The rise of the “wealth multitasker”

The rise of the “wealth multitasker”

Americans are blending multiple wealth strategies, taking an active and diverse approach to achieving financial success.

Americans are blending multiple wealth strategies, taking an active and diverse approach to achieving financial success.

Americans see multiple paths to wealth — with investing (26%), career advancement (25%), and retirement savings (24%) all ranking nearly equally, according to new Empower research. And while 24% of Americans worry they're starting too late to build real wealth, nearly 30% feel optimistic about reaching financial milestones in their lifetime.

Key takeaways

- 40% say they're building wealth now in order to save for a comfortable retirement and close to a third say a top motivation is to achieve early financial independence (31%).

- Close to 1 in 5 say they actively spread their efforts across multiple wealth-building strategies.

- Half (46%) believe rising costs and inflation will have the most significant impact on their wealth-building in the year ahead.

- Americans see multiple paths to wealth like investing (26%), career advancement (25%), and retirement savings (24%).

- Nearly 30% of Americans feel optimistic about reaching financial milestones in their lifetime.

- More than a quarter say the secret to building wealth is sticking to a financial plan (26%) and seeking financial guidance and knowledge (23%).

Americans balance multiple wealth-building strategies

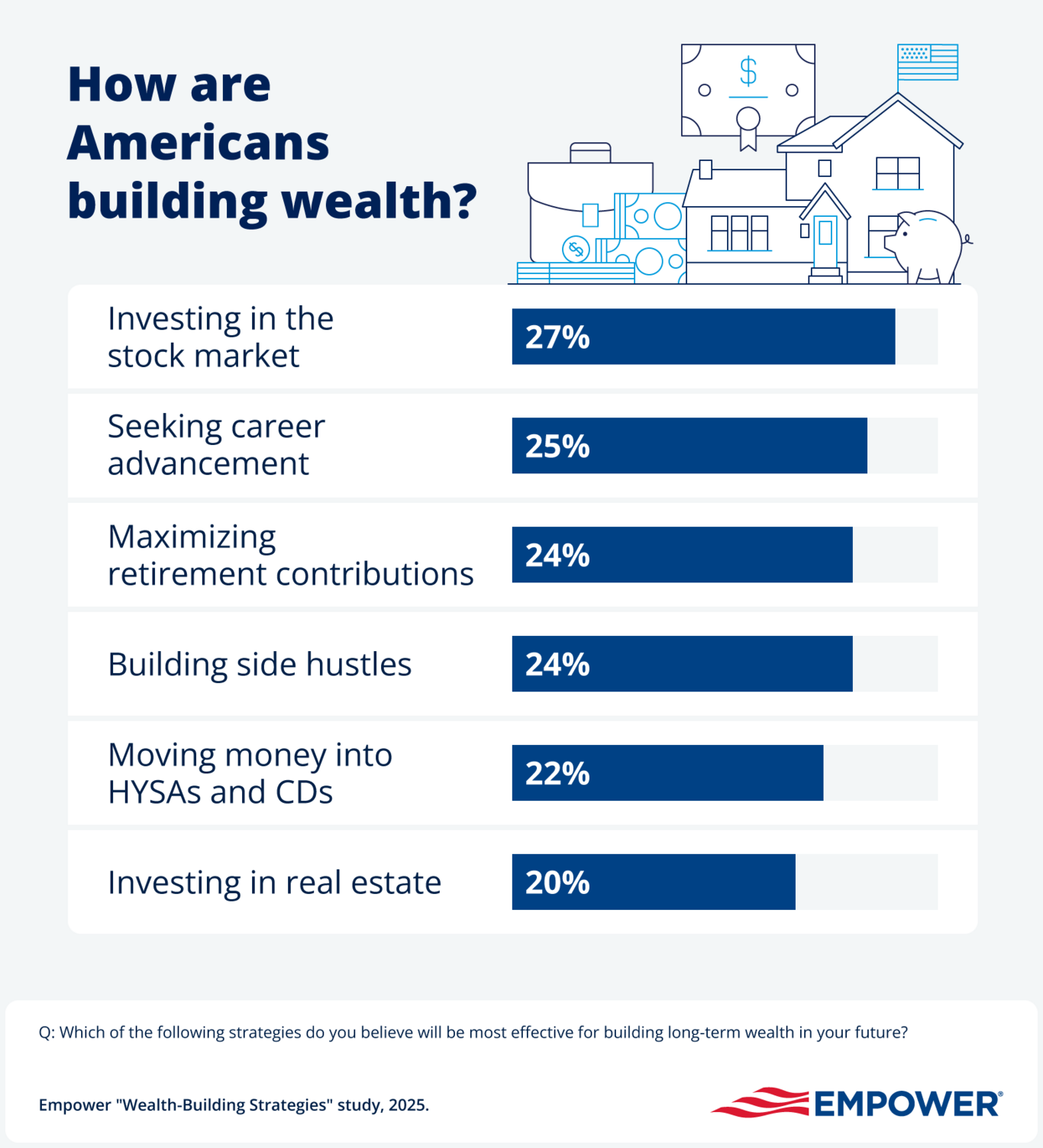

Overall, Americans view the top pathways to long-term wealth building as a combination of retirement savings (24%), investing (27%) and career advancement (25%).

Others prioritize moving money into high-yield savings accounts and CDs (22%) or investing in real estate (20%), showing the breadth of Americans' approaches to financial growth.

In the last five years, 15% say they've actively started diversifying across a range of wealth-building strategies. For some, this means pivoting from saving to strategic investing (18%), while others are opting to pay off debts before they think about growing their portfolios (22%).

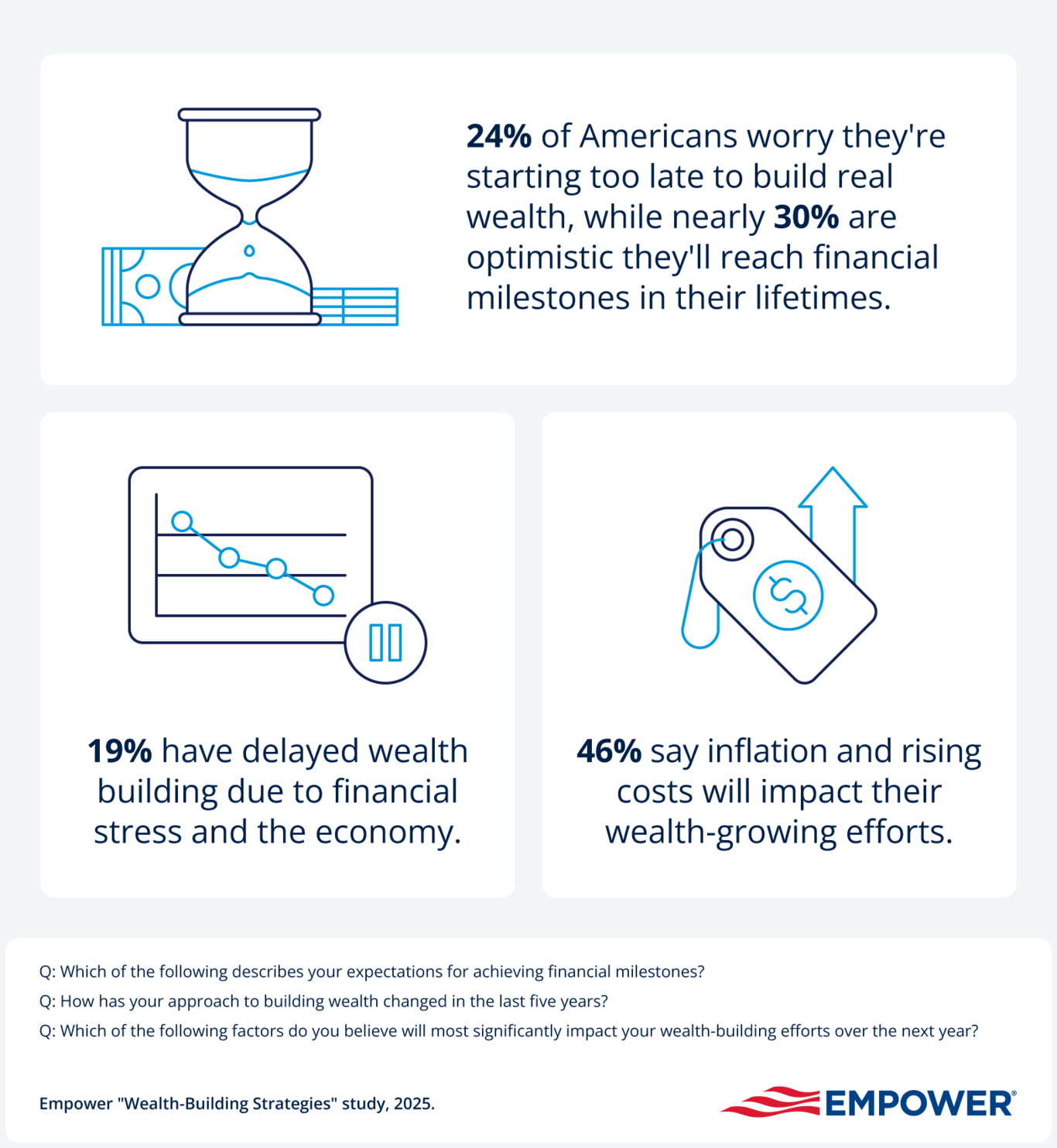

One in 5 say they've become more conservative about financial growth due to market volatility over the past five years. And looking to the future, half of Americans (46%) believe rising costs and inflation will have the most significant impact on their wealth-building efforts in the year ahead.

But while 24% of Americans worry they're starting too late to build real wealth, nearly 30% feel optimistic about reaching financial milestones in their lifetimes.

Discipline is a top factor for wealth growth

For Americans, discipline and consistency (32%) are important factors for building wealth, over earning power (21%), luck (15%), and family support (12%).

But there's more than one way to succeed: Other core factors for growth include living within your means (28%), sticking to a financial plan (26%), seeking financial guidance and knowledge (23%) and making smart investments (24%). Nearly a quarter believe that a positive mindset (23%) is as important as earning a high income (21%) when it comes to building wealth effectively.

Together, these factors show that Americans value diverse, proactive approaches to growth instead of waiting on a windfall. Even as the "Great Wealth Transfer" looms, only 15% expect to receive a significant inheritance that helps them reach their financial goals.

Saving for a comfortable retirement

Just under 40% say they're building wealth now in order to save for a comfortable retirement, and close to a third (31%) say a top motivation is to achieve early financial independence.

One in 3 prefer to enjoy their money today instead of setting it aside for the future (30%). This number is even higher for Gen Z, 37% of whom would rather spend their money now and focus on building lasting wealth later.

Diving deeper into retirement, people have split expectations: 24% expect to retire early, while 25% plan to continue working past 65 — a reminder that wealth-building timelines can vary.

Expectations aside, Americans agree that success today hinges less on picking the perfect strategy and more on discipline, diversification, and taking the long view.

Additional findings:

- Slow and steady: Young Americans are more likely to take a conservative approach to wealth building than their parents (30% of Gen Z vs. 10% of Gen X).

- Set it and forget it: Over 15% of Americans want to go hands-off and build wealth through automated investing.

- Playing catch-up: Over 1 in 4 Americans (26%) feel they're financially behind compared to previous generations.

- No pressure: Only 13% of Americans say they feel pressured to keep up with peers' wealth-building efforts.

Methodology:

Empower's "Wealth-Building Strategies" study is based on online survey responses from 1,223 Americans ages 18+ on July 16, 2025.

Get financially happy

Put your money to work for life and play

RO4737311-0825

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. No part of this blog, nor the links contained therein is a solicitation or offer to sell securities. Compensation for freelance contributions not to exceed $1,250. Third-party data is obtained from sources believed to be reliable; however, Empower cannot guarantee the accuracy, timeliness, completeness or fitness of this data for any particular purpose. Third-party links are provided solely as a convenience and do not imply an affiliation, endorsement or approval by Empower of the contents on such third-party websites. This article is based on current events, research, and developments at the time of publication, which may change over time.

Certain sections of this blog may contain forward-looking statements that are based on our reasonable expectations, estimates, projections and assumptions. Past performance is not a guarantee of future return, nor is it indicative of future performance. Investing involves risk. The value of your investment will fluctuate and you may lose money.

Certified Financial Planner Board of Standards Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design), and CFP® (with flame design) in the U.S., which it authorizes use of by individuals who successfully complete CFP Board's initial and ongoing certification requirements.