Target date funds offer a convenient, long-term solution for retirement savings. Rather than research and select individual investments, you can choose a single fund based on your retirement date or the date you plan to start withdrawing your funds.

Here are four things to know:

To retirement and through retirement: What’s the difference?

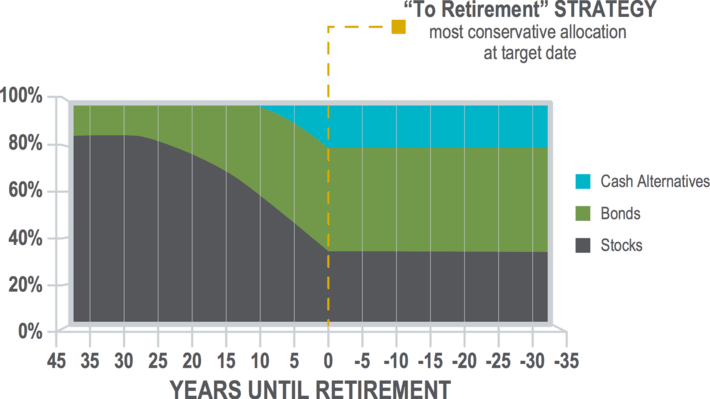

When funds are managed with a to-retirement strategy, they reach their most conservative mix at the target date. They remain fixed at that allocation throughout retirement.

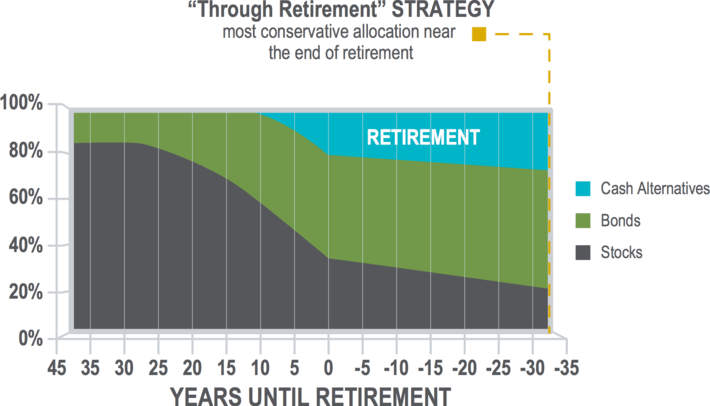

When funds are managed with a through-retirement strategy, they continue to adjust beyond the target date. These types of target date funds will continue to be automatically adjusted to a more conservative mix for a set number of years after the target date.

As with all investments, the principal value of the fund(s) is not guaranteed at any time, including at the target date.