When we say you’re in charge, we mean it.

Here at Empower, you can chart your own path and grow your career while helping more customers achieve financial freedom. We have one suggestion: Empower Yourself.

Career areas

A culture that lets

you take the wheel

We have a flexible work environment that offers more career freedom for you. Every day, our people are empowered to ask questions and find answers. We listen patiently and act quickly, and the results speak for themselves.

See how we’ll empower youBenefits that work

as hard as you do

Our benefits cover every part of your life – from health and well-being to long-term financial planning and work-life balance. Our programs help meet your needs today and tomorrow.

See our benefits

At Empower, we’re driven by our values, which shape everything we do. I engage with our associates regularly, and their willingness to share ideas helps us constantly improve and drives our organization to new heights.

Edmund F. Murphy III

President and CEO, Empower

Awards

Financial Services Top Workplaces

USA Today

Top Workplaces

The 2025

Top Employers

Employee

Work-life Flexibility

Top Workplaces

The Denver Post Top Workplaces

Hartford Courant Top Workplaces

An empowered culture

Our work environment is based on the idea that transforming financial lives starts by giving our people the freedom to transform their own.

At work in the community

From volunteering thousands of hours in our communities every year, to giving a voice to every person in our organization with our Diversity, Equity, Inclusion, and Belonging initiatives, we're creating a workplace where everyone can contribute and belong.

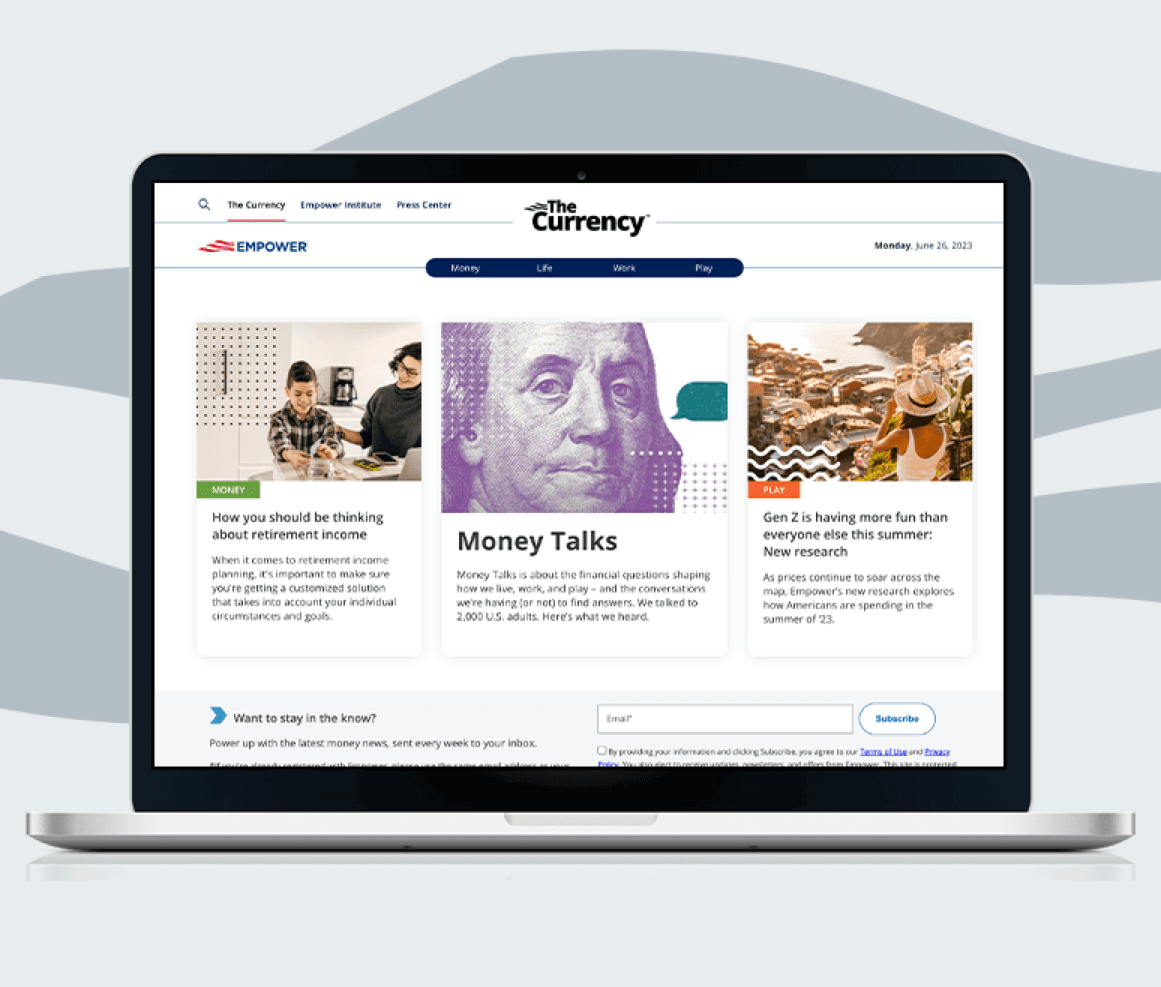

The Currency

Want to stay in the know with the latest money news? The Currency covers financial views shaping how we live, work, and play.

Join our Talent Community

Sign up to get job alerts tailored to your interests. Choose your preferred job categories and locations and upload your resume so we can match you to the right opportunities.