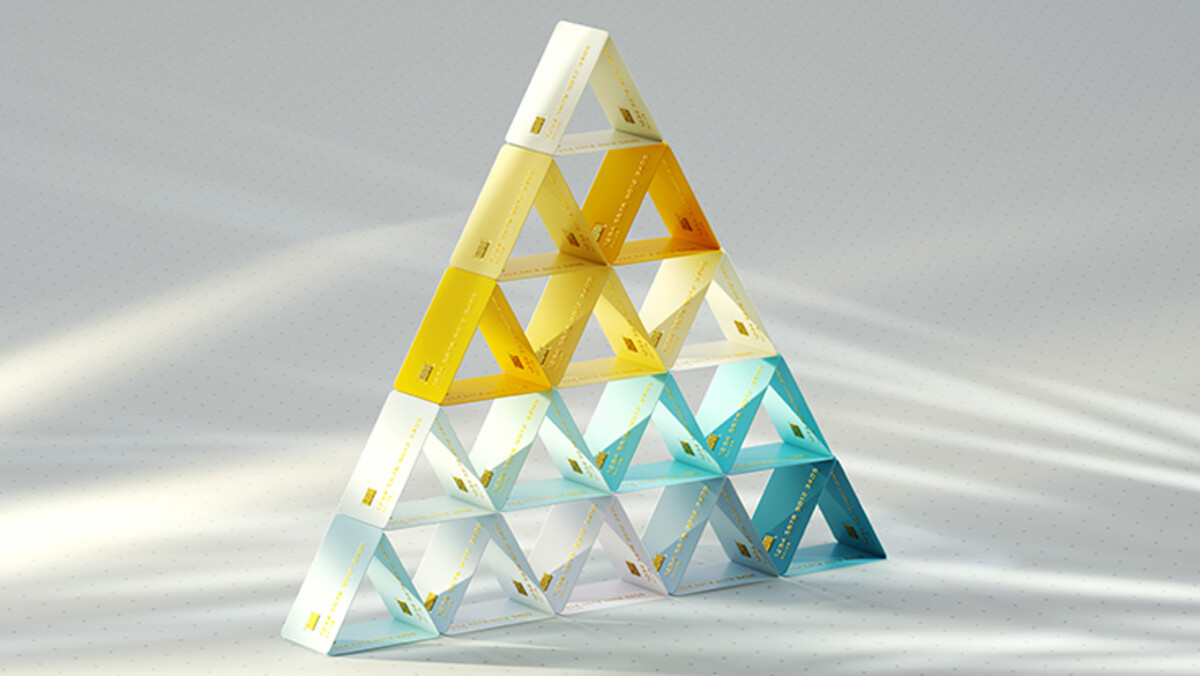

Luxury credit cards get an upgrade

Luxury credit cards get an upgrade

As annual fees climb and perks expand, premium cards are redefining what counts as value

Luxury credit cards get an upgrade

As annual fees climb and perks expand, premium cards are redefining what counts as value

Listen

·Key takeaways:

- Premium credit cards are increasing fees — as well as the benefits they offer

- Luxury cards increasingly market themselves as lifestyle enablers, rather than just payment methods with perks

- Some households can break even with cards with higher annual fees if their interests and spending habits line up

- Card providers bank on experiences that turn accounts into “lifestyle memberships”

Annual fees on luxury credit cards are set to increase, but so are their perks. Card companies may offer more at a higher price, but spenders are evaluating if the expense is worth the benefits.

Premium credit cards are getting an upgrade. Card issuers are expanding their high-end travel, dining, and wellness benefits, reframing them as everyday savings tools rather than luxury add-ons.1 The competition among major issuers is intensifying, creating a race to deliver richer perks on luxury cards — often with higher annual fees than traditional cards. That means cardholders who underuse benefits may want to size up these new offerings closely — and even weigh them against the other credit cards they may have.

Recent refreshes from American Express, Citi, and Chase reflect a broader shift in how premium cards try to earn business (and make fees worthwhile).2,3 Instead of relying on attention-grabbing perks like VIP concert access or exclusive private events, issuers are now bundling travel credits, lifestyle extras, and delivery discounts that may offer enough real-world value to help cover the card’s cost.4

Why luxury cards are in vogue for providers

Card issuers are interested in luxury cards because they can offer steady revenue and often attract high-spending, lower-risk customers.5 Annual fees often bring in reliable income, and luxury cardholders tend to spend more and pay on time.6 The way these cards are designed also keeps activity within each issuer’s ecosystem, linking rewards, partners, and services into a single ecosystem.

What new perks do luxury credit cards offer in 2026?

Premium credit cards increasingly use perks to appeal to new customers, and a number of issuers are banking on an expansive set of perks that could help justify higher annual fees. Be it lounge access, gym credits, or even app subscriptions, today’s cards are positioning themselves to be part payment tool, part lifestyle enhancer.

- American Express Platinum: Refreshed benefits center on categories where most households already spend, including hotels, dining services, streaming platforms, and wellness programs.7

- Citi Strata Elite: Offers lifestyle perks and travel-focused benefits, with $700 in annual credits across multiple categories.8

- Chase Sapphire Reserve: Revamped in June 2025, raising the annual fee to $795 while adding roughly $1,200 in new credits for lodging, restaurants, streaming, and subscription perks.9

- Chase rewards expansion: Introduced a points-boosting program encouraging cardholders to redeem through its travel portal.10

Credits that match real-world spending categories may help create the kind of practical value that transforms perks into lifestyle memberships, not just credit card accounts.

Read more: Business of Play: Airport lounges balance access and exclusivity

Where perks-rich credit cards make a difference

Premium cards tend to maximize rewards for consumers when their benefits match typical spending patterns. Households that already pay for travel, food delivery, or wellness on a credit card can often offset a portion of the annual fee through credits alone.

Getting the most out of a high-fee card isn’t necessarily about chasing every benefit. Stacking predictable expenses over time can offset the fee when recurring credits apply to everyday purchases. If a household orders delivery from restaurants or food delivery apps included in card perks or rebates, they may end up getting some of the card’s fee returned to them in the form of balance credits against their credit card bill. Over the span of a year, those recurrent statement credits can add up to meaningful value, offsetting part of the annual card fee in the process.

When perks are tied to routine spending, the opportunity to find value in the ordinary grows, and the potential value of a high-fee card may reveal itself.

When are premium credit cards worth the annual fee?

Premium cards tend to justify their cost when the benefits align with a household’s regular spending, and can be used consistently throughout the year. The math often works best when the perks used can match or exceed the annual fee.

Card | Annual Fee | Perks Value |

AmEx Platinum11 | $895 | ~$3,500 |

Citi Strata Elite12 | $550 | ~$700 credits |

Chase Sapphire Reserve13 | $795 | ~$1,500 credits |

How to decide if a luxury credit card is worth it

The fees that come with luxury credit cards may be justified when they’re used deliberately. The more they’re treated as structured tools, versus status symbols, the more their fees may have less of a financial impact.

1. Map out existing spending to available credits

Begin with a clear breakdown of recurring expenses — travel, dining, subscriptions, delivery, wellness — and match them to the credits that come with the card. When a credit provided by the card issuer can offset a recurring or upcoming expense, the card’s annual fee could be more acceptable.

2. Automate recurring charges

Routinely collecting card perks may start as simply as automating payments. Assigning a premium card to be the payment method for qualifying services can help ensure consistent redemption without extra effort. In some cases, credits are triggered automatically once an eligible purchase posts, such as a monthly streaming charge or food delivery order. Others may require a one-time activation through the issuer’s website or app before they can apply.14

3. Activate every eligible benefit

Some credit card issuers require people to opt-in to certain benefits, or to activate them on a recurring basis.15 Not all perk requires enrollment, but several major issuers do ask cardholders to activate select credits or memberships before using them.

4. Combine overlapping incentives

People can maximize the value of card benefits by having a good understanding of how redemption works. For example, booking travel through the credit card issuer’s portal can increase the number of points earned per transaction.16 Holding elite status with an airline through the same card can add even more perks — from free upgrades to priority boarding.17 Each of these elements used together can take the bite out of the yearly credit card fee.

5. Track reward cycles and expirations

Monthly and quarterly benefits may be easy to miss without reminders. Card issuers will often include information about cyclical benefits and perks on their card holder dashboard.18 Regularly checking online accounts can help people remember which perks are active and can help reduce the likelihood of losing out on rewards.

6. Add authorized users strategically

Depending on the card’s terms, it may be possible to assign spending categories to additional users.19 Doing so can expand how often rewards or credits are earned across a household’s regular expenses.

7. Monitor usage often

Luxury cards can be at their most useful when the benefits associated with them are used. Card members should consider auditing their usage frequently. If a large share of credits go without being used, the card may not be the right fit. Downgrading or switching might be a better option.19

Read more: Money meets lifestyle: Around the world in 80 extreme day trips

Check the fit

The decision to renew or change premium cards should rely on usage data, rather than habit. A card that can offset its fee, either in part or in sum, may justify its position in one’s wallet. Cards that require behavior changes or frequent travel to break even may not be the right fit.

Premium cards work best when they mirror a household’s financial rhythm: steady spending, use of credit, and a clean balance every billing.20 When those elements align, the true cost of a luxury card can become more predictable, and value can feel earned instead of aspirational.

Get financially happy

Put your money to work for life and play

1 New York Times, “With Amex’s Platinum Refresh, an Even More Exclusive Card Emerges,” September 2025

2 Wall Street Journal, “Rising Fees Force Premium Credit-Card Holders to Choose Sides,” October 2025

3 Wall Street Journal, “Citi Rolls Out a New Premium Card in Fight for Affluent Customers,” July 2025

4 American Express, “AMEX Experiences,” Accessed October 2025

5 Bloomberg, “American Express allays competition concerns after profit beat,” July 2025

6 Reuters, “AmEx upgrades Platinum cards with $3,500 annual perks, hikes fee by $200,” September 2025

7 Ibid.

8 Citi, “Citi Launches the Citi Strata Elite Credit Card,” July 2025

9 Condé Nast Traveler, “Chase Sapphire Reserve Card: New Look, Updated Benefits, and a $795 Annual Fee,” June 2025

10 Chase, “The Most Rewarding Cards Are Here: The New Chase Sapphire Reserve and Introducing Chase Sapphire Reserve for Business,” June 2025

10 Wall Street Journal, “Rising Fees Force Premium Credit-Card Holders to Choose Sides,” October 2025

11 Reuters, “AmEx upgrades Platinum cards with $3,500 annual perks, hikes fee by $200,” September 2025

12 Citi, “Citi Launches the Citi Strata Elite Credit Card,” July 2025

13 Condé Nast Traveler, “Chase Sapphire Reserve Card: New Look, Updated Benefits, and a $795 Annual Fee,” June 2025

14 Reuters, “AmEx upgrades Platinum cards with $3,500 annual perks, hikes fee by $200,” September 2025

15 CNBC, “Watch out for these 6 credit card surprises so you can avoid debt and get the most out of your card,” March 2025

16 Forbes, “Credit Card Travel Portals: A Quick Guide,” August 2025

17 AAA, “Is Airline Status Worth It? A Frequent Flyer’s Honest Take,” September 2025

18 CNBC, “When it comes to cash-back credit cards, which is better: Flat rate or bonus categories?” September 2025

19 U.S. News, “Authorized Users: The Pros and Cons,” August 2025

20 Yale University, “Understanding Credit Cards,” Accessed October 2025

RO 4895305-1025

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. No part of this blog, nor the links contained therein is a solicitation or offer to sell securities. Compensation for freelance contributions not to exceed $1,250. Third-party data is obtained from sources believed to be reliable; however, Empower cannot guarantee the accuracy, timeliness, completeness or fitness of this data for any particular purpose. Third-party links are provided solely as a convenience and do not imply an affiliation, endorsement or approval by Empower of the contents on such third-party websites. This article is based on current events, research, and developments at the time of publication, which may change over time.

Certain sections of this blog may contain forward-looking statements that are based on our reasonable expectations, estimates, projections and assumptions. Past performance is not a guarantee of future return, nor is it indicative of future performance. Investing involves risk. The value of your investment will fluctuate and you may lose money.

Certified Financial Planner Board of Standards Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design), and CFP® (with flame design) in the U.S., which it authorizes use of by individuals who successfully complete CFP Board's initial and ongoing certification requirements.