Taft-Hartley Defined Contribution Study 2025

Helping members pursue a more secure retirement

Third Edition

Taft-Hartley Defined Contribution Study 2025

Helping members pursue a more secure retirement

Third Edition

A critical pillar of the U.S. retirement system, Taft-Hartley plans represent a unique collaboration between labor unions and employers and reflect a powerful mode of collective bargaining and partnership.

A defining characteristic of these multiemployer benefit funds is their ability to serve workers in industries marked by employment mobility, such as construction, trucking, and trade unions. Workers in such industries often move between multiple employers throughout their careers, making traditional single-employer retirement plans less efficient for them — and the portability of Taft-Hartley plans a potentially attractive benefits model for an increasingly mobile American workforce.

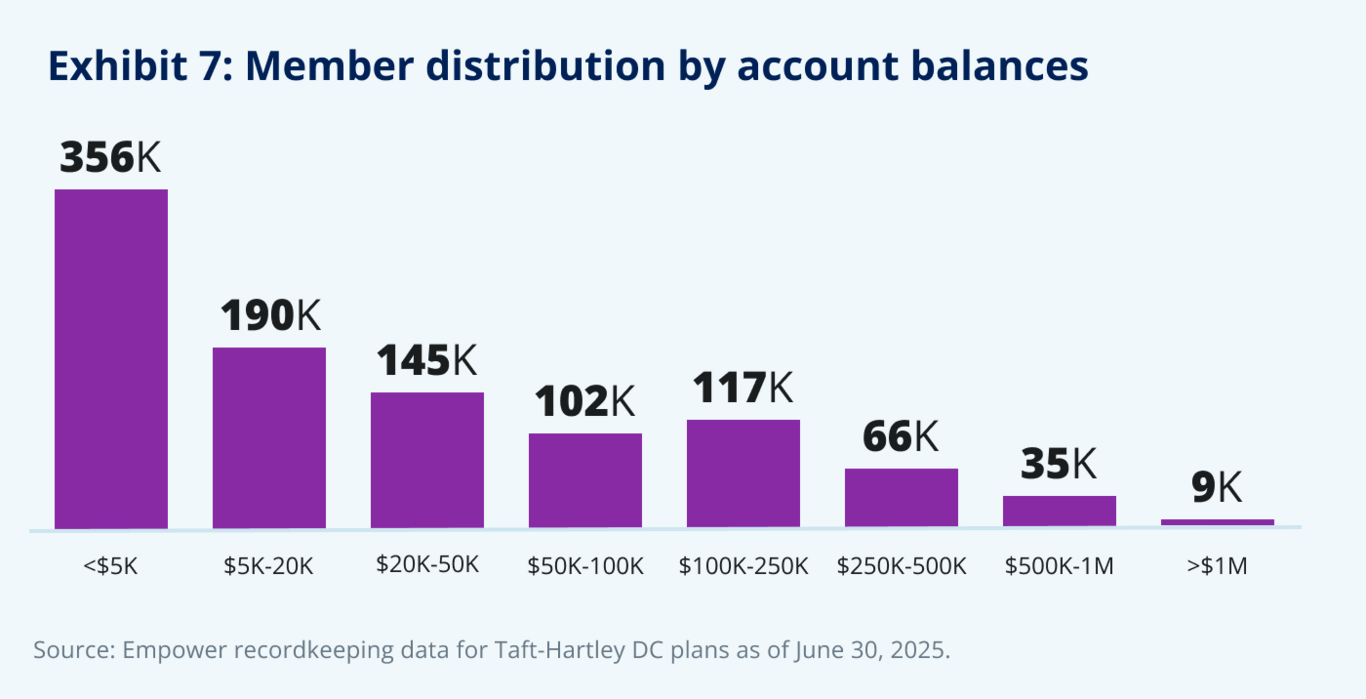

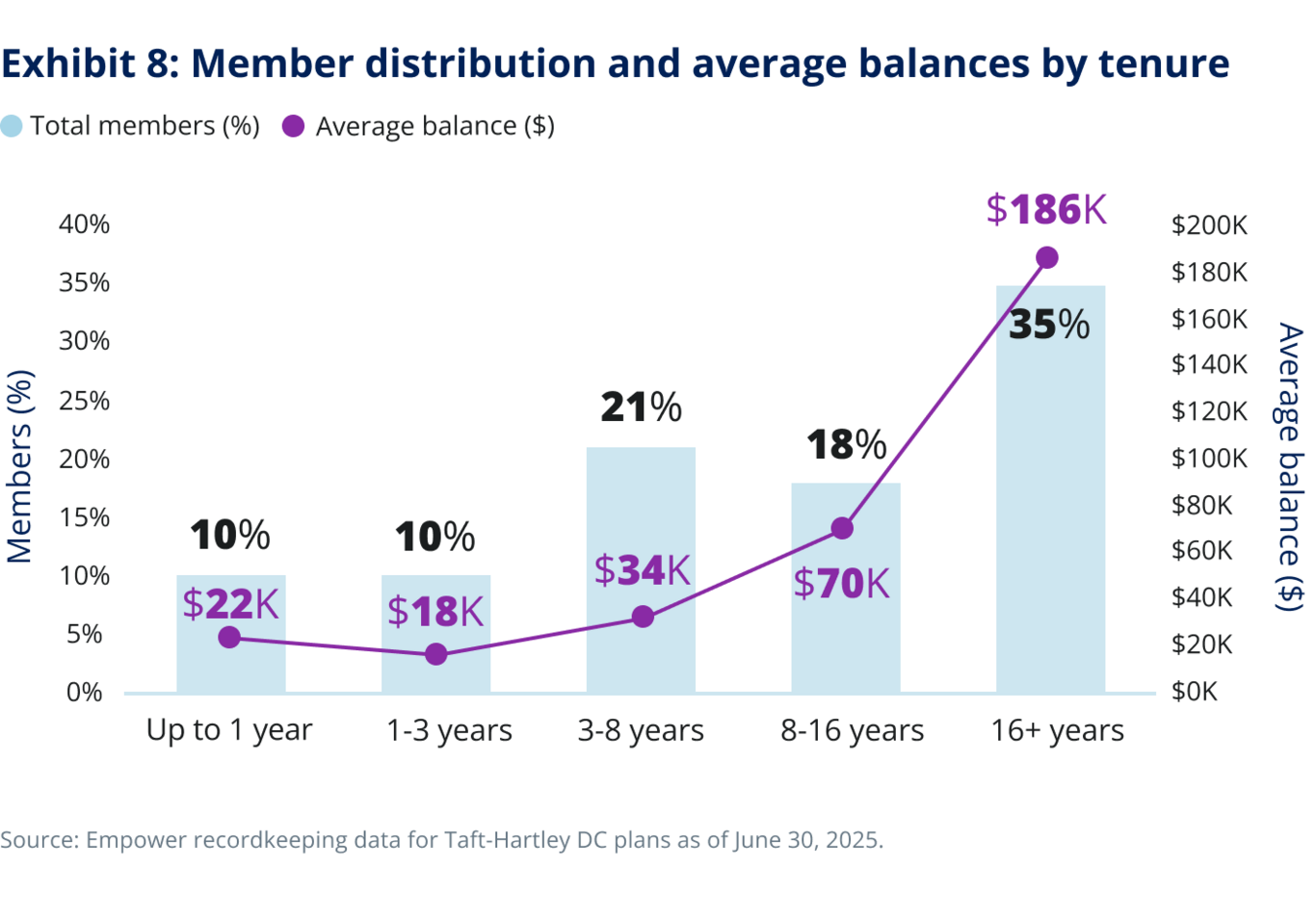

Empower’s proprietary analysis shows that Taft-Hartley multiemployer defined contribution (DC) plans under its administration continued to expand and modernize in 2025, with robust growth in both participation and assets. Long-tenured members are building meaningful nest eggs to supplement their traditional pensions. For example, members with 16+ years in their plan have an average balance around $187,000 while a significant and growing cohort have accumulated substantial savings (22% now have balances above $100,000). Notably, the number of “Taft-Hartley millionaires” (members with over $1 million in their account) grew by 31% to roughly 9,300 individuals.

According to Empower’s proprietary survey of ~1,000 union members conducted in tandem with our plan-level analysis in 2025, financial health and personal well-being are tightly linked for virtually everyone (~94%). And while 57% feel comfortable managing their current financial situation, a sizable number (35%) report concerns or struggles (26% and 9%, respectively), signaling that material financial stress exists below the headline number. Also, while ~71% say they are confident they will be financially prepared for retirement, 12% explicitly are not confident, and 16% remain neutral. Members clearly express a positive outlook overall, but great opportunity for improved outcomes persists.

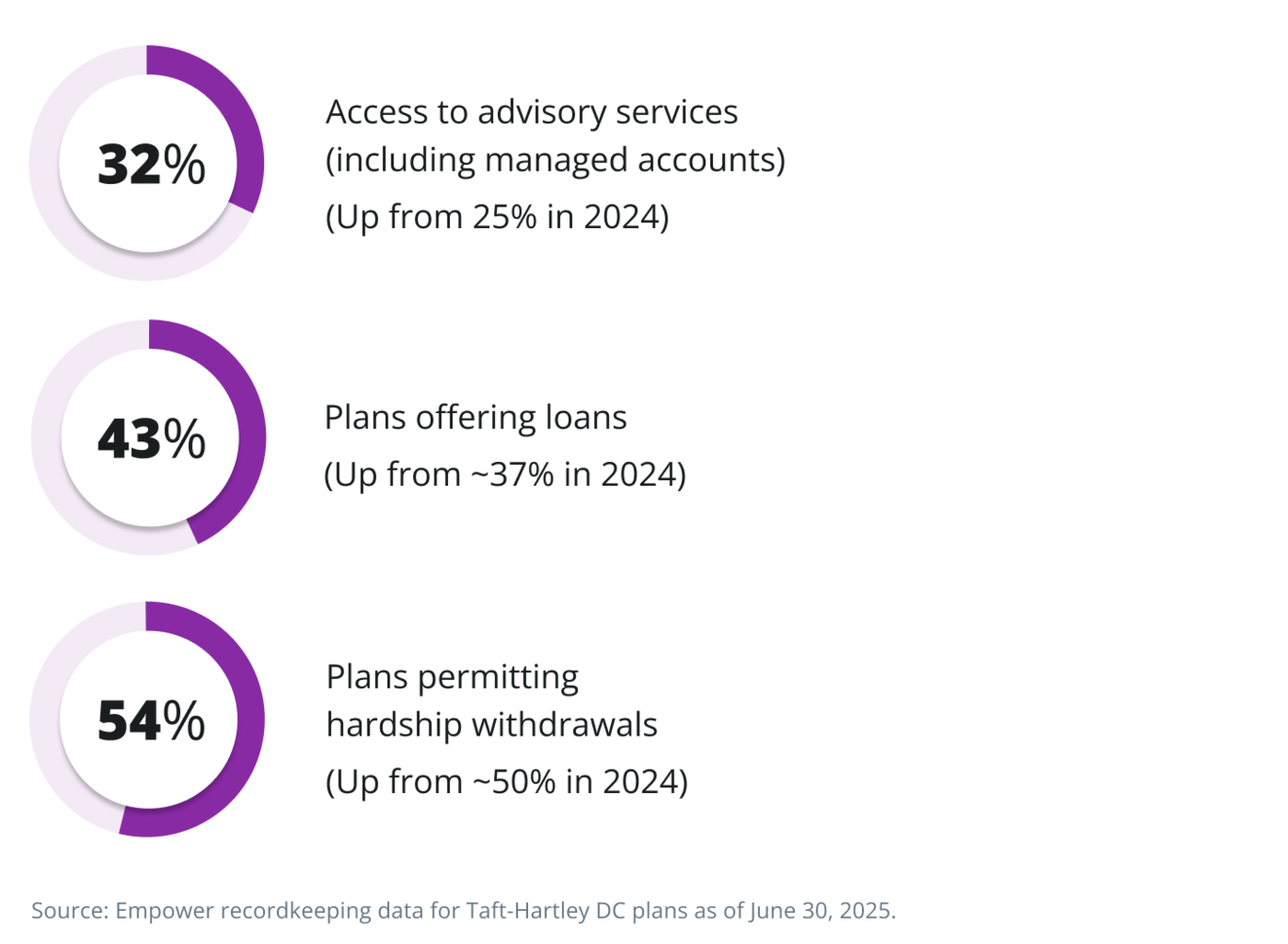

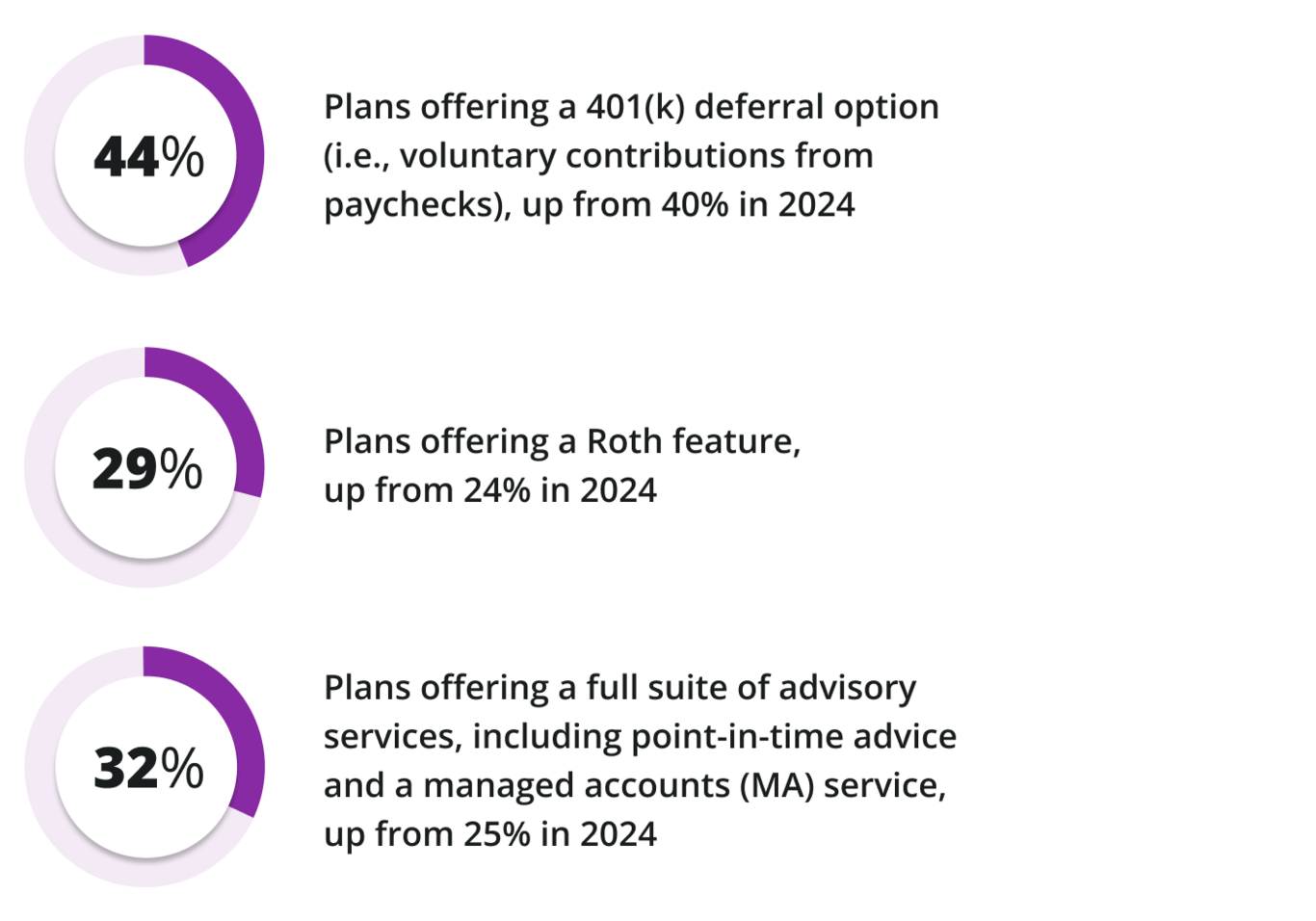

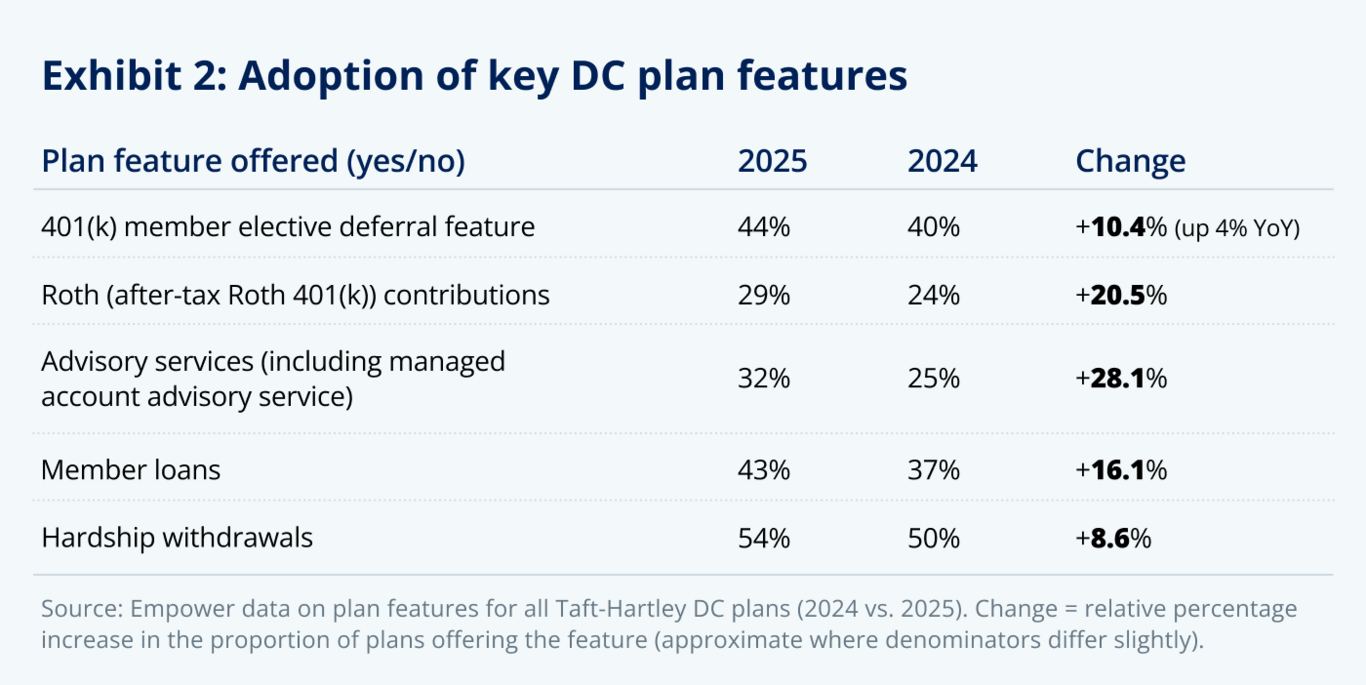

In tandem with asset growth, Taft-Hartley plan design features are evolving to offer more flexible, member-directed options. As of mid-2025, 44% of plans include a 401(k) salary-deferral feature (up from 40% in 2024) — allowing members to contribute their own income in addition to negotiated employer contributions. Nearly 30% of plans now offer Roth contributions (up from 24% a year ago), and a few even allow traditional after-tax contributions. The trend is clearly toward expanding Roth availability.

The pace of plan modernization is also accelerating, perhaps faster than the rate of member uptake. Plan sponsors are adding a range of features that aims to balance long-term savings growth with members’ short-term financial needs by offering controlled access to funds. Importantly, approximately half of active eligible members made contributions, taking advantage of an opportunity they clearly value.

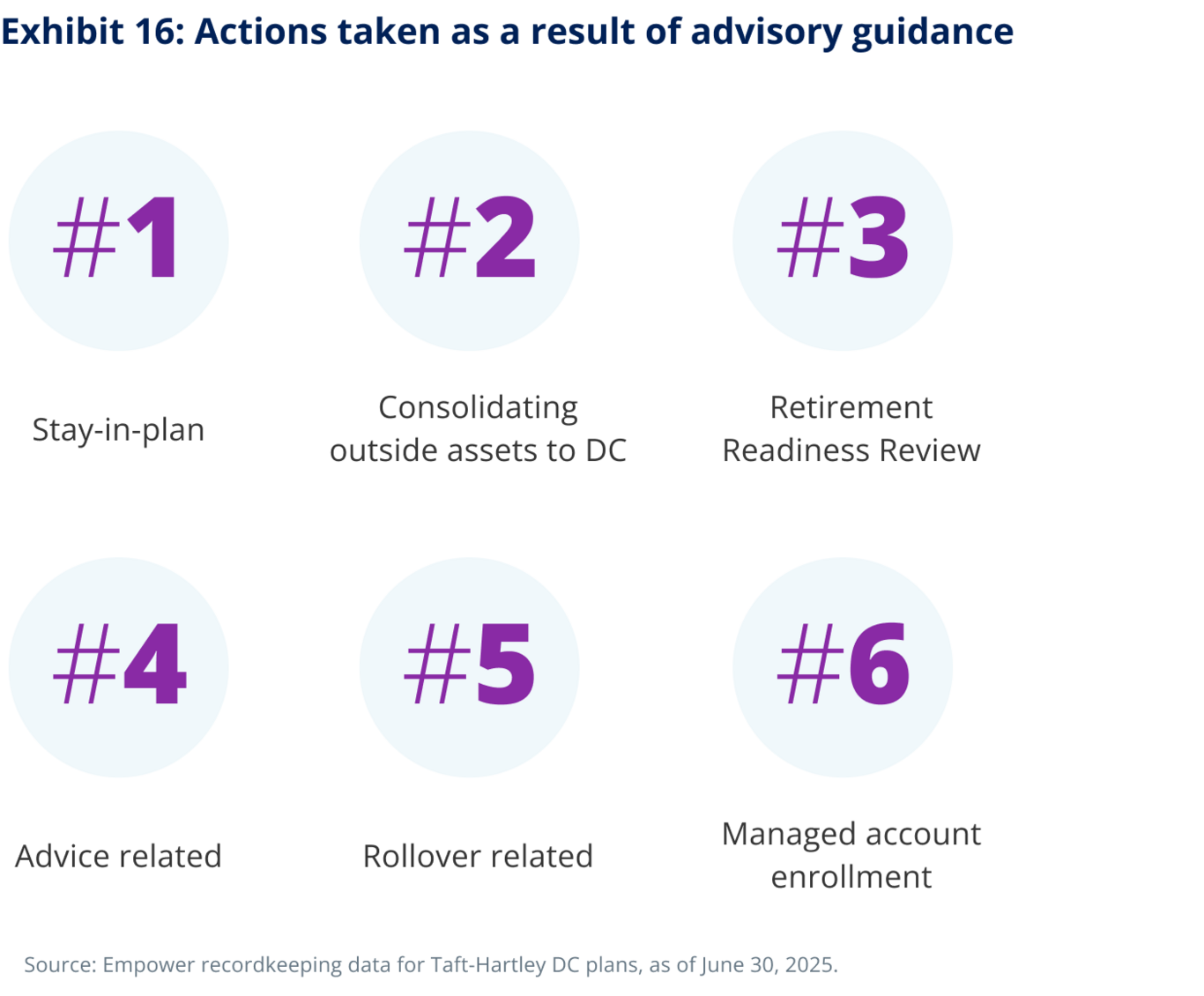

Plan stakeholders recognize the need to encourage members to take full advantage of savings opportunities. With roughly one-third of Taft-Hartley plans offering advice services and solutions, members can receive guidance through Retirement Readiness Reviews (RRRs), online tools, and on-site sessions. Data shows that when members have access to advice, it often spurs positive action. Advice and education continue to be elemental to a successful plan experience.

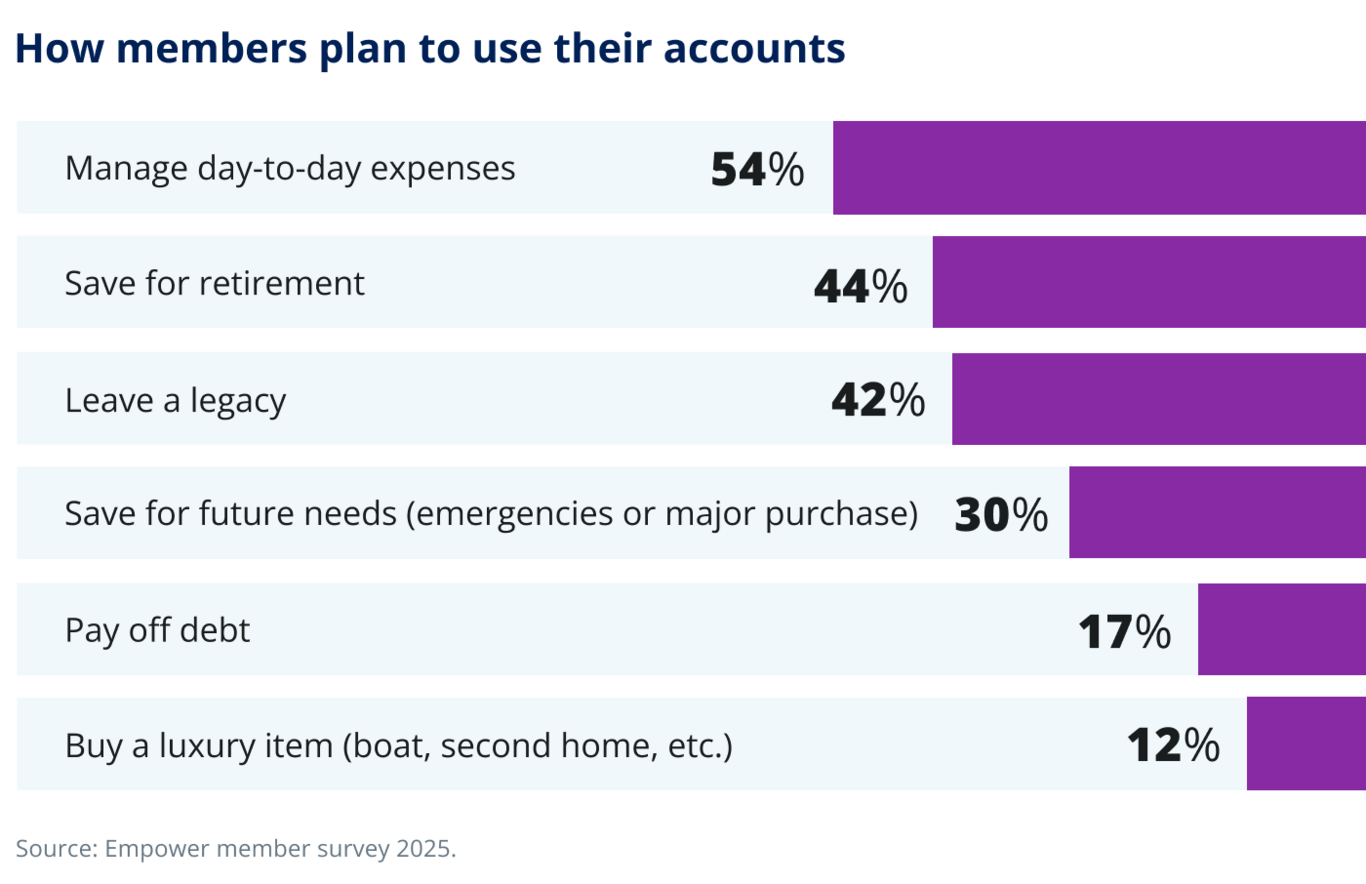

Percentages do not all add to 100% as multiple answers were permitted.

Digital engagement trends upward

As another positive, overall member digital engagement is trending upward. The vast majority (over 90%) of members who have set up online account access had logged in or performed some digital action in the prior 12-month period. Members are also increasingly “mobile-first,” with about two in three digital-active members now using the mobile app for online access.

This underscores a key theme of meeting members where they are. Many union members work on job sites and do not sit at computers, so a smartphone is often their primary internet device.

Another ongoing theme is managing “leakage” (that is, loans, withdrawals, and cash-outs) to preserve retirement assets. Even as more plans offer loans, the percentage of members taking new loans in June 2025 was modest (1.4%) and comparable to 1.2% in new member loans in June 2024. Hardship withdrawal usage was also low: Roughly 1.5% of members took a hardship distribution in the past year, and the average hardship amount ticked up slightly to ~$20,400 (from ~$19,600 the prior year).

These figures indicate that while access to emergency funds has expanded, union members use them sparingly, likely reflecting the cultural emphasis that these options are “last-resort” safety valves. Indeed, as noted in last year’s report, many union trustees remain wary of promoting loans and hardships, stressing the importance of educating members on the long-term cost of pulling money out of their plan prematurely.

As the member population has continued to age and growing numbers of members retire, assets have been leaving Taft-Hartley plans at a higher rate each year, sparking concerns from plan trustees. In what we view as a favorable aspect of this trend, members are increasingly rolling their assets over to other plans or IRAs instead of cashing their accounts out and incurring the tax consequences of such liquidation. (More than 75% of the assets that left Empower plans during this time period were rolled over to another qualified plan or IRA.)

More than 60% of the rollover assets from Taft-Hartley plans between July 1, 2024, and June 30, 2025, went to advisory services organizations (with eight of the top 10 on this list being financial advisory firms and two mutual fund companies).1 Two factors appeared to drive these rollovers:

- Members looking for advice on investments and a spend-down strategy may not have access to that in their plan today, prompting them to roll money out of the plan to other options.

- Many members believe or are being told by outside parties they have to take their money out of their plan and may be getting sales calls from advisors who encourage them to move their assets. Our survey revealed that 38% of members are unaware they can leave their balances in their plan when they separate from their union-sponsored employer.

This is a clear signal from union members that they are looking for help with their financial needs, investment advice, and retirement planning. If they are not provided with access to the advice through their retirement plan, they will seek it on their own when eligible to take a distribution from the plan.

In summary, the 2025 findings portray a Taft-Hartley DC landscape that is healthy, growing, and modernizing. |

Still, there’s room for improvement. For plan sponsors, the imperative is to build momentum by adopting features that encourage savings, delivering advice and education that drive engagement, and holistically supporting members’ financial wellness. Making in-plan advisory services available to members and encouraging Retirement Readiness Reviews (RRRs) can potentially reduce rollovers out of a plan over time.

This year’s report details findings across plan design, member demographics, engagement and digital behavior, advice and retirement readiness, and trade-specific insights, providing data-driven implications for Taft-Hartley plan sponsors and stakeholders.

About the study

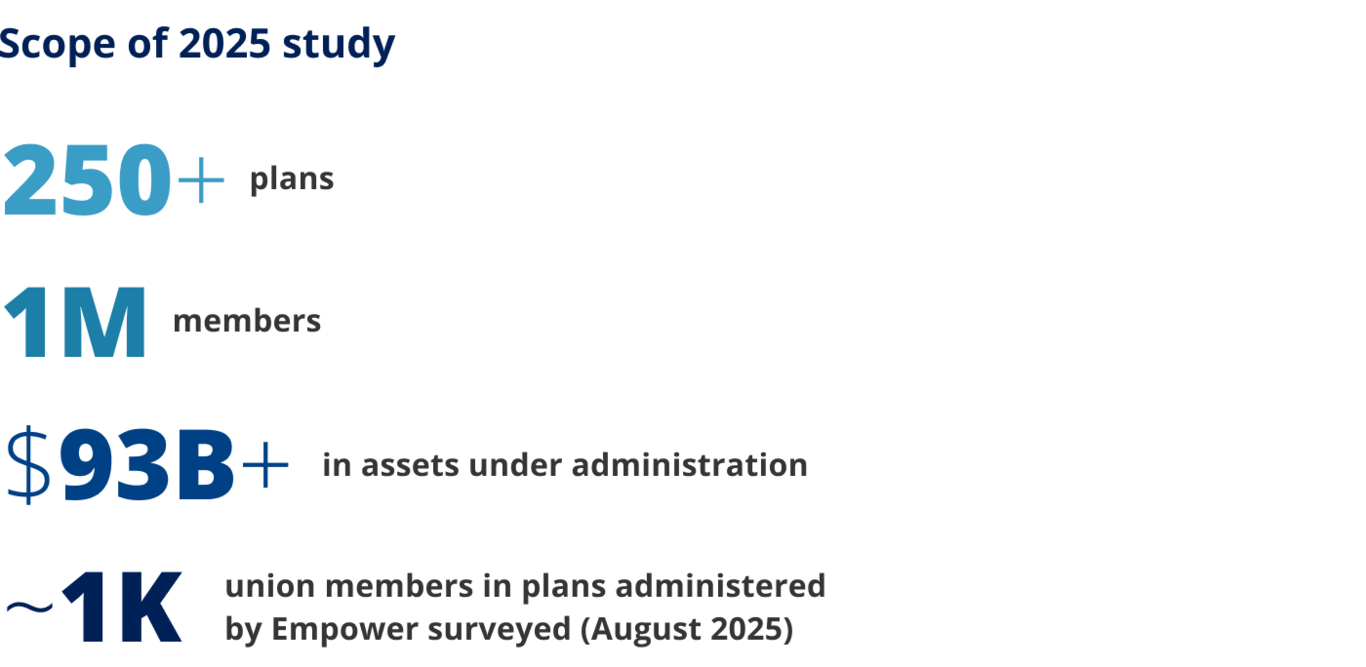

Our third annual research study offers the single most comprehensive look at the financial well-being of today’s union members and provides valuable survey insights from Taft-Hartley plan members that focuses on their financial goals, challenges, and priorities as they pursue their retirement journey. The findings are based on the following quantitative and qualitative data:

1

Empower’s Taft-Hartley defined contribution recordkeeping platform

The study tabulated results from analyzing roughly 250+ Taft-Hartley DC plans, one million members with account balances, and more than $93.1 billion in assets under administration.

2

Union member survey

Empower surveyed nearly 1,000 union members to explore and better understand the prioritized needs of union members whose retirement plans are administered by Empower.

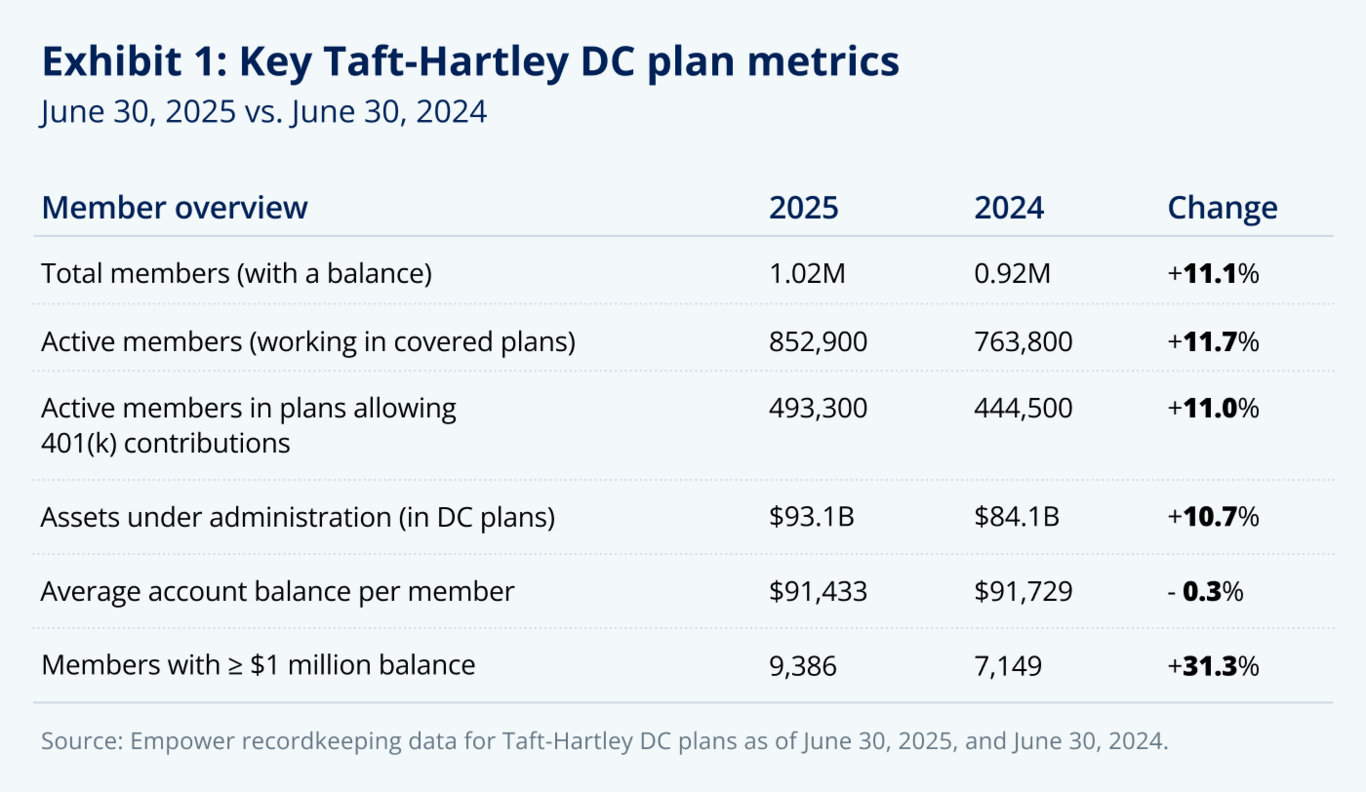

The multiemployer Taft-Hartley DC universe grew on all fronts over the past year. Member counts and assets under administration rose by roughly 11% while the average account balance held essentially steady (down a mere 0.3% despite market gains—effectively flat due to an influx of new members and start-up plans with relatively small balances). The proportion of active members held steady at 84% even as the overall member pool grew. Notably, the number of members with over $1 million jumped by 31%, reflecting both market growth and ongoing contributions at the high end (see Exhibit 1).

These figures illustrate a system that is scaling up: More union members are participating in DC plans than ever, and total assets have reached a new high. The slight dip in average balance, despite positive market returns over the year, is largely explained by demographics: The influx of new and often younger entrants with small initial balances diluted the average, as did a small number of start-up DC plans that were added to the database and new plans that selected Empower.

2025’s key stats point to healthy growth and a gradual rejuvenation of the member population. The challenge ahead is ensuring that these new members get on track with meaningful contributions and engagement early in their careers so asset growth translates into improved retirement security for America’s unionized workers.

Plan design trends: Modernization is driving participant growth

Union-sponsored DC plans have historically varied in structure, but a clear trend has been a convergence toward more member-friendly, 401(k)-style designs. Many Taft-Hartley plans have added supplemental 401(k) features, expanded withdrawal options, and introduced Roth or holistic advice offerings in recent years.

One notable shift we see is the increase in plans allowing member elective contributions. This expansion means more union members have the ability to contribute their own money in addition to employer contributions. Employer contributions have boosted DC plan balances, but ultimately it is member elective deferrals that will determine how quickly those with shorter service tenures accumulate assets. It is therefore encouraging that nearly half of active members in plans with a 401(k) feature made member contributions last year.

The retirement industry is eagerly awaiting final SECURE 2.0 regulations pertaining to auto-enrollment and auto-escalation. Through comment periods and trade groups, Taft-Hartley professionals (including Empower) have been encouraging regulators to exclude multiemployer plans from the auto-enrollment and auto-escalation requirements of SECURE 2.0. Those required elements could result in creating potentially too much complexity and risk for multiemployer plans to add 401(k) features in the future and curb adoption of this valuable design feature.

Plans are also steadily adding Roth contribution options. The ~5% increase in this area (a 21% relative jump) was partly spurred by the SECURE 2.0 mandate, initially expected to start in 2026, that catch-up contributions for high earners would have to be made as Roth. This prompted many plans to add Roth capabilities, and more are expected to follow suit. The recent delayed implementation date to the later of January 1, 2026 or the first of the taxable year following the last collective bargaining agreement (CBA) expiration date following November 17, 2025, will allow more time for multiemployer clients to review options and negotiate the addition of this feature with employers.

The growing adoption of Roth also provides tax-diversification options to members. Many union members could benefit from tax-free retirement income given that their DB pensions will provide taxable income. Younger members in lower tax brackets especially might prefer to lock in tax-free growth via Roth contributions.

Another area of modernization is the availability of in-plan advice and managed accounts, which can include one-on-one consultations and online advice tools.

Overall, Taft-Hartley plans are shedding what may have been perceived as a one-size-fits-all past and embracing features common in private sector 401(k) plans. This evolution better serves a workforce whose retirement needs are more complex than in decades past (see Exhibit 2). The modernization trend is expected to continue as plans respond to regulatory changes and member demand for flexibility.

Most features saw an uptick in adoption year over year. The expansion of 401(k) features means more members can contribute their own money (more than half of members now do so), and the jump in Roth availability aligns with regulatory drivers (SECURE 2.0’s Roth catch-up requirement) and with broader awareness that tax diversification is valuable for members.

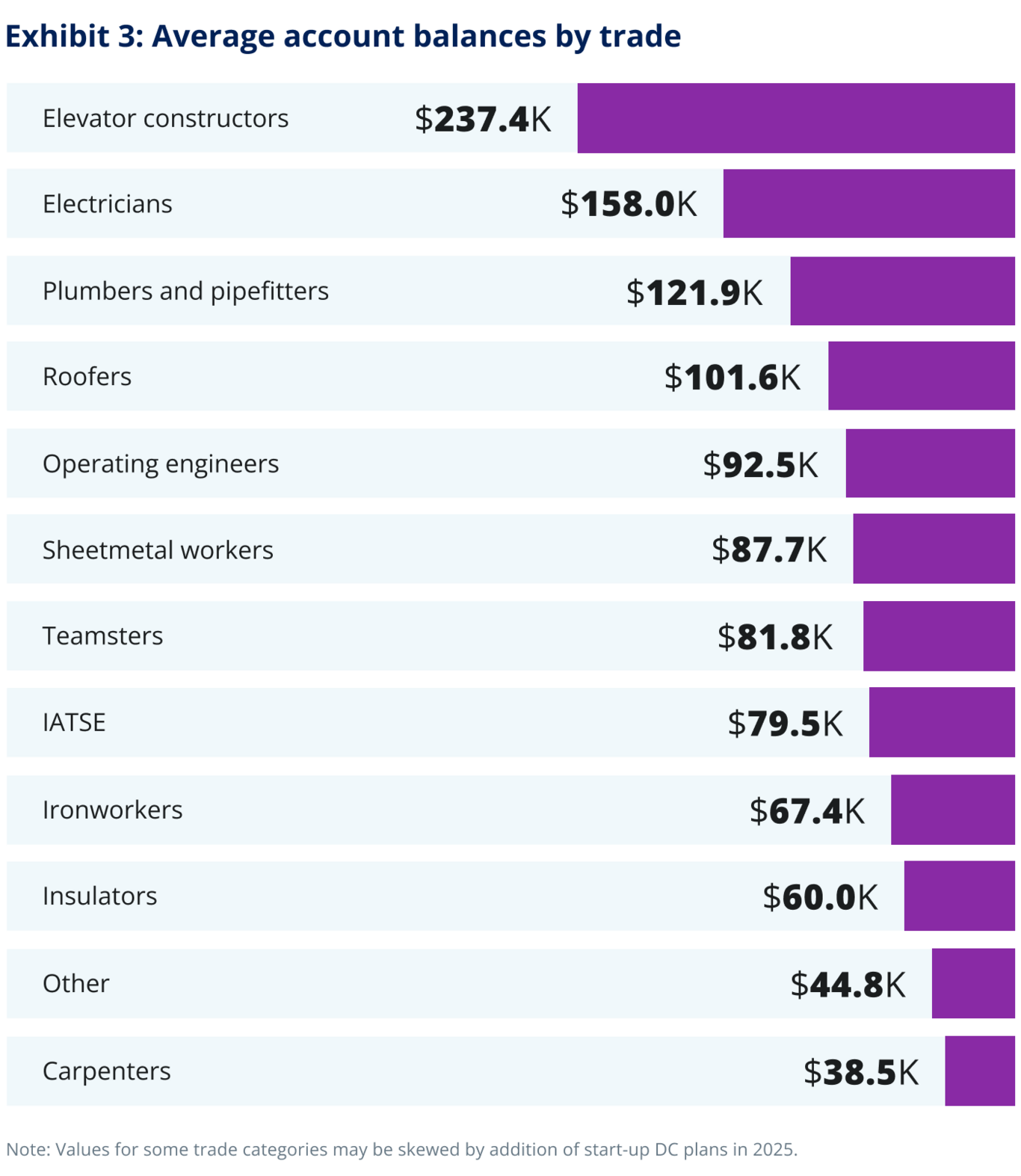

Meanwhile, the widespread utilization of target date funds (present in nearly nine in 10 plans) ensures that even those who don’t actively make investment choices are defaulted into an age-appropriate strategy and benefit from professional management of their account. The net result of these plan-feature adoptions was an increase in average member account balances in 2025 (see Exhibit 3).

Understanding demographic effects on account balances

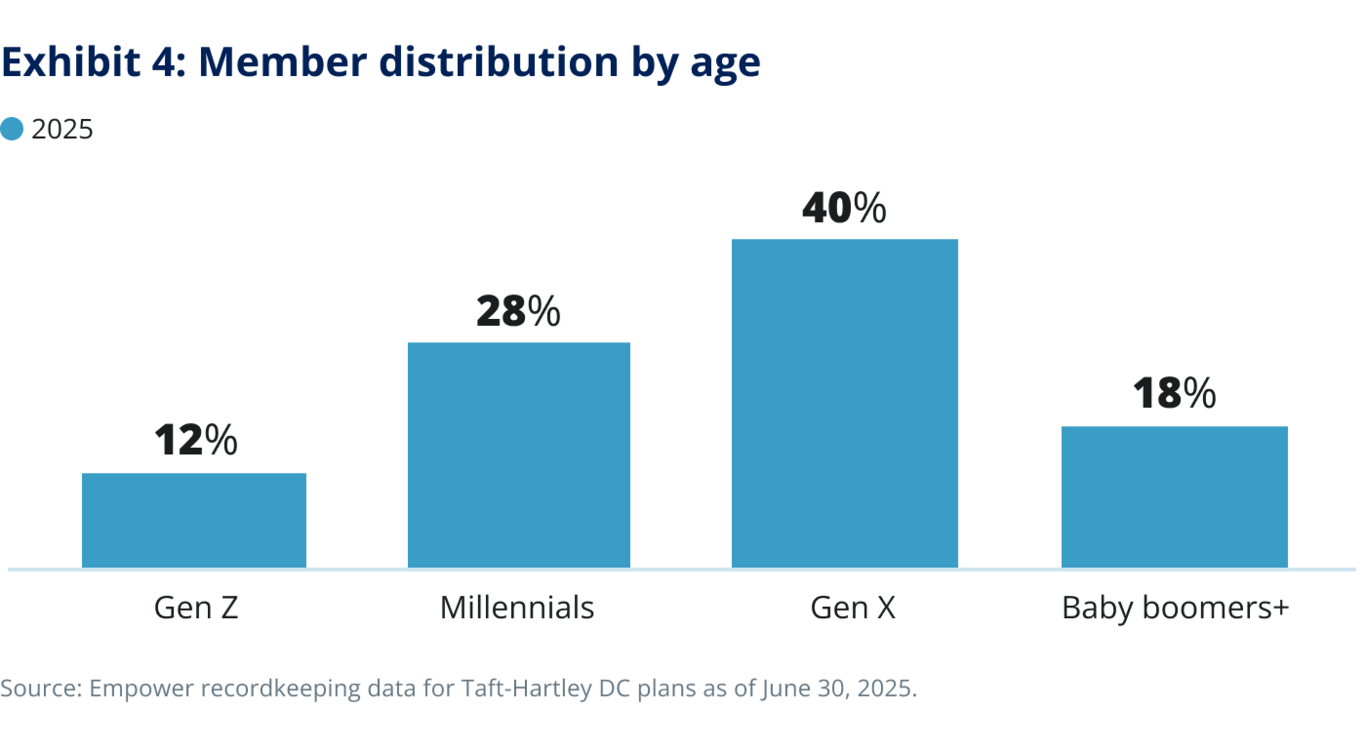

The union member population in Taft-Hartley DC plans spans multiple generations and trades, leading to wide dispersion in account balances and behaviors. Understanding these demographic patterns is crucial for sponsors as they tailor plan management and communications to their workforce profile (see Exhibit 4).

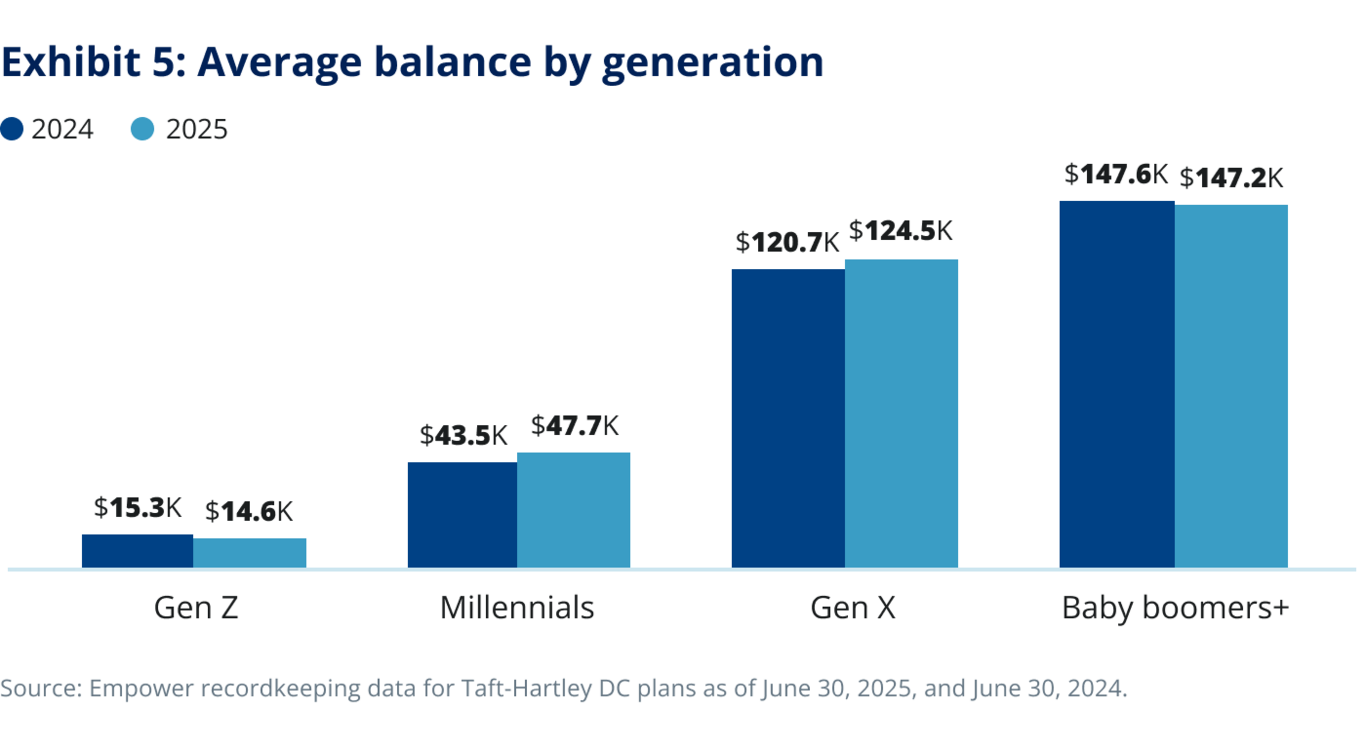

This year’s data shows more muted demographic shifts and their impacts on plan assets (see Exhibit 5).

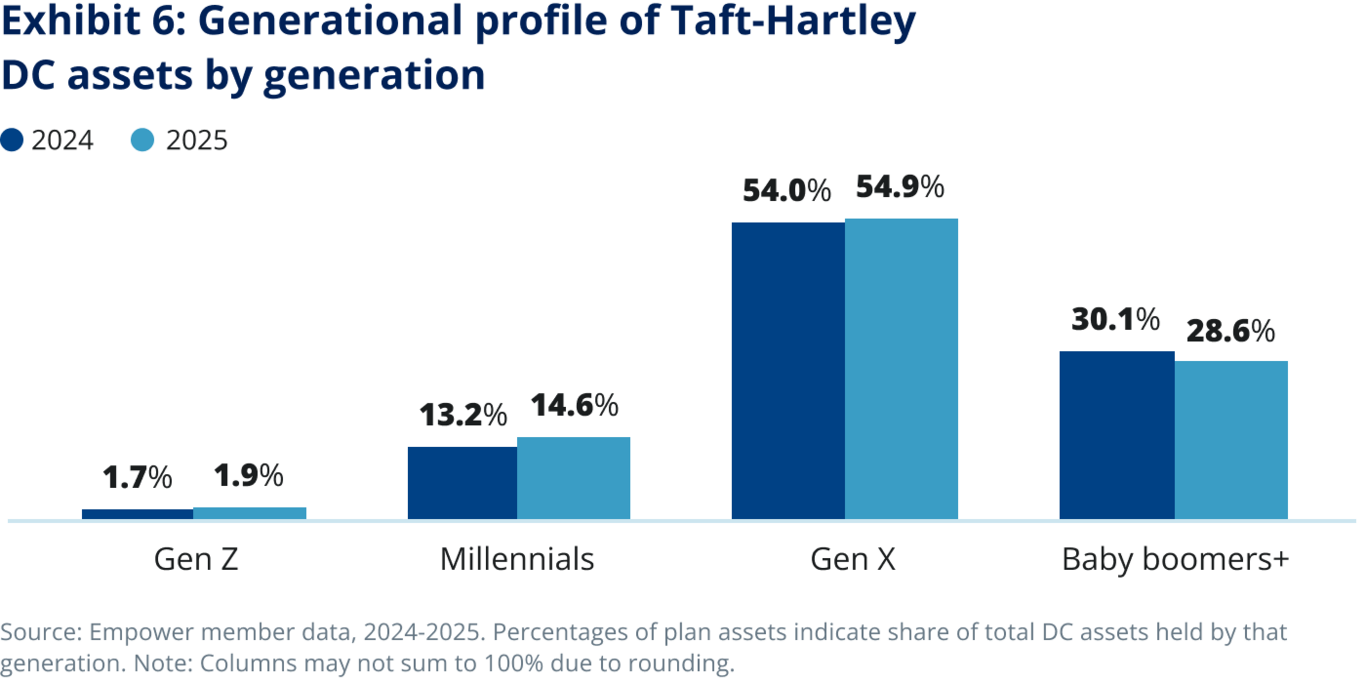

At mid-year 2025, the median age of members is around 46, essentially unchanged from last year. Gen Xers now constitute the largest share of members (about 40%) and an even larger share of assets (~55%). Baby boomers (including silent-generation members) make up roughly 18% of members and hold 29% of plan assets. Millennials are about 28% of members but only ~14.6% of assets. Gen Zers are growing in presence (now ~12% of members) but account for just ~2% of assets so far (see Exhibit 6).

The member base is slowly rejuvenating as older baby boomers retire and younger workers join. Between 2024 and 2025, the Gen Z share of members rose by ~1.6% (from 10.3% to 11.9%) while the baby boomer share fell by about 1%. Millennials and Gen X held roughly steady in terms of population share. The data suggests a modest generational turnover: New apprentices and younger hires are entering the plans but not yet in numbers that would drastically shift the median age. We expect the baby boomer share to continue declining in coming years as more retire, with Gen Zers and younger millennials gradually rising to replace them.

Asset accumulation remains heavily skewed toward older generations. The average baby boomer’s DC account ($146,000) is about 10 times the average Gen Z account ($14,600). This ~10:1 ratio is essentially unchanged from last year, which simply reflects the fact that it takes time (and compounding) for young members to build balances. In addition, for plans that don’t offer a 401(k) feature, contributions are determined by the collective bargaining agreement, not by the member, so by default, younger members have less contributions than older members — a generational gap that grows over time.

A related factor is tenure: The longer a member stays active in their plan, the larger their balance tends to grow (see Exhibits 7 and 8). Members with very short tenures naturally have low balances. In fact, about 35% of all members have less than $5,000 in their account, and many of these were either new entrants, have intermittent work (common in trades like construction, where work can be seasonal), are in an increasing number of start-up plans with zero initial balances, or are younger members not yet contributing enough.2 At the other end, those with 16+ years of participation have an average balance around $187,000.

Continued participation without cashing out is crucial for building assets. Sponsors might consider promoting the idea of “staying in the plan” as members get closer to retirement. With the survey showing more than half of members being aware of the option to remain in their plan (but 38% unaware), the key is to reinforce keeping one’s money invested.

Engagement drives action

Member engagement continues to be the lever that turns plan design and features into better participant outcomes. In 2025, Taft-Hartley plan sponsors made strides in getting members to interact with their retirement accounts (using tools, getting advice, etc.), but considerable gaps remain.

A fundamental structural challenge is that unions often lack direct channels to reach members, such as work email. Unlike corporate 401(k) sponsors, unions can’t simply broadcast company-wide emails to encourage action. Instead, they rely on more multichannel methods: postal mail, union newsletters, personal email addresses, text message campaigns (where members opt in), in-person union meetings, vendor solutions, and prompting through the benefits office or training/apprenticeship programs.

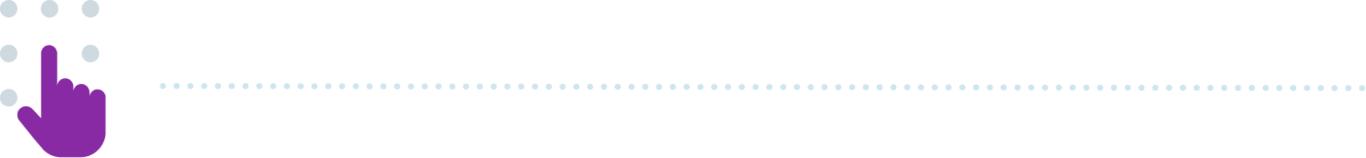

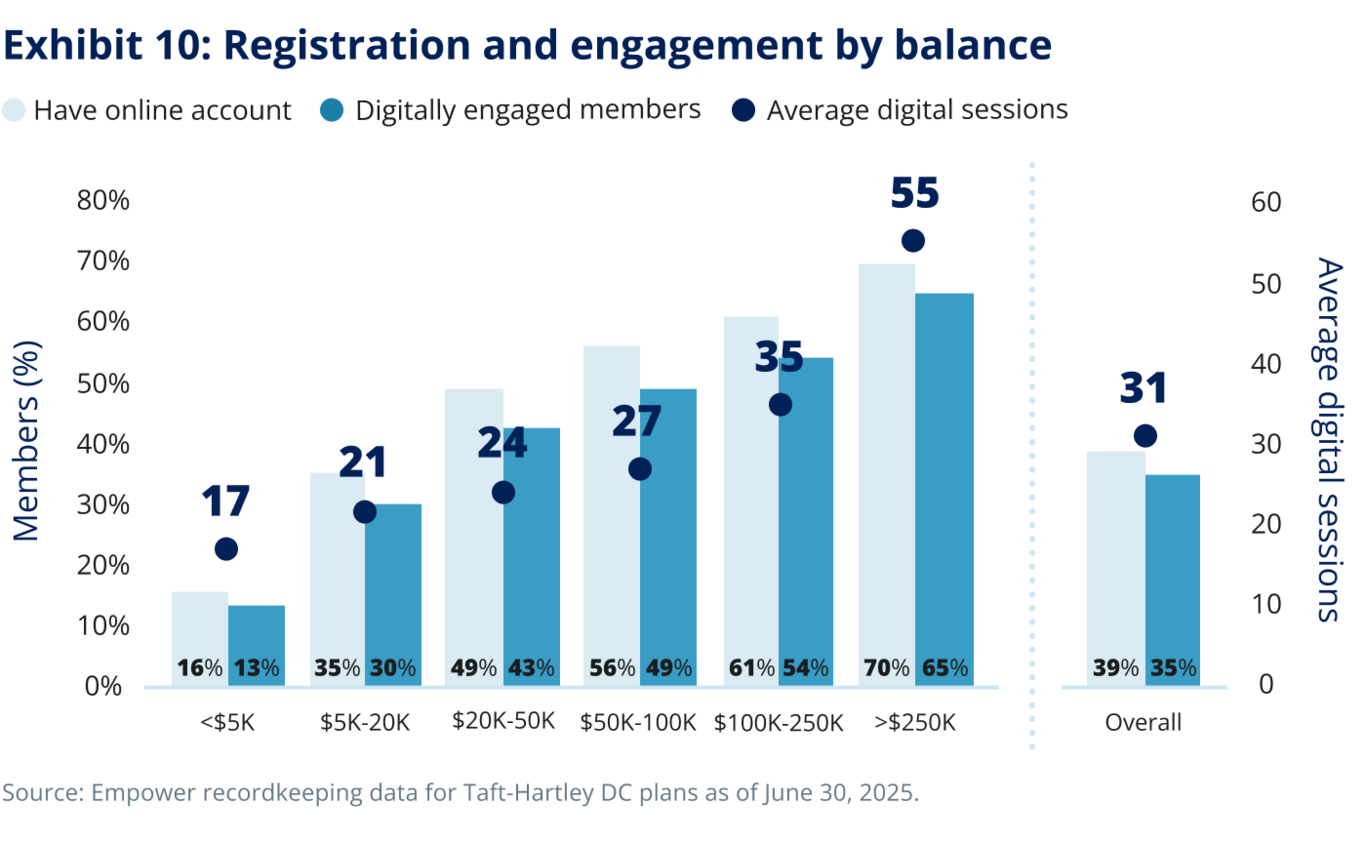

Multichannel methods can be effective but require extra effort and coordination. Data and experience suggest that once unions successfully funnel members to digital tools, engagement soars (see Exhibits 9 and 10). The key is getting them through that initial barrier of registration.

Members increasingly favor mobile access. Among those who do engage digitally, 69% use mobile apps and, among those members, two-thirds use mobile apps exclusively. This makes sense intuitively as many union members spend most of their time on job sites or on the go, so their smartphone is their primary tool for managing finances.

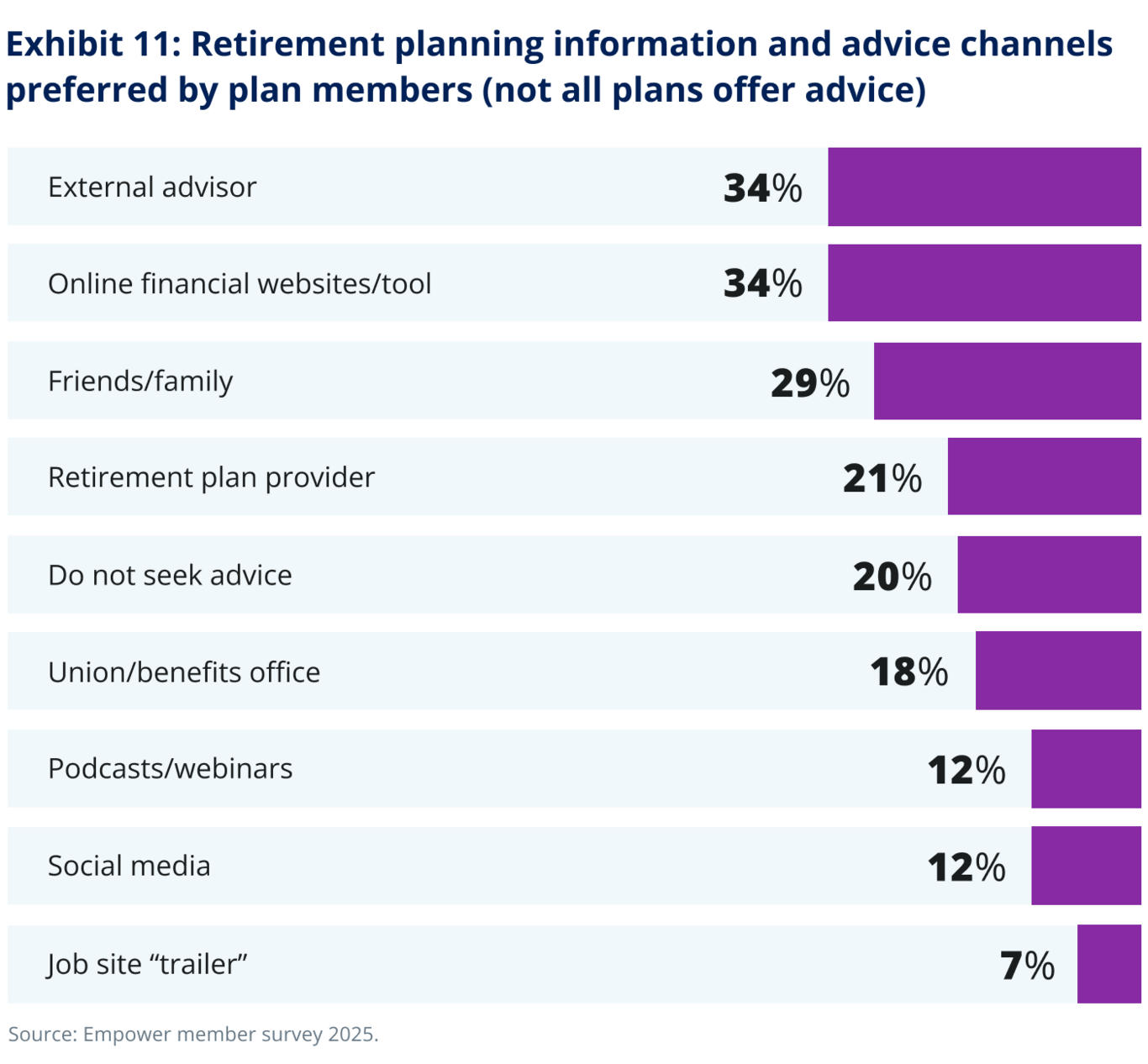

Plan sponsors who have leveraged on-site meetings, convenient digital experiences, and personalized communications report significantly better engagement outcomes than those relying on traditional mailed notices only. When members were asked where they typically seek information or advice about retirement planning, financial professionals and online tools were the top responses (see Exhibit 11).

The implication for plan sponsors is to meet members where they are: Ensure that the mobile app experience is promoted and optimized and consider using text messaging (with proper opt-in consent and privacy guardrails) as a “nudge.”

On the other hand, traditional channels still have value. Direct mail and email are still widely used for outreach and can reach members who are less tech savvy. The key is to follow a multichannel approach using the union’s trusted voice across in-person, print, and digital methods to prompt engagement.

In terms of outcomes, overall engagement is on the rise, but opportunity still exists. Baby boomers had the highest overall engagement rate in 2025 (~42% in some way during the year) despite having the lowest digital adoption rate. Many baby boomers clearly prefer to engage by calling the service center or talking to a plan representative rather than accessing the website or app.

In contrast, Gen Z had the lowest engagement (33%), likely reflecting that younger members often feel retirement is too distant to worry about. This is an important gap to address: Framing the DC plan not just as “retirement” but as “savings for your future” (e.g., saving for a first home or building financial security) may help by making the benefit of plan participation more immediately relevant. Consider rebranding the DC plan away from “an annuity plan,” as that positioning generally does not resonate with younger members. In some feedback such members have stated that they didn’t authorize the purchase of an annuity and would rather have a 401(k) plan like their spouse or partner. Some unions have had success by integrating financial wellness education into apprenticeship programs.

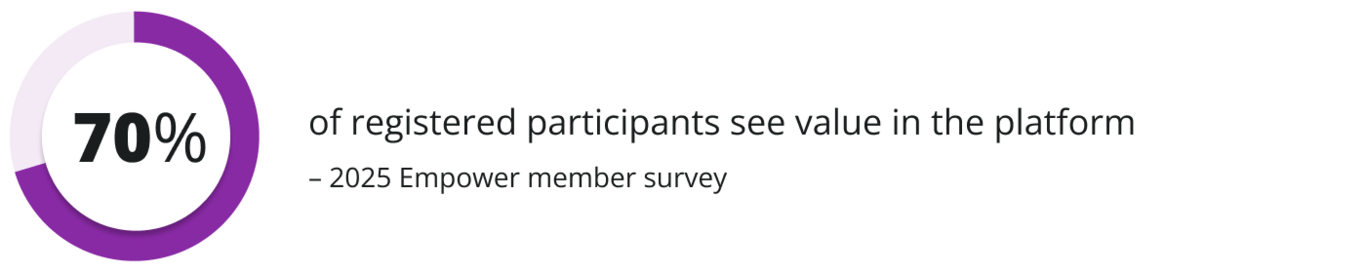

Another aspect of engagement is use of tools and support resources. When members do go online, many are taking advantage of the modeling tools and calculators. Seven in 10 (70%) registered members find value in the online platform, whether it be the website or app. And nearly one in two members who visit the website use at least one planning tool. This indicates an appetite for guidance when it’s easily accessible. In addition, engagement tends to align with career stage: Our member survey revealed that the highest platform value ratings were almost equally distributed among journeymen (73%), retirees (71%), and pre-retirees (69%) and were above the ratings of apprentices (59%, measured from a smallish base).

For those who remain unengaged digitally, the primary mode of interaction is often the call center. Empower has a dedicated contact center for union members that is open on Saturdays as well, making it easier for members to act or get required information when they need it.

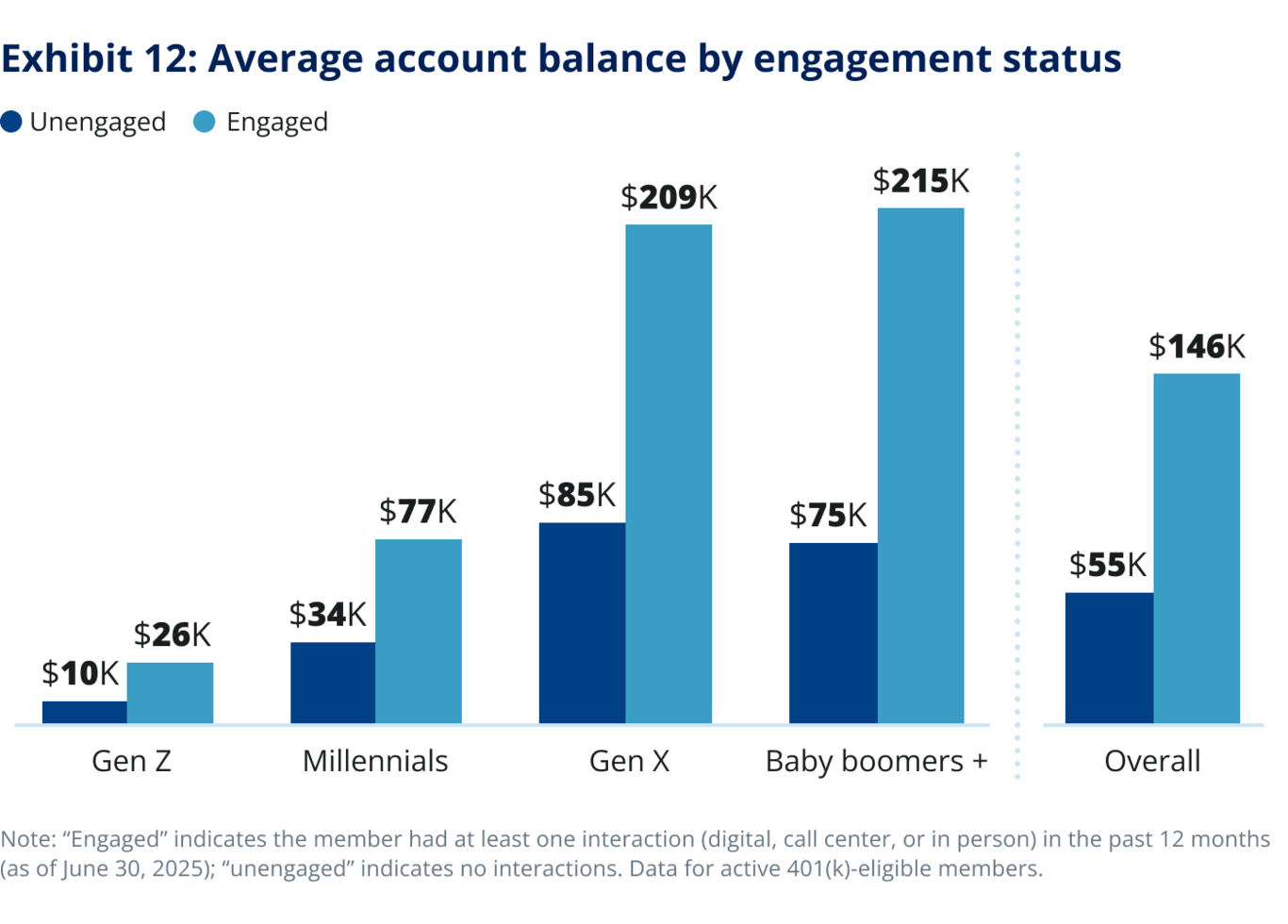

Engaged members tend to have dramatically higher account balances than unengaged members across all generations (see Exhibit 12). While this correlation doesn’t prove causation, it aligns with broader Empower research that shows engaged members save more and achieve better outcomes. It also suggests that engagement efforts might usefully target segments with low engagement and low balances.

Engaged members’ balances are generally two to three times higher than those of their unengaged peers, on average, and nearly three times the balances of unengaged baby boomers. |

Part of this is intuitive: Those who have larger balances may be more inclined to check their accounts or need assistance. But it’s also likely that being engaged helps members make better decisions that lead to larger balances over time. This two-way linkage means that promoting engagement could yield real improvements in retirement readiness.

Another window into member needs is analyzing why members use the call center. Understanding call drivers can illuminate pain points or information gaps.

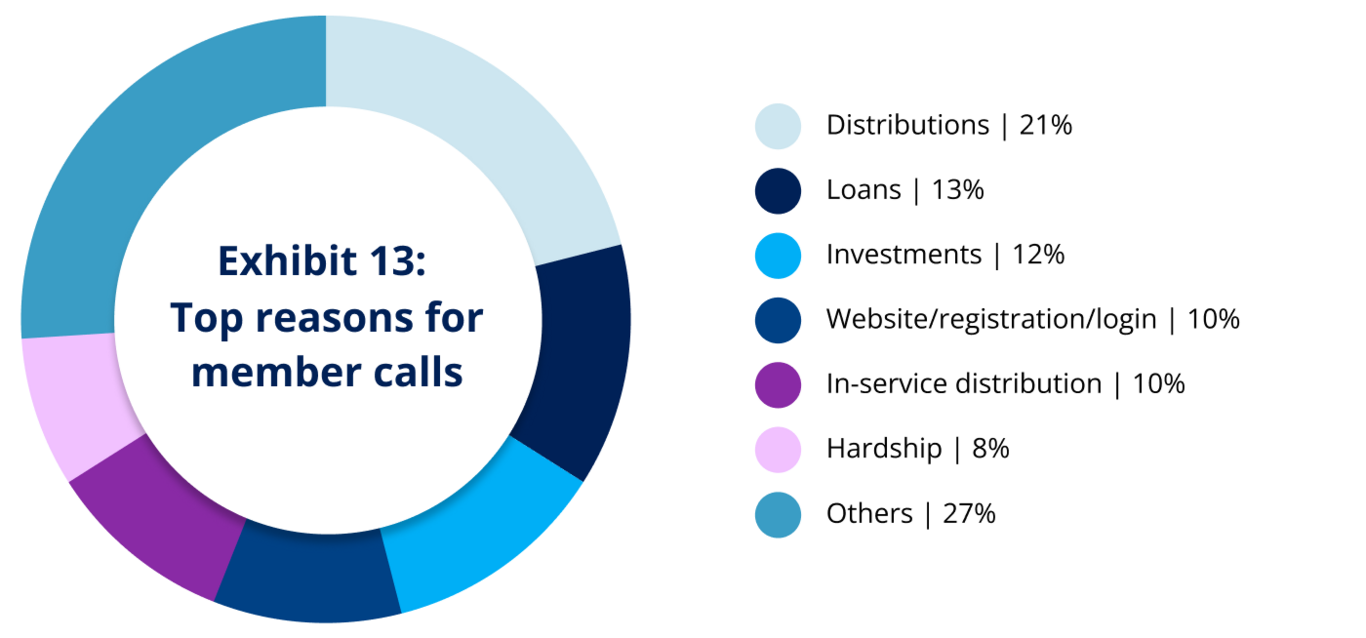

In the first half of 2025, the top reasons members called were related to withdrawing money. Specifically, separation-related distribution requests (people leaving a job and asking about withdrawing or rolling over assets) was the single largest category, accounting for about 20.6% of all calls.

The next most common call topics were loans (13.1%) and investment questions (11.8%). Together, inquiries about distributions, loans, and investments made up nearly half of all calls.

There were also numerous general inquiries (categorized under “Other” — about 27% of calls) covering topics like eligibility, balances, forms, and procedural questions. Exhibit 13 summarizes the main call categories.

The call data reveals some communication opportunities. For instance, the fact that eligibility and procedural questions are common suggests that some members don’t fully understand the plan rules or how to access certain benefits. By partnering with union leadership to help ensure members are looking regularly at plan communications, we often see better participant uptake.

Overall, member engagement in Taft-Hartley plans is improving in areas where digital access is leveraged, but it remains a work in progress.

Key takeaways for sponsors include the following:

- Encourage members to register online.

- Leverage mobile apps and texting to reach members in the field.

- Continue to offer personalized advice/education sessions (such as worksite retirement workshops or one-on-one consultations).

- Tailor communications to different demographics (e.g., messages that resonate with younger workers versus those near retirement, versions in translation, etc.).

Ultimately, an engaged member is more likely to save adequately and make prudent decisions while unengaged members may not contribute enough or may make suboptimal choices. |

Taft-Hartley plan sponsors, given their trusted relationship with union members, are uniquely positioned to foster engagement by using the union’s voice and culture. The continued goal should be to dissuade members from putting off thinking about retirement and instead instilling an expectation of regular interactions with their retirement plan as a normal part of union membership.

Expanding professional guidance through advice

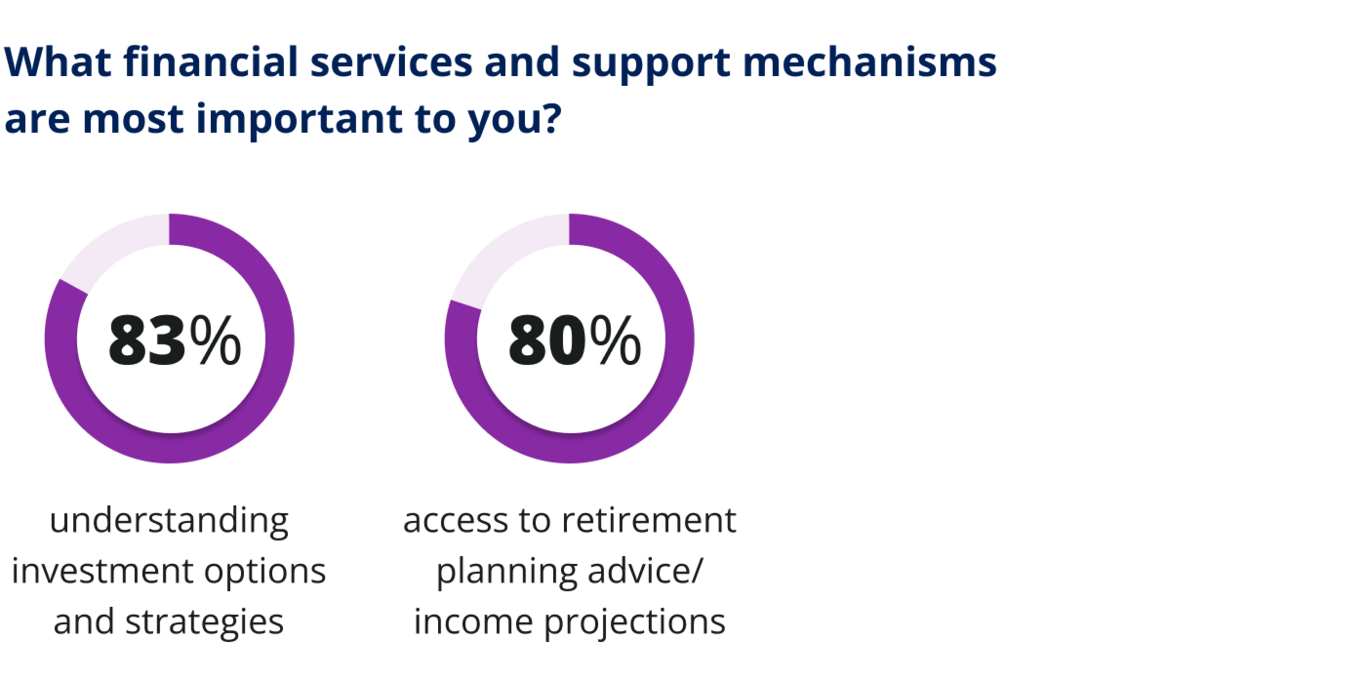

One of the more striking findings in 2025 is the range between the availability of advisory services and member utilization of them. On one hand, target date funds have captured the lion’s share of professionally managed solutions usage as they represent a high percentage of default investment options. On the other hand, a growing number of members (80%) said they value access to retirement planning advice or projections, and 63% value financial education and coaching.

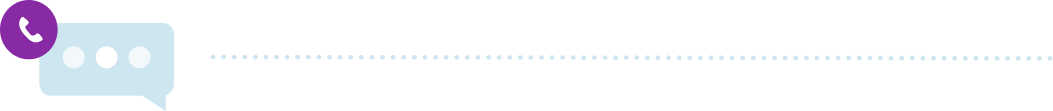

As noted earlier, about 32% of Taft-Hartley plans now offer access to Empower’s advisory services. Consistent with prior years, the uptake of advisory solutions generally falls along age and tenure lines (see Exhibit 14).

Furthermore, a majority of members are already invested in professionally managed strategies — primarily target date funds, plus those enrolled in managed accounts. Use of advice solutions varies by generation (e.g., 85% of Gen Zers vs. 54% of baby boomers). The lower percentage for older members can be largely attributed to many baby boomers working with an external financial advisor and moving away from target date funds as their financial situations grow more complex.

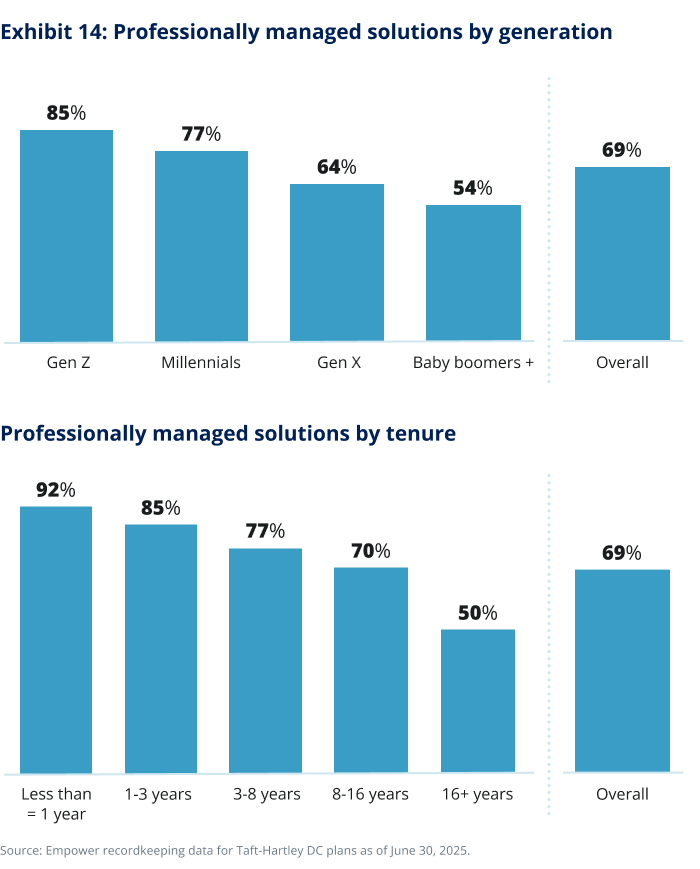

Managed accounts offer one form of advice. Another form is advice sessions such as the free Retirement Readiness Reviews (RRRs) offered by Empower representatives, ad-hoc consultations, and on-site and online resources (see Exhibit 15).

Source: Empower member survey 2025

Members seek out financial guidance from trusted sources, and long-term planning comes up as an area where members seek help. Quality advice services and easily accessible tools can bridge that knowledge gap and boost member confidence (see Exhibit 16).

Despite the widespread availability of advisory services, more members need to be made aware of them. Some possible strategies include:

- Emphasizing advice during life events: Promote the availability of advice services when members are entering new age or career stages and undergoing milestones such as nearing retirement. For example, when a member requests a loan or pension estimate, or begins to complete retirement paperwork, ensure they are encouraged to talk to a DC plan advisor for a holistic checkup.

- Publishing peer testimonials and union culture: Leverage the tight-knit nature of union communities. If fellow members share success stories (e.g., “I sat down with the plan advisor and they helped me consolidate my old accounts”), it can encourage others. Union newsletters or events can highlight members who benefited from advice.

- Asking for leadership endorsements: If union leaders and trustees openly encourage members to use the free advice resources, members are more likely to follow. Hearing from a trusted union figure that “this is a benefit we negotiated for you — please use it” can overcome skepticism.

Plan sponsors should continue to promote these resources as part of the union commitment to member welfare. Given that a large share of members say they get financial information from their plan provider or union, when a plan normalizes the use of advice, unions can help their members make the most of their DC benefits and become more retirement ready.

Balancing accumulation and preservation

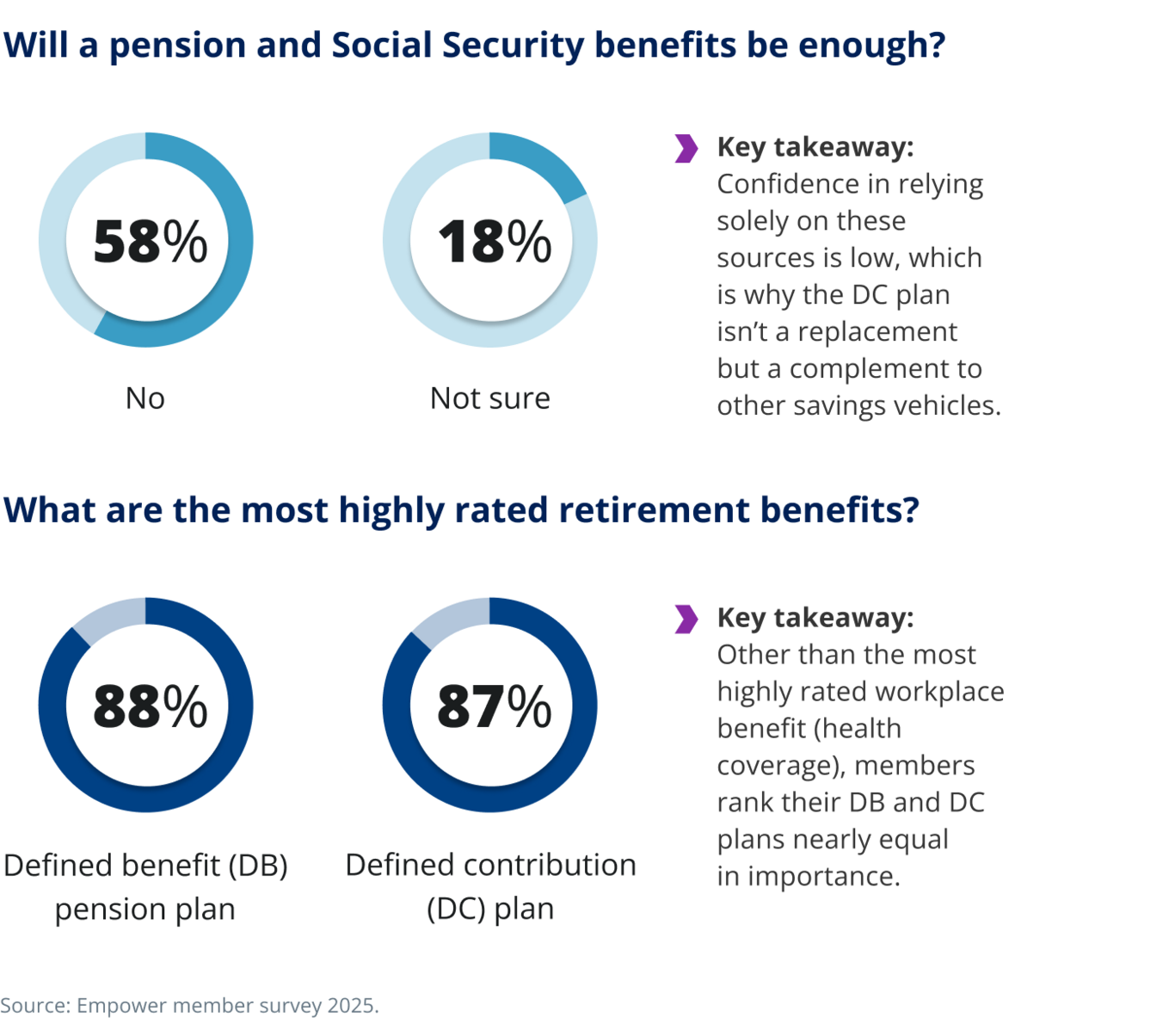

The ultimate measure of a retirement plan’s success is whether it enables members to achieve a secure retirement. For Taft-Hartley members, “retirement readiness” is a joint function of their pension benefits and DC savings plus any personal savings, including Social Security. While quantifying total retirement readiness is beyond the scope of this report, we can examine indicators related to the DC component — namely, how well members are accumulating assets and how much is being lost to leakage — to gauge the contributions of DC plans to future security. Empower stands with union leadership to help bridge any gaps that exist across member DB plans, Social Security benefits, and DC plans — which members now rank at nearly the same level of importance as a traditional pension (87% versus 88% respectively).

High inflation, increased longevity, and other external factors could mean few union members are likely to retire comfortably on their DB pension alone. The DC plan is intended to fill that gap. Importantly, a DC plan account can also offer something a pension cannot: a potential legacy. Having a DC plan account that can be passed to children or grandchildren is valued by members. This perspective could resonate with members who see the DC plan as not just extra money for retirement but also possibly something to leave for the next generation.

Looking at how members are utilizing their DC savings as they approach retirement, we see encouraging signs but also a looming challenge. The encouraging sign is that long-tenured members are accumulating significant balances. The challenge is leakage. Leakage can seriously erode retirement readiness if not managed because every dollar taken out early not only reduces the balance but also loses years of potential growth. Seventy-five percent of the assets leaving Taft-Hartley plans on Empower’s platform between June 2024 and July 2025 rolled over to another plan or an IRA. Of this amount, approximately 60% rolled over to advisory services firms. Eight of the top 10 firms receiving rollovers assets were advisory services firms and two were mutual fund organizations.

This highlights members’ desire to access advisory services to get help with their key financial decisions and reinforces the need to offer these services in a plan to meet that demand and allow members to benefit from the buying power their plan affords them. Staying in plan for these services generally allows members to access advisory services and investment costs at lower fees than retail alternatives.

So, are union members becoming more retirement ready? The trend is positive. Long-term members are growing their balances, and more members are saving than before. The key will be helping newer and younger members ramp up their savings and keeping all members engaged over time. Increased digital interactions and human interactions have been shown to improve savings behavior and outcomes.

By continuing on this path (that is, modernizing plans, engaging members, expanding advice, and safeguarding assets for retirement), sponsors can significantly improve their members’ retirement readiness while still honoring the unique needs and culture of the union workforce.

Sponsor action checklist: Five ways to bolster union members’ retirement security

Taft-Hartley DC plans are increasingly vital in bridging the retirement income gap for union members. To maximize retirement readiness, sponsors should focus on a few key areas to strengthen retirement outcomes for their members:

Embrace modern plan features

Continue adopting features that encourage greater savings and flexibility. If your plan does not yet have a 401(k) elective contribution or Roth option, evaluate adding them to give members more ways to save. Similarly, consider offering in-plan advisory services or financial wellness tools as part of the plan. These features align the plan with the evolving needs of a mobile workforce and can boost participation.

Encourage early and continuous contributions

Work with unions to instill a culture among members of contributing from day one (for plans that allow member contributions). Use orientations, apprenticeship programs, and member communications to highlight the power of starting early. Emphasize that even small contributions add up over time. The data confirms that those who begin contributing in their 20s or 30s and never cash out achieve dramatically higher balances by retirement.

Meet members where they are (to boost engagement)

Develop a multichannel engagement strategy that leverages both technology and the union’s personal touch (statements and benefits channels) to get every member to register for online account access. Promote the mobile app as a convenient way to check balances or use planning tools on the go. At the same time, maintain robust in-person support: Schedule benefits fairs, job-site visits, or union hall workshops. Use text-message reminders to reach members who might ignore mailed notices. By meeting members through the channels they actually use, sponsors can dramatically increase engagement rates.

Promote advice and education opportunities

Don’t let valuable advisory services remain underutilized. Promote consultations and the availability of phone advisors and online tools. Highlight success stories of members who improved their finances after an advice session (without violating privacy; general anecdotes are powerful). Union leaders and trustees should endorse these services so members see them as a normal and trusted part of their benefits. Enhance the apprenticeship program by including education and advisory engagements as a mandatory part of the program. The goal is to make seeking financial guidance as routine as getting a yearly physical exam.

Preserve retirement assets and minimize leakage

Implement policies and communications to help members preserve their savings. Well ahead of retirement, have a “stay-in-plan” or rollover assistance program to counsel members on their options. Waiting until a member is retiring to tell them they can keep their money in the plan is usually too late.

These action items build on the current insights from this year’s plan analysis and survey — focusing on increasing savings, leveraging engagement and advice, and preventing avoidable losses of retirement assets. Each plan may implement them differently, but collectively they offer a compelling roadmap toward improved retirement outcomes for U.S. unions. |

1 Empower, “Money in Motion” report, plan details as of July 31, 2025.

2 Low balances are partly driven by plans that don’t allow member contributions, as well as some new plans just recently adding a DC plan option alongside the defined benefit (DB) plan.

The Retirement Readiness Review is provided by an Empower representative registered with Empower Financial Services, Inc. and may provide tailored retirement education and guidance at no additional cost to participants.

Point-in-time advice provided by an Empower representative may include savings, investment allocation, distribution, and rollover advice, including advice on consolidating outside retirement accounts.

Empower refers to the products and services offered by Empower Annuity Insurance Company of America and its subsidiaries. This material is for informational purposes only and is not intended to provide investment, legal, or tax recommendations or advice.

Online advice and the managed account service are part of the Empower Advisory Services suite of services offered by Empower Advisory Group, LLC, a registered investment adviser. Past performance is not indicative of future returns. You may lose money.

The research, views, and opinions contained in these materials are intended to be educational, may not be suitable for all investors, and are not tax, legal, accounting, or investment advice.

Testimonials may not be representative of the experience of other individuals and are not a guarantee of future performance or success.

Point-in-time advice is provided by an Empower representative registered with Empower Financial Services, Inc. at no additional cost to account owners. There is no guarantee provided by any party that use of the advice will result in a profit.

“EMPOWER” and all associated logos and product names are trademarks of Empower Annuity Insurance Company of America.

©2025 Empower Annuity Insurance Company of America. All rights reserved. WSA-FBK-WF-5022250-1025 RO4917991-1025

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. No part of this blog, nor the links contained therein is a solicitation or offer to sell securities. Compensation for freelance contributions not to exceed $1,250. Third-party data is obtained from sources believed to be reliable; however, Empower cannot guarantee the accuracy, timeliness, completeness or fitness of this data for any particular purpose. Third-party links are provided solely as a convenience and do not imply an affiliation, endorsement or approval by Empower of the contents on such third-party websites. This article is based on current events, research, and developments at the time of publication, which may change over time.

Certain sections of this blog may contain forward-looking statements that are based on our reasonable expectations, estimates, projections and assumptions. Past performance is not a guarantee of future return, nor is it indicative of future performance. Investing involves risk. The value of your investment will fluctuate and you may lose money.

Certified Financial Planner Board of Standards Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design), and CFP® (with flame design) in the U.S., which it authorizes use of by individuals who successfully complete CFP Board's initial and ongoing certification requirements.