Learning Curve: America’s money lessons

What do people wish they had learned about money sooner? Retirement savings and planning top the list.

Learning Curve: America’s money lessons

What do people wish they had learned about money sooner? Retirement savings and planning top the list.

Nearly half of Americans (49%) said it was not until at least age 25 that they began to understand how money works. When asked what financial topics they wish they had learned earlier in life, Americans pointed to the building blocks of long-term financial security: retirement savings and planning (56%), investing (54%), and debt (44%). Many also wanted earlier education on building emergency savings (43%) (read The Safety Net), budgeting and expense tracking (43%), and credit scores (42%). More than half of Americans (55%) believe they have made financial mistakes because they lacked knowledge at a critical moment.

Key findings:

- The top financial topics people wish they learned sooner are retirement savings and planning (56%), followed by investing (54%), and debt (44%).

- More than three in five Americans (63%) said they would have made different decisions if they had received better financial education earlier.

- Nearly half of Americans (49%) said it was not until age 25 or later that they began to understand how money works.

- About two in five Americans (43%) believe they learned the basics of budgeting at the right time in their life.

- About one in two Americans (49%) said they wish they had learned more about credit and debt before using a credit card.

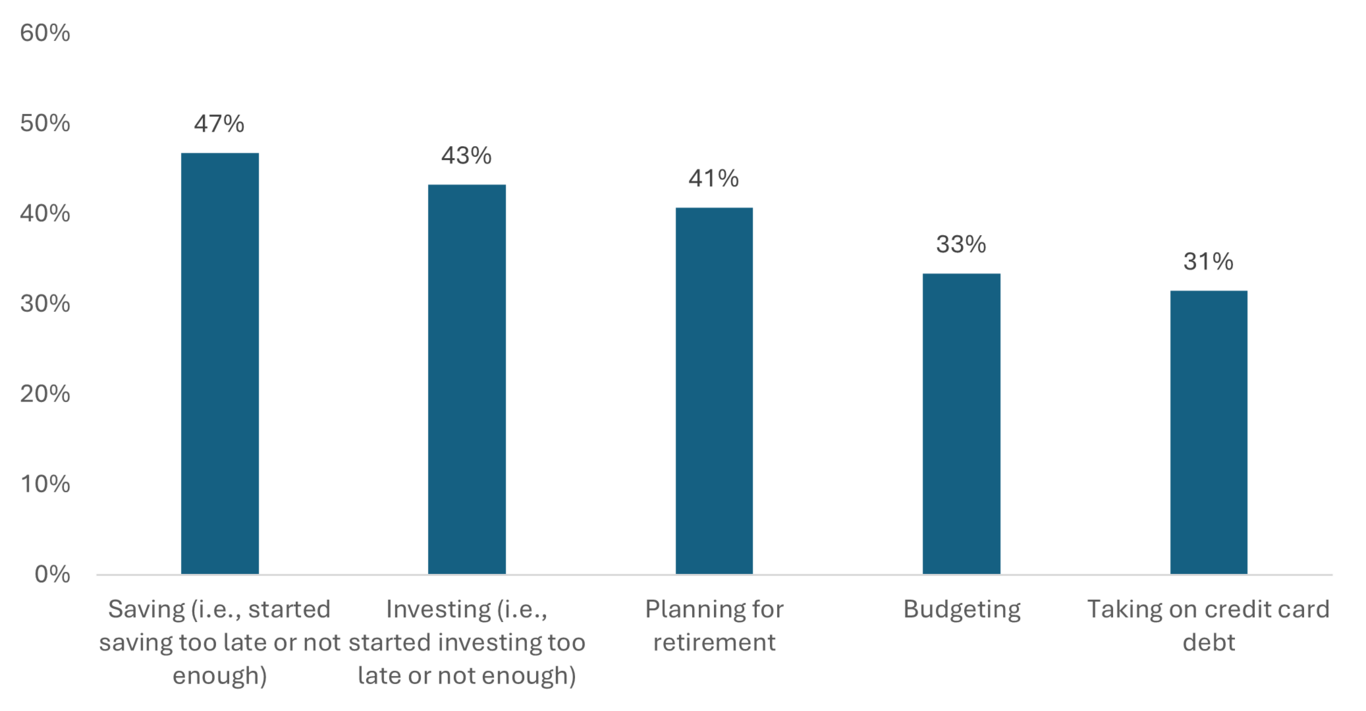

The top money do-overs Americans wish for

When asked which financial decisions they would change if given the chance, Americans pointed to some of the biggest building blocks of long-term security (Figure 1).

- Saving (47%) tops the list, followed closely by investing (43%) and planning for retirement (41%). Nearly one in three (31%) would change decisions related to taking on credit card debt, while 13% would have changed something different in regard to taking on student loan debt.

- About one in five (18%) wish they had negotiated their salary or benefits, and another 18% feel they bought a car or home too soon or not soon enough.

- Roughly one in five (19%) say not understanding taxes or tax-advantaged accounts.

Figure 1. If I could do it over again… the top financial regrets Americans carry

Source: Empower “Learning Curve,” September 2025. Question: If you could go back and change a financial decision(s), which of the following would it be?

Learning on the job: Work as a classroom for money

For many Americans, the workplace is where financial knowledge begins to take shape. Across multiple financial topics, people pointed to their first job as a key moment when they started to feel confident managing money.

- Budgeting: About one in five (21%) gained budgeting confidence at their first job.

- Credit scores: Nearly one in four (23%) said the same about understanding credit.

- Filing taxes: Close to two in five (39%) first felt confident about taxes after starting their first full-time job.

- Debt: About one in four (23%) said their first job was when they began to feel confident managing debt.

- Retirement planning: Roughly one in five (21%) said their first job was the point when they began to understand retirement planning.

Through access to retirement plans, workplace benefits, and financial wellness programs, the workplace plays an important role in people’s financial lives.

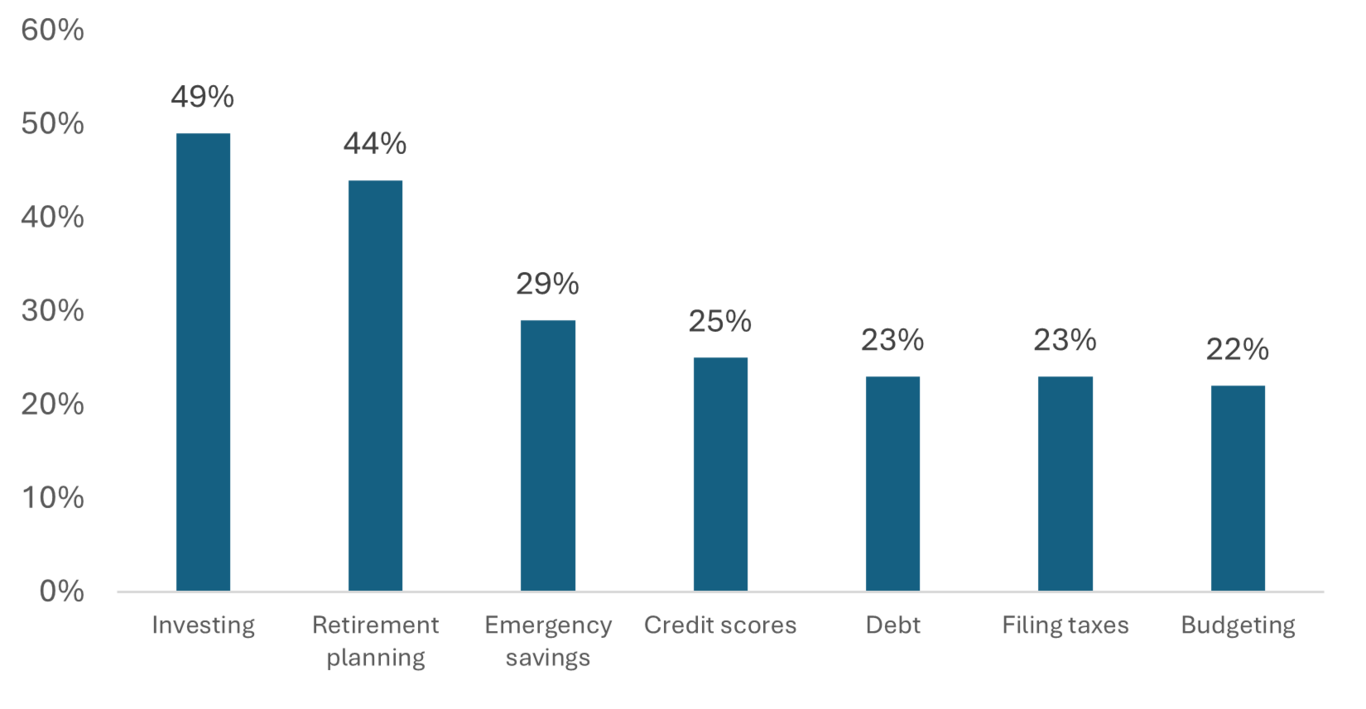

The confidence gap in financial knowledge

Younger Americans consistently report less confidence across most financial topics (Figure 2). For example, 37% of Gen Z do not feel confident about filing taxes, compared to 21% of Gen X and just 12% of Boomers.

Figure 2. Financial confidence

Source: Empower “Learning Curve,” September 2025. Question: When did you first feel confident about each of the following financial topics? Please select one option one each row: budgeting, credit scores, filing taxes, investing, retirement planning/retirement savings, emergency savings, and debt. Response option: I still do not feel confident.

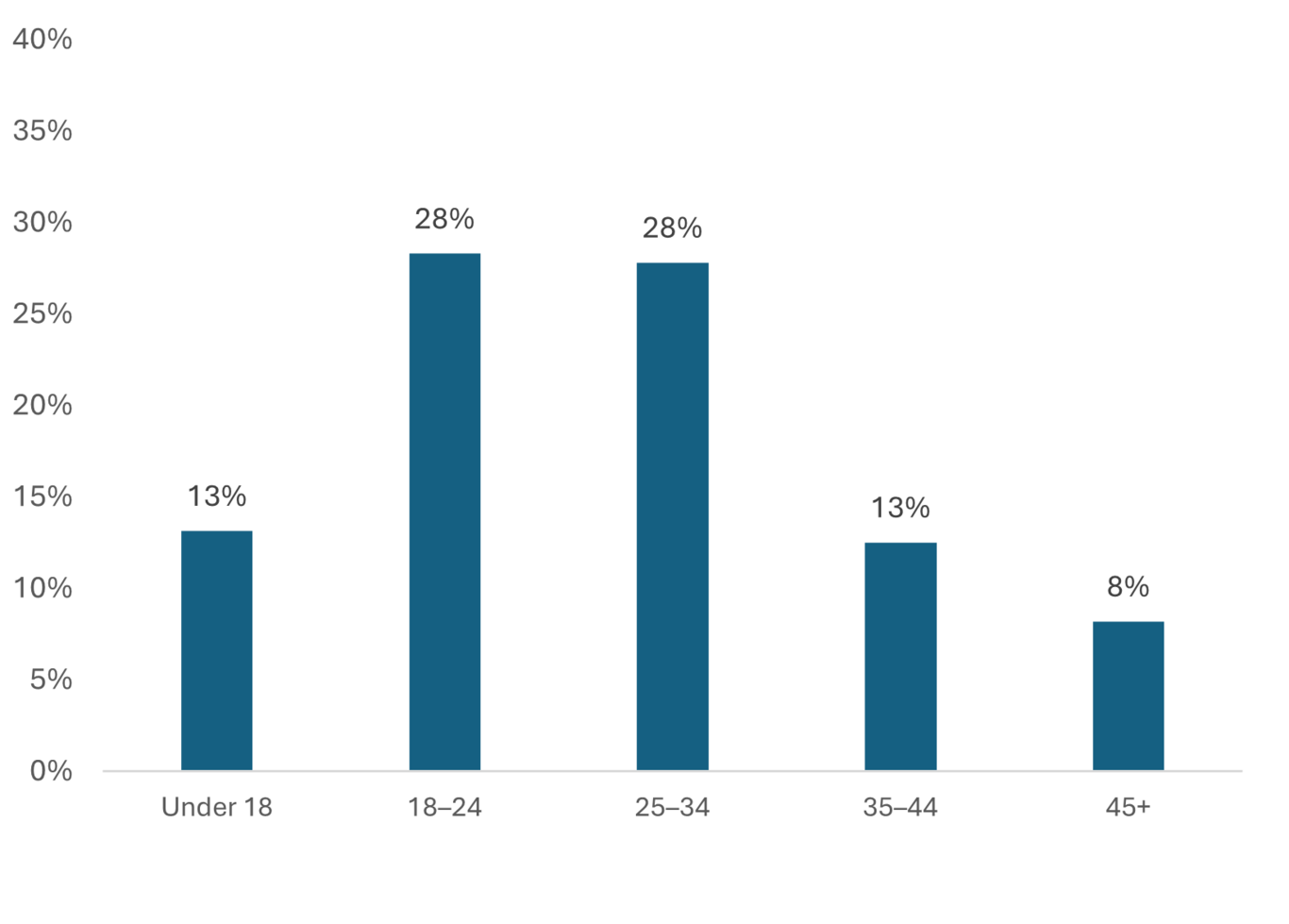

When money makes sense

For most Americans, financial understanding comes relatively late in life (Figure 3). Nearly three in five Americans (77%) said they did not feel they understood how money works until age 18 or later. Just above a quarter (28%) first gained clarity between ages 18–24, a period often tied to starting college or entering the workforce. Another 28% said 25–34, underscoring how responsibilities like housing expenses or debt management play a role in financial confidence.

Figure 3. Money lessons in time

Source: Empower “Learning Curve,” September 2025. Question: At what age did you feel like you really started understanding how money works?

Still learning

Four in ten Americans (44%) say financial topics can feel overwhelming or inaccessible. This sentiment is strongest among Gen Z (53%) and Millennials (48%), while fewer Boomers (37%) report feeling overwhelmed.

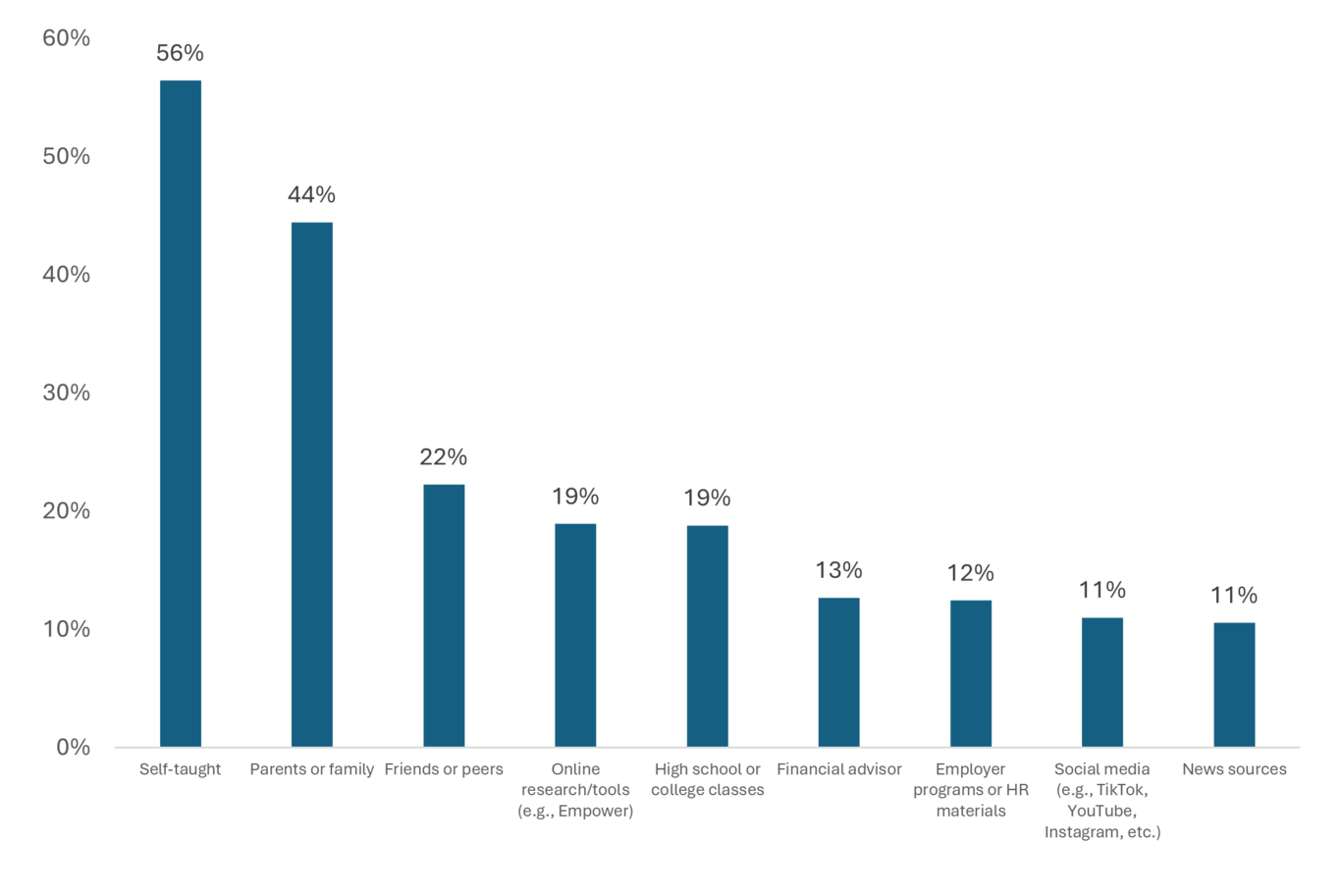

And how do Americans learn about money? More than half of Americans (56%) identify as self-taught (Figure 4), with the share rising among Gen X (60%) and Boomers (64%). By contrast, only 44% of Gen Z rely on self-teaching.

Parents and family are also a key source of financial education (44%), with the influence especially strong among Gen Z (59%).

Formal education plays a smaller role: only 19% of U.S. adults learned about finances through high school or college classes, though 30% of Gen Z report learning from this source.

Digital platforms are reshaping financial learning for the youngest generation. Over one in four (26%) of Gen Z cite social media (e.g., TikTok, YouTube, Instagram) as a primary learning source, compared with 16% of Millennials and just 4% of Gen X.

Figure 4. Different financial education formats

Source: Empower “Learning Curve,” September 2025. Question: How did you primarily learn about managing your personal finances?

Methodology

Empower’s “Learning Curve” is based on online survey responses from 2,485 Americans ages 18+ from August 20-22, 2025. The survey has been weighted to be nationally representative of all U.S. adults.

Get financially happy

Put your money to work for life and play

RO4805206-0925

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. No part of this blog, nor the links contained therein is a solicitation or offer to sell securities. Compensation for freelance contributions not to exceed $1,250. Third-party data is obtained from sources believed to be reliable; however, Empower cannot guarantee the accuracy, timeliness, completeness or fitness of this data for any particular purpose. Third-party links are provided solely as a convenience and do not imply an affiliation, endorsement or approval by Empower of the contents on such third-party websites. This article is based on current events, research, and developments at the time of publication, which may change over time.

Certain sections of this blog may contain forward-looking statements that are based on our reasonable expectations, estimates, projections and assumptions. Past performance is not a guarantee of future return, nor is it indicative of future performance. Investing involves risk. The value of your investment will fluctuate and you may lose money.

Certified Financial Planner Board of Standards Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design), and CFP® (with flame design) in the U.S., which it authorizes use of by individuals who successfully complete CFP Board's initial and ongoing certification requirements.