The Buy Now, Pay Later (BNPL) boom in 2025: Statistics you need to know

The Buy Now, Pay Later (BNPL) boom in 2025: Statistics you need to know

Buy Now, Pay Later (BNPL) is reshaping how people pay. This short-term financing option allows consumers to split purchases into smaller installments—often interest-free—without the need for traditional credit. Once a niche offering, BNPL has become more mainstream with nearly half of Americans saying it makes it easier to manage large or unexpected expenses, according to Empower research.

As adoption continues to grow, so do the questions around its impact on spending habits, debt, and financial health—including credit scores. Understanding the BNPL landscape in 2025 is important for brands aiming to optimize checkout experiences and meet consumer expectations.

This list of 26 key statistics dives into the data behind the boom, where BNPL is headed, and what it means for the future of spending.

Key BNPL statistics

- Monthly BNPL spending increased almost 21% from $201.60 in June 2024 to $243.90 in June 2025, according to Empower Personal Dashboard™ data.

- More than half of BNPL consumers are 35 years old or younger.1

- Empower research shows 1 in 10 Americans use BNPL to pay for travel and vacations.

- Over one in four (26%) Americans say they’re more likely to buy when BNPL is an option offered.

BNPL growth and adoption

The Buy Now, Pay Later market has seen tremendous growth in recent years, and now, more consumers than ever are choosing it as a payment method.

- This year, it is expected that 90 million Americans will use BNPL for purchases.2

- By 2028, the BNPL market is projected to reach $700 billion.3

- Empower Personal DashboardTM data reveals BNPL usage has grown significantly in recent years: Monthly BNPL spending increased almost 21% from $201.60 in June 2024 to $243.90 in June 2025.

BNPL demographics

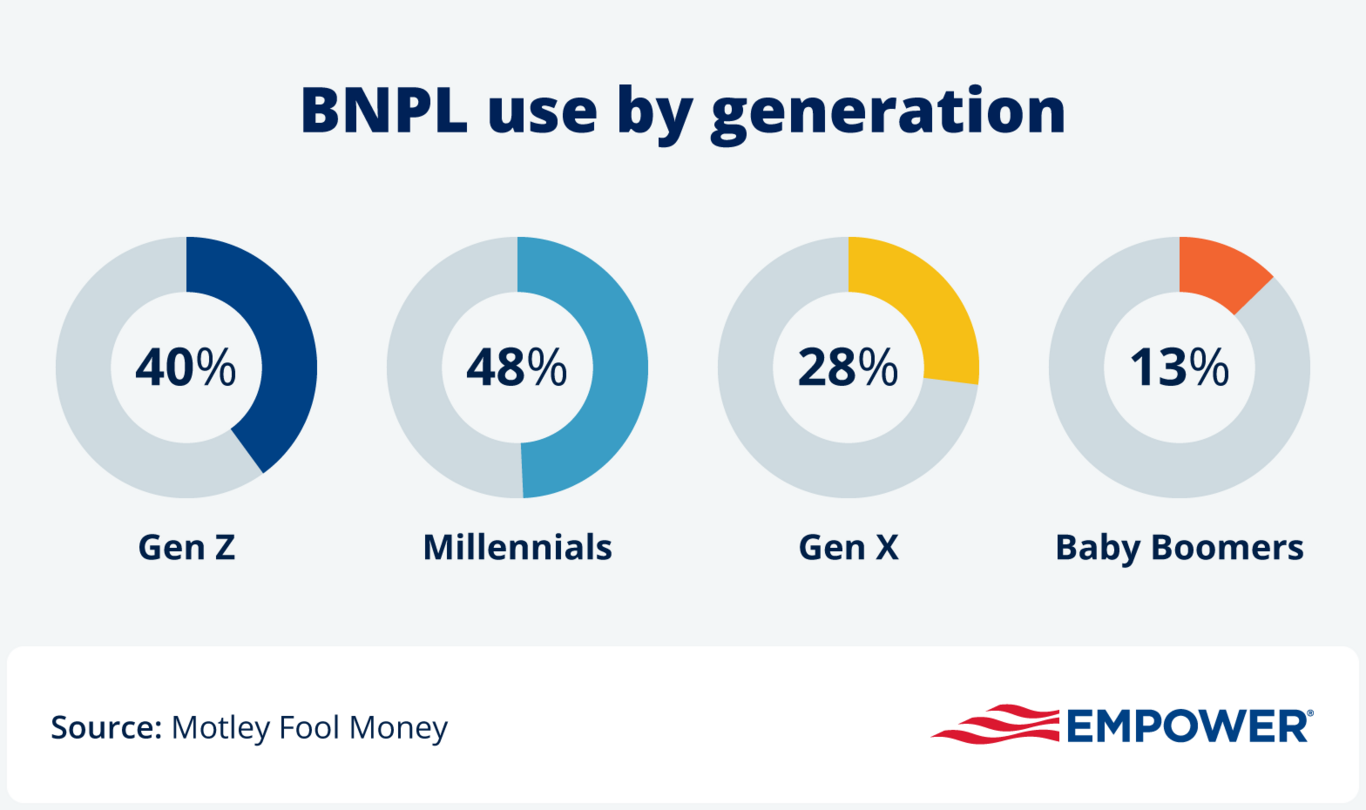

Comparing demographics, BNPL payment options tend to be most popular among Gen Zers and Millennials and used more regularly by women when compared to men.

- Last year, 44% of Gen Zers used BNPL services, which is approximately 30 million young people in the U.S.4

- Millennials are most likely (48%) to have reported using BNPL at least once, compared to 40% of Gen Z, 28% of Gen X, and 13% of Baby Boomers.5

- More than half of BNPL consumers are 35 years old or younger.6

- Women are more likely to use BNPL (20%) compared to men (14%).7

- About two in five (38%) say BNPL makes shopping feel less financially ‘real’ than using a debit or credit card.

BNPL user behavior

Not everyone uses BNPL for the same reasons — or for the same kinds of purchases — but most consumers like it for its convenience and flexibility. At the same time, many struggle with making payments on time or keeping track of what (and how much) they owe.

The top reasons cited for using BNPL services include to spread out payments (87%) and convenience (82%).8

Over half of Gen Z (55%) feel that BNPL helps them better manage their finances.9

Nearly 40% of Gen Z use BNPL weekly or more frequently compared to Millennials (28%), Gen X (10%) and Baby Boomers (9%).10

In 2024, nearly 25% were late making a BNPL payment, compared with 18% in the prior year, according to The Federal Reserve.11

Close to a third (31%) of BNPL users say they've lost track of what payments they owe.12

Empower research found that half of Millennials (53%) say BNPL makes it easier to manage large or unexpected expenses.

Financial impact

While Buy Now, Pay Later (BNPL) offers a flexible and accessible way to manage purchases, it also presents an opportunity to build stronger financial habits.

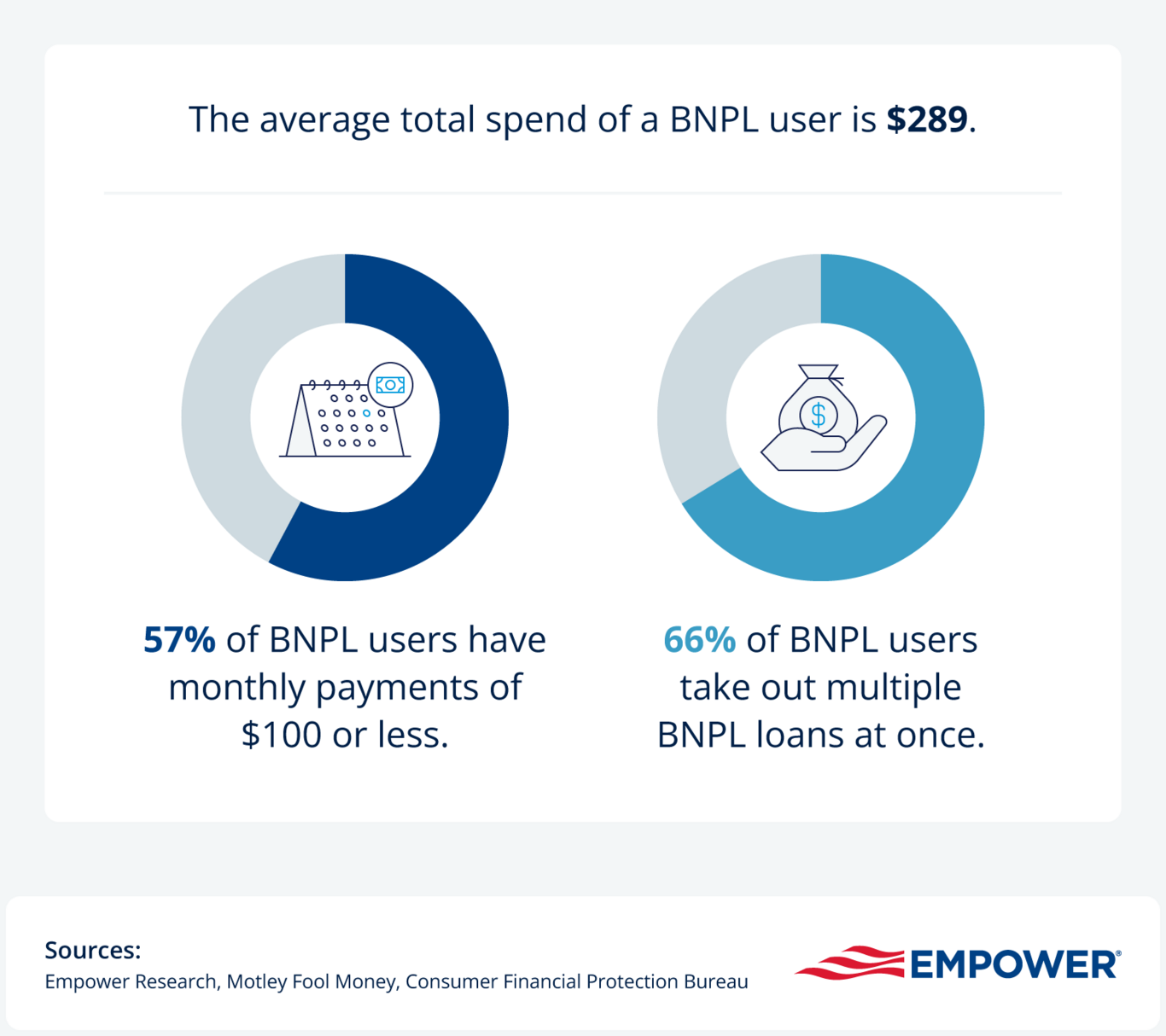

According to Empower data from April 2024, the average monthly total spend per BNPL user is $289.

The Consumer Financial Protection Bureau found that, 66% of BNPL users take out multiple BNPL loans simultaneously, and 33% borrow from multiple lenders at once.13

Americans who use BNPL services typically have higher balances on other unsecured credit types, with an average of $453 more in personal loans and $871 more in credit card debt compared to non-BNPL users.14

Americans spent $18.2 million using BNPL services during the 2024 holiday season.15

57% of BNPL users have average monthly payments of $100 or less.16

Users of Affirm, a popular BNPL service, have an average outstanding balance of $660.17

According to Empower, while 40% of BNPL users say the loans not impacting their credit is a top benefit, 45% say they won’t change the habit even if their score changes.

Product categories

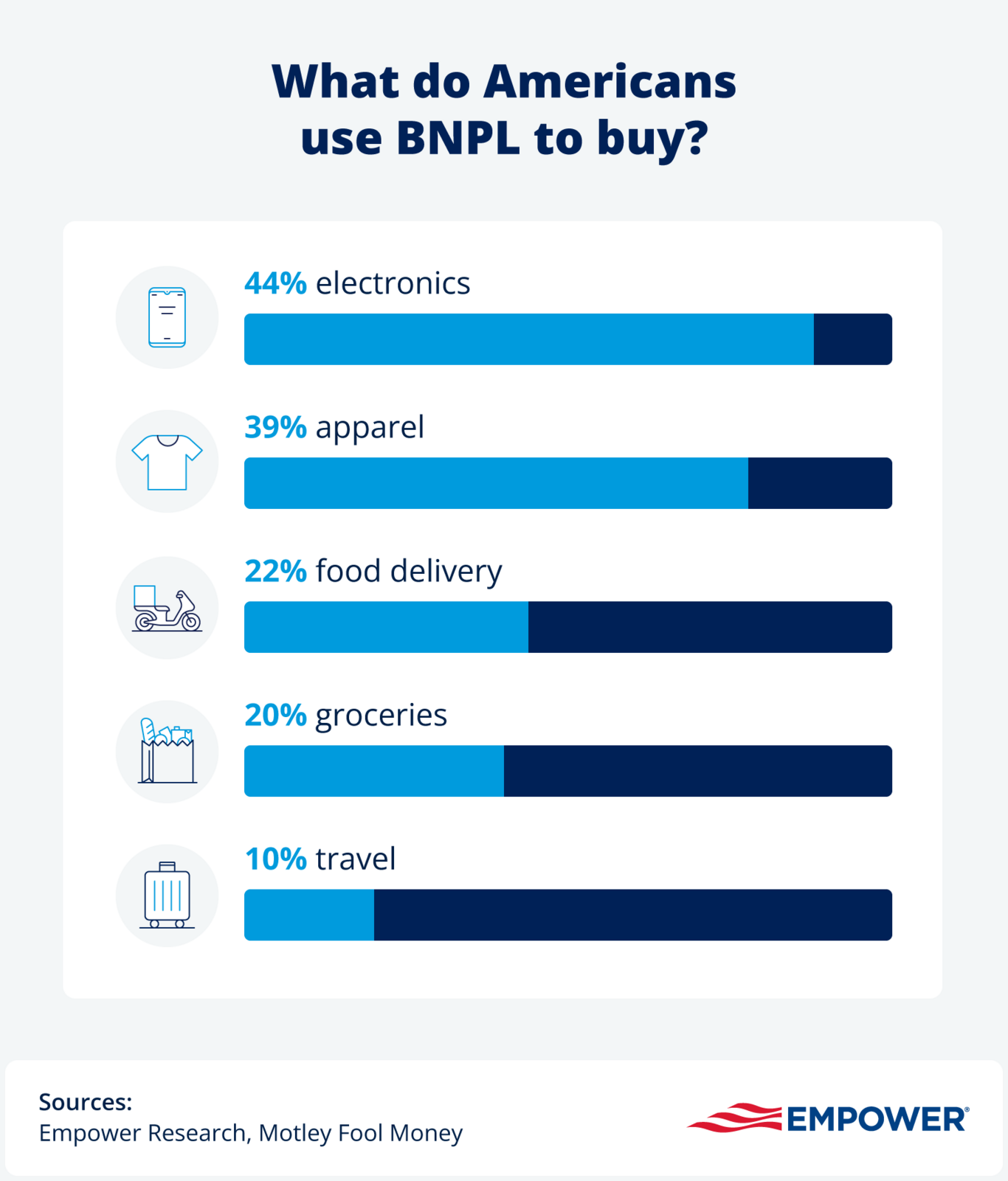

Which products are consumers buying most with BNPL? Empower data shows that electronics, apparel, and home goods like furniture and appliances are some of the most popular categories, though others use BNPL to buy everyday essentials like groceries.

22. According to Empower research, 10% of Americans say they use BNPL to pay for travel.

23. A quarter of consumers (25%) say they choose BNPL services to purchase groceries.18

24. 44% of BNPL consumers use the service to purchase electronics, while 39% use it to buy clothing and fashion accessories.19

25. BNPL is more popular for online purchases (55%) compared to purchases made in person (45%).20

26. 22% of BNPL users used the service to pay for food delivery in 2025.21

Get financially happy

Put your money to work for life and play

Sources:

1,6 Aol. “Buy now, pay later' goes from niche to normal as young people use it for daily essentials,” March 2024.

2 Axios, “FICO to incorporate buy-now-pay-later loans into credit scores,” June 2025.

3 Bloomberg, “Americans Are Racking Up ‘Phantom Debt’ That Wall Street Can’t Track,” May 2024.

4 Fortune, “Gen Z’s not drowning in buy-now-pay-later debt—yet. But experts warn it’s a luxury lifestyle trap,” May 2025.

5, 12, 16, 19, 20, 21, 22 Motley Fool Money, “2025 Buy Now, Pay Later Trends Study,” May 2025.

7 Consumer Financial Protection Bureau, “Consumer Use of Buy Now, Pay Later – Insights from the CFPB Making Ends Meet Survey,” March 2023.

8, 11 The Federal Reserve. “Report on the Economic Well-Being of U.S. Households in 2024 - May 2025.”

9, 10 Afterpay, “Why Credit Cards Give Gen Z the Ick,” 2025.

13 Consumer Financial Protection Bureau, “Study of Buy Now, Pay Later (BNPL) borrowers,” January 2025.

14 Consumer Financial Protection Bureau, “Consumer Use of Buy Now, Pay Later and Other Unsecured Debt,” January 2025.

15 Adobe for Business, “Get insights into the 2024 seasonal retail trends,” December 2024.

17 Affirm, “A deeper look at buy now, pay later users, benefits and common criticisms,” February 2025.

18 CBS News, “More Americans are turning to "buy now, pay later" loans to purchase groceries,” June 2025.

RO4660987-0925

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. No part of this blog, nor the links contained therein is a solicitation or offer to sell securities. Compensation for freelance contributions not to exceed $1,250. Third-party data is obtained from sources believed to be reliable; however, Empower cannot guarantee the accuracy, timeliness, completeness or fitness of this data for any particular purpose. Third-party links are provided solely as a convenience and do not imply an affiliation, endorsement or approval by Empower of the contents on such third-party websites. This article is based on current events, research, and developments at the time of publication, which may change over time.

Certain sections of this blog may contain forward-looking statements that are based on our reasonable expectations, estimates, projections and assumptions. Past performance is not a guarantee of future return, nor is it indicative of future performance. Investing involves risk. The value of your investment will fluctuate and you may lose money.

Certified Financial Planner Board of Standards Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design), and CFP® (with flame design) in the U.S., which it authorizes use of by individuals who successfully complete CFP Board's initial and ongoing certification requirements.