Tools and resources are available

Unsure of how much stock you should have versus other investment types? Your risk tolerance and length of time before you retire go hand in hand — the more time you have before you retire, the more risk you may want to take.

A simple rule of thumb to help you decide how much stock you want — or how risky you want to be — is to subtract your age from 110. This is the percentage of your portfolio you may want to consider investing in stock funds.

The RELX 401(k) Plan website also has several innovative calculators to help you determine a portfolio that meets your needs, including:

Other savings rules of thumb1:

- A diversified domestic stock portfolio will

return an average of 10% per year. - Save at least 10% of your income toward retirement.

- To make sure your retirement nest egg lasts, never withdraw more than 4% a year.

- Save at least six months’ worth of living expenses in your emergency fund.

1 www.bankrate.com, “8 rules of thumb on saving and retirement,” Claes Bell, Jan. 25, 2011.

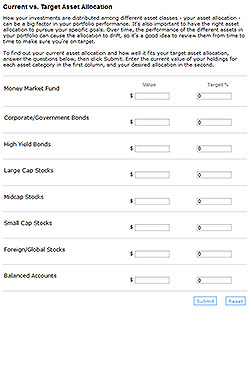

Current vs. Target Asset Allocation

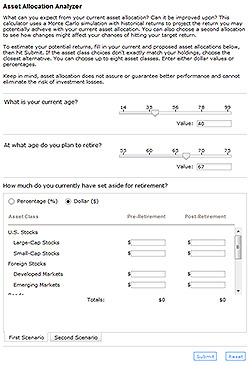

Current vs. Target Asset Allocation Asset Allocation Analyzer

Asset Allocation Analyzer