Trump account for kids: Eligibility, government contribution, and limits

Trump account for kids: Eligibility, government contribution, and limits

Find out how Trump accounts for kids work, plus learn more about contribution limits, withdrawal rules, and tax implications

Trump account for kids: Eligibility, government contribution, and limits

Find out how Trump accounts for kids work, plus learn more about contribution limits, withdrawal rules, and tax implications

Key takeaways

- Trump accounts are a type of individual retirement account (IRA) intended to help anyone under age 18 with a social security number save and invest for the future.

- Under the pilot program, eligible U.S. children born from January 1, 2025, through December 31, 2028, will receive a one-time $1,000 contribution from the federal government to their account.

- Parents, family members, employers, and others can contribute additional money to a child’s Trump account, but those contributions are limited to a total of $5,000 per year.

What is a Trump account for kids?

Trump accounts, also known as 530A accounts, are a new type of traditional individual retirement account (IRA) for children under age 18. These custodial-style, tax-advantaged accounts are owned by the child, while a parent or guardian is authorized to act on the child’s behalf until they turn 18. The child is both the legal owner and the beneficiary of the account.1 The U.S. Treasury Department will set up and administer the initial accounts, which are expected to become available on July 5, 2026.2

Who qualifies for a Trump account?

Any child under age 18 with a Social Security number is eligible for a Trump account. Some children may also qualify for a one-time $1,000 government contribution under the new pilot program. To be eligible, a child must:3

- Be born between January 1, 2025, and December 31, 2028

- Be a U.S. citizen

- Have an eligible Trump account opened on their behalf (and have not already claimed the pilot benefit)

How to open a Trump account for kids or a baby

Parents and legal guardians can open Trump Accounts for eligible children by making the election on IRS Form 4547 when filing taxes or by completing the form electronically on the trumpaccounts.gov website.

Trump account contribution limits

Parents, other adults, and employers can contribute up to a combined total of $5,000 per year per child to a Trump account, for 2026 and 2027. The contribution limit does not include the initial government seed contribution, if eligible, or any philanthropic contributions. Contribution limits may change in the future, as they will be subject to cost-of-living adjustments for future tax years.4

Individual contributions can be made on an after-tax basis or as a pre-tax payroll deduction, if offered by the employer. Employer-funded contributions (if available) are capped at $2,500 per year per employee. If an employee has multiple children, the employer may split the contribution among children.5

For example, Jane has two children — a baby born in January 2026 and a five-year-old. Jane opens two individual Trump accounts for her children. The baby is eligible for the government seed contribution of $1,000. Jane’s employer contributes $1,250 to each child’s account, for a total of $2,500. Jane can then contribute $3,750 to each of her child’s accounts before hitting the contribution limit of $5,000.

| Baby | Child |

Government contribution | $1,000 | Ineligible |

Employer contribution | $1,250 | $1,250 |

Jane’s contribution | $3,750 | $3,750 |

Total contributions for 2026 | $6,000 | $5,000 |

What investments are available in a Trump account?

Funds will be invested in a diversified portfolio of low-cost index funds designed to maximize long-term growth while minimizing risk.6 The investments will not use borrowed money, and annual fees and expenses are capped at 0.1% of the balance of the investment or less.

Trump accounts vs. 529s vs. custodial accounts

A key question for many parents is how Trump accounts differ from other custodial or tax-advantaged savings accounts for children, and why you might choose to open one instead of (or in addition to) another type of account. The table below summarizes the key differences and similarities between Trump accounts, 529 plans, and Uniform Gifts to Minors Act (UGMA) or Uniform Transfers to Minors Act (UTMA) accounts.

Feature | Trump accounts | 529 plan | Custodial accounts (UGMA/UTMA) |

Primary purpose | Broad long-term savings for a child (education, home, business, investing). | Education-specific savings (college and qualified K–12 expenses). | General-purpose savings and investing for a minor. |

Who owns the account | Child is the legal owner; account follows federal program rules. | Parent or adult owns the account; child is the beneficiary. | Child owns the account; adult manages it as custodian until adulthood. |

Tax treatment of any growth | Tax-advantaged growth potential under program rules; withdrawals subject to conditions. | Any earnings grow tax-free, and withdrawals are not taxed when used for qualified education expenses. | Investment income is taxable (often under kiddie-tax rules). |

Contribution limits | Federal seed money for eligible children; additional contributions subject to program limits. | High lifetime limits set by each state; gift-tax rules apply. | No formal contribution limits beyond gift-tax rules. |

Investment options | Limited menu of low-cost, broad index funds. | Options vary by state plan; typically age-based portfolios and mutual funds/ETFs. | Wide range of investments, depending on the custodian and brokerage. |

When funds can be accessed | Generally available to the child at retirement, with limits on early withdrawals. | Withdraw anytime for qualified education expenses; taxes penalties for non-qualified use. Up to $35K of unused funds can be rolled into the beneficiary’s Roth IRA, subject to annual contribution limits. | Child gains full control at age 18–21, depending on state law. |

Free Application for Federal Student Aid (FAFSA) impact | Similar to IRA accounts, balances do not impact FAFSA calculations, though distributions do | Varies by ownership: Grandparent-owned 529s do not impact FAFSA. Parent-owned 529 assessed at a max of 5.64% of value towards Student Aid Index (SAI). Student owned 529 assessed at a max of 20% of value towards SAI. | UGMA/UTMA show up as student owned and reduce financial aid eligibility by up to 20% of the account’s value annually for SAI. E.g. a $5000 UTMA can reduce aid by $1000. |

When can you take withdrawals from a Trump account?

Withdrawals from a Trump account are restricted until the child turns 18, except for:

- Qualified rollover contributions

- Qualified ABLE rollover contributions*

- Distributions of excess contributions

- Distributions upon death of the account beneficiary

The beneficiary can take withdrawals from January 1st in the year that they turn 18, however distributions are generally subject to the same rules as traditional IRAs. Withdrawals before age 59½ are generally subject to income tax and a 10% penalty unless they meet certain exceptions.7

Trump account tax implications

How Trump account contributions are taxed upon withdrawal depends on how they were contributed in the first place:

- Government contribution: The initial $1,000 contribution for eligible children will be taxable when withdrawn.

- Individual contributions: After-tax contributions made by the child’s parents or another adult are not taxable when withdrawn.

- Employee deferrals: Pre-tax contributions made by the child’s parents through their employer’s payroll are taxable when withdrawn.

- Employer-funded contributions: If available, contributions from a parent’s employer are made on a pre-tax basis and are taxable when withdrawn.

All earnings are taxable when withdrawn. Here’s how Trump account taxes could look in practice:

Tax treatment of a Trump account withdrawal

Assuming the account owner waits until age 62 before withdrawing funds, the table below shows how different types of contributions would be taxed.

Source of funds | Taxable? |

Government seed contribution | Yes |

Employer contributions (pre-tax) | Yes |

Parent pre-tax contributions | Yes |

Parent after-tax contributions | No |

Investment earnings | Yes |

Amounts marked as taxable are generally taxed as ordinary income at the account owner’s tax rate at the time of withdrawal.

What happens once the child turns 18?

When the child turns 18, they have a few options. First, they may choose to leave the money in the Trump account which will become subject to general IRA rules.8 Alternatively, they could roll over some or all of the balance to another retirement account, such as a traditional IRA or another eligible retirement account. Finally, they could consider a Roth conversion to a Roth IRA or Roth 401(k). Consider all your options, including taxes, fees and expenses, before moving money between accounts. Assess all benefits of current accounts before moving money.

Read more: A comprehensive guide to Roth conversions

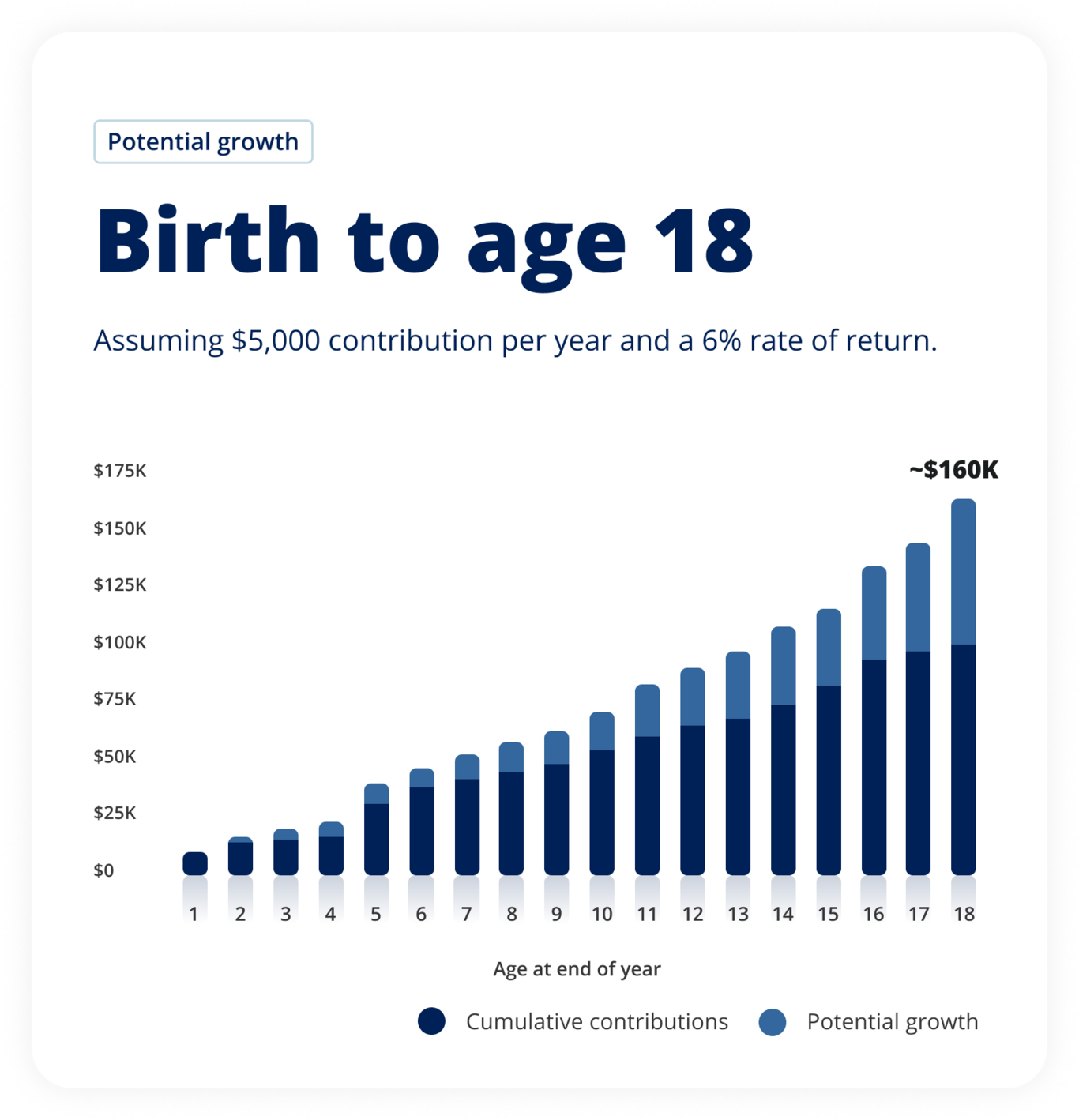

Potential growth by age 18

If a child receives a $1,000 government contribution at birth and $5,000 is added each year for 18 years, the account could potentially grow to about $160,000 by age 18, assuming a 6% annual return.

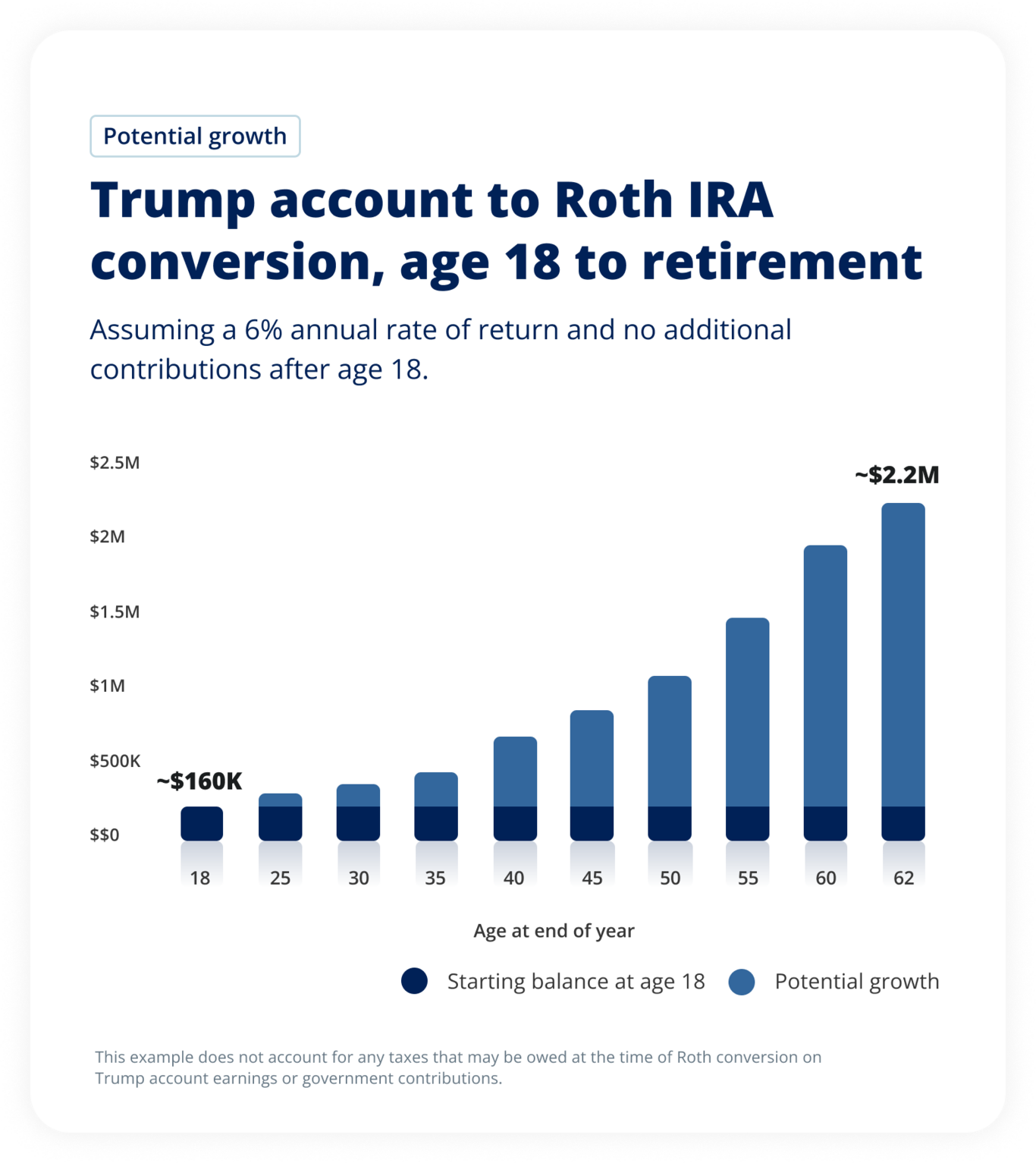

Potential growth by retirement

Trump accounts are designed as a long-term savings vehicle. If the child keeps the money invested after age 18 — either in the Trump account or after rolling it into another retirement account — the funds can continue to potentially grow for decades.

One possible strategy is to convert the account to a Roth IRA at age 18. Whether a Roth conversion is appropriate depends on individual circumstances and tax considerations.

- A parent contributes $5,000 for their newborn and is eligible to receive the $1,000 government contribution.

- The parent contributes $5,000 in after-tax contributions per year for the next 17 years ($85,000).

- By age 18, assuming 6% annual growth, compounding monthly, the account grows to roughly $160,000, including about $69,000 in investment growth.

- The parent’s after-tax contributions (totaling $91,000) can be converted to a Roth IRA tax-free; the $67,000 in growth and the government seed contribution would be taxed at the child’s marginal rate at the time of conversion.

- If the Roth account then grows at 6% annually until age 62, the balance could reach around $2.2 million, tax-free.

For illustrative purposes only. Actual results will vary. This hypothetical example assumes a consistent 6% annual return, does not reflect market volatility, and does not account for inflation. Investment returns are not guaranteed and may be higher or lower.

Get financially happy

Put your money to work for life and play

* Certain rollovers to an ABLE account may be permitted, subject to IRS limits and requirements. Individuals should consult a qualified tax advisor regarding their specific situation.

1 IRS, “Notice of intent to issue regulations with respect to section 530A Trump accounts,” December 2025.

2 Trumpaccounts.gov, “Trump Accounts jumpstart the American Dream,” February 2026.

3 IRS, “Notice of intent to issue regulations with respect to section 530A Trump accounts,” December 2025.

4 Ibid.

5 Ibid.

6 Ibid.

7 IRS, “Retirement topics - Exceptions to tax on early distributions,” December 2025.

8 IRS, “Notice of intent to issue regulations with respect to section 530A Trump accounts,” December 2025.

RO5205516-0226 RO5237110-0326

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. No part of this blog, nor the links contained therein is a solicitation or offer to sell securities. Compensation for freelance contributions not to exceed $1,250. Third-party data is obtained from sources believed to be reliable; however, Empower cannot guarantee the accuracy, timeliness, completeness or fitness of this data for any particular purpose. Third-party links are provided solely as a convenience and do not imply an affiliation, endorsement or approval by Empower of the contents on such third-party websites. This article is based on current events, research, and developments at the time of publication, which may change over time.

Certain sections of this blog may contain forward-looking statements that are based on our reasonable expectations, estimates, projections and assumptions. Past performance is not a guarantee of future return, nor is it indicative of future performance. Investing involves risk. The value of your investment will fluctuate and you may lose money.

Certified Financial Planner Board of Standards Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design), and CFP® (with flame design) in the U.S., which it authorizes use of by individuals who successfully complete CFP Board's initial and ongoing certification requirements.