers: 2.4 hours/day

More than half (54%) say they’re thinking about money more often than they did last year.

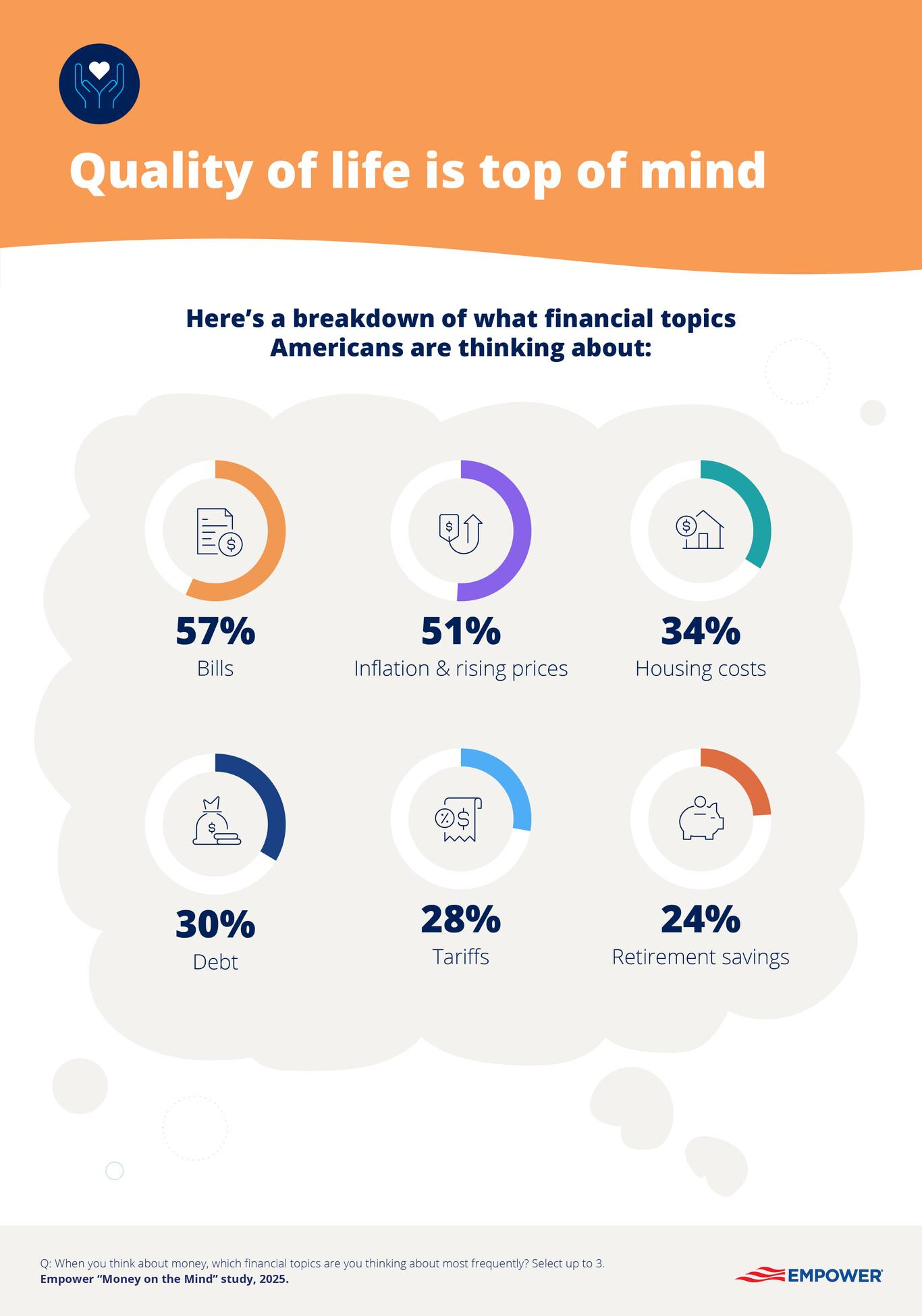

What are people thinking about? For most, it's quality of life considerations: Bills (57%), inflation and rising prices (51%), housing costs (34%), debt (30%), tariffs (28%), and retirement savings (24%).

In fact, a majority (55%) of Americans say they think about their retirement weekly, or daily (27%). One in 4 (22%) high-income earners have retirement on the mind multiple times a day.

Checking in – and in

People are not just thinking about finances—they’re checking in, and in. Nearly one-fifth of the population (17%) checks their financial accounts, including credit cards and investments, multiple times per day, and a quarter (24%) checks their bank account daily. Keeping a close eye is more common among younger adults: 24% of Gen Z and 21% of Millennials monitor accounts several times a day, compared to just 10% of Boomers.

"In an era of 24/7 economic headlines, it’s no surprise that money is dominating our daily thoughts. But here’s the silver lining: we’re seeing a real shift from passive worry to proactive behavior. People are motivated. They’re looking for tools, information, and advice to turn that energy into progress."

The time of day matters, too. Gen Z is most likely to think about money in the late afternoon, between 2 p.m. and 5 p.m., whereas Millennials and Gen X report an uptick in financial thoughts between 8 p.m. and 11 p.m., when the day slows down.

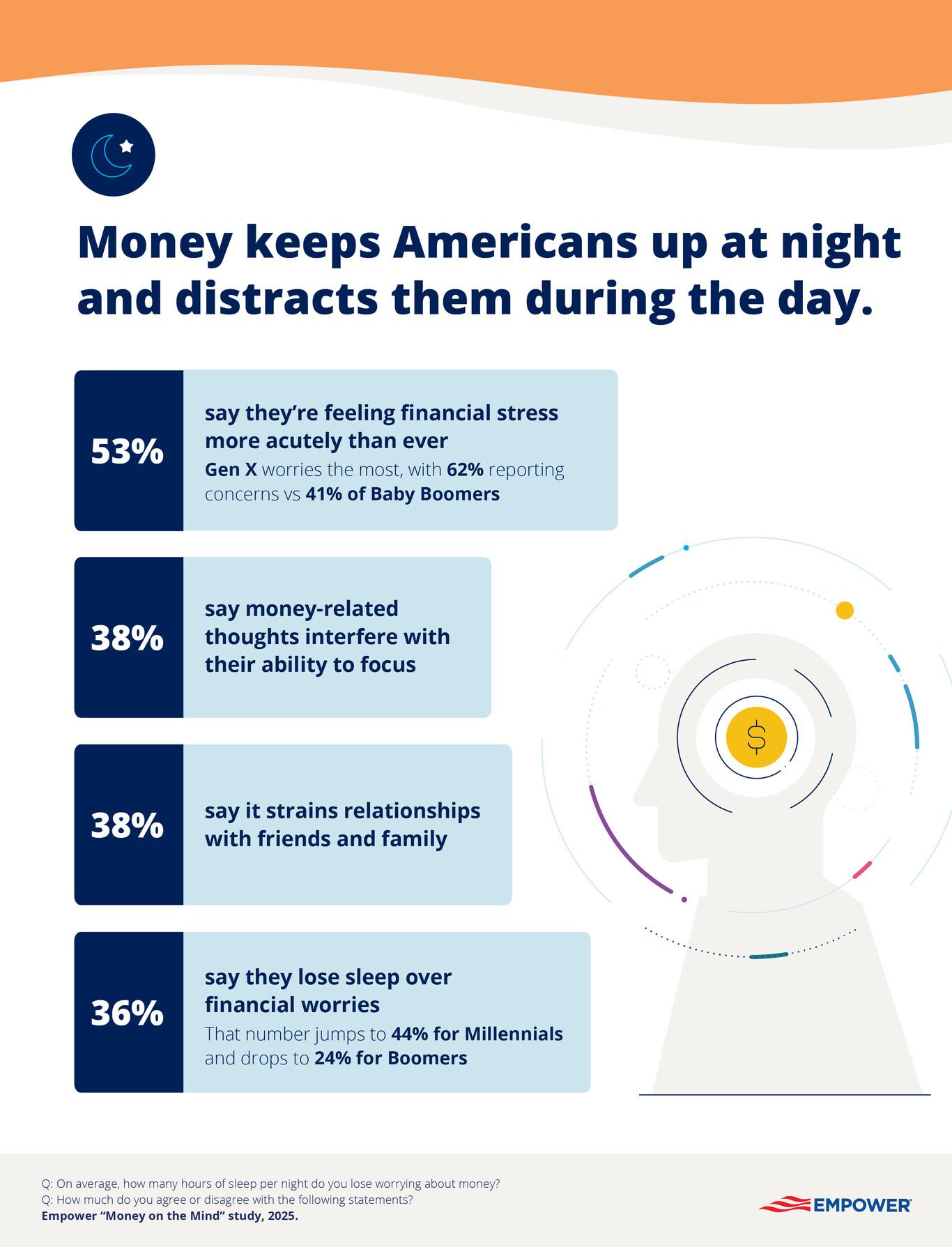

When money keeps Americans up at night

Over a third of Americans (36%) say they lose sleep over financial worries, and for Millennials, that number jumps to 44%. Boomers report sleeping better: just 24% say money keeps them up at night.

Even during the day, 38% say money-related thoughts interfere with their ability to focus, and close to 2 in 5 say it strains relationships with friends and family (38%). In fact, over half (53%) say they’re feeling financial stress more acutely than ever (62% Gen X, 41% Baby Boomers).

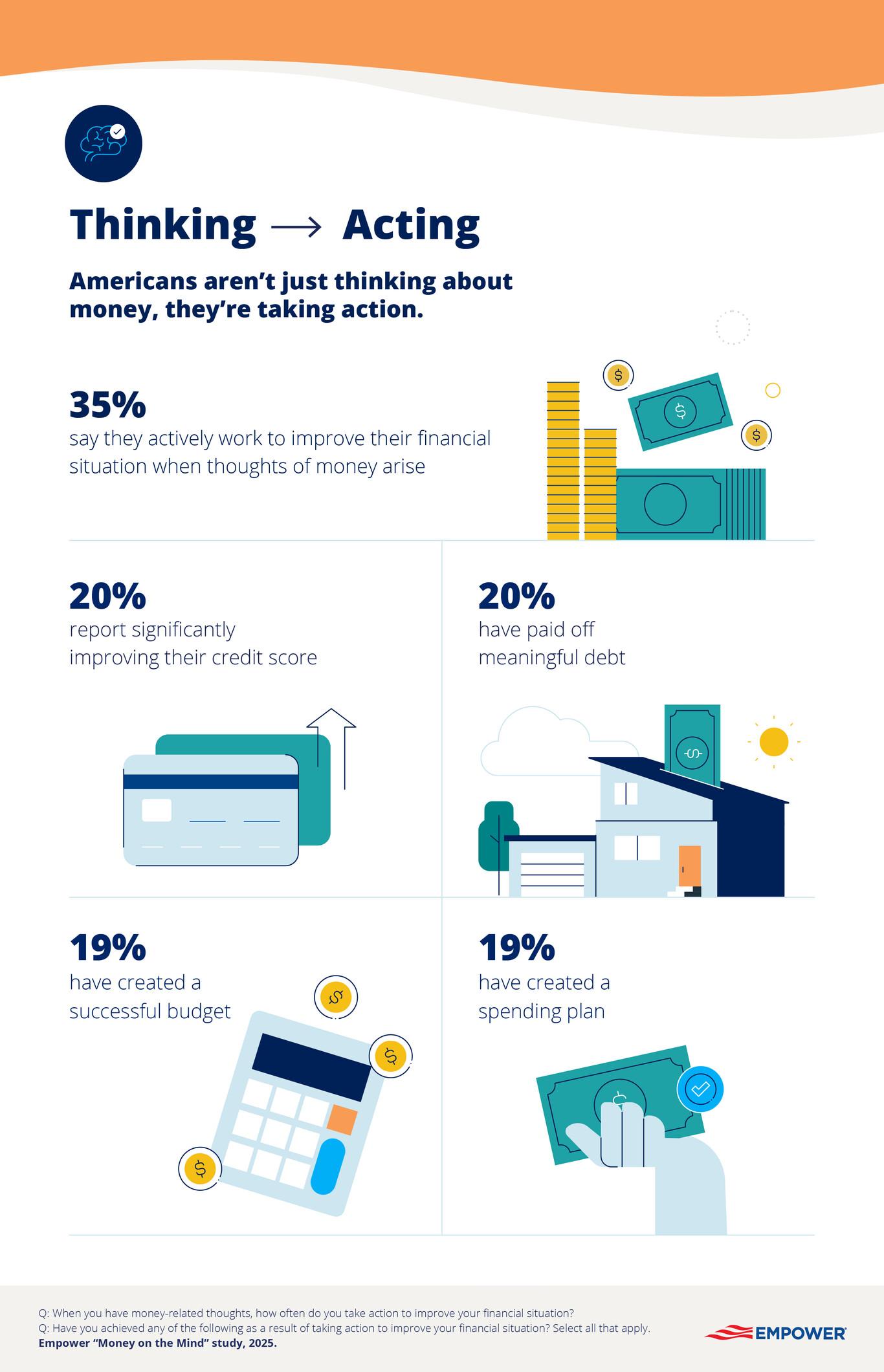

But there's a flip side: motivation

One third (33%) are thinking about how to grow their money, and how to achieve long-term security (30%). Some 35% say they actively work to improve their financial situation when these thoughts arise, with Millennials among the most proactive (40%).

These actions are paying off. One in 5 (20%) respondents report significantly improving their credit score. Another 20% have paid off meaningful debt, created a successful budget (19%) or spending plan (19%).

Seeking information and advice

With money top of mind, Americans are searching for insights they can trust. About 1 in 5 people seek out financial news multiple times a week, and nearly half say that trusted financial information helps them make smarter decisions (41%). High-income earners report they are seeking out financial news and insights at least once per day (31%). A third of respondents say that talking with a financial advisor helps clarify their thinking around money and financial goals (33%).

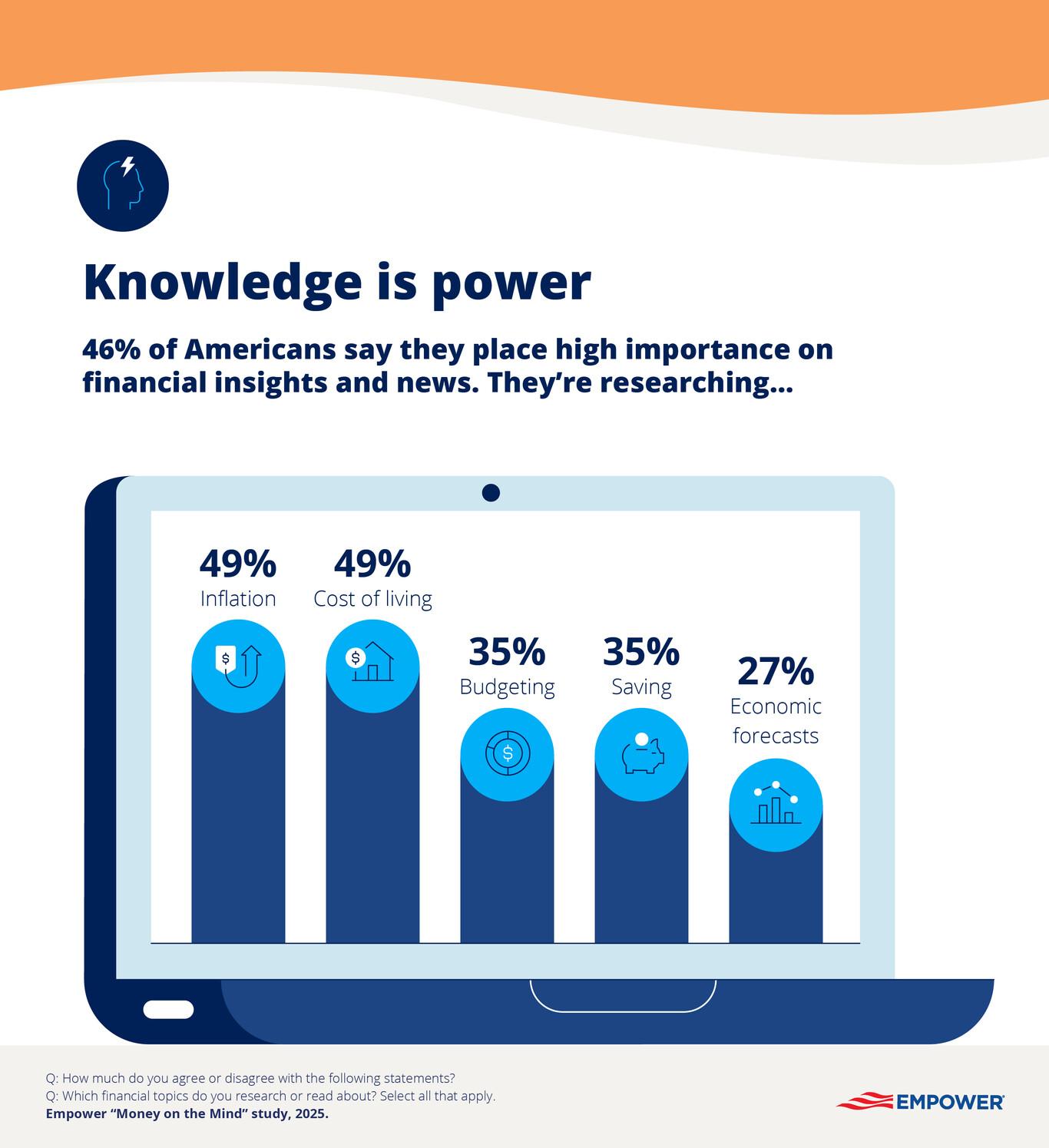

Notably, younger adults are leading the way in financial curiosity. Millennials, in particular, value financial education—52% say they place a high importance on financial insights and news (46% overall). More than half say they follow financial news to stay informed. Inflation and cost of living (49%) are the top topics people are researching, followed closely by budgeting (35%), saving (35%), and broader economic forecasts (27%).

What would help ease the pressure?

When asked what would reduce their financial stress, nearly half said a higher income (47%) would ease their worries, while 45% pointed to lower living expenses. Broader economic improvements (29%) and debt elimination (28%), and a larger emergency fund (24%) were also top responses. Notably, almost 1 in 5 (18%) people said a detailed financial plan would go a long way toward helping them feel better about their finances (25% Gen Z, 23% Millennials).

To keep up with rising costs and financial anxiety, Americans are cutting back: 53% have reduced dining out; 46% are buying fewer non-essentials; 40% are scaling back entertainment; 39% are postponing travel or vacations; 33% are canceling subscription services; 29% are passing on social activities with friends.

Nearly 1 in 4 adjust their spending habits every month due to financial concerns, and 17% recalibrate weekly.

Money mindset: focus on the future

Americans can’t stop thinking about their finances, but for many, it’s because they are dreaming of a bright future. Nearly half of Americans (47%) say they feel confident they will reach their financial goals.

Methodology:

Empower’s “Money on the Mind” study is based on online survey responses from 2,206 Americans ages 18+ from June 10-12, 2025. The survey is weighted to be nationally representative of U.S. adults.

Get financially happy

Put your money to work for life and play

1 US Bureau of Labor Statistics. “The Economics Daily.” January 2024.

RO4674848-0725

RO4770641-0925

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. No part of this blog, nor the links contained therein is a solicitation or offer to sell securities. Compensation for freelance contributions not to exceed $1,250. Third-party data is obtained from sources believed to be reliable; however, Empower cannot guarantee the accuracy, timeliness, completeness or fitness of this data for any particular purpose. Third-party links are provided solely as a convenience and do not imply an affiliation, endorsement or approval by Empower of the contents on such third-party websites. This article is based on current events, research, and developments at the time of publication, which may change over time.

Certain sections of this blog may contain forward-looking statements that are based on our reasonable expectations, estimates, projections and assumptions. Past performance is not a guarantee of future return, nor is it indicative of future performance. Investing involves risk. The value of your investment will fluctuate and you may lose money.

Certified Financial Planner Board of Standards Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design), and CFP® (with flame design) in the U.S., which it authorizes use of by individuals who successfully complete CFP Board's initial and ongoing certification requirements.