December Private Client Mail - Simplify Your Taxes

Enhance your annual return up to 1.00%1

Enhance your annual return up to 1.00%1

Learn how professional guidance and personalized tax strategies can work together to potentially enhance your annual returns and overall financial well-being.

Learn how professional guidance and personalized tax strategies can work together to potentially enhance your annual returns and overall financial well-being.

- Optimizing your investment portfolio with tax-smart planning to help safeguard your legacy.

- In-depth tax planning and analysis with a tax specialist at no additional cost.

- Asset location, tax-loss harvesting, and tax-efficient investments that may help reduce your tax liability.1

Watch your financial plan come to life - in real time

Watch your financial plan come to life - in real time

Planning for your entire financial life

Planning for your entire financial life

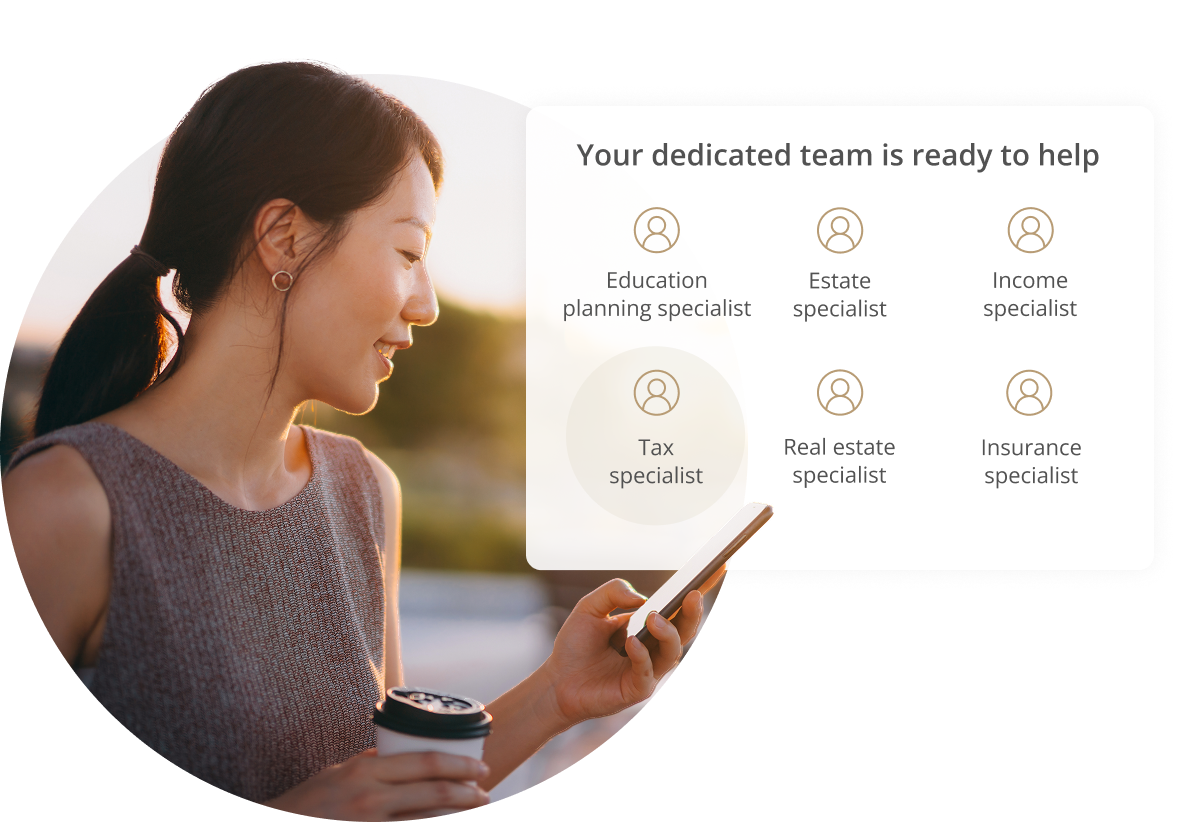

Experience wealth management beyond your portfolio. Get help with insurance, taxes, estate planning, and more.

A deep knowledge pool at your service

A deep knowledge pool at your service

Your wealth is in good hands with two dedicated advisors and a team of knowledgeable professionals.

Personal financial guide and coach

Personal financial guide and coach

When emotions run high, rash decisions get made. That's why behavioral coaching and pragmatic advice can help increase returns by up to 2%2.

1 By avoiding tax-inefficient funds and adding the benefit from tax location and tax-loss harvesting, our research shows proper tax management can improve portfolio returns by up to 1.0% annually. Inefficient funds alone can carry an average tax cost ratio of 1.5%, which is based on YCharts data for all domestic equity mutual funds as of March 31, 2024. Calculations take the average tax-cost ratio since inception of each fund. If a fund did not provide a tax-cost ratio since inception, it was excluded from the calculation.

2 Vanguard, Putting a value on your value: Quantifying Vanguard Advisor s Alpha, July 2022.

Advisory services are provided for a fee by Empower Advisory Group, LLC (EAG). EAG is a registered investment adviser with the Securities and Exchange Commission (SEC) and an indirect subsidiary of Empower Annuity Insurance Company of America. Registration does not imply a certain level of skill or training. Investing involves risk. Past performance is not indicative of future returns. You may lose money. Advisory fees are calculated based upon the amount of assets being managed (as detailed further in the Empower Advisory Group, LLC Form ADV EAG Form CRS

Empower Private Client advisory services are available when you invest $1,000,000 or more with us. Advisory fees do not include underlying fund expenses, brokerage fees, or other costs that may apply. Please review our full fee schedule for details.

EMPOWER and all associated logos and product names are trademarks of Empower Annuity Insurance Company of America.

©2025 Empower Annuity Insurance Company of America. All rights reserved. EPW-WMLPNV-WF-4982050-1225 RO4853300