The Safety Net: Americans have $500 in emergency savings

The Safety Net: Americans have $500 in emergency savings

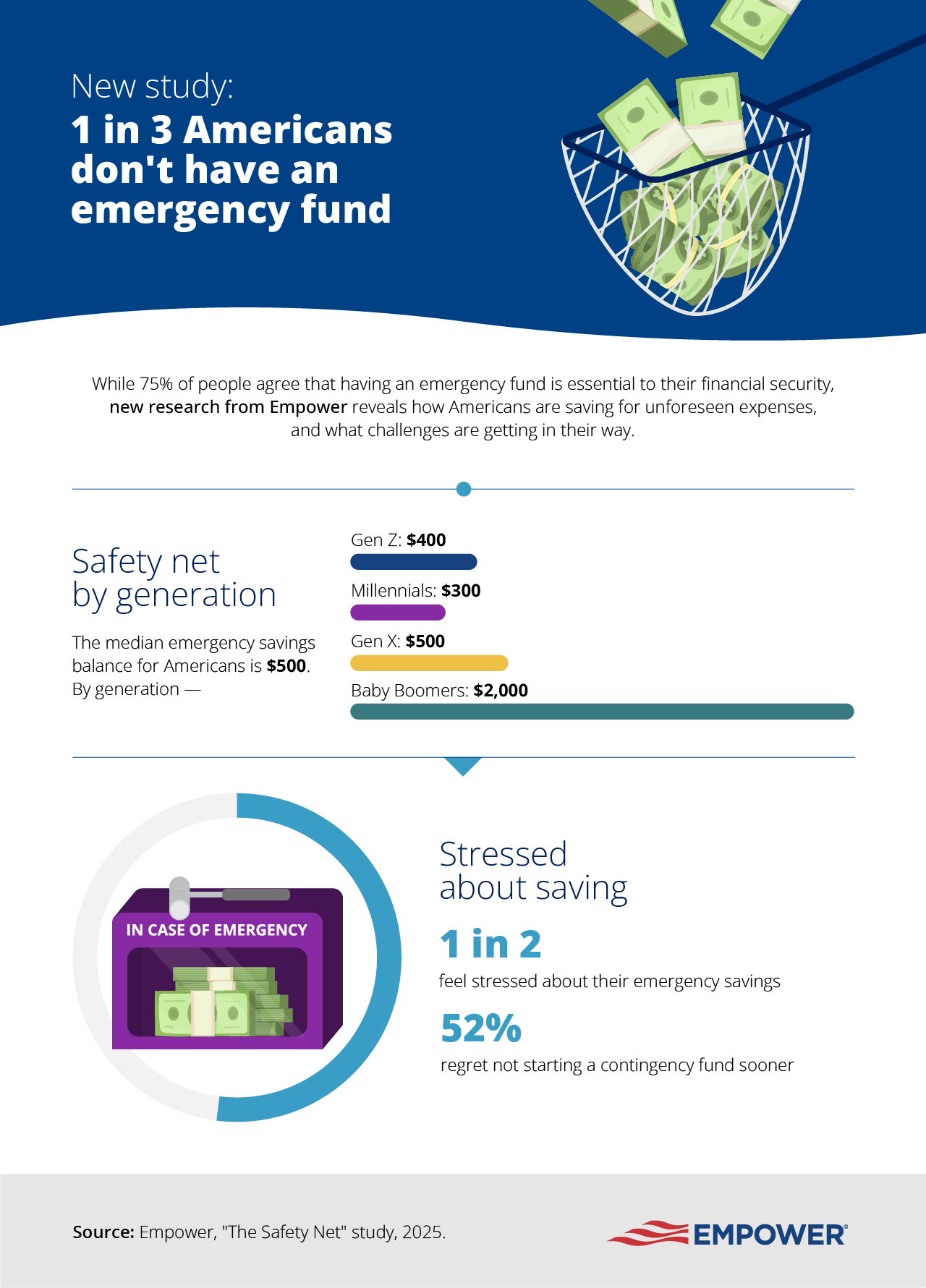

1 in 3 Americans have no emergency savings fund and 29% say they can’t afford an unexpected expense over $400.

1 in 3 Americans have no emergency savings fund and 29% say they can’t afford an unexpected expense over $400.

The median emergency savings for Americans is $500. The size of the safety net varies by generation, with Boomers saving a median of $2,000 – five times that of Gen Z’s reserves of $400. One third of Americans (32%) don’t have an emergency savings fund and 29% say they can’t afford an unexpected expense over $400, according to new Empower research.

Half of Americans admit they’re stressed about their current level of emergency savings (50%) and recognize the importance of a safety net. Some 75% of Americans agree emergency savings are essential for financial security and 64% say it’s a financial priority for them.

Key takeaways

- 1 in 3 (32%) of Americans have no emergency savings set aside.

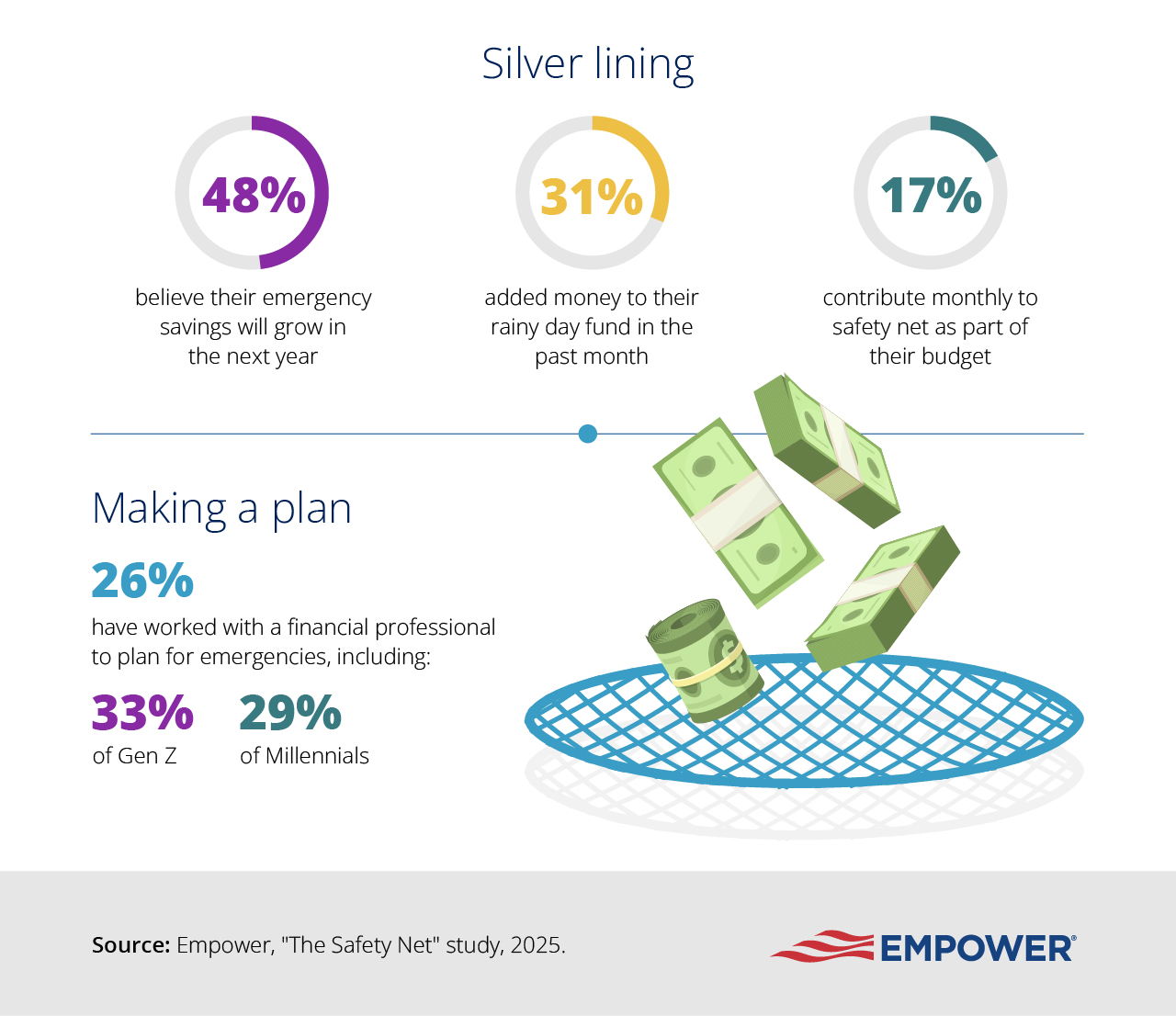

- 64% of Americans say building emergency savings is a top financial priority and one third (31%) have contributed to their emergency fund in the past month.

- Half of Americans admit they’re stressed about their current level of emergency savings (50%).

- 42% say their current savings wouldn’t help if they lost their job today.

- Half (48%) believe their emergency savings will grow in the next year.

- Over 1 in 2 (52%) regret not starting an emergency fund sooner.

- 39% say rising prices are the biggest roadblock to saving for a rainy day.

Emergency savings are top of mind

The majority of Americans (64%) say growing their emergency savings is a financial priority right now—even if they’re still finding their financial footing. So where do things stand?

The median emergency savings balance for Americans:

- Overall: $500

- Gen Z: $400

- Millennials: $300

- Gen X: $500

- Boomers: $2,000

A third (30%) do not believe they could handle unexpected expenses that could arise in the year ahead. Close to 1 in 5 Americans say their savings would cover less than a month of expenses (18%).

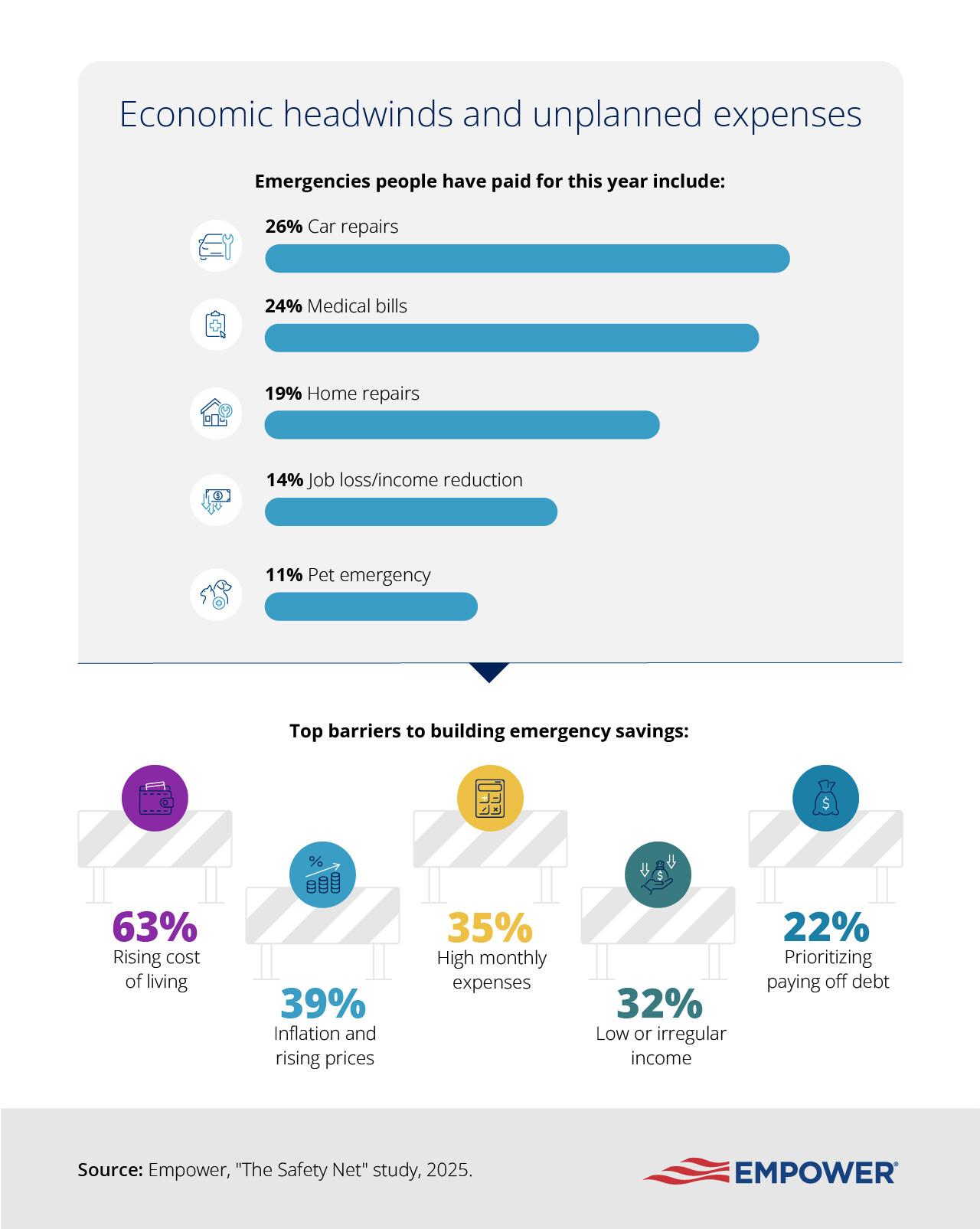

The majority (63%) say the rising cost of living has made it harder to build or maintain emergency savings, and 35% say the economy and tariffs have caused them to increase their contributions. More than half (58%) say saving for emergencies feels “almost impossible” with how expensive everything is right now.

In the past year, many have faced unplanned financial events including:

- Car repairs (26%)

- Medical bills (24%)

- Home repairs (19%)

- Job loss or income reduction (14%)

- Pet emergency (11%)

Nearly two-thirds (64%) of Americans say emergency savings are a financial priority for them in 2025. Some 17% contribute to their fund monthly as part of their budget, 31% say they’ve added to their savings in the past month.

Stress meets strategy

Most take a “better safe than sorry” approach to emergency savings and want to put away as much as possible (39%), with half (52%) wishing they had started saving sooner. Close to 1 in 5 are more modest, saving up “just enough to sleep at night” (17%), while 13% are opportunity cost conscious – they balance emergency savings with other investments.

But the study reveals awareness and momentum: Nearly half (48%) believe their emergency savings will grow over the next year:

- 20% add to their fund sporadically when they have extra money

- 12% have set up automatic monthly contributions

What gets in the way?

Nearly a quarter (23%) say they maintain the same emergency savings approach regardless of economic conditions, though Americans cite several common roadblocks to saving for a rainy day:

- 39% say inflation and rising prices are the top barrier

- 35% point to high monthly expenses

- 32% say their income is too low or irregular

- 22% prioritize paying off debt first

Close to half (46%) say their emergency savings account has less money compared to a year ago and more than 2 in 5 (42%) say their savings wouldn’t help them if they lost their job today. Some 40% say they can count on their family to help if something goes wrong financially.

Where do Americans keep their safety nets?

Around 37% of Americans store their emergency saving fund in a regular savings account. A quarter use a checking account (23%). Nearly 1 in 5 keep emergency cash at home (19%) —a figure that rises to 27% among Gen Z.

Only 16% have set a specific goal of saving six months of expenses. But the lack of a precise number isn’t stopping people from trying. In fact, 41% don’t have a target at all—but they’re putting away money as they go.

Generational check-in

- Gen Z: 25% say they don’t have emergency savings yet, but a notable 33% have worked with a financial professional to help them get started.

- Millennials: Nearly 3 in 10 have consulted an advisor about emergency savings, and they’re increasingly focused on building long-term security.

- Gen X: The most likely generation to say they couldn’t afford an unexpected $400 expense (35%).

- Boomers: Feel they could handle an emergency expense over $10,000.

A roadmap for resilience

When asked what would make the biggest difference in their ability to save more, respondents pointed to:

- Higher income (48%)

- Lower monthly expenses (37%)

- Lower inflation or more stable prices (36%)

- Ability to pay off debt first (27%)

- Better tools and smarter automation (9%)

Safety net snapshot

Americans are expecting the unexpected, and many are seeking advice: More than 1 in 4 people (26%) have worked with a financial professional to plan for emergencies, including 33% of Gen Zers and 29% of Millennials.

Methodology:

Empower’s “The Safety Net” study is based on online survey responses from 2,202 Americans ages 18+ from June 3-5, 2025. The survey is weighted to be nationally representative of U.S. adults.

Get financially happy

Put your money to work for life and play

RO4715749-0825

RO4770647-0825

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. No part of this blog, nor the links contained therein is a solicitation or offer to sell securities. Compensation for freelance contributions not to exceed $1,250. Third-party data is obtained from sources believed to be reliable; however, Empower cannot guarantee the accuracy, timeliness, completeness or fitness of this data for any particular purpose. Third-party links are provided solely as a convenience and do not imply an affiliation, endorsement or approval by Empower of the contents on such third-party websites. This article is based on current events, research, and developments at the time of publication, which may change over time.

Certain sections of this blog may contain forward-looking statements that are based on our reasonable expectations, estimates, projections and assumptions. Past performance is not a guarantee of future return, nor is it indicative of future performance. Investing involves risk. The value of your investment will fluctuate and you may lose money.

Certified Financial Planner Board of Standards Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design), and CFP® (with flame design) in the U.S., which it authorizes use of by individuals who successfully complete CFP Board's initial and ongoing certification requirements.